[ad_1]

The funds revision course of is important as a result of you’re spending an excessive amount of cash or have extra that’s unused.

You could be amazed at how the straightforward job of revising your funds can encourage you.

There hasn’t been a 12 months the place we’ve completely managed each funds class; it’s inconceivable. Why? As a result of shit occurs, there’s no different extra simple approach to say it.

We aren’t PERFECT with our cash and perceive budgeting is an ongoing course of.

Nevertheless, the very last thing you need after making a funds is to start out over, however it occurs.

A funds revision is completely regular particularly when you’re new to budgeting, overspending, or making a new budget category.

Yearly our miscellaneous funds class may be excessive some months. You may ask us why if the whole lot has a spot within the funds.

The truth is that it’s close to inconceivable to discover a funds class that’s a one-size match.

We discovered having the miscellaneous budget category important as a result of it allowed us to see spending patterns and whether or not we would have liked a funds revision.

At the moment, I wish to briefly talk about why a funds revision is crucial, the funds revision course of, and the way it will assist you manage your money higher.

Finances Revision Simplified

What’s a funds revision?

You wish to know why and who’s spending too much money and whether or not the expense will happen constantly.

It’s a easy course of and one that everybody who makes use of a funds ought to full all year long or as wanted.

A spending log is a good instrument to assist the person determine the place the cash goes.

Subsequent, I wish to talk about when it is best to make a funds revision and the method.

Course of Concerned To Make A Finances Revision

In relation to making a funds revision, you want a number of months of funds numbers.

Comparables are one approach to resolve whether or not you’ll want to create a brand new funds class, spend much less or transfer cash round.

For instance, you may funds $100 for clothes every month however discover you’re not utilizing the whole quantity.

After finishing a median of prices for clothes during the last 3-6 months of budgeting, you study that you simply’ve solely spent 50% of the quantity. Incredible.

Take that more money you’re not utilizing and create a funds revision.

Take a look at the grocery class the place you’ve been spending extra recently as a consequence of elevated costs.

As a substitute of spending $550 every month, you’ve been overspending by $50, bringing your month-to-month grocery bills to $600.

Add the additional $25 a month to your grocery funds by finishing a funds revision.

Though the $25 received’t deliver you to $600, you’ll now have a grocery funds of $575.

I like to enter our funds excel spreadsheet and repair the numbers, straightforward peasy.

You are able to do the identical fairly simply when you use a paper funds or cellular funds app.

Whenever you create your funds for 2023, for instance, now you’ve got the instruments to know whether or not a funds class is working or not.

Base the numbers on present or potential upcoming worth will increase. You’re conscious of a median of your class bills from the earlier 12 months.

What you don’t wish to do is proceed to overspend in a specific class every month with out making a fast repair.

Don’t wait till the top of the 12 months when you discover an issue instantly.

Nip it within the bud so that you don’t grow to be into debt due to an unbalanced funds.

Instances You Could Want A Finances Revision

Inheritance

If you happen to’re one of many fortunate ones who obtain an inheritance, put that cash to good use. Repay your money owed resembling training, bank cards, traces of credit score, loans and so forth.

Spend money on your future, whether or not or not it’s buying a house or different housing and set cash apart for retirement.

No matter you select to do with an inheritance you obtain is private and will assist your monetary state of affairs.

In such a case a funds revision could also be mandatory.

Empty Emergency Fund

In case your emergency savings are empty, you want a funds revision in hopes of discovering even a number of {dollars} to save lots of.

Life Occasion

A life occasion can vary from a brand new child, wedding ceremony, divorce, job loss, profession change, incapacity, demise or caring in your ageing mother and father.

Maybe you discover out your baby is disabled or has a incapacity and requires companies that aren’t coated beneath advantages.

Life occasions are an enormous class because it covers so many conditions that would occur in our lives.

Return To Schooling

You’re an grownup and resolve that returning to high school is one thing that you simply wish to do. You may give up your present job and get OSAP or work part-time for more money. Conditions resembling continued training will have an effect on your month-to-month funds.

New or Used Car

Anytime you buy one thing new or used, whether or not a automobile, trailer, or motorbike, it might improve insurance coverage, petrol, and cost prices.

New Home

You’ll need to both begin utilizing a funds or revise the funds once you purchase a brand new home.

Many bills would include house possession when you have been beforehand budgeting whereas renting an condo.

A Finances Revision Is Not For Everybody

Yesterday I watched International information, the place a girl in Windsor, Ontario, who’s disabled and dwelling in poverty, has given up on life.

She will now not afford to reside, and the ache is insufferable and in addition has a disabled daughter and two canine that she cares for.

Extra alarming is that she earns $1228 every month from Ontario Incapacity. Nobody asks to be disabled, which is past their management. ,

At this level, she is choosing assisted demise in Canada, which is gloomy and unfair.

What caught out to me within the video was when she received upset about budgeting.

It’s not the ache that’s driving Canadians towards assisted demise; it’s poverty.

She says that folks inform her to “funds higher,” and she or he desires to inform all of them to go to hell.

It made me notice that not everybody can revise their funds if there is no such thing as a cash to maneuver round.

I want I had solutions for Canadians who aren’t capable of meet their fundamental wants moreover neighborhood freebies, however I don’t.

Canada must do higher to worth human life and assist seniors, adults, caregivers, kids, or anybody coping with a incapacity, psychological or bodily.

I’ll hyperlink the video under so you may watch it. I would like you to know that I’m sorry when you’ve ever felt that approach due to me.

The video tugs on my coronary heart, and also you’ll see from each contributors how tough it’s to reside.

Presently, I’m working in direction of my Canadian citizenship so I can vote and voice my opinion.

My general take from that is that budgeting is strict, and when you’ve exhausted the whole lot to scale back prices, the place do you flip? Emergency financial savings? Positive, however that received’t final endlessly.

One thing to think about is that huge issues will occur with the inflation price driving costs by the roof.

A recession is rarely a superb factor for anybody, irrespective of which aspect of the coin you’re on.

I hope I’ve given you some examples of the way to create a funds revision and the way sure occasions can set off the duty.

Dialogue: Whenever you make a funds revision, why did you select to take action?

Please depart your feedback under, and I’ll reply to any questions.

Let’s get to the September 2022 Finances Replace under.

CBB Household Finances Report For September 2022

September 2022 Finances Abstract

We had a considerably busy September with back-to-school and family breakdowns costing us huge bucks.

Fortunately we now have the cash to pay for this stuff, which is sweet that we now have emergency financial savings.

Listed below are a number of of our most vital bills for September:

- New Central Vac $711

- Dyson Vacuum $511

- Laptop computer $1000

- Cell Cellphone $1200

- Birthday Presents (surprising and one thing to think about for the 2023 funds)

- Parking Work $546

Our central vac died on us, so we purchased one other, however solely the hose and head half, as the bottom was delicate.

I made a decision to get a Dyson for the higher degree of the home, so Mrs. CBB doesn’t should lug the hose upstairs or into the basement. She’s fallen in love with how straightforward a Dyson is to make use of.

Mrs. CBB smashed my cell phone,e so I paid money to purchase a model new one and paid $67 for an Otter field case.

The telephone’s contact display now not works as a consequence of a crack on the backside right-hand nook of the telephone. If attainable, I’m getting the telephone mounted, however it’s going to take a number of weeks to get that completed.

We went to an grownup party in September, which garnered surprising bills. Mrs. CBB purchased our good friend a bottle of her favorite wine, two bathtub sheets, two chocolate bars and a candle.

Our son has an upcoming party, so we spent about $50 on the reward. Our petrol was decrease in September as we didn’t go wherever however to work and normal operating round city.

We picked some stunning Swiss chard from our backyard because the remaining vegetable, and it’s nonetheless rising. I hoped to plant garlic earlier than the snow, so we now have it prepared for subsequent season.

Aside from that, we had a busy month and a few funds classes to revamp.

You may suppose I’m ignoring the fI’m that I paid $546 to park at work, however I’m not. I select to disregard it as a result of there’s nothing I can do, which elevated by $46 this 12 months.

Thanks for studying,

MR. CBB

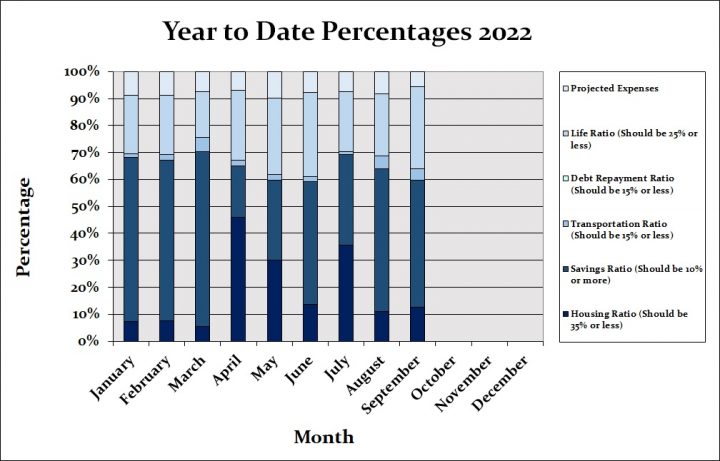

12 months To Date Percentages 2022

Our financial savings of embrace investments in addition to any financial savings for this month based mostly on the internet revenue of $15,430.44.

Equally essential is that we lower your expenses on our projected expenses due within the coming months.

An instance of projected bills can be shopping for Christmas presents in December or all year long.

All classes took 100% of our revenue, exhibiting that we accounted for all of the income in September 2022.

One of these funds is a zero-based budget the place all the cash has a house.

Finances Bills Percentages For September 2022

Month-to-month Residence Finances Breakdown

Under is a breakdown of our bills which helps us perceive the place our cash goes.

- Chequing– That is the checking account from which we pay our family payments. We use Simplii Financial, TD Canada Belief, and Tangerine Bank. Join Simplii Financial today! Learn extra about one of the best Canadian online virtual banks.

- Emergency Savings Account– This cash is in a laughable high-interest financial savings account.

- Common Financial savings Account– This financial savings account holds our projected expenses.

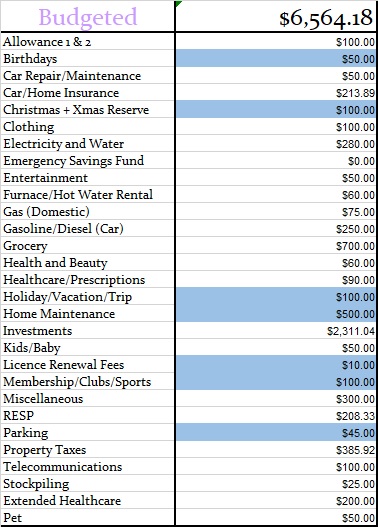

- Month-to-month Budgeted Complete: $6564.18

- Monthly Web Earnings Complete: $15,430.44

- (Take a look at the Ultimate Grocery Guide to see the place our grocery cash goes)

- Projected Expenses: These are bills we all know we pays for all year long = $852.91

- Complete Bills Paid Out: $9820.99

- Complete Bills Paid Out: Calculated is $15,430.44 (whole internet month-to-month revenue) – $852.91 (projected bills) – $4,756.54 (Financial savings to emergency fund) = $9820.99

- Precise Money Financial savings going into Emergency Financial savings: Calculated is $15430.44 (whole month-to-month internet revenue) – $9820.99 (precise bills paid out for the month) – $905.00 projected bills) = $4756.54

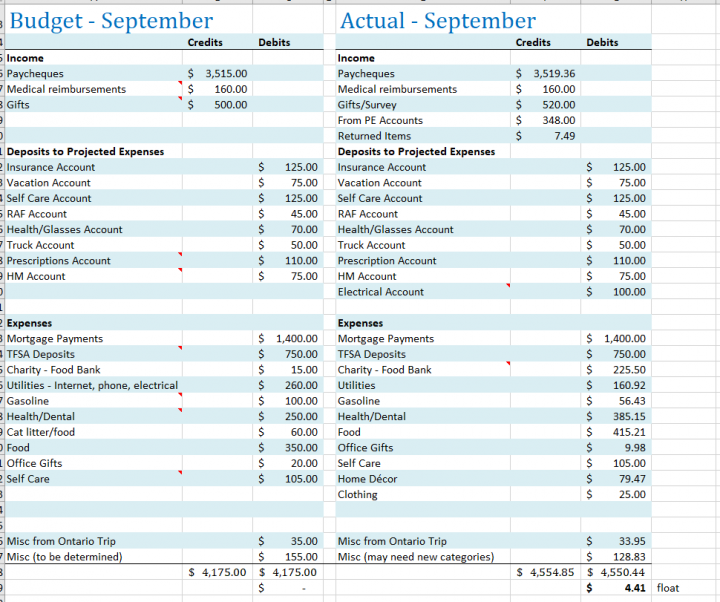

Estimated Finances and Precise Finances

Under, you will notice two tables: Our month-to-month and precise budgets.

Our month-to-month funds represents two adults and an 8-year-old boy.

Finances Color Key: It’s a projected expense when highlighted in blue.

Since Could 2014, we’ve been mortgage-free, redirecting our cash into investments and renovations.

Spending lower than we earn and budgeting has been the best approach to pay off our debt and save money.

Month-to-month Finances Quantities August 2022

Precise Month-to-month Finances September 2022

I’ll be again in November to share our October Finances Replace.

Hold studying under to see how our 2022 Finances Challengers are doing with their month-to-month funds report.

Thanks for stopping by to learn our funds replace.

Mr.CBB

2022 Finances Problem Canadian Finances Binder

Welcome to the 2022 Finances Problem Studies.

Over the previous two years, this problem began with many optimistic CBB readers who wished to affix.

For 2022 we started with six folks prepared to alter their lives by difficult how they handle a funds.

As of September, we now have 4 funds challengers for the remainder of 2022.

Every funds abstract will at all times fall beneath the identical Finances Challenger quantity under.

If you happen to depart feedback about any of the budgets, at all times use the funds challenger quantity, so that they realize it’s for them.

Finances Challenger # 1

Web Earnings

- Sept 2, $1140.67 {dollars}

- Sept 16, $1092.32 {dollars}

- Sept 30, $1140.67 {dollars}

- Spousal assist $700

- Sarcan 0

- Victoria cell $95

- Primarily reward card is $50

- Yard sale $30

Web revenue whole, $4248.66.

Bills

- Earnings tax $100

- Automobile insurance coverage is $90

- Automobile restore $325

- Cells $266.26

- Elec/water/energy $163

- TFSA $50

- RRSP $250

- Crave $16.70

- Wifi $80

- Fuel $110

- Groceries $270

- Residence Insurance coverage $110

- Alarm $54.33

- S.p.p. $50

- Water softener $30

- Water heater/ac/furnace $188

- Life insurance coverage $75

- Lotto $7.50

- Mortgage $560

- Parking $45

Complete bills – $3290.79

$4248.66 – $3290.79 = +957.87

August funds was = -935.97

So now I’m +22 {dollars}.

September was my birthday and my dad’s too. I didn’t save my current cash as I spent it.

Additionally, some family and friends took me out for lunch.

In September, like most individuals, I received paid thrice, in order that’s nice.

I hosted a yard sale to earn further revenue, though I solely made 30 {dollars}.

Throughout the identical storage sale, I made my dad 100 {dollars}.

Then I primarily donated the whole lot leftover as I used to be uninterested in having it amassing mud.

Fortunate me, I received a 50-dollar Esso reward card from a contest.

I had 325 {dollars} for bills from my passenger automotive door electrical drawback.

I had a credit score from my energy invoice, so I didn’t should pay.

Ups and downs for the month, however nonetheless up.

Thanks.

Finances Challenger #3 Ok

Hello Mr. CBB, Greatest bills this month have been on Dental, some roof restore, and child’s dance charges.

I’m doing higher at conserving the pet bills in the correct column as I had put the meals within the grocery expense. (ah, sure, we now have a separate cat funds class).

We’re engaged on ending the backyard and a few yard cleanup for the 12 months.

Work is busy as we’re rolling out a brand new provincial digital charting program, so further courses to get us going.

We’re additionally very short-staffed at work, so there have been numerous additional time shifts provided.

You may learn her full September month-to-month funds replace here.

Finances Challenger #4

Greetings from the Yukon, CBB!

I don’t have a lot to speak about for September.

There was one final $50 Inflation Rebate on my electrical invoice in order that I might stash a earlier deposit within the Electrical PE account. I made an additional TFSA deposit to maintain my Tangerine account energetic.

You will note on the finish of my report that Miscellaneous spending was a bit excessive – I’ve recognized new classes for the funds for subsequent 12 months. (that’s implausible. That’s what we do as nicely.)

I’ve some well being stuff impacting my well being and meals spending – hoping to know extra mid-October.

The one huge spending occasion in September was unplanned. Yearly, the United Means places on a Pancake Breakfast and Silent Public sale, and I received swept up in bidding on a printer.

I haven’t had one for years, and this one has many extra capabilities than my final one.

October shall be all about meal planning/preparation and discovering a steadiness between work and exterior actions.

See you after Halloween!

Finances Challenger #5

Nicely, September was a costlier month than I had hoped, however they’re all beginning to really feel that approach, and I’m beginning to feI’mthe impact of my boyfriend not working proper now.

I did plenty of journey this month for work, we’re tremendous short-staffed, and due to my place, it’s simpler for me to leap between workplaces after we are short-staffed.

This provides to the price of my gasoline invoice, however I’ll see a few of that cash again later in October.

A few of my bills got here from my mini trip as a consequence of an extended weekend.

I’ve shifted some prices to a ‘trip class’ inside my month-to-month funds.

I’ve a trip that has already occurred, and my actual trip is deliberate for November.

- Trip deliberate: $73.76

- Trip previous: $300

- Clothes $81.64

- Groceries $252.08

- Pet $56.33

- Leisure $26.47

- Quick meals $100

- Fuel $246.80

- Web $110

- Quick-term financial savings of $200

- Energy $166.95

- Insurance coverage $165.66

- Cell $72.94

I received again $84.43 on my money-back bank card, which helped a bit of bit.

Fortunately I even have a superb quantity of Air Miles left, which I plan to make use of for my trip in November,

With the factors, I hope to cowl no less than half of the prices I would like apart from the airfare.

I’m glad we’re in a monetary place, however I’m apprehensive about others I do know.

We’re fortunate we personal our house, as I do know so many individuals getting kicked out of residences and having to seek out one thing new.

They’ve little selection however to take out there residences, which value 70% of their revenue.

Plus, jobs in our space are fairly good the place we reside.

I don’t know the place it’s going to lead sooner or later and the way the potential of a recession will influence us.

I typically really feel responsible about planning a trip, however I do know you need to discover a steadiness between dwelling within the second and planning for the long run.

The subsequent few months, I’ve land charges, VMI, tire change, undercoat, oil change, trip, Christmas presents and a retirement reward for my mother – which I’m nonetheless contemplating.

I suppose we’ll should see what the long run holds!

Subscribe To Canadian Finances Binder

Subscribe To the Canadian Finances Binder And Get My Unique CBB Emergency Binder FREE!

Photograph by Annie Spratt on Unsplash

[ad_2]

Source link