[ad_1]

When DBS launched digiPortfolio in 2019, it shook up the whole marketplace for its low beginning capital and administration charges (which was virtually unparalleled amongst banks at the moment). By now, we already know why DBS digiPortfolio is one of the best options for retail investors, and now, there are 2 new portfolios added for us to select from – SaveUp and Earnings.

Are these portfolios any good, and the way do they stack up in opposition to the present different choices out there? Right here’s what you have to know earlier than you resolve whether or not to place your cash in.

Back in 2019, I said this about DBS’ digiPortfolio providing:

“The DBS digiPortfolio…makes a variety of sense for traders who don’t have time to actively analysis and handle their portfolios, in addition to those that have all the time wished to take a position however stayed out of the markets as a result of they’ve no clue on easy methods to assemble their very own well-diversified and balanced portfolio.

Even for DIY traders, for these trying to diversify and add to the index element of your portfolio, this may simply be a less expensive and productive manner to take action. It actually saves you from on a regular basis and further charges incurred every time you manually rebalance your portfolio.”

That was after they solely had 2 portfolios (Asia and International) for us to select from. At this time, the pie has since expanded:

With the latest macro uncertainty, it isn’t stunning that DBS has launched various portfolios for traders who’re rethinking their urge for food for threat, particularly within the gentle of market efficiency for the reason that pandemic.

I’ll assessment SaveUp and Earnings under, to assist information you in direction of deciding which is extra applicable to your wants.

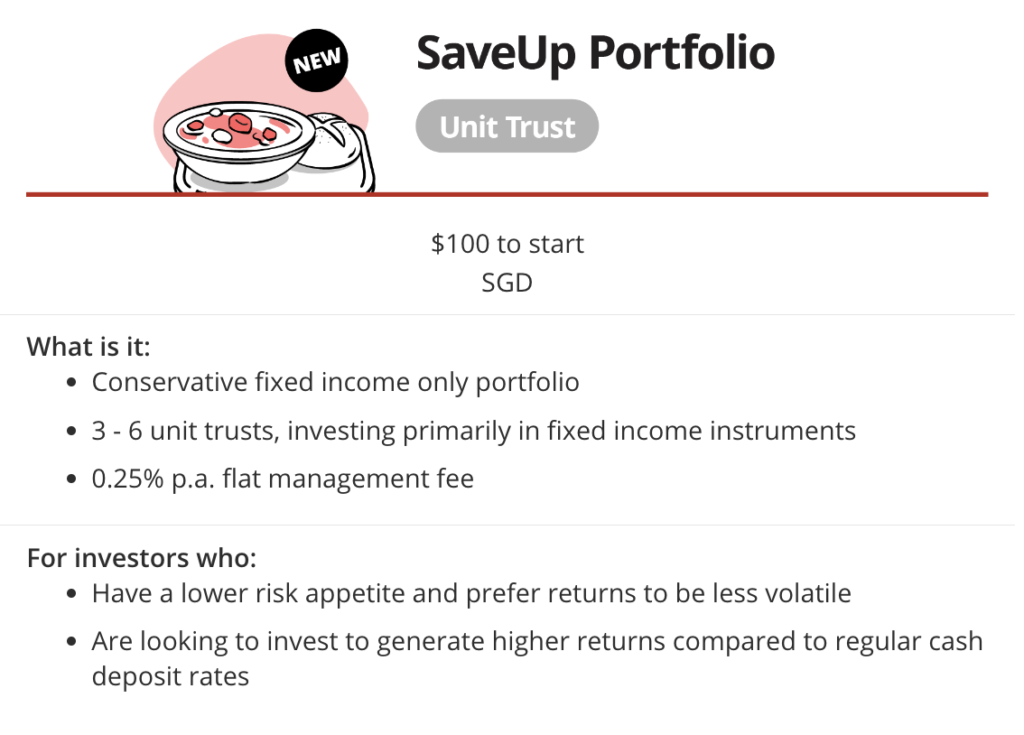

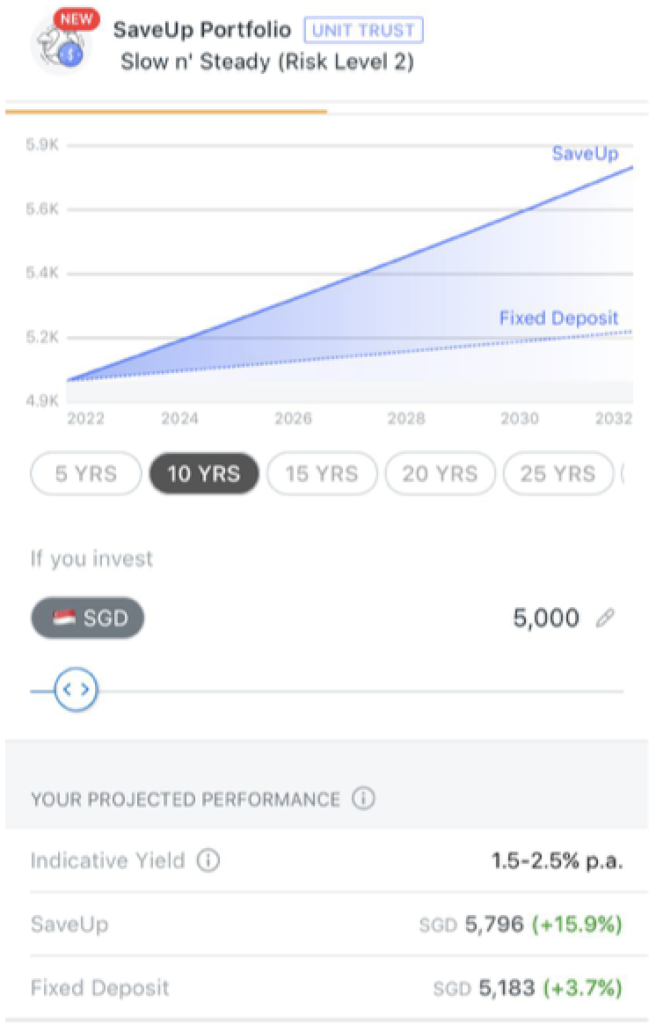

SaveUp – a portfolio of largely mounted earnings devices

For those who’re typically fairly risk-adverse and have been periodically rotating your cash between mounted deposits and authorities treasury payments, then SaveUp would seemingly curiosity you extra.

(additionally learn: Is it worth investing in Singapore T-bills now?)

Comprising of 95% mounted earnings devices, its long-term yield is projected to be about 1.5% – 2.5% p.a., however is at present yielding nearer to 4% because of the larger rates of interest setting that we at the moment are in.

For those who didn’t already know, previous to this yr, rates of interest have been muted for a few years.

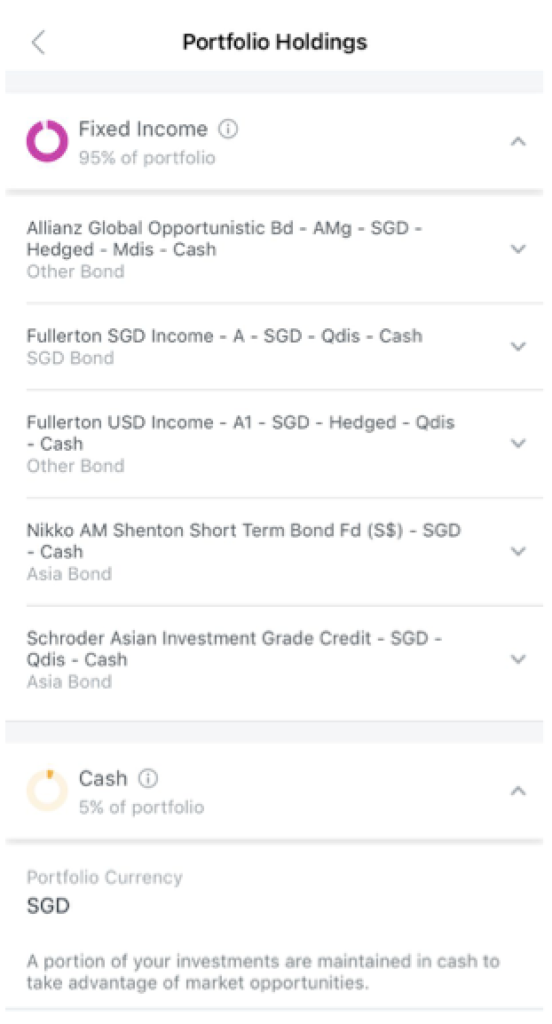

You too can view the portfolio holdings and the rationale while you click on on it in your DBS app:

How does SaveUp examine in opposition to different choices now?

For those who’re SaveUp, then your different comparable choices can be mounted deposits, the Singapore Financial savings Bonds (SSBs), treasury payments and money administration portfolios supplied by the opposite robos or brokerages.

Let’s examine in opposition to the money administration options supplied by different robos / platforms first – for those who zoom in rigorously into the funding breakdown, you’ll understand that almost all of them allocate to 2 – 3 funds in equal (or virtually static) weightage. However, SaveUp allocates into 5.

However is extra the higher?

Bear in mind, digiPortfolio has had a singular proposition since Day 1, which is for retail traders to have the ability to entry a portfolio constructed with views from the DBS CIO workplace. On this case, SaveUp’s portfolio at launch already displays this, with the 5 funds being of the next totally different profiles:

- Defensive world bond

- Asian quick period

- Asia investment-grade bonds

For those who resonate with that, then you definately’ll most likely like digiPortfolio’s providing higher.

As for the bonds and treasury payments, by way of yields, the charges differ every time primarily based on when you’re doing the comparability. As an example, T-bills have been yielding lower than 1% for the final 3 years till issues modified earlier this yr. As for mounted deposits, you’ll must lock your cash in for a minimum of 1 – 2 years for those who’re aiming to get something greater than 2% p.a.

So for those who’re somebody who is continually monitoring the market and actively rotating your cash across the best-yielding choice at anyone given level, then there’s an opportunity you could nonetheless beat the charges on SaveUp, although it requires extra of your time and power.

However for those who’re somebody who simply desires:

- A low minimal capital (S$100),

- No lock-up interval,

- Yields larger than what you may earn in your financial savings accounts,

- With out a lot work wanted in your half,

then on this case, SaveUp can be a superb choice.

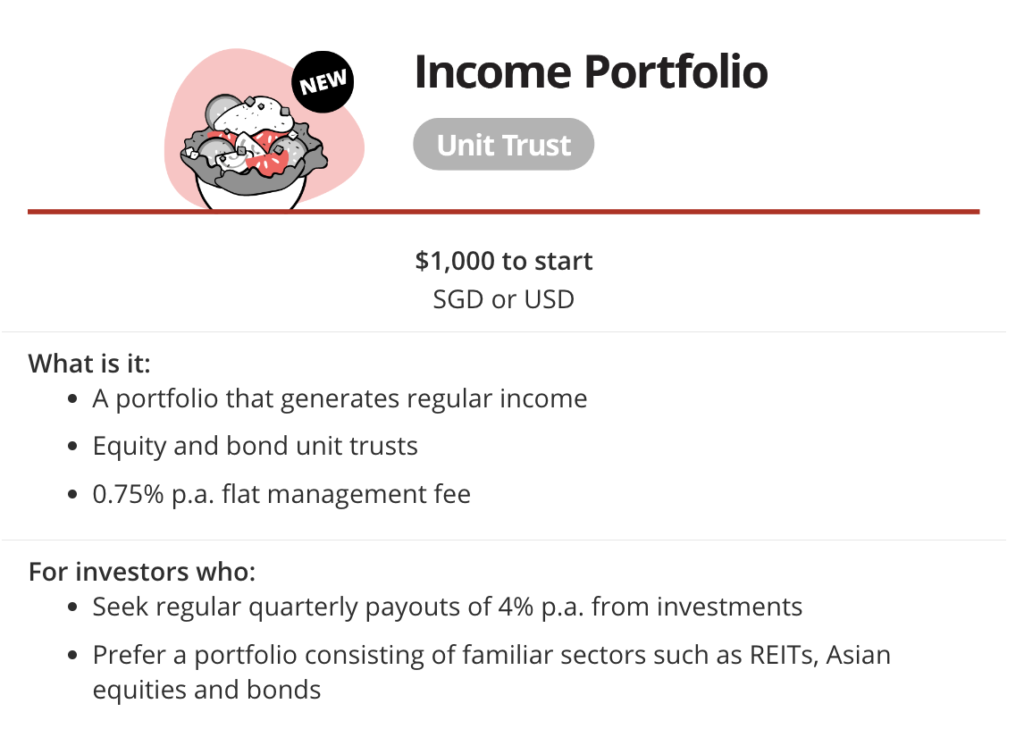

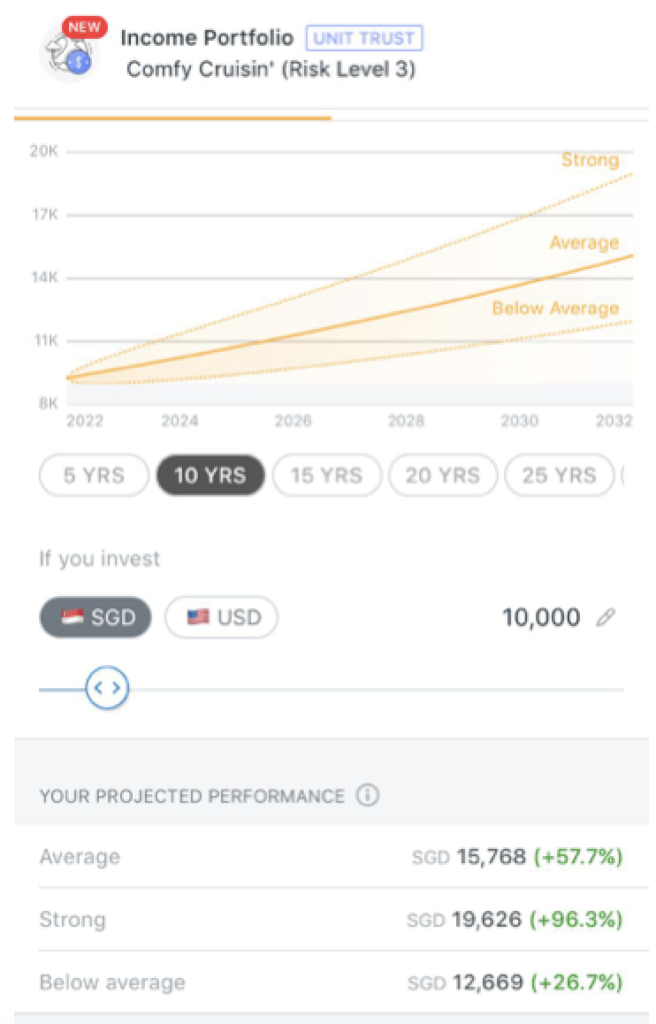

Earnings – search common payouts of 4% p.a.

What for those who wished returns larger than what SaveUp might probably supply?

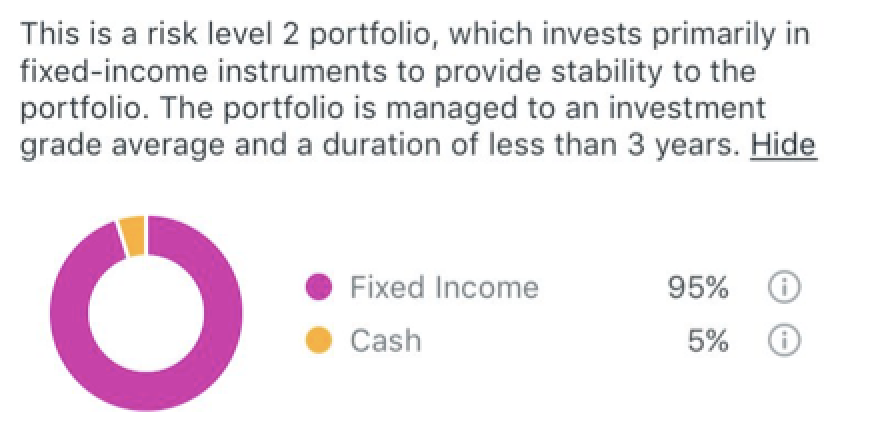

In that case, begin wanting past simply mounted earnings devices and dial up your equities publicity as properly. On this case, the Earnings portfolio could be a extra applicable choose:

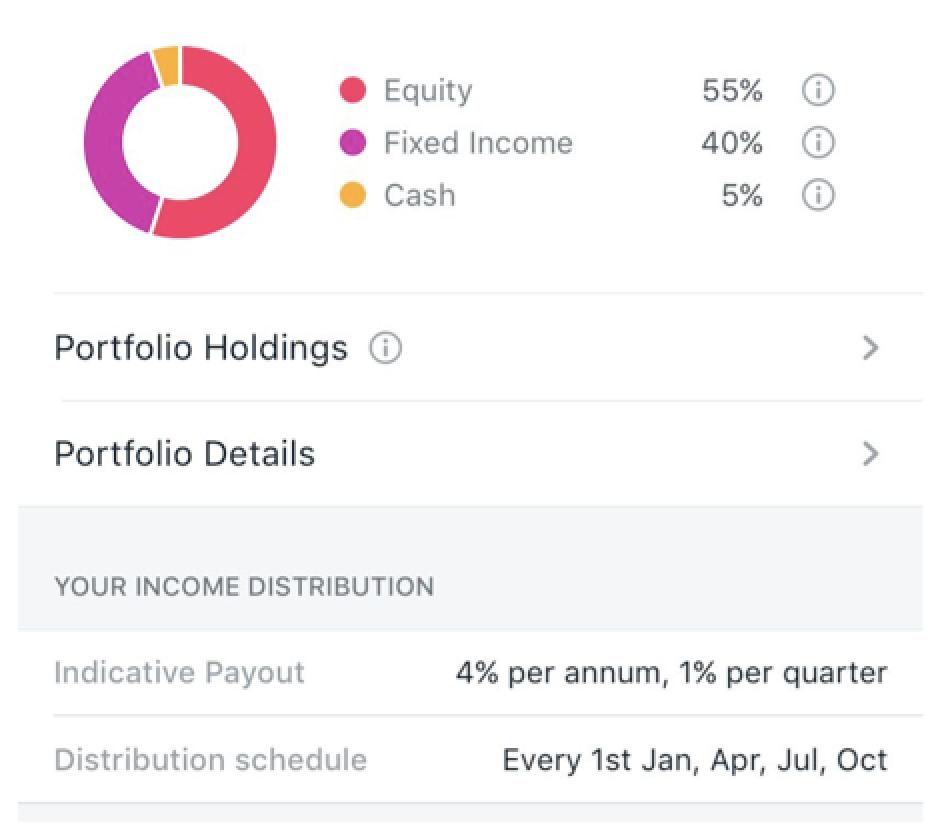

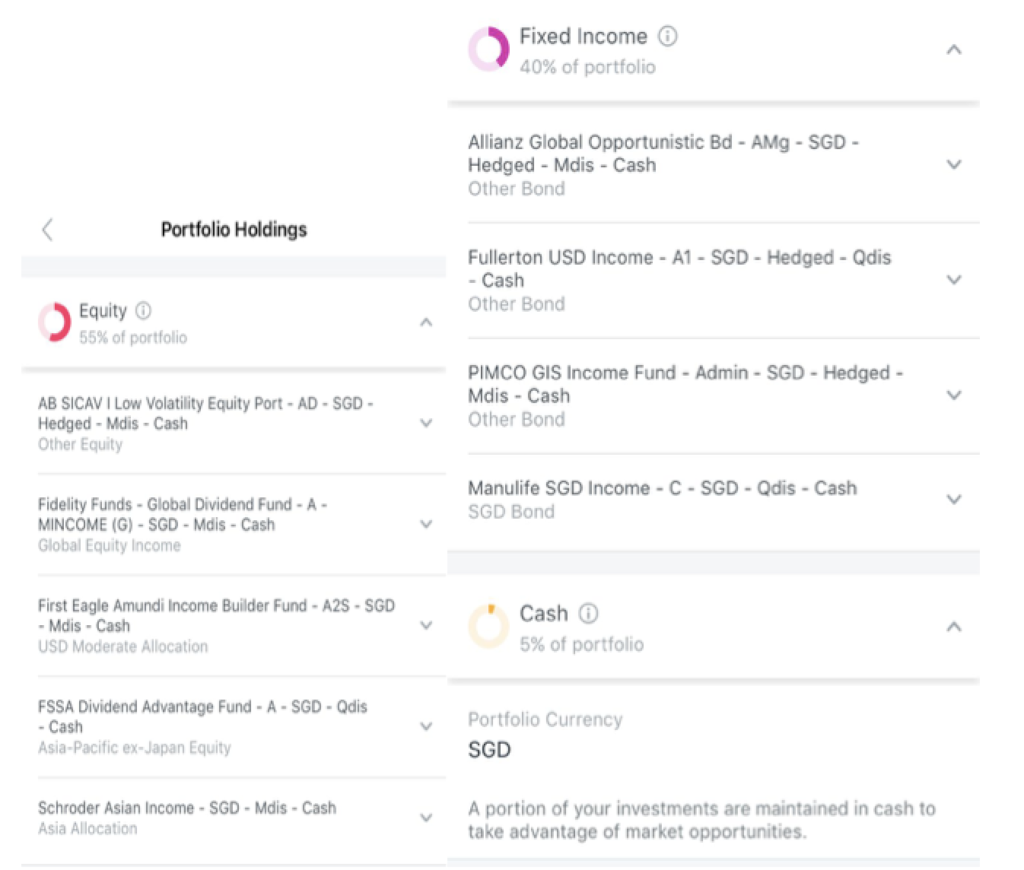

With a 55% equities publicity, this portfolio will likely be taking up extra threat than SaveUp, however remains to be much less unstable than most portfolios that include larger fairness allocations.

Faucet to view the portfolio holdings, which can reveal publicity to largely high-quality bonds (each world and Asia), dividend shares, REITs and different blue-chip firms that typically have a historical past of paying steady dividends:

How does Earnings examine in opposition to different choices now?

For those who’re Earnings, then your closest comparable choices can be the low to medium threat portfolios supplied on different banks or robo-advisory platforms.

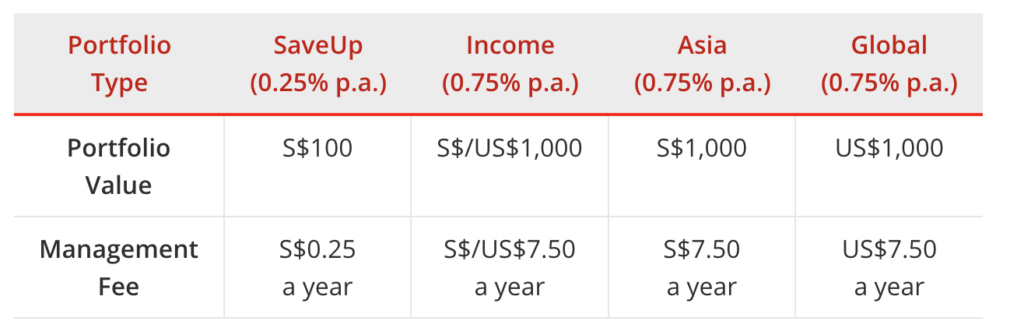

Among the many banks, DBS positively has the bottom charges proper now:

| Supplier | Charges (p.a.) | Minimal funding |

| DBS digiPortfolio | 0.75% | S$1,000 |

| OCBC RoboInvest | 0.88% | US$100 |

| UOBAM Robo-Make investments | 0.8% | S$500 |

What’s extra, your funding in digiPortfolio additionally qualifies for larger bonus curiosity in your Multiplier account, so that you’ll find yourself killing two birds with one stone.

What’s stopping me from DIY?

Nothing.

DBS digiPortfolio was by no means meant to be a whole alternative; and from a price perspective, DIY virtually all the time wins.

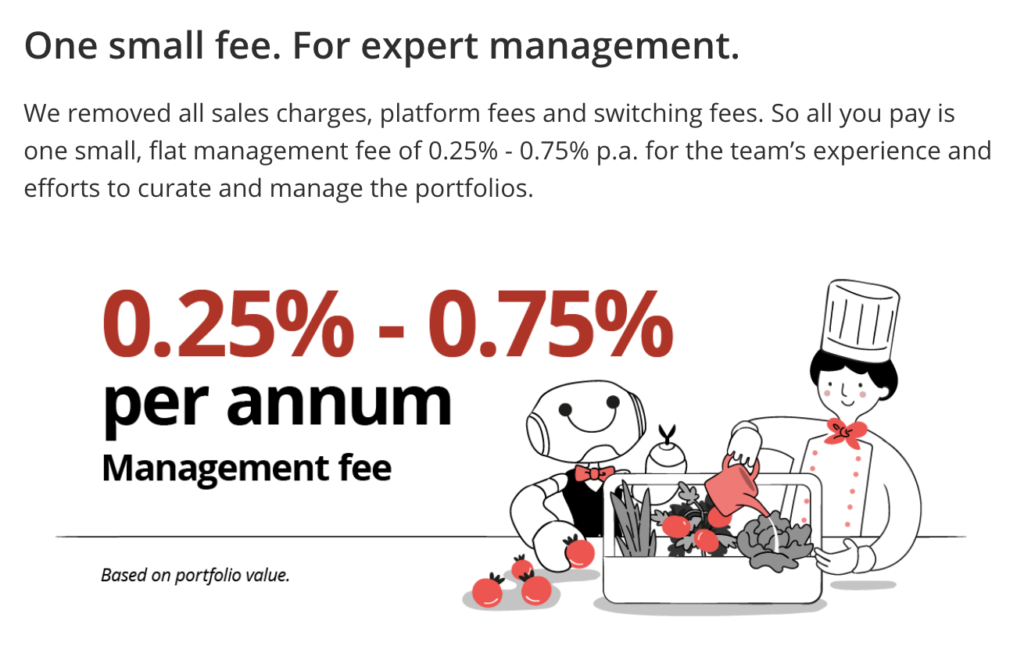

However while you calculate your prices primarily based on the time and power wanted to analysis, execute, monitor and rebalance your portfolio periodically…then the digiPortfolio turns into a no brainer, particularly while you’re paying for charges this low.

Conclusion

Maybe you’re a kind of who began wanting into digiPortfolio since you’re attempting to maximise the bonus curiosity earned in your Multiplier financial savings account.

Or maybe you have been among the many many who began investing in the course of the pandemic – solely to grasp you weren’t as expert as you thought you’ll be – and also you’re now trying to transfer your investments to a robo-advisory as a substitute.

No matter your cause, there’s little doubt that digiPortfolio will help, particularly now that it has been enhanced to supply 4 ready-made portfolios constructed and managed by the DBS funding staff for you. I like how DBS has moved together with the instances and launched SaveUp and Earnings now, particularly in an period the place extra traders who went in large in the course of the pandemic at the moment are beginning to realise that they took on an excessive amount of threat than what they bargained for.

I hope this text lets you higher perceive what SaveUp and Earnings supply, and easy methods to learn the portfolio allocations accordingly. If you’re considering the Asia or Global portfolio instead, check out my previous review here.

For a hassle-free funding expertise, all you have to do is to decide on which portfolio fits your wants higher, set the quantity and frequency at which you’ll like to take a position, submit, and also you’re accomplished!

Find out more about the full digiPortfolio offerings here.https://ad.doubleclick.net/ddm/clk/540848882;349686391;f

Sponsored Message from DBS Every portfolio on digiPortfolio is curated and managed by our elite staff of portfolio managers, whose experience was beforehand accessible solely to funding sums of S$500,000 and above. Apart from rigorously choosing trade traded funds (ETFs) and unit trusts to create high quality portfolios, our staff screens the market repeatedly, aligning digiPortfolio with our Chief Funding Workplace’s views to make sure optimum asset allocation and portfolio resilience, and initiating rebalancing at any time when essential. digiPortfolio is coded to automate processes comparable to back-testing, rebalancing and monitoring. In doing so, we are able to ship scale and effectivity, whereas giving each investor full transparency of commerce actions. That is our manner of creating investing simpler and extra accessible to the lots.

Disclosure: This submit is delivered to you by DBS. All opinions are that of my very own.

Disclaimers and Necessary Discover • This text is for common info solely and shouldn't be relied upon as monetary recommendation. Any views, opinions or advice expressed on this article doesn't have in mind the particular funding goals, monetary state of affairs or specific wants of any specific individual. Earlier than making any determination to purchase, promote or maintain any funding or insurance coverage product, you must search recommendation from a monetary adviser relating to its suitability. • This commercial has not been reviewed by the Financial Authority of Singapore. • It's supplied in Singapore by DBS Financial institution Ltd (Firm Registration. No.: 196800306E), an Exempt Monetary Adviser as outlined within the Monetary Advisers Act and controlled by the Financial Authority of Singapore • The data and opinions contained on this article has been obtained from sources believed to be dependable, however DBS makes no illustration or guarantee as to its adequacy, completeness, accuracy or timeliness for any specific objective. • This text just isn't meant for distribution to, or use by, any individual or entity in any jurisdiction or nation the place such distribution or use can be opposite to legislation or regulation.

[ad_2]

Source link