[ad_1]

The world of banking is huge—too huge for one particular person to cowl alone, particularly with at the moment’s digitally-fueled tempo of change. In that spirit, I’m turning my weblog over to my colleague Steven Smith for this submit on the once-in-a-generation alternative rising in retail banking proper now. Steve is a managing director at Accenture and our Banking Trade Lead for our US South market unit.

– Mike

I nonetheless keep in mind the evening again within the winter of 1986 when my mother dragged me out into the chilly Michigan evening to have a look at Halley’s Comet. “Come on,” she urged, “it’s solely right here for a short while!” Halley’s Comet is a short-period comet seen from Earth roughly each 75 years, and she or he needed to make certain I didn’t miss the possibility to see it.

Retail banks at the moment are in an identical place. They face a once-in-a-generation alternative to serve their clients in new methods. The implications of lacking out may span not years however a long time.

The celebrities align

Shopper banking, like astronomy, is cyclical. Proper now, main traits are aligning in a super-cycle. COVID-19, the conflict in Ukraine, inflation, rising rates of interest, the Nice Resignation and social unrest are only a few. Banks proper now face a short alternative to seize elevated earnings from a rising-interest-rate setting and make investments them of their transformation efforts.

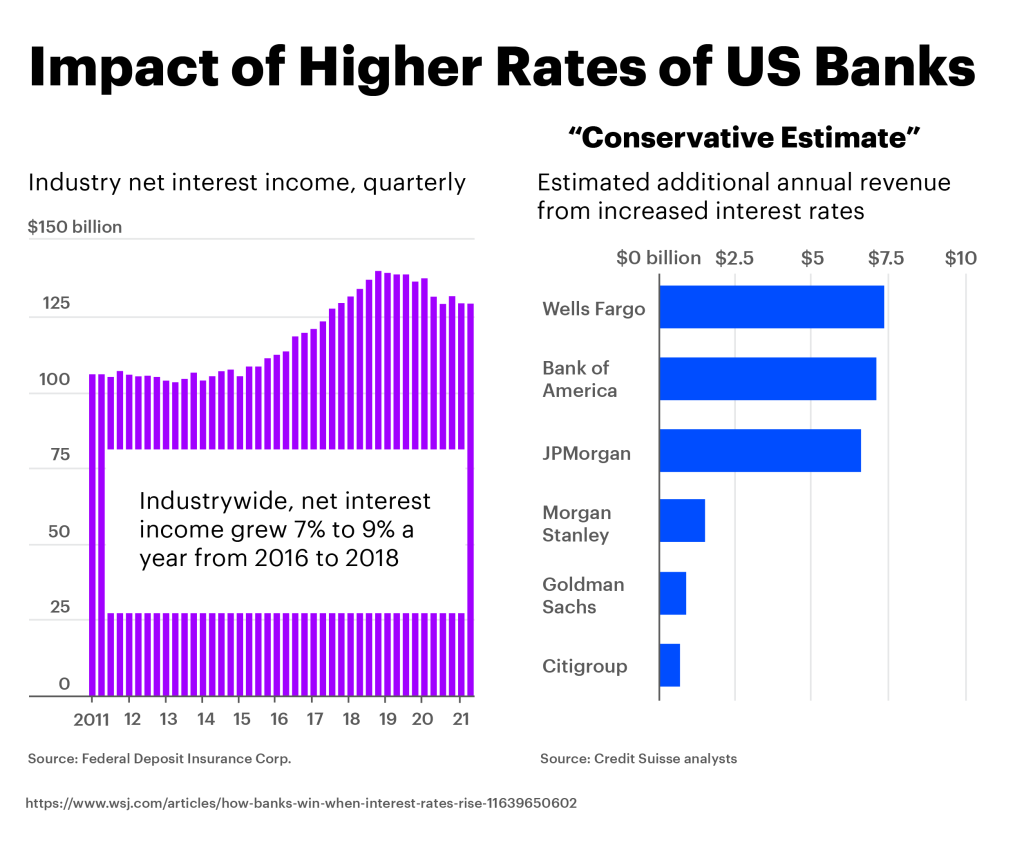

Simply how a lot cash are they prone to have? Effectively, a conservative estimate primarily based on a Credit score Suisse evaluation is that top-tier US banks will every acquire extra income of greater than $5 billion a 12 months—presumably as much as $7.5 billion.

Some banks will likely be tempted to take a seat tight on this extra income or go it on to shareholders. There are many persuasive causes for this, like financial uncertainty, diminished buyer confidence, extended inflationary pressures, rising beta on deposits and potential greater credit score losses. Analysis by Celent signifies win and retain enterprise now then it was 12 months in the past.

There’s additionally rising competitors from fintechs, neobanks, and non-banks, every searching for to lift the bar for buyer expertise.

Some banks could really feel that the digital buyer experiences they provide at the moment are adequate. Definitely, most banks have achieved a minimum of fundamental competence right here. Analysis from MagnifyMoney discovered that customers of the cell apps of the 110 largest incumbent banks, credit score unions and on-line banks within the area gave their instruments a mean ranking of 4.1 out of a potential 5.

Nonetheless, at the moment’s digital banking experiences quantity to a galaxy of indistinguishable stars. To make use of a favourite phrase of Mike’s at the moment’s digital banking is generally functionally right and emotionally devoid. True differentiation going ahead will rely much less on the pixels and extra on driving significant experiences via hyper-personalization, transparency, product innovation, human availability when it issues and, in the end, measures that promote clients’ monetary wellness.

That is very true as retail clients shift from over-saving (a consequence of pandemic stimulus checks and the moratorium on pupil mortgage funds) to over-spending attributable to pent-up demand, inflationary stress on the worth of the greenback, the rise in unsecured lending balances, and so forth.

For this reason I firmly imagine that hesitation to take a position these earnings will result in long-term remorse. The query isn’t whether or not to take a position however the place.

The highlight shifts to belief and innovation

As shoppers brace for an financial downturn, they are going to be searching for a secure harbor the place they’ll climate the storm. Trusted establishments have a head begin in filling this want. For instance, by explaining the distinction between a cryptocurrency supernova and the rising constellation of central financial institution digital currencies, incumbent banks ought to be capable to advise and shield their clients as they grapple with difficult, unfamiliar points. Clients will likely be watching their banks intently to see if they’re actually “there for them” when it issues.

Fintechs are additionally feeling the influence of a pull-back in funding coupled with rising labor prices, which may result in a culling of their numbers. Nonetheless, these left standing are prone to be stronger—and even stronger competitors for conventional banks. To counter this menace, incumbents might want to transcend upgrading their cell apps and constructing higher digital variations of themselves. They should present clearly the worth they supply their retail clients.

This worth, and the differentiation it delivers, will likely be based both in enterprise mannequin transformation (open banking, platform marketplaces, embedded finance) or innovation (new capabilities, hyper-personalization, partnerships in adjoining markets). Each methods would require modernization from the within out, as legacy platforms impose basic constraints on pace to market, information availability and innovation typically. Trendy platforms might want to embody event-driven structure, superior information and analytics capabilities, and modernization of the core.

However like Halley’s Comet, this chance is not going to be right here without end. We imagine retail banks that act now to redeploy the surge in internet curiosity earnings will profit from their transformation for a few years to come back.

Within the subsequent submit on this sequence, I’ll focus on what I imagine are the 5 important steps to profitable transformation.

Within the meantime, we’d welcome the chance to speak in regards to the North American macro-economic panorama and the way retail banks ought to reply. You possibly can attain Mike here and Steve here.

Disclaimer: This content material is supplied for normal data functions and isn’t supposed for use instead of session with our skilled advisors. This doc could consult with marks owned by third events. All such third-party marks are the property of their respective house owners. No sponsorship, endorsement or approval of this content material by the house owners of such marks is meant, expressed or implied. Copyright© 2022 Accenture. All rights reserved. Accenture and its brand are registered logos of Accenture.

[ad_2]

Source link