[ad_1]

Whereas the Singapore authorities’s newest Finances 2023 doled out a number of goodies, it additionally got here with one surprising shocker (particularly for a lot of working moms) when it was introduced that there’ll be modifications to the Working Mom’s Youngster Reduction (WMCR) scheme from 2024 onwards.

The scheme is among the authorities’s efforts to encourage married girls to remain within the workforce even after they’ve children. And for a number of years now, you could possibly say the scheme has been comparatively profitable at attaining its goal, particularly as being a working mom meant one may get much more advantages from the federal government vs. if one selected to stop and be a stay-home mum.

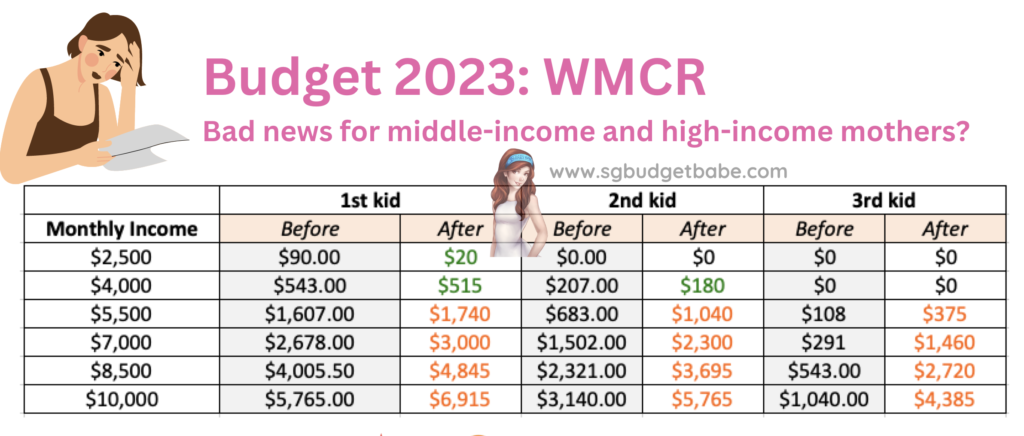

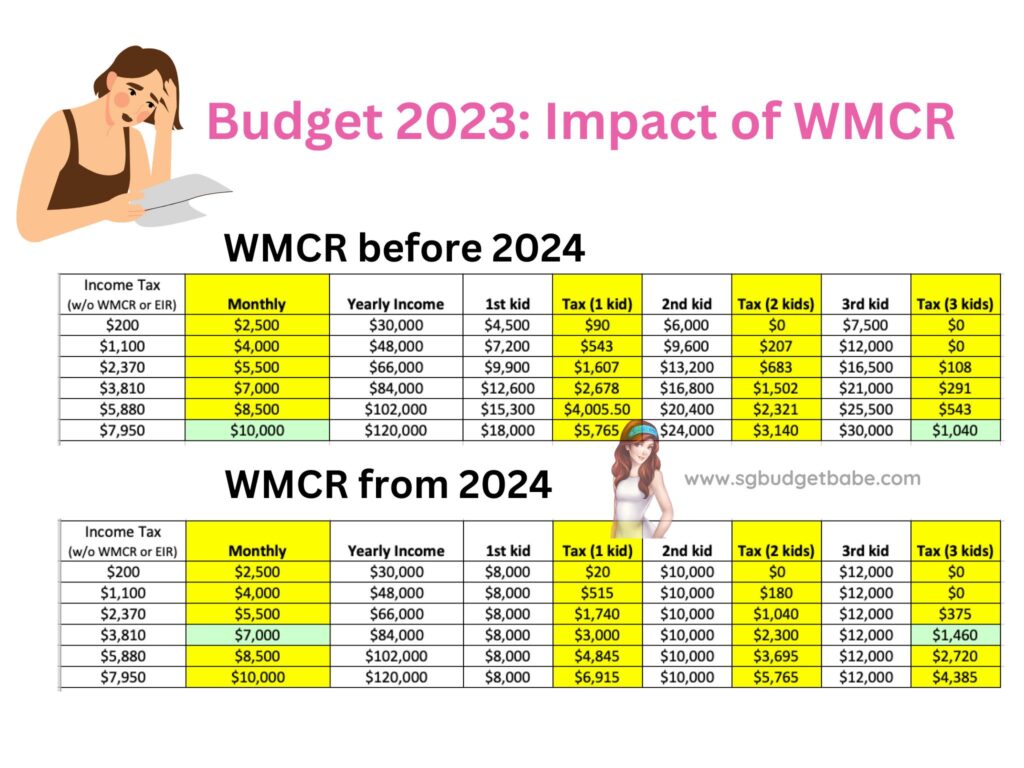

The outdated scheme, which allowed working moms to assert a share of revenue tax reliefs for each little one, was good within the sense that even for girls who had been high-flyers at their workplaces and incomes a excessive revenue, may gain advantage in the event that they determined to have extra youngsters and contribute to Singapore’s beginning inhabitants.

After all, there have been sure limits to make sure this wouldn’t be abused. As an example, the utmost reliefs had been capped at $80,000 per mom (whatever the variety of youngsters) and 100% of her revenue for individuals who have extra children.

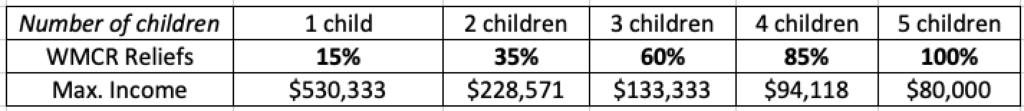

However come 1 January 2024, moms who give beginning after this date will now have their reliefs pegged at a set greenback fairly than a share of their revenue.

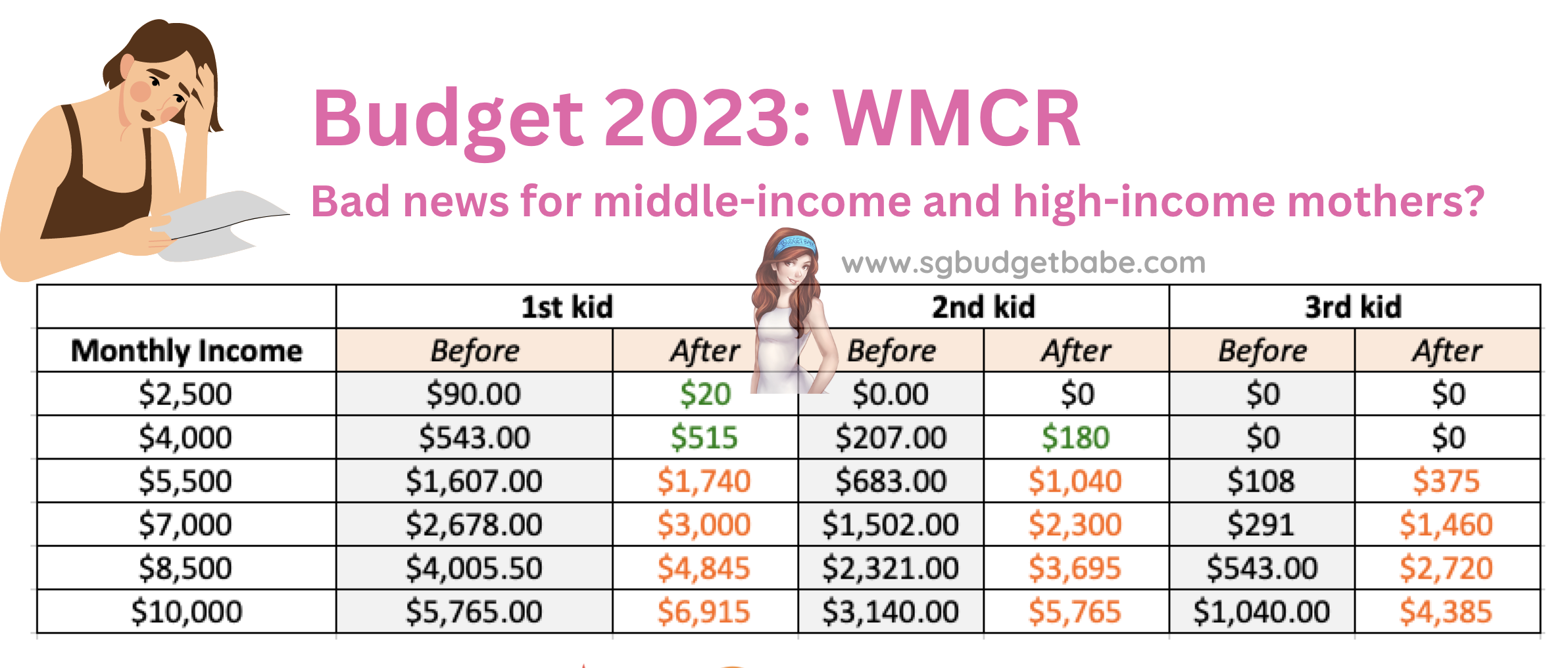

This transfer has been stated to be a type of wealth tax, the place the upper revenue are taxed disproportionately greater than the poor. Nonetheless, based mostly on my calculations, it appears just like the middle-income may also bear a major brunt from now:

I’ve calculated the assorted revenue situations, and located that for working moms who earn $4,200 or extra and have youngsters subsequent 12 months onwards, the brand new WMCR modifications will hit them the toughest.

And when you take a look at the fields I’ve highlighted in inexperienced, you is perhaps shocked to see how a mom of three incomes $7k will now should pay extra taxes ($1,460) vs. her older peer who earns $10k ($1,040), regardless of doing what the federal government needs and producing the identical variety of children (3).

On social media, the feelings are combined. Most individuals aren’t too blissful in regards to the change, however extra importantly, whereas it does assist the decrease revenue moms extra, you’ll be able to see from the desk above that the greenback influence actually isn’t that a lot. However, much more taxes is now being collected from each the middle-income AND higher-income moms, including additional to the stress that profitable profession girls already face as it’s.

With inflation and rising prices, it’s already troublesome to justify elevating 3 youngsters even when a feminine earns $7,000 a month ($84k a 12 months). Whereas I get that there are a lot of different elements that finally leads a pair to deciding what number of youngsters they wish to have, the federal government eradicating this doesn’t bode properly, in my view.

And once we contemplate how having children is changing into more and more costly, this will likely make higher-income girls suppose twice about whether or not to have extra youngsters, so it’s doable that we’d see the beginning price drop amongst this group.

Basically, any good or succesful woman incomes greater than $4,200 will now be affected. Contemplating how the median income for fresh university graduates is already at $4,200, this may have vital influence on the females.

Giving an even bigger Child Bonus ($3k extra) doesn’t actually minimize it when you think about how that’s a one-time payout, whereas paying revenue taxes is throughout a few years, sometimes 20 – 40 years for many moms.

I’m all for paying taxes, particularly wealth taxes, however I’m unsure I like how the federal government has chosen to take extra of it from a bunch who’s already wired sufficient as it’s – working moms who’re struggling to do properly at their job and climb the company ladder WHILE concurrently being a great and current mother or father as properly.

What do you consider the latest coverage modifications?

Share your ideas with me within the feedback under!

[ad_2]

Source link