[ad_1]

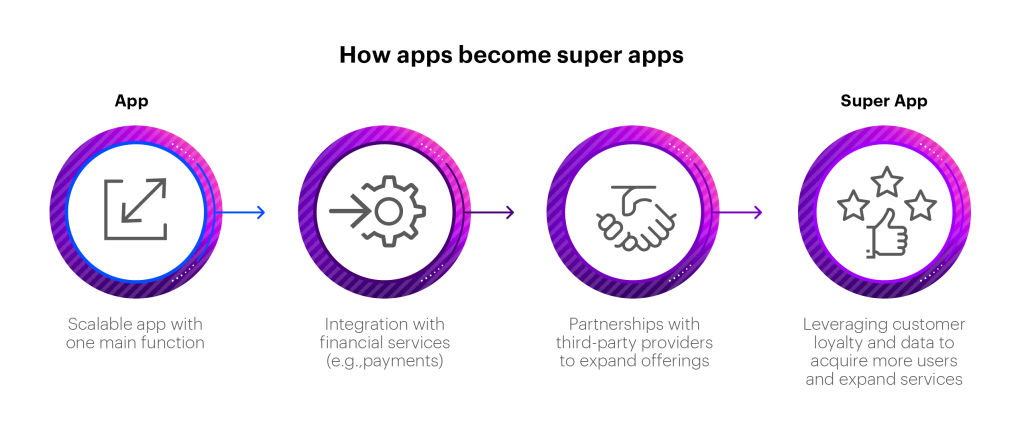

Again in 2009, Apple coined the catchy phrase, “there’s an app for that.” Since then, apps (single-use apps, that’s) have multiplied exponentially and change into a part of on a regular basis life for most individuals. However a brand new breed of app is on the rise, and it’s threatening to consolidate energy and market share. The “super-app” is changing into a significant disruptor within the on-line market and the digital monetary providers ecosystem. Ought to incumbents be frightened, or is that this a possibility in disguise?

What’s a super-app?

A brilliant-app is an umbrella app that provides a full ecosystem of providers formed round customers’ on a regular basis life-style wants, utilizing one built-in interface or platform. It normally entails a market of third-party choices absolutely built-in into the ecosystem and makes use of huge quantities of knowledge to have interaction with customers and supply all kinds of experiences and providers.

Among the most typical options in super-apps embrace:

Funds and monetary providers

- Cashless funds

- Cellular funds

- Funding platforms

- Insurance coverage

- Credit score and loans

- QR code funds and rewards

Retail providers

- Occasion ticket bookings (e.g., films, theatre, sporting occasions)

- Restaurant and grocery ordering

- Lodge bookings

- E-pharmacies

- Transportation ticketing (e.g., bus, practice, flight)

- Different e-commerce

Different features

- Information and media content material

- Calling and messaging

- Job search

- Leisure (e.g., music, movies)

- Actual property and leases

- Cloud storage

Why are super-apps on the rise?

As utilizing apps has change into a longtime conduct for a lot of customers, they’ve change into comfy doing increasingly more on-line and on their sensible telephones—from purchasing and banking to attending enterprise conferences, watching films, reserving transportation and extra. This has paved the way in which for super-apps to consolidate a market that has change into too giant and unwieldy for customers to maintain up with.

Tremendous-apps supply the good thing about a one-stop platform for a number of duties that customers wish to carry out on-line. Opening a single super-app is far more handy for customers than managing dozens of particular person apps. That is the primary cause super-apps are gaining floor over single-use apps.

By bringing collectively a spread of experiences, providers and features on a single platform that clients already really feel assured utilizing, super-apps present seamless experiences that maintain customers engaged. Additionally, by providing loyalty rewards, customers are inspired to conduct extra of their enterprise on the super-app to maximise these advantages.

Tremendous-apps are already dominant in a number of markets

1.24 billion customers China’s main social app has change into a profitable super-app, providing messaging, social networking, purchasing, funds and different providers totally free.

230 million customers A extensively used digital pockets in China began by {the marketplace} big Alibaba, Alipay’s QR code funds are utilized by hundreds of thousands of companies from luxurious malls to avenue outlets.

187 million customers Southeast Asia’s main super-app, Seize, affords providers in three foremost areas: deliveries (meals, meals, packages, paperwork), transportation (journey hailing) and monetary providers (funds, e-commerce and insurance coverage).

![]()

170 million customers Though it began as a name centre for ride-hailing providers, Indonesia’s GoJek super-app now affords over 20 providers in transport & logistics, meals & purchasing, funds, each day wants, enterprise and information & leisure.

150 million customers India’s main super-app affords cell recharges; utility invoice funds; journey, film, and occasions bookings; in-store funds; parking funds; tolls and cost at instructional establishments by their QR code system.

![]()

48 million customers Working throughout 13 nations within the Center East and North Africa, Careem affords a variety of providers together with transportation, meals, purchasing, deliveries, funds and sending credit score.

How is Open Banking powering super-apps?

The rise of Open Banking around the globe is enabling super-apps to make use of monetary information from a number of sources to focus on clients’ wants and ship monetary merchandise. This may give the platforms a good larger alternative to offer a spread of economic providers and goal the suitable providers to every consumer.

Open Banking will energy super-apps by:

- Maximizing personalization: Open Banking creates an ecosystem that proactively helps platforms leverage clients’ information and create really customized experiences for them.

- Accessing the whole lot on one platform: As soon as the super-app is ready to use Open Banking information, customers could make funds, examine their account balances, monitor current transactions and carry out different conventional banking operations from the app’s digital pockets, decreasing the necessity to entry a financial institution’s personal app.

- Utilizing superior expertise: Analytics, synthetic intelligence, and machine studying can leverage Open banking information to construct customer-relevant merchandise and foster a tradition of knowledge sharing and data-driven decision-making throughout the super-app’s enterprise ecosystem.

- Connecting the suitable companions: As Open Banking expands additional into open finance and open information, super-apps will be capable to entry and join with a bigger variety of companions to offer sooner pace to marketplace for new merchandise and a good wider buyer base.

How will super-apps have an effect on banks?

Tremendous-apps combine monetary providers into their platforms to offer seamless experiences for his or her clients. For banks, which means that an rising variety of customers might bypass banking apps and easily use the extra built-in super-app. Tremendous-apps with digital wallets additionally make it simpler for the customers to remain within the super-app ecosystem and scale back their dependence on money and bank cards.

Some banks have already change into part of the super-app ecosystem by offering unbranded “banking as a service” to the apps, making all of this seamless integration attainable. The regulatory framework round monetary providers is so onerous that many super-apps merely don’t wish to navigate it themselves, particularly throughout a number of markets and regulatory regimes. Which means super-apps providing e-commerce, loans, insurance coverage merchandise, investing platforms and extra are creating strategic partnerships with each banks and fintechs of their key markets to offer these providers.

As the recognition of super-apps grows, they might change into a a lot greater supply of competitors for banks than both neobanks or fintechs. By protecting customers engaged on their platform, they might make it nearly inconceivable for banks to persuade clients to depart the super-app as a way to use the financial institution’s standalone digital banking apps.

What ought to banks do now?

Banks typically have three choices for responding to the rise of super-apps:

- Settle for modifications to the market and attempt to keep aggressive by selling their very own choices.

- Lengthen their attain by embedding providers (probably unbranded) inside super-apps or different digital monetary providers.

- Compete head-to-head with the super-apps by launching their very own wide-ranging super-app encompassing each monetary and non-financial choices.

Let’s take a look at every of those choices in additional element:

Settle for: Selecting choice 1 will restrict banks’ progress, though well-established banks might be able to maintain on to their market share as a result of they’re trusted manufacturers which have a big buyer base and proprietary information. Nonetheless, banks might discover that even the purchasers that stick with them are additionally utilizing super-apps for a few of their monetary wants, doubtlessly chipping away at income.

Extend: Choice 2 is the method that many banks will seemingly think about. Some will supply white-label providers within the background and quietly generate income from them. Others might proceed to leverage their model throughout the super-app’s ecosystem, utilizing the platform to create a smoother and extra handy consumer expertise. Nonetheless, given the truth that the variety of super-apps is restricted, banks might want to act rapidly or danger having nobody left to associate with.

Compete: Choice 3 will entice the boldest banks—these prepared to reimagine their enterprise mannequin and regulate their imaginative and prescient to embrace the challenges of constructing an ecosystem of their very own. So as to compete with the rising and established super-apps, these banks might want to:

- Set up a imaginative and prescient: Banks must pinpoint what their function will probably be on this new period earlier than enterprise the transformation to change into a monetary providers or life-style ecosystem. Banks that don’t carve out an outlined area of interest may discover themselves made redundant.

- Embrace open information: Tremendous-apps thrive on the free movement of knowledge between entities. To compete, banks might want to discover open information structure and software programming interfaces (APIs) too.

- Grow to be an information participant: Banks might want to construct information administration capabilities like analytics algorithms and machine studying to unlock the worth of their very own information and third-party information, and launch new consumer experiences and journeys.

Contact us to debate your technique for surviving—and thriving—past the rise of super-apps.

With because of Vibhu Gangal and Deepika Rathi for his or her contributions to this text.

Get the newest blogs delivered straight to your inbox.

Disclaimer: This content material is supplied for basic info functions and isn’t meant for use rather than session with our skilled advisors. This doc refers to marks owned by third events. All such third-party marks are the property of their respective house owners. No sponsorship, endorsement or approval of this content material by the house owners of such marks is meant, expressed or implied.

[ad_2]

Source link