[ad_1]

Generative AI: what’s in it for me? Everybody, together with auto and tools finance suppliers, desires to know. The way in which I see it, it’s a expertise that may have far-reaching impacts on the lending and leasing enterprise, bringing efficiencies and higher experiences for these organizations that incorporate it throughout the worth chain.

A couple of weeks in the past, I put ChatGPT to the check myself. I wanted to jot down a brand new bylaw for the board of a non-profit I sit on, and I used to be curious to see what ChatGPT would provide you with. Did it generate a superbly shaped bylaw that I may use as-is? It didn’t. But it surely did give me a wonderful place to begin and considerably diminished my time on the duty—by my estimate it saved me a number of hours. With some finetuning and the addition of particulars particular to our state of affairs, it helped me write a really usable doc that I used to be capable of take to the board.

By now, auto and tools lenders and lessors have most likely heard a whole bunch of anecdotes like this. However you’re most likely nonetheless questioning whether or not it’s price implementing generative AI or if it’s simply the newest flash within the pan that may rapidly get replaced by another cool new expertise.

To reply this query, let’s take a look at 4 areas of the auto and tools finance worth chain the place my colleagues and I see generative AI being invaluable.

Pre-originations and originations

In Michael Abbott, Jess Murray and Keri Smith’s latest submit on the Accenture Banking Weblog, Breaking Barriers: Exploring How Banks Scale Generative AI for Growth, they famous that early adopters are already exploring the usage of generative AI for advertising. The thought is to make use of it to scale hyper-personalized advertising content material, so that each buyer communication is extra related.

My Specialty Finance Heart of Excellence colleague Abhishek Rastogi agrees that generative AI may very well be an enormous boon for auto and tools financiers’ advertising campaigns. He suggests utilizing information and AI to higher goal advertising campaigns by analyzing clients’ preferences and needs—for improved conversion charges and better income.

Generative AI may be used as a gross sales assistant. With human-sounding interactions mixed with its evaluation capabilities, it may assist reply buyer questions immediately, or rating and phase results in assist gross sales reps prioritize their efforts. It may additionally level out alternatives for cross-selling.

Lately my colleague Bailey Carrigan helped one among our purchasers, which has an tools leasing portfolio, determine proactive advertising and cross-selling alternatives. Utilizing AI to help with information evaluation, her workforce was capable of acknowledge patterns that the consumer may use as a basis for enhancing the advertising of apparatus finance merchandise—launching the following decade of development and profitability.

Underwriting

Auto and tools lenders and lessors are all the time looking for methods to make underwriting higher, quicker and cheaper. I believe generative AI may play a big position in serving to financiers view and analyze credit score in new methods.

When Abhishek and I have been talking about this, he instructed that generative AI may develop into an underwriter’s assistant. What would that seem like? The AI would confirm the shopper’s info, analyze their reimbursement historical past, earnings / monetary ratios, employer particulars, credit score scores and publicity, and think about advertising info and information studies earlier than auto-generating a credit score evaluation report. It may additionally work together with the underwriter to carry out further checks and auto-update the credit score evaluation report based mostly on these findings.

Generative AI may be used for pricing evaluation. Based mostly on comparable credit score scores, mortgage to worth, monetary efficiency, earlier loans written and closed, and danger, it may present the optimum pricing for the present contract. This is able to free appreciable bandwidth when it comes to time spent by a human underwriter or funding in a separate pricing system.

Servicing

Variable workflow administration is one other widespread problem confronted by auto and tools lenders and lessors. Due to the cyclical nature of this enterprise, and the necessity for month-to-month and quarterly reporting, financiers expertise resourcing bottlenecks a number of instances a yr. Our purchasers typically ask for our assist in streamlining workflows and discovering methods to backfill positions with assets from different components of the group to assist throughout these exceptionally busy instances.

Usually, we work collectively to implement a mix of expertise and cross-training methods to fill the gaps. However with generative AI, I anticipate variable workflow administration to be much less of a difficulty. AI can help the human workforce by performing the repetitive guide duties considerably extra rapidly, thereby decreasing the staffing variability and liberating up folks for higher-value work the place the human connection is a precedence.

As increasingly leases are bundled with a contract for service and upkeep of the asset, we all know generative AI can even develop into a useful software for predictive upkeep. AI fashions can predict when an asset is prone to fail and schedule its upkeep accordingly. This can cut back downtime prices for the financier in addition to shield the resale worth of the asset—and enhance the expertise for purchasers.

Generative AI can even be helpful for fleet administration. It may be used to observe and handle driver habits, monitor the placement and standing of autos, examine insurance coverage coverage expiry dates, file claims and observe their progress. Additional, it may generate studies on fleet and claims administration, analyze information and suggest alternatives for enchancment and growing profitability.

Finish of time period

Finish of time period is one space of leasing the place I see one other hole that may very well be stuffed by generative AI. I’m all the time stunned at how few—if any— lessors benefit from the wealth of data at their fingertips to make data-driven selections at this important time within the financing life cycle. In lots of instances, financiers don’t even use a spreadsheet to optimize their finish of time period, not to mention refined analytics instruments.

Take into consideration the case of a copier leased to a buyer for 36 months. On the finish of the time period, as a lessor, how do you maximize the return?

- Do you make a proposal to the shopper to maintain the copier in place?

- Do you carry the copier again and promote it?

- Do you prolong the time period or speed up it?

With the assistance of generative AI, you could possibly reply these questions and make the optimum selections for your online business.

One other information level that would have a huge effect on end-of-term selections for auto financiers is how the colour of a automobile impacts its depreciation and resale worth. A survey by iSeeCars.com discovered that yellow, beige and orange carry essentially the most cash when it’s time to promote, though with some variance relying on the automobile phase. Generative AI may use this info together with different components—like mileage, put on and tear, geography and time of yr—to find out one of the best time to promote an off-lease automobile and whether or not it’s price repainting it earlier than promoting.

AI may additionally assist with end-of-lease inspections. It may analyze automobile pictures to evaluate costs for extra mileage, harm, and put on and tear, and auto-generate automobile inspection and harm estimation studies. It may even work together with the shopper to barter the fees and help them within the automobile return course of.

The expertise may additionally assist lenders and lessors focus their retention efforts by predicting which clients are most probably to churn. And it may personalize presents for purchasers based mostly on their particular person wants, and their preferences for vehicles with extra space or decrease month-to-month funds, for instance.

The use instances for generative AI at finish of time period are so quite a few that my prediction is the entire end-of-term course of will likely be automated within the subsequent few years.

The underside line

These are only a handful of examples out of a whole bunch that illustrate how generative AI goes to alter the way in which auto and tools finance firms work. It’s like Paul Daugherty and workforce say of their report, A New Era of Generative AI for Everyone: “The expertise underpinning ChatGPT will remodel work and reinvent enterprise.”

One other level from our new report that hit house for me: “We’re at a section within the adoption cycle when most organizations are beginning to experiment by consuming basis fashions ‘off the shelf.’ Nevertheless, the largest worth for a lot of will come after they customise or advantageous tune fashions utilizing their very own information to deal with their distinctive wants.” For auto and tools lenders and lessors which have a long time of information to mine, customizing generative AI’s foundational mannequin and coaching it to finetune its evaluation based mostly by yourself datasets will likely be a key aggressive benefit.

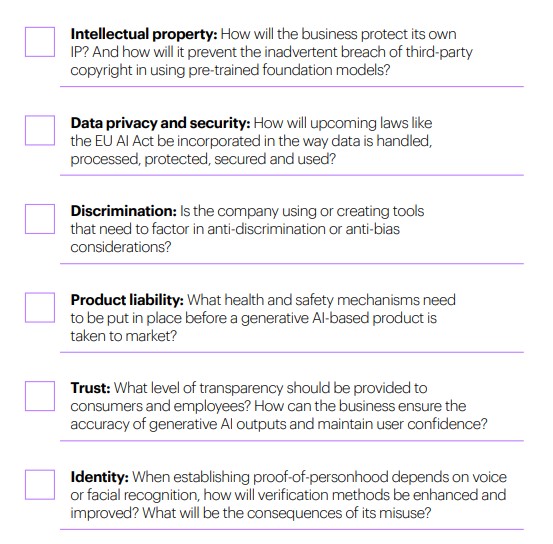

After all, utilizing generative AI is just not with out danger. In that very same report, the authors determine the next six key danger and regulatory questions for potential customers of generative AI:

My banking colleagues add three additional risks to this record: mannequin hallucinations (credible-sounding solutions that is probably not correct), black-box considering (no solution to know the way the generative AI got here to its reply), and biased coaching information (output high quality is barely pretty much as good because the supply materials).

Nonetheless, it’s my opinion that generative AI will carry untold benefits to auto and tools finance organizations, particularly these with the foresight to make use of it together with their huge shops of underutilized information.

Early adopters are already exploring use instances in these areas of the finance worth chain. Will you be one among them?

If you happen to’d like to debate how your finance enterprise may uncover new efficiencies throughout the worth chain by incorporating generative AI, please reach out to me.

Additionally, I extremely suggest studying this Accenture report written by Paul Daugherty and colleagues: A New Era of Generative AI for Everyone.

Particular because of Bailey Carrigan, Accenture Tools Finance Senior Supervisor, and Abhishek Rastogi, Accenture Auto and Tools Finance Enterprise and Integration Supervisor, for his or her beneficiant contributions to this submit.

Disclaimer: This content material is supplied for normal info functions and isn’t supposed for use instead of session with our skilled advisors. This doc might seek advice from marks owned by third events. All such third-party marks are the property of their respective house owners. No sponsorship, endorsement or approval of this content material by the house owners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

[ad_2]

Source link