[ad_1]

Investing in fractional shares will be helpful for each new and skilled traders. For many who are simply beginning out and wouldn’t have an enormous sum of capital to take a position, fractional shares mean you can personal the shares of an organization while you can’t afford to pay full value for a inventory. For knowledgeable traders, fractional shares are helpful in portfolio allocation, because it permits us to regulate the precise portfolio publicity that we wish to have for sure shares and even industries. With Syfe Trade, which calls itself Singapore’s first neobroker, now you can spend money on fractional shares within the US from as little as US$1.

I typically get requested by readers who’re new to investing and want to buy shares of firms like Fb, Amazon and even Google for a begin, however wouldn’t have sufficient to buy even the minimal (1 share for US equities).

In Singapore, the minimal funding sum has been reduced from 1000 shares to 100 shares since 2015, whereas the minimal in HK is determined by which inventory you are shopping for (S$8000+ for Tencent at time of writing vs. S$2000 for Alibaba).

Most traders within the US don’t face this concern as Robinhood – which is broadly used there – affords fractional shares buying and selling, however Singapore didn’t have this selection till pretty just lately.

What’s a fractional share?

A fractional share is something that’s lower than 1 share of an organization.

They aren’t a brand new idea, albeit referred to as “odd heaps” for these of you who’ve invested or obtained scrip dividends earlier than. Nonetheless, you can’t immediately buy fractional shares in any inventory listed within the SGX, which implies that should you wished to purchase DBS, you will want to pay a minimal of S$32 x 100 = $3,200 to personal it.

In case you’re utilizing Tiger, Moomoo, FSMOne, POEMS, DBS Vickers or OCBC Securities, you can find that while you wish to purchase 1 share of any US inventory e.g. Alphabet, you will want to pay not less than US$2,800 (at time of writing).

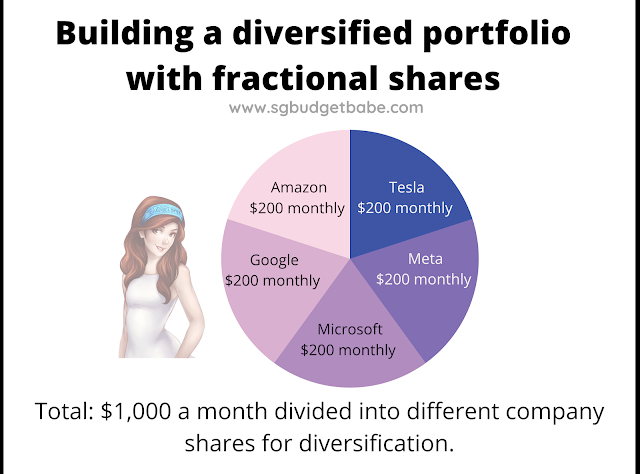

However what should you’re beginning with $10,000, and wish to unfold that out throughout 5 or totally different shares somewhat than simply having one place be greater than 25% of your portfolio?

Attempt to recreate the portfolio I’ve proven for instance above, and you’ll shortly discover that you’ve

- uneven allocations

- >70% publicity on simply 3 positions alone (AMZN, GOOGL and TSLA)

- uninvested {dollars} left over

However should you use a brokerage that means that you can purchase fractional shares – like Syfe Trade – you may simply be capable to management and craft your required portfolio with out the above points.

What are the advantages of shopping for fractional shares?

Make investments with as little as US$1.

Fractional shares are extremely helpful to youthful or newer traders who might not have (or want to commit) some huge cash to a inventory.

Which means not like traders of my period, you now not have to attend till you have constructed up a capital base of not less than a number of thousand {dollars} earlier than you begin investing. I began solely after I had constructed up S$20,000, as fractional shares weren’t accessible throughout then.

Get publicity to a inventory that may in any other case have been too costly so that you can personal.

You get the identical proportion (%) returns no matter your capital. Amazon is commonly used for instance, as its share value of greater than US$3,000 is kind of tough for a lot of younger traders to purchase. However with fractional shares, you now not should pay full value – as a substitute, you get to pay what you may and get the corresponding fraction of the share.

If Amazon goes up by 10%, you may additionally see your place go up by 10%.

Gone are the times the place you have to limit your self to solely firms with a decrease share value (comparatively talking) since you had restricted capital.

You are able to do dollar-cost averaging extra effectively.

Whether or not you want to allocate US$10 or US$100 per thirty days to all of your favorite shares, now you can accomplish that precisely. This is able to have been unattainable up to now while you needed to think about minimal lot measurement (which remains to be the case in Singapore and Hong Kong immediately – this can be very tough to do DCA into shares like Tencent or BYD).

You possibly can management your portfolio publicity and asset allocation.

Think about that you simply wished to set particular allocations to totally different industries or inventory sorts in your portfolio, similar to restrict SaaS (software-as-a-service) firms in your portfolio to not more than 20% since you’re involved in regards to the volatility of their share value particularly as we transfer into 2022.

You nonetheless cannot do this on any of the prevailing native brokerages, however with Syfe Commerce, you now can.

What are the downsides to purchasing fractional shares?

The most important downside to fractional shares is that they don’t seem to be all the time accessible in most brokerages. In the meanwhile, solely Interactive Brokers and Syfe Commerce supply this to traders. Interactive Brokers targets the extra savvy and superior traders / merchants, with extra complicated options similar to choices, margin buying and selling, derivatives, and so forth.

You may additionally find yourself paying much more in transaction charges because of the temptation to spend money on many various firms.

This can be a widespread drawback amongst new traders, who might find yourself being extra reckless with their cash since they will spend money on nearly any inventory no matter capital now.

To keep away from these, you will want to be disciplined as an investor and calculate the price of your strikes both manner.

Shopping for fractional shares with Syfe Commerce

If you wish to purchase fractional shares, one of many best methods to take action could be by means of Syfe Trade once they launch on 18 January 2022.

For now, you may join their waitlist with the intention to get early entry to the buying and selling platform. What’s extra, it’s possible you’ll end up one in all 10 fortunate winners to stroll away with an iPhone 13 while you be part of the waitlist! The draw closes on 17 January 2022 and you may view the waitlist contest details here.

Most of us are already acquainted with Syfe, due to their revolutionary robo-advisory platform which has launched a number of options over time, and just lately gave DIY traders the flexibleness to customize our own ETF portfolio.

However what’s much more thrilling is that Syfe has just lately been accredited to start out providing brokerage companies, and can quickly be launching Syfe Commerce. Syfe touts this as Singapore’s first neo-broker, with the goal of creating investing extra accessible (and simpler) for extra individuals.

In case you’re unfamiliar with the time period, neo-brokers basically check with a brand new class of brokerages which can be democratising inventory investing by means of decrease charges and easy-to-use digital platforms. Robinhood is probably the perfect instance, as they empowered retail traders to take a position even with simply $1 due to fractional shares. In any other case, not each US investor would have been in a position to afford Tesla shares.

Designed as an easier and extra inexpensive manner for retail traders to commerce US shares, Syfe Commerce additionally comes with the next advantages:

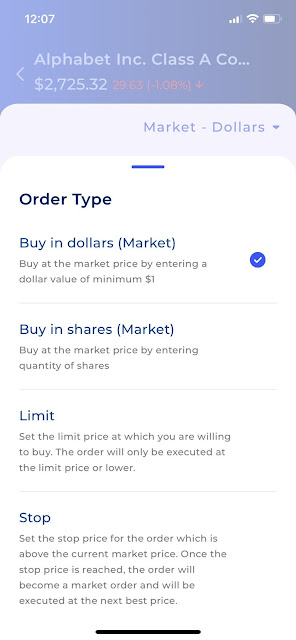

It is possible for you to to purchase AND promote fractional shares on Syfe Commerce, and your orders shall be crammed in real-time i.e. not like some brokerages which group the fractional shares throughout totally different traders and buy on the finish of the buying and selling day.

In case you are shopping for full models of shares, you too can set Restrict or Cease order operate to regulate the costs that you’re keen to pay for.

How a lot are charges on Syfe Commerce?

As a part of its introductory supply, you may get 5 commission-free trades per month, and just US$0.99 per trade after that.

From Q2 2022 onwards, you’ll nonetheless get 2 commission-free trades every month, with subsequent trades at US$1.49.

Except for being the bottom amongst all the opposite brokerages in Singapore proper now, what I like that Syfe has chosen to cost its charges as a easy all-in price, as a substitute of charging individually for fee price + a platform price.

There are no custodian charges and likewise no dividend dealing with charges. If the inventory you are invested in pays out dividends, your corresponding share of that dividend shall be credited immediately into your account.

Is Syfe Commerce protected?

In case you’re involved about safety, you may be glad to know that Syfe is regulated by the Financial Authority of Singapore. Your US securities are custodised in particular person accounts maintained with Syfe’s US broker-dealer, who’s a member of the SIPC (Securities Investor Safety Company) in the US. SIPC protects the securities clients of its members as much as US$500,000 (together with US$250,000 for claims for money) within the occasion of brokerage failure.

Once you switch cash into Syfe Commerce to take a position, your funds are held in a belief account with HSBC and are stored separate from Syfe’s personal accounts.

As somebody who principally curates particular person shares and ETFs for my very own funding portfolio, I’ve all the time advocated that robo-advisors are a super-easy manner for newcomers to get began, whereas instructing readers who search increased returns on how they will be taught to pick their very own particular person shares.

Which is why I am happy that Syfe is doing this, and see it as a transfer in the proper path.

Sponsored Message by Syfe

Investors in Singapore trying to commerce US-listed shares and exchange-traded funds (ETFs) will quickly have another choice with Syfe Trade. What’s extra, you can commerce fractional shares on Syfe Commerce, which implies you’ll now not should pay excessive commissions, charges, or massive sums of cash to take a position on the earth’s largest firms.

You possibly can earn greater than S$200 in money credit while you join, fund and execute your first commerce, and refer your pals to Syfe Commerce. This shall be credited into your account as a rise in your shopping for energy, which you’ll then use to purchase any US inventory or ETF of your selection. Full T&Cs here.

Click here to register on the waitlist for Syfe Trade, and stand a chance to win an iPhone!

P.S. In case you’ve beforehand registered for the waitlist and have been given early entry, you may follow the steps here to create your Syfe Commerce account. For present Syfe customers, the toggle operate to get to Syfe Commerce is inside “Settings”.

Early entry shoppers are additionally eligible for the Syfe Commerce welcome promotion, so that you don’t have to attend for the official launch to start out buying and selling.

Disclosure: I am an present person of Syfe, and was given early entry to check out Syfe Commerce with the intention to evaluation it. This text was written in collaboration with Syfe. All opinions are that of my very own.

Disclaimer: Not monetary recommendation. Any type of funding carries dangers, and not one of the shares talked about on this article serves as a advice to purchase (or promote). Your particular person returns might differ relying by yourself ability as an investor. At all times do your personal analysis earlier than investing. This commercial has not been reviewed by the Financial Authority of Singapore.

[ad_2]

Source link