[ad_1]

Monetary Effectively-Being. What’s it? Do you have got it? The vacations have come and gone, and as most of us return to work (or return to working at residence), it’s a important time for recalibrating and enhancing the way in which we handle our private funds.

Two years into a worldwide pandemic, well being is on everybody’s thoughts this yr. However there are lots of points to your private well being and wellbeing. Managing your funds correctly is without doubt one of the best and accessible methods of enhancing your on a regular basis life.

With that in thoughts, listed here are 10 methods you possibly can enhance your monetary well being in 2022, together with our estimates of how a lot effort and time every of those actions must be a hit.

Make use of Budgets

(Est: 2 Hours Per Month)

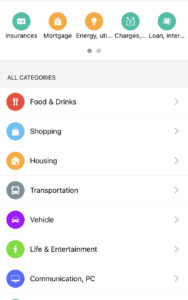

Whether or not you select to make use of “Zero Based Budgeting” or a extra versatile category-focused strategy, budgeting is an oft-overlooked however essential ability that may assist enhance your monetary well being with a average time funding. The “granularity” or specificity of your month-to-month finances is as much as you. Prior to now, I’ve gone as far as to interrupt down my spending on totally different classes of leisure akin to “cinema,” “quick meals,” and “eating places.”

Experiment and mess around with Pockets’s budgeting instruments with a purpose to determine the very best degree of element for you personally. The thought is to not guilt your self into not spending cash. That sucks, and it’s no enjoyable. Monetary well-being is about enjoyable too.

The objective is as a substitute to permit your self to spend a deliberate amount of cash, guilt free, on stuff you discover necessary. Deciding forward of time what every space of your finances is value to you personally is a good way of aligning your private priorities along with your psychological well being and monetary wellbeing. Who is aware of? Perhaps you don’t spend sufficient on the great issues in life.

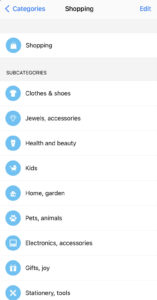

Set and Use Extra Classes

→

→

(Est: 5 minutes a day)

It’s arduous to finances correctly for those who don’t know what counts as what. Pockets by BudgetBakers has a big library of spending classes, however the app will depend on you to divy up your spending based on which class every gadgets belongs in. You’re free to make use of as many or as few classes as you want, an it’s additionally doable to set sub-categories to get much more readability in your spending.

Pockets works utilizing machine studying to regulate its automated categorization primarily based in your habits. So educate Pockets the way you need your classes to work. This may pay dividends as your classes turn into extra clear, and inside a matter of weeks, you’ll discover it takes no work in any respect to maintain them organized.

Plan Funds

(Est. 30 Minutes Per Week)

Do you know you possibly can plan upcoming payments with Wallet, together with by turning present funds into recurring ones? Lots of our clients don’t use this function, however they need to! There are often an entire bunch of things that come up frequently – often month-to-month. Understanding and categorizing every of those, in addition to planning your money circulation prematurely will assist your monetary well-being in the long term.

Optimize Debt Repayments

(Est. 2 Hours As soon as)

First settle for this controversial however finally releasing realization: money owed are usually not dangerous. Sure, nobody likes to have money owed looming over their heads, however the truth is that the world as we all know it’s constructed round debt. Lots of you have got pupil money owed, much more have mortgages, automobile funds, bank cards, or cost plans.

With inflation rising in most OECD nations, you have got a novel alternative proper now to realign your debt reimbursement plan round your monetary well-being. Not all of those money owed are equal. Right here’s a easy method: in case your rate of interest is decrease or equal to the projected inflation charge in your nation, then you must maintain paying solely the minimal funds on that debt. In case your rate of interest is increased than inflation, you must pay as a lot of that debt as you possibly can as quickly as you possibly can.

Why does this matter? It’s easy: in case your rate of interest is beneath inflation, that implies that the precept quantity you owe the lender will, in impact, be smaller a yr from now, even for those who didn’t pay any of it again. If the rate of interest is increased than inflation, you’ll owe extra in a yr than you owe now, all else being equal.

We’ll get to how you can optimize your money owed additional in a later level, however an necessary query is to ask your self whether or not you’re optimally paying again your money owed. It’s not the dimensions of a debt that issues, it’s the speed at which that debt grows or shrinks. You need money owed to develop slowly or by no means. In the event that they’re shrinking, a lot the higher!

Verify Your Credit score

Constructing on the earlier level, managing your money owed correctly will have an effect on your credit standing. This works in a different way in numerous nations, however most developed nations have a credit standing or analysis system that helps banks and different lenders perceive your credit score worthiness.

As unfair because it sounds, an individual with a greater deal with on their credit score may also get cheaper loans and extra favorable phrases. Subsequently it’s crucial that you just verify your credit score scores and historical past, and be sure to’re not lacking something necessary in your cost historical past. Ensuring your credit score report is correct will make it easier to to qualify for higher monetary phrases sooner or later.

Borrow Cheaper

(Est: 5-10 Hours)

And right here we loop again to the debt administration as part of monetary well-being. In case your credit score historical past is nice and your rating is excessive, then you definately might be able to borrow cash extra cheaply than you presently do.

Why does that matter? As a result of relying on how a lot you owe, getting cheaper debt can vastly scale back the amount of cash you find yourself paying lenders for a similar amount of cash. For instance, for those who carry bank card debt from month to month, you’re usually paying as much as 25% of the precept on that debt yearly.

For those who’re in a position to consolidate your money owed at a decrease rate of interest, you possibly can usually save an enormous amount of cash. Your money owed will disappear quicker, and your credit score will solely get higher, permitting you to decrease your debt burden even additional. For those who’re carrying bank card money owed, however you have got residence fairness or different collateral, you might qualify for a significantly better mortgage that may cease your increased premium funds, and make your debt *a lot* extra manageable.

With residence costs rising and inflation surging, for those who’re a home-owner, you will have the prospect to refinance your money owed and consolidate. Speak to a mortgage officer at your native financial institution or credit score union, and you might discover that they’re able to make it easier to make your burden far more inexpensive.

Cancel and Renegotiate

(Est. 30 Minutes Per Merchandise)

There’s an previous saying in enterprise: yearly, double your costs and hearth your worst consumer. Monetary well-being is not only about doing extra, but in addition about doing much less. So on the threat of encouraging our personal clients to cancel their subscriptions, you must undergo your month-to-month funds, and in lots of instances, cancel or renegotiate your funds.

Electrical, web, fuel, cellphone, and even automobile leases can usually be renegotiated when the shopper publicizes they’re seeking to transfer to a competitor. Who is aware of? Perhaps you’re leaving cash on the desk. Simply please don’t ask us for a yearly low cost! You possibly can already purchase Premium Lifetime for the price of a yr on the net… ?

Automate Your Financial savings

This one’s simple. Decide an quantity that you just’re snug with, and set an automated cost to your financial savings or cash market account each month. A buffer of 4-6 months of wage is usually thought-about wholesome, and it’ll enable you the non-public satisfaction and freedom within the information that you possibly can at all times stop your job and be okay for a while whilst you search for one other.

Don’t prioritize financial savings over debt funds, significantly if in case you have any excessive curiosity money owed (you possibly can at all times borrow sooner or later, however you’re paying for the privilege of owing this cash now), however for those who’re okay within the debt division, then begin saving!

Make Certain You’re Insured Correctly

(Est. 3-4 Hours)

For those who’re a household individual, or a home-owner, then you realize that your monetary well-being is about extra than simply having cash in your checking account. Huge bills can crop up that may kill your financial savings and finances. That’s, except you’re insured towards sudden enormous shocks.

House owner’s insurance coverage, private legal responsibility insurance coverage, and an energetic life insurance coverage coverage will carry you peace of thoughts, and safety towards sudden bills. If in case you have an energetic life insurance coverage coverage, significantly for those who’re self-employed, you possibly can even get advantages within the occasion that you just turn into unable to work or pay your mortgage or different obligations. Speak to a trusted insurance coverage dealer to just be sure you’re carrying the suitable quantity of insurance coverage. You could be stunned, significantly for those who’re nonetheless younger, how inexpensive good insurance coverage might be.

Lease Your Depreciating Belongings

(Est. 2-3 Hours Per Merchandise)

I do know, I do know. You’re a member of the PC grasp race, and you must have the most recent graphics playing cards and displays to get probably the most out of that Name of Responsibility subscription. Do what you suppose is greatest, however contemplate not shopping for costly depreciating property akin to computer systems, telephones, tablets, vehicles, and different gadgets that tumble in worth each month. Many markets have these things accessible for very cheap month-to-month funds, with the additional benefit of loss and breakage insurance coverage, and a substitute merchandise yearly or two.

Proudly owning can usually be financially advantageous, however the fact is that it carries dangers many people can’t afford. Ask your self: are you able to afford it in case your newest iPhone falls and breaks? If not, perhaps you need to be leasing one that’s insured in case that occurs.

[ad_2]

Source link