[ad_1]

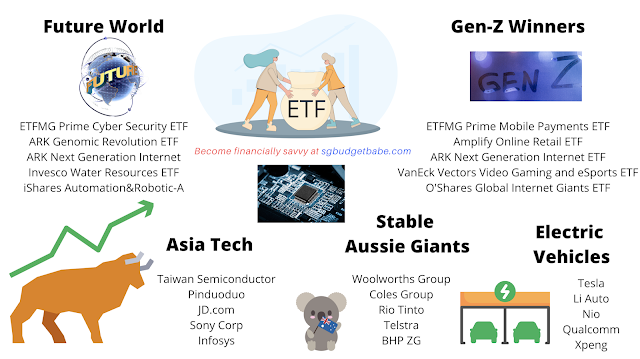

OCBC’s RoboInvest is essentially the most in depth robo-advisor in Singapore, with a complete of 36 thematic portfolios throughout 6 markets. Whereas most robo-advisors use ETFs of their portfolios, OCBC differs by together with shares that they’ve screened and curated to match the chosen funding theme(s). Does having extra selection spell excellent news for traders? I evaluation it right here.

As an energetic investor who prefers to have management over my very own portfolio, I want robo-advisors that add worth by serving to me to save cash (within the type of charges that I might have in any other case paid to the brokerages) whereas driving on rising themes or tendencies that I foresee will form our world.

Which was why when OCBC reached out to showcase their RoboInvest answer, it definitely received me intrigued – largely as a result of it affords over 36 core and thematic portfolios which invests into shares or ETFs, or each.

Considered one of its extra intriguing ETF portfolios, as an example, is the Gen-Z Winners portfolio, which is designed to supply diversified publicity to sectors which can be prone to profit from the spending of the Gen-Z era. Proper now, the portfolio rides on tendencies like on-line retail, cell funds, next-generation web and video-gaming, to call just a few.

However whereas most robo-advisors already provide ETF portfolios, OCBC RoboInvest stands out as a game-changer for utilizing shares in theirs. One instance can be that of the Asia Tech portfolio, which consists of shares of Asian corporations with vital enterprise publicity to the IT sector in China, Japan, Taiwan and India.

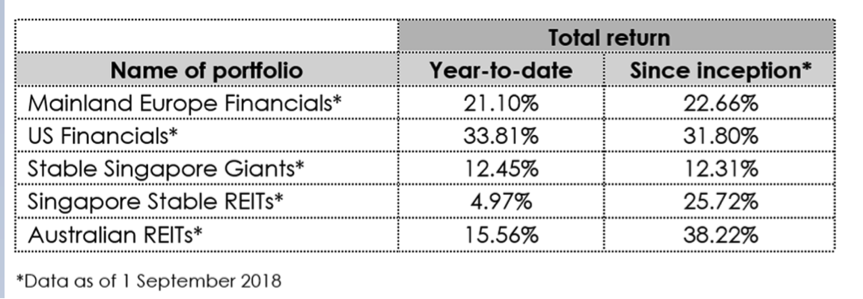

One other fascinating portfolio that caught my eye was the Mainland Europe Healthcare portfolio, as a result of I at the moment don’t have any publicity to shares listed in Europe. This portfolio consists of shares with comparatively decrease volatility within the healthcare sector in France and Germany, which is prone to expertise regular development in demand for medical services and products, particularly as a result of rising financial affluence and an ageing inhabitants.

There are 11 ETF portfolios and 25 Equities portfolios in complete, with Electrical Autos and Cyber Safety being the newest additions to OCBC RoboInvest.

How are the shares or ETFs chosen?

What methodology does OCBC use to find out whether or not a inventory or ETF qualifies to be of their curated portfolios?

I requested the OCBC workforce this query, and whereas the algorithms used stay a commerce secret, OCBC shared that over 60 quantitative components throughout High quality, Worth, Momentum, Development and Volatility are being thought-about. For shares, they highlighted that numerous components are taken under consideration earlier than a inventory qualifies for inclusion into one in every of their curated portfolios. This consists of screening for

- income development

- return on invested capital (ROIC)

- revenue margin

- earnings per share (EPS)

The portfolios are additionally rebalanced in your behalf (you will obtain an e-mail and notification suggesting the rebalance, and when you approve, it’s going to then be routinely executed for you), in order to make sure you’re by no means caught with too massive an publicity to any single inventory or ETF.

With over 36 curated portfolios to select from, I might think about it is going to be tremendous simple for any investor to seek out one, or just a few, to probably spend money on.

Selecting a portfolio based mostly in your threat urge for food

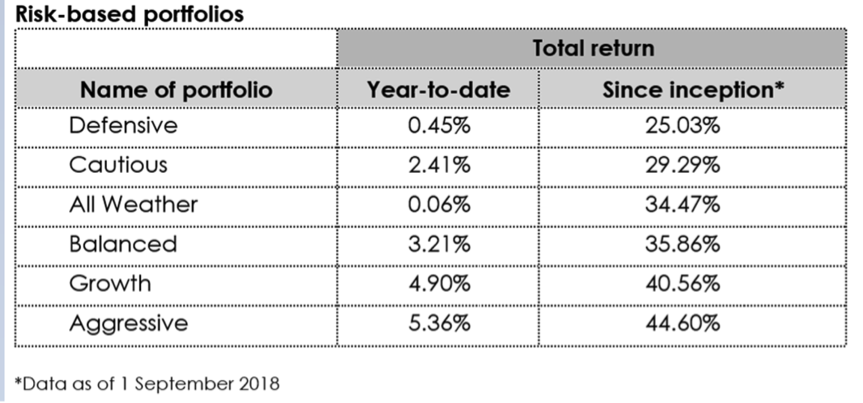

You can read about each of their 36 portfolios here, and when you want to not select any theme(s), then you can even go for one in every of their 6 core, risk-based portfolios as a substitute – Defensive, Cautious, Balanced, All Climate, Development or Aggressive.

The All Climate portfolio, as an example, is curated to be effectively diversified throughout mounted earnings, equities and gold. This could present a steadiness between capital preservation and appreciation, whereas nonetheless rising your investments via numerous cycles of financial development and inflation.

What are the fees?

Following the standard funding recommendation in books (the place you must keep away from paying greater than 1% in charges), OCBC has capped its expenses to 0.88% every year on the entire worth of your investments held with OCBC RoboInvest.

In return, you get to save on transaction charges paid to your brokerage when you had been to attempt to replicate the underlying holdings your self, in addition to the month-to-month quantities while you make use of the dollar-cost averaging technique of diligently including new capital every month.

Rebalancing additionally doesn’t incur any extra charges, in comparison with when you had been to manually purchase or promote the items your self.

How a lot do I must get began?

Whether or not you like to make use of lump-sum investing or make common month-to-month contributions for dollar-cost averaging, you get to decide on and management how and while you need to make investments.

You’ll be able to make investments from as little as US$100 while not having to open a securities or custodian account. Do observe that a few of the portfolios have specified minimal sums earlier than you possibly can spend money on them, reminiscent of US$100 for Future World Portfolio or US$3,500 for the Canine of the Dow Portfolio.

You too can go for a month-to-month funding plan choice to automate your capital injections, when you like. And since there’s no lock-in interval, you can also make withdrawals with none expenses at anytime you select.

If inspecting the historic efficiency provides you better assurance, then you can even evaluation the highest performers in every month to resolve whether or not you will wish to allocate extra of your capital, or liquidate them and channel into a distinct portfolio.

A worthy contender amongst at this time’s robos

Although I have been an OCBC buyer for years and beforehand used their securities platform for purchasing and promoting shares in Singapore. I by no means knew they’d a robo-investment choice till now. It’s thrilling that the financial institution has added a robo advisor for his or her shoppers who need to develop their wealth, and is working with WeInvest because the platform operator to energy its RoboInvest providing.

With extra retail traders selecting to take a position via robos, OCBC’s RoboInvest really stands out for its large number of portfolios. That is undoubtedly appropriate for traders who might really feel restricted in having to chooseg between the (typically lower than 10) restricted portfolios provided by different platforms in at this time’s market.

That is additionally a way more handy answer for these of you who’ve an OCBC account, since you possibly can make investments immediately utilizing your funds with the financial institution, as a substitute of getting to make a switch individually.

What’s extra, you possibly can simply get publicity to abroad markets with out worrying about custodian charges via their answer which can be usually charged by the native banks in any other case.

Undoubtedly value testing, whether or not you are on the lookout for funding concepts or an answer that will help you make investments higher and extra simply.

You have to to fill an e-form with your details here.

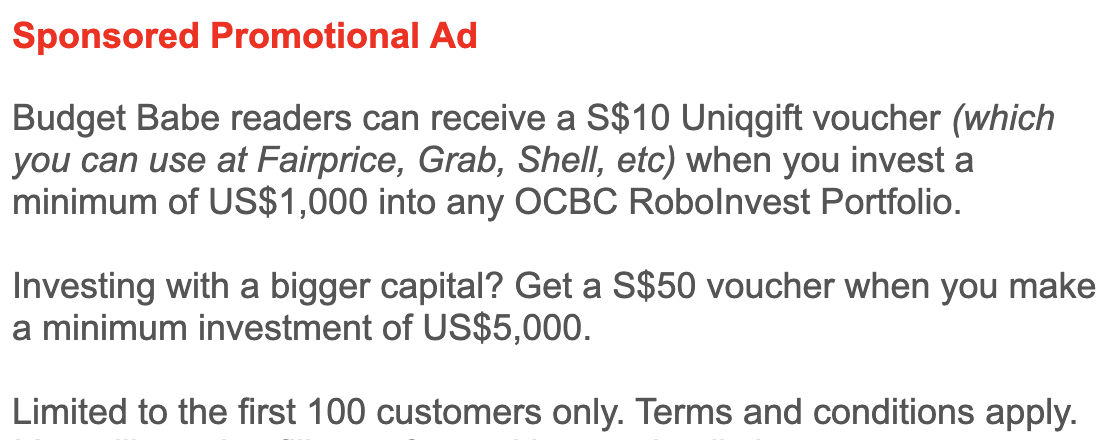

Sponsored Message

Once you spend money on OCBC RoboInvest, you could be relaxation assured that you’re investing with a trusted monetary establishment recognised for its stability and wealth administration experience.

Select from 36 totally different portfolios in RoboInvest and make investments at this time through the OCBC Digital app, the place you will additionally get funding concepts and market insights from our OCBC funding consultants, whereas with the ability to observe and handle your portfolio simply on the go!

For more details, check us out at OCBC RoboInvest here.

Disclaimers:

Necessary Info

This commercial has not been reviewed by the Financial Authority of Singapore.

1. Any opinions or views of third events expressed on this doc are these of the third events recognized, and don’t signify views of Oversea-Chinese language Banking Company Restricted (“OCBC Financial institution”, “us”, “we” or “our”).

2. This info is meant for basic circulation and / or dialogue functions solely. It doesn’t contemplate the precise funding aims, monetary scenario or wants of any explicit individual.

3. Earlier than you make an funding, please search recommendation out of your Relationship Supervisor concerning the suitability of any funding product taking into consideration your particular funding aims, monetary scenario or explicit wants.

4. Should you select not to take action, you must contemplate if the funding product is appropriate for you, and conduct your individual assessments and due diligence on the funding product.

5. We do not make a suggestion, solicit to purchase or promote or subscribe for any safety or monetary instrument, enter into any transaction or take part in any buying and selling or funding technique with you thru this doc. Nothing on this doc shall be deemed as a suggestion or solicitation to purchase or promote or subscribe for any safety or monetary instrument or to enter into any transaction or to take part in any explicit buying and selling or funding technique.

6. No illustration or guarantee in any way in respect of any info supplied herein is given by OCBC Financial institution and it shouldn’t be relied upon as such. OCBC Financial institution doesn’t undertake an obligation to replace the knowledge or to appropriate any inaccuracy that will turn into obvious at a later time. All info introduced is topic to alter with out discover.

7. OCBC Financial institution shall not be accountable or chargeable for any loss or harm in any way arising immediately or not directly howsoever in reference to or on account of any individual performing on any info supplied herein.

8. Investments are topic to funding dangers, together with the attainable lack of the principal quantity invested. The data supplied herein might include projections or different forward-looking statements concerning future occasions or future efficiency of nations, property, markets or corporations. Precise occasions or outcomes might differ materially. Previous efficiency figures, predictions or projections are usually not essentially indicative of future or possible efficiency.

9. Any reference to an organization, monetary product or asset class is used for illustrative functions and doesn’t signify our suggestion in any approach.

10. The data in and contents of this doc will not be reproduced or disseminated in entire or partially with out the Financial institution’s written consent.

11. OCBC Financial institution, its associated corporations, and their respective administrators and/or staff (collectively “Associated Individuals”) might, or might need sooner or later, pursuits within the funding merchandise or the issuers talked about herein. Such pursuits embody effecting transactions in such funding merchandise, and offering broking, funding banking and different monetary providers to such issuers. OCBC Financial institution and its Associated Individuals might also be associated to, and obtain charges from, suppliers of such funding merchandise.

12. You need to learn the Supply Doc/Indicative Time period Sheet/Product Spotlight Sheet earlier than deciding whether or not or to not buy the funding product, copies of which can be obtained out of your relationship supervisor.

13. Any hyperlink to any third social gathering article, or different web site or webpage (together with any web sites or webpages owned, operated and maintained by third events) is for informational functions solely and in your comfort solely and isn’t an endorsement or verification of any such article, web site or webpage by OCBC Financial institution and may solely be accessed at your individual threat. OCBC Financial institution doesn’t evaluation the contents of any such articles, web site or webpage, and shall not be liable to any individual for a similar.

14. There are hyperlinks or hyperlinks which hyperlink you to web sites of different third events (the “Third Events”). OCBC Financial institution hereby disclaims legal responsibility for any info, supplies, services or products posted or provided on the web site of the Third Events.

Collective Funding Schemes

1. A duplicate of the prospectus of every fund is offered and could also be obtained from the fund supervisor or any of its accepted distributors. Potential traders ought to learn the prospectus for particulars on the related fund earlier than deciding whether or not to subscribe for, or buy items within the fund.

2. The worth of the items within the funds and the earnings accruing to the items, if any, might fall or rise. Please seek advice from the prospectus of the related fund for the title of the fund supervisor and the funding aims of the fund.

3. Funding includes dangers. Previous efficiency figures don’t replicate future efficiency.

4. Any reference to an organization, monetary product or asset class is used for illustrative functions and doesn’t signify our suggestion in any approach.

For funds which can be listed on an accepted trade, traders can’t redeem their items of these funds with the supervisor, or might solely redeem items with the supervisor beneath sure specified circumstances. The itemizing of the items of these funds on any accepted trade doesn’t assure a liquid marketplace for the items.

[ad_2]

Source link