[ad_1]

Have you ever ever tried a brand new finances solely to search out out that it takes an excessive amount of trip of your month?

You’ll have gleefully determined that you simply didn’t want a finances so that you simply left it.

From that time transferring ahead you gave up on utilizing a finances since you thought it was troublesome and never worthwhile.

Properly, I can let you know that you simply’re flawed so decide up your massive boys and gals pants and let’s get to work.

We haven’t struggled however in fact, we created the CBB excel finances and the bare-bones finances. that’s as a result of we wished to develop into debt-free, together with our car and residential.

It took years dwelling a frugal lifestyle to pay our mortgage off in 5 years, together with the fairness from our different houses.

Associated: 20 Crazy Happy Things We Did As Frugal Savers

Immediately, I plan to share and encourage you to make use of a brand new finances and put a smile in your face.

Let me present you ways a brand new finances can preserve you as eager as mustard.

Begin With A New Finances

Mrs. CBB used a piece of paper and a pen much like what finances challenger #4 did on the finish of this weblog put up.

It was fast and straightforward and bought the job carried out, which issues essentially the most, together with the arithmetic.

I usually really feel that beginning a brand new finances is frightening for people in debt and don’t need to know their numbers.

It’s important to not let your feelings get in the best way of utilizing a brand new finances.

If you’re struggling financially or dwelling pay to pay, attempt to be optimistic about your state of affairs.

You may have two decisions, go away the debt till collectors name, proceed paying the minimal stability.

No one Desires To Hear About Your Debt

The only option is to buckle up and begin budgeting, eradicating the animosity of your state of affairs.

Nobody desires to understand how you had a tough life, or your ex screwed you over. Have you learnt why?

It’s as a result of they don’t care, and there’s nothing they’ll do that can assist you.

Let go of resentment, anger, disappointment and guilt in regards to the life we’ve been strolling.

I’m fairly sure that everybody desires to really feel profitable and comfortable, and when they aren’t, bitterness exhibits.

They don’t need to understand how a lot cash they owe and the way a lot cash is left on the mortgage.

Change Your Angle In the direction of Expectations and Cash

Be optimistic, take cost, assume success, persistence and dedication to taking management of your funds.

It’s unusual since you assume having a finances plan in place is a child step towards debt freedom.

Like weight-reduction plan, beginning a brand new finances is simply as irritating as a result of we don’t know what to anticipate.

I can guarantee you that making a finances administration plan for the 12 months will change the way you spend your cash.

It’s additionally fairly cool to check numbers every month to see if you happen to can beat what you spent the month earlier than.

I need to share many optimistic causes for utilizing a brand new finances with you.

Obtain A FreeBudget From CBB

I hope that these studying this don’t use a finances to tackle the problem.

I’ve a number of free finances downloads on my free resources page.

The budgets I’ve included are two excel budgets and a bare-bones printable finances.

In the event that they received’t give you the results you want, strive utilizing a mobile budget app or maybe your financial institution provides a free finances on-line.

Constructive Causes To Use A New Finances

- You’ll find out how a lot cash you’re spending

- Warn you to finances classes you could improve or lower

- Retains you motivated when you might have a way of management over your cash

- Permits you to get monetary savings when you recognize what you’ve bought

- It’s simpler to see what your debt to revenue ratio is.

- Making a fee plan in your bank card debt when you know the way a lot you may afford to pay again.

- Finances numbers usually are eye-openers for individuals who use a brand new finances for the primary time.

- When you study to make use of a bare bones budget you may transfer up and use my excel finances for much more particulars on every finances class.

- A finances will enable you get again on monitor to paying off your debt and for many individuals that may put a smile on their faces.

- The numbers hopefully will affect you to cease buying and begin saving.

From expertise, I can let you know that being debt-free is wonderful, and that’s what I hope for all of you.

Our timeline to debt-freedom might be completely different however figuring out that you simply’re doing one thing is healthier than not figuring out something.

Dialogue: What kind of finances do you utilize in your month-to-month finances? What motivates you to make use of a finances?

Please go away me your feedback beneath as I’m inquisitive about your responses.

P.S- If you’re not subscribed to the weblog, please achieve this, and also you’ll get my unique FREE Emergency Binder despatched to your inbox.

Belief me that it’s going to make a world of distinction for anybody taking care of your affairs as you age or if one in all you passes away.

Mr.CBB

CBB Household Revenue Report

The place Did Our Cash Go?

This Christmas was our flip to host the household right here, which didn’t end up as deliberate.

We did go a bit overboard at Costco for Christmas, so we’d have sufficient for the week.

Each Mrs. CBB and I by no means did focus on how our relations would come from out of city, and we’d need to feed them.

We are going to work extra into our Christmas bills, together with groceries for 2022.

Sadly, your complete Christmas fell aside when our nephew examined optimistic for Covid-19.

Our household all examined unfavourable with the house checks from our son’s college.

We determined to quarantine for ten days to make sure we have been okay and examined once more unfavourable.

Now now we have all this meals now we have to eat, together with two stuffed Butterball turkeys.

That’s our month, how was yours?

Household Finances Percentages December 2021

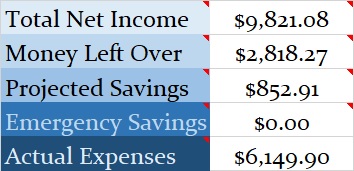

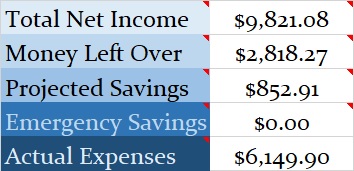

Our financial savings of embody investments in addition to any financial savings for this month based mostly on the web revenue of $9821.08

All classes took 100% of our revenue, which accounted for December 2021.

This kind of finances is known as a zero-based budget, the place all the cash is accounted for.

If you happen to’re inquisitive about utilizing the identical finances, we’re I’d learn in regards to the zero-based budget.

Month-to-month Dwelling Finances Bills

Observe that I blended up the Cash Left Over and the Emergency Financial savings.

Beneath is a breakdown of our bills which helps us perceive the place our cash goes.

- Chequing– That is the checking account the place all of our debt will get paid from. We use Simplii Monetary, TD Canada Belief, and Tangerine Bank. Join Simplii Financial today! Learn extra about among the finest Canadian online virtual banks.

- Emergency Savings Account– This can be a high-interest financial savings account.

- Common Financial savings Account– This can be a financial savings account that holds our projected bills.

- Month-to-month Budgeted Complete: $6570.80

- Monthly Web Revenue Complete: $9821.08

- (Learn our Ultimate Grocery Guide with over 300 Canadian Grocery Suggestions and Financial savings Posts.

- Projected Expenses: These are bills we all know we can pay for all year long = $852.91

- Complete Bills Paid Out: $6149.90

- Complete Bills Paid Out: Calculated is $9821.08 (complete web month-to-month revenue) – $852.91 (projected bills) – $2818.27 (Financial savings to emergency fund) = $6149.90

- Precise Money Financial savings going into Emergency Financial savings: Calculated is $ 9821.08 (complete month-to-month web revenue) – $6149.90 (precise bills paid out for the month) – $852.91 (projected bills) = $2818.27

Estimated Finances And Precise Finances

Beneath you will notice two tables: our month-to-month finances and the opposite is our precise finances.

This finances represents two adults and our 7-year-old son. Since Might 2014, we’ve been mortgage-free and redirecting our cash to investments and renovations.

In 2017 we purchased a brand new showroom truck for $48,000 money, so now we have no car funds aside from insurance coverage. When creating your month-to-month finances, attempt to remove the sensation of comparing your financial numbers as each state of affairs is exclusive.

Spending lower than we earn and budgeting has been the best solution to pay down debt and save money. One final thing, conditions change, and typically we spend much less or spend extra.

Month-to-month Budgeted Quantities December 2021

Finances Color Key: It’s a projected expense if highlighted in blue.

Precise December 2021 Finances Outcomes

CBB 2021 Finances Problem Replace

The 12 months certain did fly by with Covid-19 and households struggling to search out childcare or working from house.

We are going to at all times have some type of disaster or incident that throws us off the trail in our lives.

One factor to not do is let your month-to-month finances be the very first thing you neglect about as a result of you could know.

In 2021 we began with round 20 Canadian Finances Binder mates asking to hitch the Month-to-month Finances Problem.

We completed the 12 months with solely two individuals that made it to the tip for some purpose or one other.

I wasn’t shocked as a result of I’ve had finances challenges up to now, and other people drop off like flies.

It amazes me how that occurs, however the finances was not a precedence for no matter purpose.

We might have had a 3rd participant end; nevertheless, she handed away in 2021.

I realized a lot from her over time, and he or she at all times had my again on CBB.

In my intestine, I do know she would inform me not to surrender the Finances Problem and to proceed.

So, as we begin the 2022 month-to-month finances problem, I’ll begin posting on the finish of January 2022.

Beneath are the final two finances problem individuals for 2021.

I’ve determined to offer them each $50 presents or money for his or her participation in posting your complete 12 months.

Be effectively,

Mr.CBB

Finances Challenger #2

Hello all, I suppose that is the final replace of 2021!

The 12 months ended fairly effectively; most issues have been as anticipated although a winter-based accident did trigger some harm to my automotive.

It was cheaper to pay out of pocket than going via insurance coverage, however surprising funds have been spent.

Additionally, my boyfriend’s final day of labor was the final day of the 12 months, so now we have been attempting to chop again on bills to be a bit extra financially accountable whereas it’s simply my revenue beginning subsequent month.

I attempt to observe the Gail Vox Oxlade plan: 35% on housing, 25% life, 15% transportation, 15% debt and 10% financial savings.

Fortuitously, I’m fortunate my home and automotive are paid off, and I don’t have debt. It additionally means I don’t have to fret as a result of I’ve the power to shift issues round.

Nonetheless, it does imply that I don’t at all times persist with a finances as a result of I’m not apprehensive about working out of cash on the finish of the month.

2021 Finances Abstract

- $842 spent on the home – that is housing repairs in addition to home insurance coverage for the 12 months

- $3717.00 on the automotive – that is fuel, automotive repairs, common automotive upkeep and insurance coverage

- $14,879 was spent on life – groceries, pet, quick meals, energy payments, cellphone payments, web and leisure.

- $15000 was put in short-term financial savings – that is one thing that was mechanically set as much as exit of my account. I set it up in order that my outdated mortgage and automotive fee go in mechanically. I’ve some extra money within the safe that should make its solution to the financial institution. Normally I really feel higher having some money readily available. I additionally arrange an RRSP this 12 months.

I really feel I did badly this 12 months because it’s the identical as at all times, particularly spending an excessive amount of on quick meals.

Additionally, I pay for a fitness center membership that I barely use.

These are the issues I need to give attention to in 2022 and provides my cash a preventing probability.

If I’ve a fitness center membership, I want to make use of it slightly than letting my cash go to waste.

To remember for the upcoming 12 months

- Boyfriend received’t be working not less than for a bit – one revenue

- The automotive is at 242K km; how lengthy will it go?

- Out of firewood, so I attempt to purchase for 2 years so taking a look at most likely $2000-2500

- Trip – if we will journey, I plan on two smaller and one bigger. I’m pondering I’ll be spending about $4000-5000 between the 2 of them.

Right here’s to 2022!

Finances Challenger #4

Hello Everybody,

December was good and busy as I’ve been working a number of time beyond regulation.

My son bought into line cooking college, and he might be getting minimal wage too.

He’s working at my pal’s store on Sundays beginning on January tenth.

My daughter is transferring out and might be dwelling with a pal.

I received’t be getting hire however not as a lot groceries.

Christmas was solely alleged to be 50 {dollars} as we solely purchase a present for one particular person.

I purchased my son’s present, my nieces and their mom a present.

We bought takeout dinner, and my dad and I went to the films.

My battery froze on my automotive, so I bought a brand new one for 110 {dollars} and 25 {dollars} to put in.

They assure a brand new battery for 5 years which makes me comfortable.

I used 20 {dollars} value of Petro Factors for fuel.

My son’s cellphone contract was up, so he renewed it and bought a brand new one.

There isn’t a cash down, the identical value monthly, and now we have 150000 factors.

We spent it on groceries, and I’ve determined that January is a no spend month solely shopping for requirements.

My employer tousled my cheque, and I’m nonetheless owed 300 {dollars}.

I talked to my son and informed him that we/I might be cheaper.

Use extra coupons/apps and menu plans as costs go up, and it’s scary.

We should be smarter, however I really feel up for the problem.

This finances problem has been a curler coaster for us, each good and dangerous.

It’s self-discipline but laborious to see if you happen to’re not doing effectively financially.

When you see the month-to-month finances numbers, you may repair them.

I’ve a brand new monetary advisor who helps me get again on monitor to retire by 58 years outdated.

If potential, I’d additionally wish to have my mortgage paid off earlier than I retire.

I’m nonetheless determining how to do this, but it surely’s a begin, and I’ll proceed to speak to my advisor for recommendation.

I’ll get a plan and finances for that, and I’m optimistic that 2022 might be nice.

HAPPY NEW YEAR!.

The Finish Of 2021

Thanks for studying, and I’ll see you again in January 2022 for our finances problem.

I’m so excited to see how everybody does in 2022.

Please remark beneath you probably have any questions on any of the participant’s finances updates.

Take care,

Mr.CBB

[ad_2]

Source link

%20(1).png)