[ad_1]

Need assistance managing your little one’s allowance? BusyKid supplies a solution to monitor your little one’s chore achievement and seamlessly ship allowance funds.

Plus, the related app gives itself as a educating device to assist your kids construct good cash habits.

Let’s take a more in-depth have a look at what BusyKid has to supply.

Abstract

BusyKid gives dad and mom a straightforward solution to preserve monitor of their little one’s chores and allowance. You may train your little one cash administration habits with the suite of instruments included on this reasonably priced service.

-

Teaches cash administration expertise

5

Professionals

- Inexpensive pricing

- Simple solution to train monetary accountability

- Separate funding supply choices

Cons

- No parental management on how the debit card is used

- Paid service

What’s the BusyKid?

In 2011, the app was created by Greg Murset, an authorized monetary planner and father.

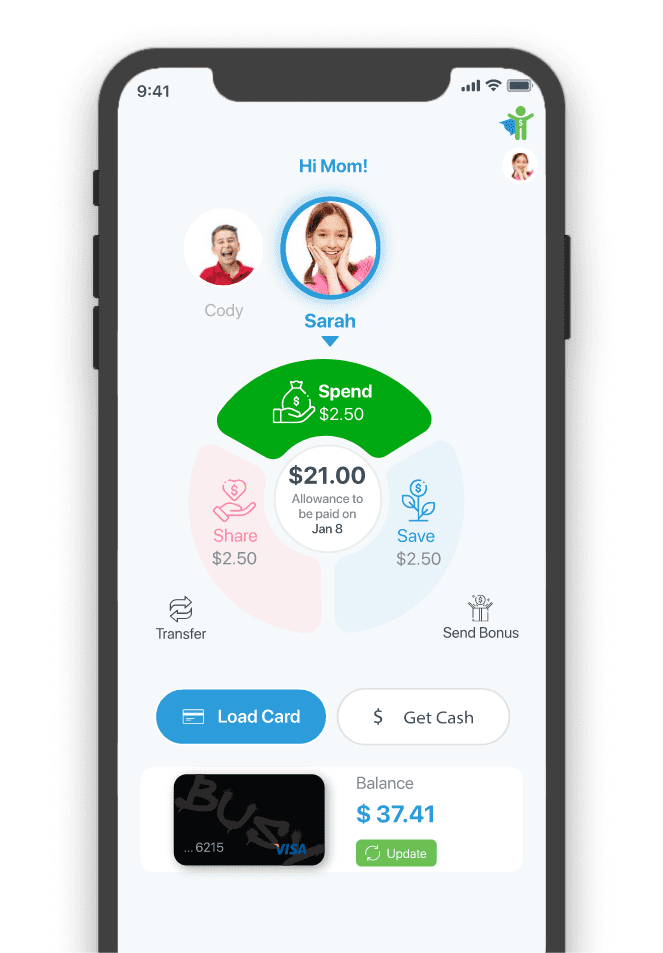

BusyKid is a chore and allowance app that gives a straightforward platform to handle your little one’s weekly allowance primarily based on the duties they full. You may arrange an everyday allowance deposit or present one-time funds primarily based on the chores accomplished.

The purpose is to show children how you can handle their very own ‘invisible’ cash. In contrast to a money allowance system, the BusyKid Visa debit card permits kids to make purchases in particular person or on-line.

Furthermore, they’ll get comfy with the thought of cash that isn’t bodily of their fingers.

Because the dad or mum, you’ll keep accountable for the amount of cash your little one can spend.

The BusyKid Visa Debit Card additionally gives the identical protections as all different VISA debit playing cards. This could present a peace of thoughts for a protected expertise.

Who’s the BusyKid For?

BusyKid is an effective match for households that need an app-based allowance system. In case your kids already full chores for an allowance, BusyKid will allow you to create a neater solution to handle your little one’s allowance.

As soon as your little one receives the funds, they’ll want your permission to load the cash onto their debit card.

Though you’ve management up till this level, you’ll must belief your little one’s spending judgment from right here. You received’t be capable of approve or deny purchases.

As a substitute, the kid can use the funds on their debit card as they see match.

With that, the BusyKid Visa debit card is a good choice for fogeys which have confidence of their little one’s spending decisions.

In the event you don’t need to give your little one the facility to make purchases in-person or on-line with a debit card, then chances are you’ll not need to work with BusyKid.

Nevertheless, this freedom to spend could assist your little one study some useful classes alongside the best way.

BusyKid Options

Are you intrigued by the BusyKid Visa debit card? Right here’s what you’ll want to know concerning the product.

Chores and Allowance

Not all households run in the identical manner. However BusyKid is ready for each choices.

If you wish to create an auto-allowance, your little one will probably be paid on an everyday schedule with none chore necessities. The schedule could be each Friday or bi-weekly payday of your selection.

After you arrange the allowance, you possibly can let it run on auto-pilot.

One other technique is to base the allowance your little one receives on the chores they complete for the week.

On this case, you possibly can create allowance quantities for chores or actions. Each chore that your little one marks as ‘Completed’ for the reason that earlier Friday will probably be included within the payday.

In the event you select the allowance primarily based on chores accomplished strategy, you’ll have to approve every payday.

With every payday, the funds will probably be transferred to your little one in three classes with every payday – Save-Make investments, Share or Spend.

Spend Card

The BusyKid Spend Card opens the door on your children to realize real-world expertise managing how they spend their cash.

With a view to load funds onto the Spend Card, you or your little one might want to use their pin quantity. Inside the app, the kid will solely be capable of load funds from their “Spend’ account.

When the kid makes the transfer to load their card, the dad or mum might want to approve the transaction by way of textual content.

In the meanwhile, you’ll want to maneuver no less than $5 at a time. The kid or dad or mum can examine the account stability at any time within the app.

As soon as the funds are on the cardboard, the kid is accountable for spending the funds appropriately. The Spend Card can be utilized in the identical manner that you simply use different Visa debit playing cards, permitting for in-person and on-line purchases.

Investing

Youngsters may also make investments their cash via BusyKid simply. The app permits children to spend money on actual inventory in in style firms. A couple of of the obtainable shares embrace Disney, Apple, and Netflix.

They’ll want no less than $10 to begin investing. However your children received’t encounter any charges to purchase or promote shares. That’s a good way to encourage them to start investing for his or her future.

Charities

BusyKid makes it straightforward to assist your children study a balanced strategy to cash. Along with constructing financial savings and studying how you can make investments, your children could have the chance to donate a proportion of their allowance to a charity of their selection.

There are dozens of charitable organizations that your little one will help assist with their allowance.

Bonuses

Did your little one make an impressive effort of their chores? Or excel at certainly one of their different tasks, reminiscent of reaching straight As at school?

BusyKid provides you the chance to reward their actions with a Bonus.

Parental Controls

The last word purpose of BusyKid is that can assist you train your kids good monetary habits. In some circumstances, which may imply you want parental management over the motion of funds inside your little one’s account.

Once you initially arrange an allowance, you’ve management over how the payday will probably be damaged out into totally different classes. As soon as the cash is in your little one’s account, you possibly can select to lock the Save, Share, and Spend classes to maintain your little one from overspending.

Moreover, you possibly can usually monitor your kids’s spending actions to remain within the loop.

Plus, you possibly can assist reward your little one’s financial savings habits via Parental Matching. That’s a good way to encourage a financial savings mindset.

Historical past

BusyKid helps you retain monitor of what your children are as much as. You’ll have an in depth historical past of chores, paydays and transactions to refer again to as wanted.

For a real-time look, you possibly can benefit from the ‘exercise feed.’

How A lot Does BusyKid Price?

Th BusyKid gives an incredible service, however you’ll want to concentrate on the charges earlier than diving in.

The BusyKid Visa® Pay as you go Spend Card provides your children the liberty to spend anyplace Visa® is accepted, and fogeys see each transaction made.

Switch funds anytime and anyplace. For as little as $3.99/mo. (or save 20% with our annual choice!), your loved ones can have full entry to our award-winning app and as much as 5 BusyKid Spend Playing cards.

So it is a excellent time to show your kids how you can spend responsibly.

FAQs

As we researched BusyKid, we discovered some frequent inquiries. Listed below are the highest questions.

Sure, The BusyKid Visa Pay as you go Spend card is issued by Stride Financial institution, Member FDIC. With that, the funds are insured for as much as $250,000 primarily based on the FDIC coverage.

Moreover, the BusyKid Visa card comes with the entire similar protections provided by different Visa playing cards. This consists of Visa’s Zero Legal responsibility safety coverage, which guarantees that you simply received’t be accountable for unauthorized costs.

With all of those protections in place, you need to really feel protected permitting your little one to make use of BusyKid.

You will get in contact with BusyKid by way of e mail at [email protected]. Or name to go away a voicemail for a immediate reply at 833-287-9543.

The client assist workforce is offered Monday via Friday from 8 AM to six PM. Plus, Saturday and Sunday from 8 AM to 11 AM and 4 PM to six PM. These occasions are primarily based on the corporate’s location in Arizona.

In case you are able to dive in with a BusyKid Visa debit card on your little one, the signup course of could be very easy.

Earlier than you dive in, verify that you’re no less than 18 years outdated, a US citizen or authorized resident, have a U.S. cellphone quantity, and have a U.S. checking account. You’ll want to fulfill all of these factors to be eligible for join. Come ready together with your date of start, your Social Safety Quantity, and your little one’s date of start for a easy course of.

You’ll have to obtain the BusyKid app. Then present some primary data reminiscent of your title, e mail, and zip code. From there, you’ll create a password on your account and choose a pin.

As soon as the account is about up, you’ll be capable of fund the account together with your checking account or bank card to finalize the method.

What Others are Saying

BusyKid received a National Parenting Product Award in 2020. With that, many are impressed with the corporate’s product.

Let’s see what present customers are saying about BusyKid.

Trustpilot

BusyKid has earned 3.8 out of 5 stars on Trustpilot with over one thousand evaluations. Over 70% of consumers report a superb or nice expertise. However 13% of consumers report a nasty expertise.

One buyer with a optimistic expertise says, “My complete household has loved utilizing busy children! I might recognize child-friendly informational movies embedded within the app, nonetheless, that specify and train children about investing. There may be the choice to speculate, which I LOVE, however nowhere that teaches children precisely what it’s earlier than they do it.”

Most complaints appeared centered round delayed transport of debit playing cards in current months.

Apple App Retailer

Within the Apple App store, the BusyKid app earned 3.7 out of 5 stars.

Right here’s what one glad buyer needed to say, “We’ve been with BusyKid a very long time with 4 children. We love the choices of give, save, and spend; and the inventory choice is a large bonus to my two boys who’re studying the ropes of investments.

The app itself is simple to navigate. Payday is a cinch, and it holds my children accountable to checking off their chores/tasks. And the bonus pay is useful after I need them to “pay for their very own” haircut, clothes, snack, and so forth.”

Google Play

Within the Google Play store, BusyKid has 4 out of 5 stars. Many complaints have been targeted on in-app glitches. BusyKid has responded with guarantees to replace the app within the close to future.

Abstract

Educating your children to handle their allowance cash by way of an app and debit card at this time will help put together them for future tasks.

The BusyKid Visa debit card might be the proper match to assist train your children useful cash classes.

[ad_2]

Source link