[ad_1]

Right here’s to a neater and higher method of planning for Millennials.

After I was single, it wasn’t too onerous to trace my very own monetary well being. Certain, it was tedious at instances, however I had a mixture of apps and my trusty Microsoft Excel recordsdata for every function – bills, revenue, financial savings, insurance coverage, funding.

The story modified after I obtained married and have become a mom. Unexpectedly, I needed to now monitor and monitor for a number of folks, which made it virtually unimaginable to maintain up. Many apps are designed for only a single profile, so Excel sheets quickly grew to become the default method. For those who already discover it onerous to handle your individual private funds, let me warn you first that it doesn’t get any simpler.

For those who’re the Chief Monetary Officer (CFO) in your loved ones like me, chances are high that the stress from having to manually monitor your family bills, make sure that payments (particularly the non-negotiable insurance coverage premiums!) are being paid on time, and so on…and all whereas checking that you simply’re on monitor to reaching monetary freedom as a pair. Add that to the psychological load that moms already need to cope with, on prime of getting to juggle a full-time job or child-rearing.

It’s a tricky (and thankless) job certainly.

Each month, there’s a whole record of ache factors that I’ve to cope with in terms of preserving on prime of our family funds – you possibly can see this within the graphic above.

So, when somebody tells me there’s a neater method, you possibly can wager that can definitely pique my curiosity.

Enter the Autumn app.

How does Autumn work?

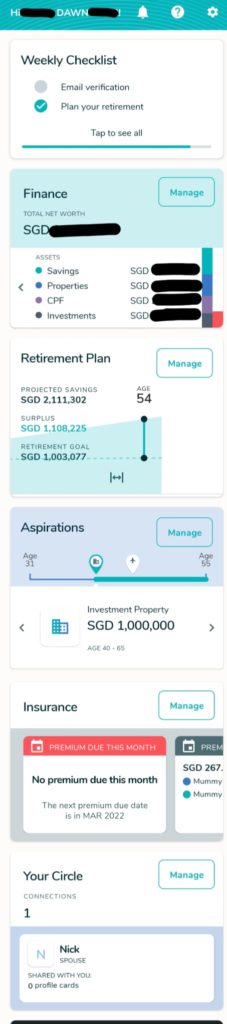

Whether or not you’re planning for your self (as a person) or for your loved ones (a number of profiles), Autumn is a free cellular app that you should use to plan, monitor and handle your monetary well-being and aspirations.

As an impartial and agnostic instrument, it goals to simplify monetary planning and gives steerage with out gross sales pitches. In a nutshell, right here’s what you will discover:

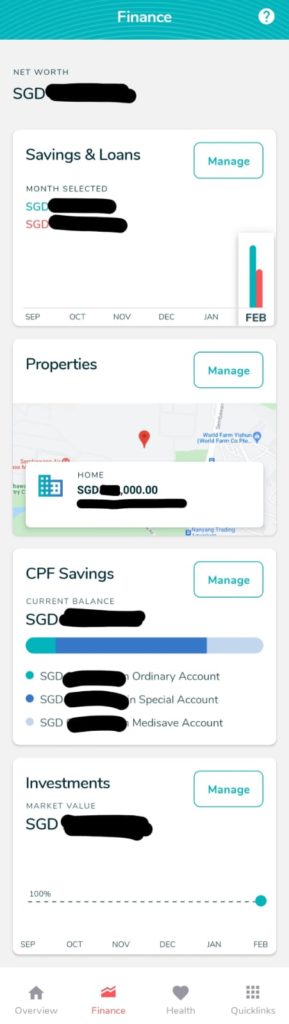

- Finance Dashboard – that is the place you view your web value throughout your Financial savings, Loans, Investments, Properties and CPF. The purpose? To at all times ensure that this will increase over time, in fact. Realizing how a lot you actually have lets you recognize whether or not you might be in good monetary well being, and if you have to make modifications corresponding to decreasing your debt.

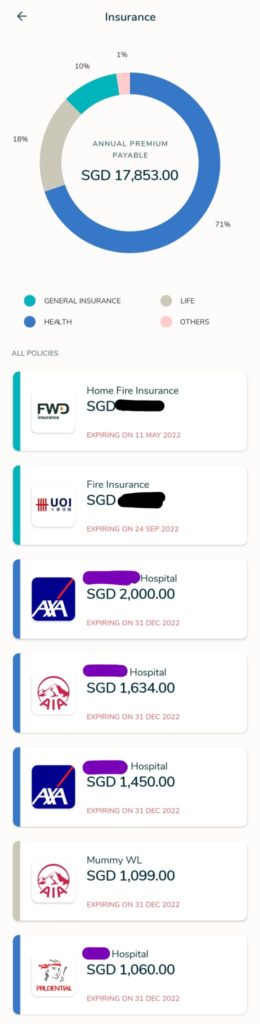

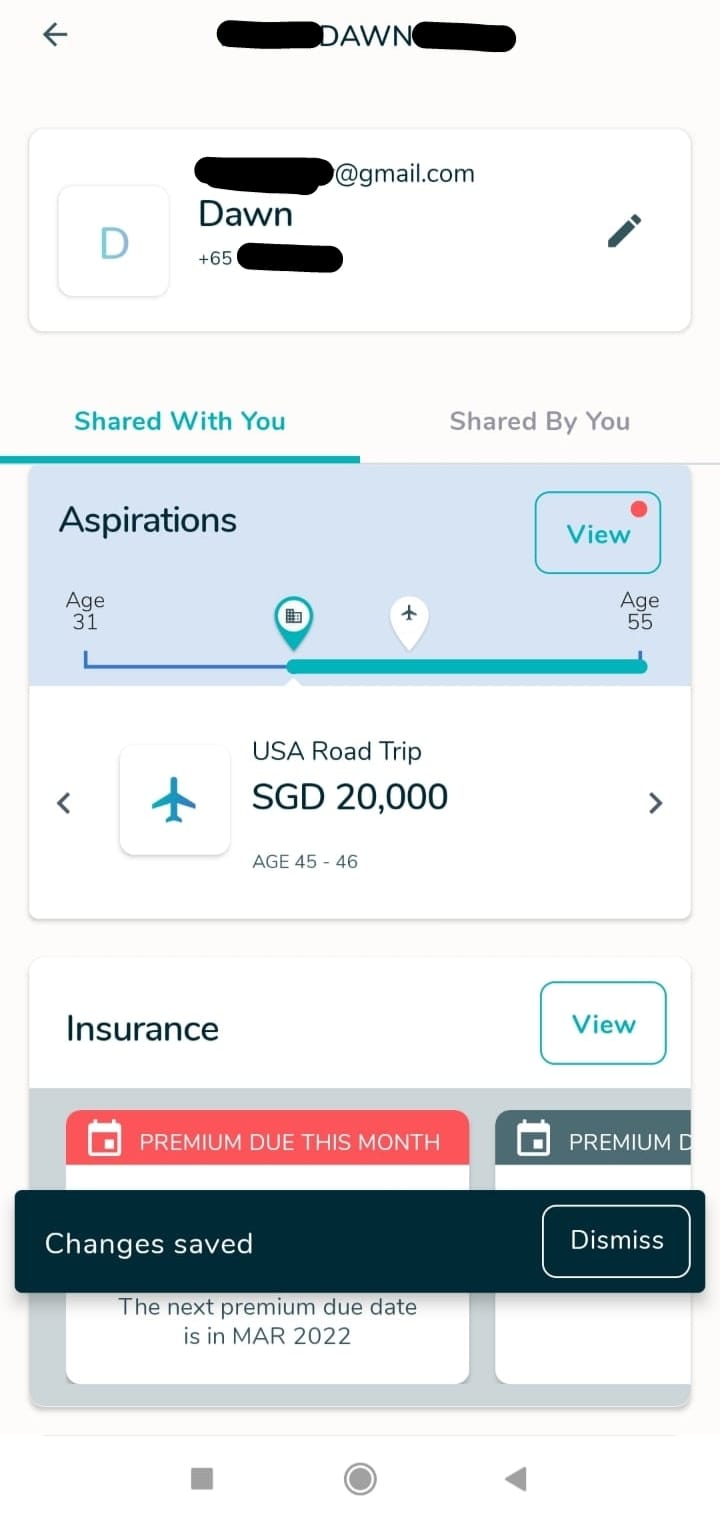

- Insurance coverage Tracker – handle and keep on prime of all your loved ones’s insurance coverage insurance policies right here. Since most of us have insurance coverage insurance policies throughout completely different insurers and/or brokers and with completely different fee due dates, the app lets you consolidate (and share together with your family members) right here, and even notify you about upcoming funds and expiration dates to forestall any attainable lapses!

- Retirement Plan – you solely need to plan out your retirement as soon as (age, desired spending, belongings and development fee), and the app then visually reveals you the place you might be in your retirement plan every time you log in. Serves as a fantastic reminder to make sure that you’re on monitor.

- Aspirations Planner – use this that will help you put together on your subsequent huge monetary buy, corresponding to a downpayment for a brand new apartment. This convenient chart additionally lets you make knowledgeable selections about your spending, and see the trade-offs incurred e.g. can you continue to go on a $10,000 household journey to Europe with out sacrificing your youngsters’ schooling fund?

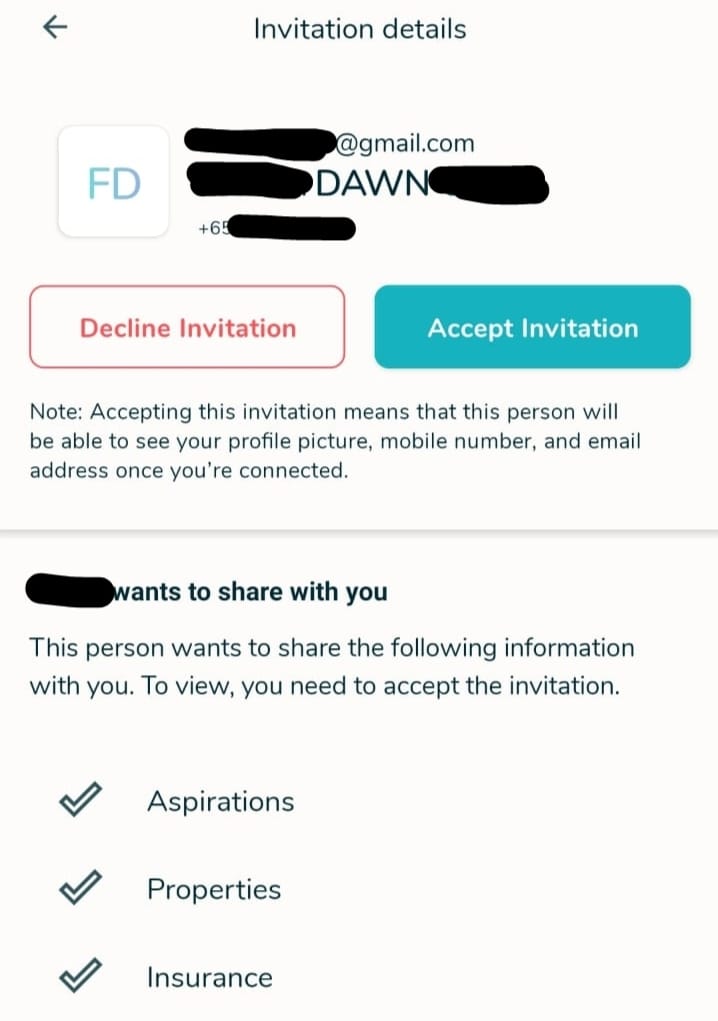

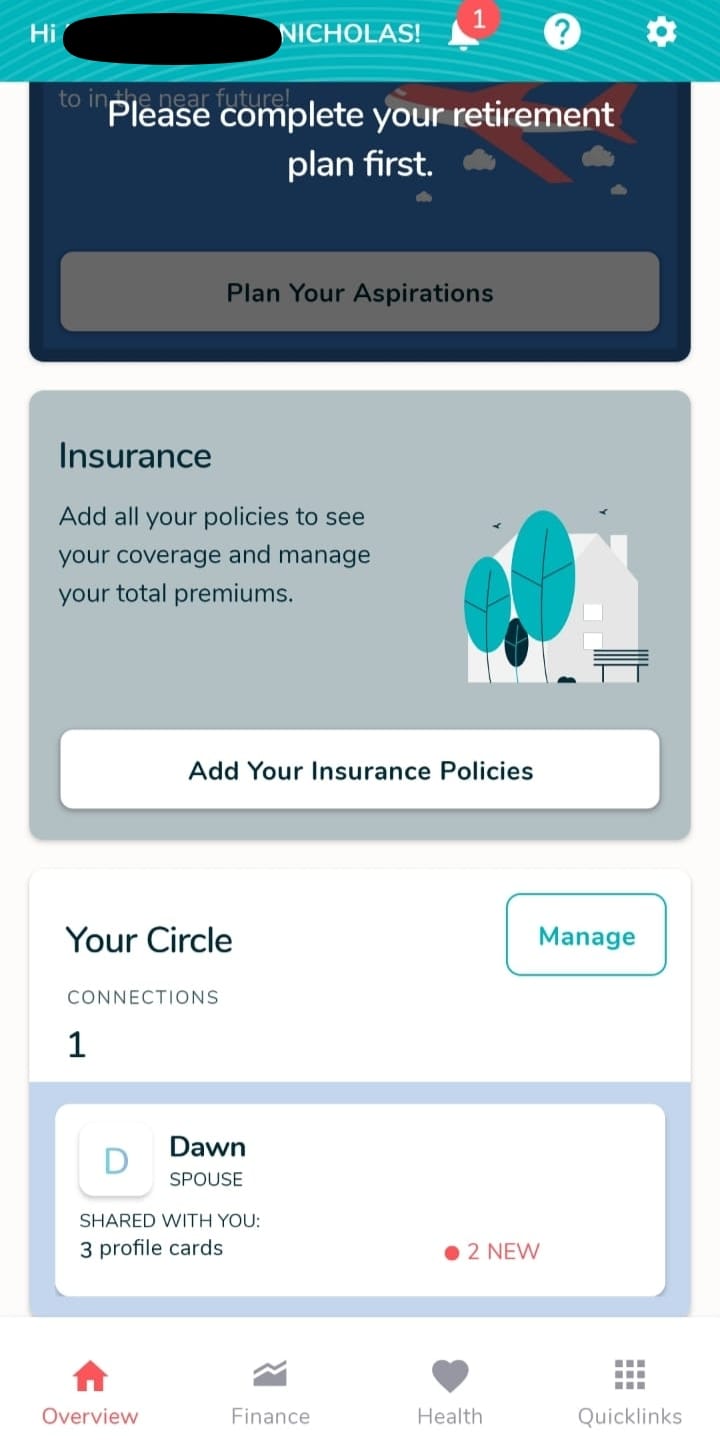

- Your Circle – that is the place it may be highly effective for households, as a result of you possibly can share your monetary particulars together with your partner so each of you might be within the loop! In spite of everything, being clear about our funds is necessary as a pair, isn’t it?

Regardless that it isn’t marketed for households, I attempted it out just lately and located it to be the perfect instrument I’ve come throughout thus far that I can use to assist me handle my household’s funds and objectives – all inside a single app.

Methods to use Autumn to handle your loved ones funds

I’ll stroll you thru use the app, however within the meantime, right here’s an thought of what you possibly can anticipate to see in your homepage display screen when you’re executed:

Step 1: Plan and set your purpose(s)

After you’ve downloaded the app, you possibly can register with SingPass after which begin by filling in your retirement plan and aspirations.

Some concepts to get you began:

- hit $1 million for retirement

- save $12,000 for a household trip

- save $100,000 for a home downpayment

- attain $80,000 for youngster’s schooling fund

Step 2: Assessment your present progress towards your objectives

Key within the worth of your monetary belongings i.e. financial savings, properties, CPF and investments. You probably have your cash unfold out throughout completely different banks and funding positions (e.g. a diversified portfolio), then it will take you longer to replenish.

Word: When you can sync your financial institution info to hurry up the method (it pulls your financial savings and loans), observe that that is utterly non-compulsory as you may also enter the small print manually, particularly should you’re not eager on offering your iBanking username, password and OTP.

Step 3: Enter your insurance coverage insurance policies

You probably have many insurance coverage insurance policies like I do (for myself, husband, Nate, Finn and three aged dad and mom), then it will take you some time to replenish. Nonetheless, it’ll be definitely worth the effort as a result of you possibly can share this together with your partner in a while!

Every insurance coverage coverage sort has completely different particulars so that you can fill in e.g. hospital sort for Well being vs. TPD quantity for Life. However don’t fear should you’re overwhelmed by the sheer variety of fields, as that’s for people who need to digitalize and monitor all the things in a single place. As a substitute, you possibly can go away lots of them clean should you want to simply use the app at its most simple performance.

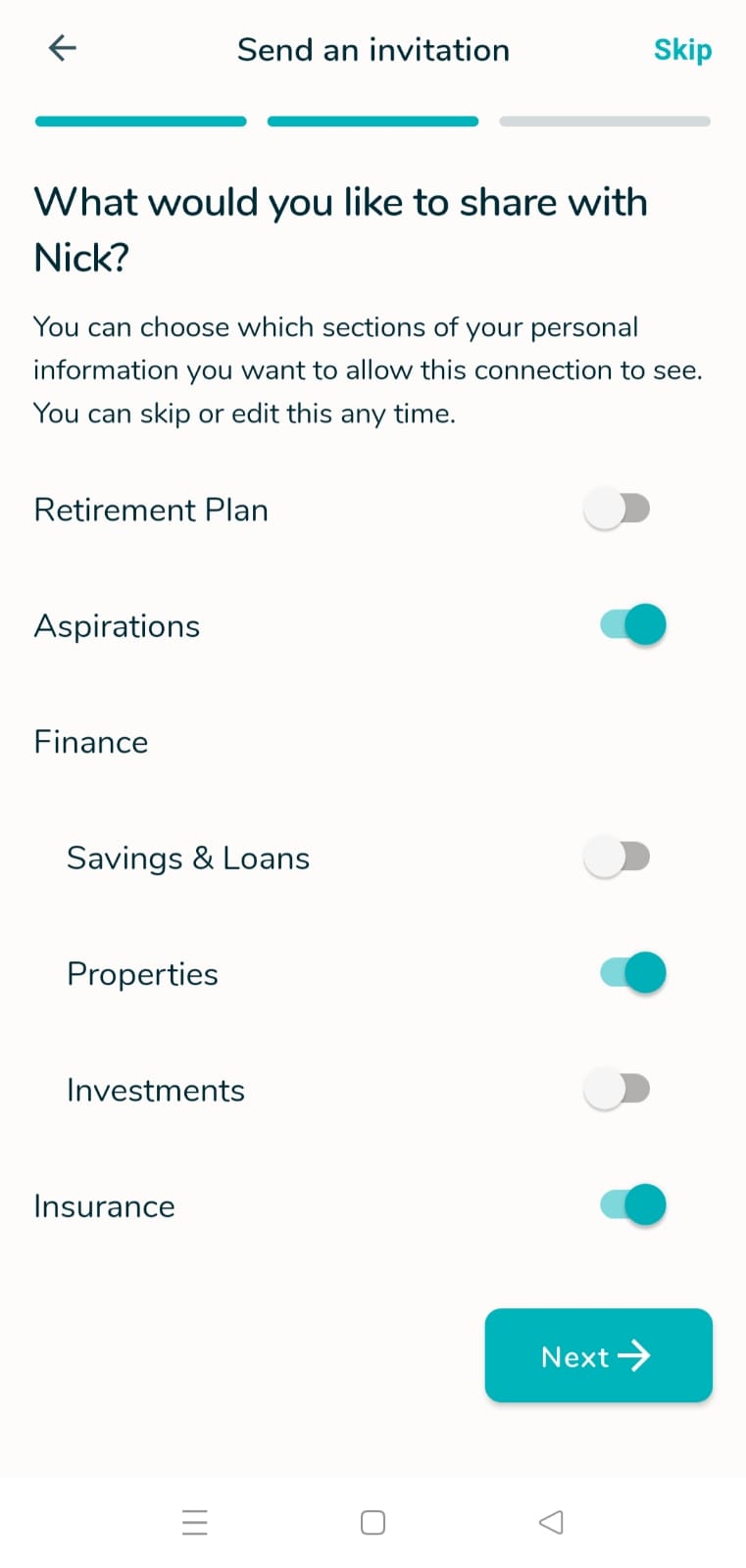

Step 4: Share with your loved ones members

This function is the place it will get highly effective for households. Use the “Your Circle” function to ask your loved ones members to be concerned. Right here, you possibly can share your financial savings and insurance coverage insurance policies info which your loved ones can then simply entry in emergencies. What’s extra, it’s a good way to start out that dialog about cash e.g. what your monetary objectives and future ought to appear like, and what it can take to get you guys there.

For {couples} who want to preserve some confidentiality, you don’t need to share ALL the small print e.g. hold your private financial savings a secret!

My husband then downloaded the app by way of the e-mail invitation hyperlink I despatched, and observe how the connection reveals up below “Your Circle”. Clicking into it then allows him to see all the small print of our household’s insurance coverage insurance policies that I had painstakingly keyed in, in addition to monitor the premium due dates!

What I Didn’t Like – To Be Improved

In fact, no app is certain to be good, and provided that this app remains to be in early beta entry, there have been a number of areas that I felt the crew may enhance on:

Insurance coverage

Ache factors:

- extraordinarily tedious to enter particulars manually

- taking picture of the coverage didn’t translate into auto-population of the fields to hurry up the method (observe: Autumn has since mentioned they’re presently exploring OCR expertise into future updates of the app)

- needed to hold manually including relations

- messy order of the insurance coverage insurance policies, making it onerous for me to seek for what I needed to edit

- didn’t have incapacity insurance coverage as a class (I needed to park CareShield Life below both “well being” or “others”, which made little sense as a result of there isn’t a area for me to enter what the month-to-month future payouts will probably be)

Advised enhancements:

- Add Household Members: as soon as a reputation and relationship has been added, enable customers to simply choose them once more vs. repeatedly having to fill within the varieties every time

- Add Incapacity / Lengthy-Time period Care class: fields and knowledge factors particular to incapacity insurance coverage (revenue alternative) and CareShield Life (with its dietary supplements) must be added

- Organize by sort OR particular person: the present color coding of every coverage by sort helps, however there’s no coherent order of how the insurance policies are ranked or organized. Counsel to both prepare by sort (e.g. group all of the Hospital plans collectively) or to permit a “view by particular person” choice. Or, why not allow each? ?

Investments

Ache factors:

- Bloomberg tickers aren’t intuitive for a lot of retail traders

- Some inventory counters didn’t work e.g. Micron

Solutions:

- As a substitute of Bloomberg, may there be a greater knowledge associate to sync with? e.g. would Google work?

Retirement

I’ve examined out many retirement planning apps and that is the place I really feel Autumn’s model could also be a tad too simplistic (though it achieves its goal). My solutions could be to:

- enable customers to enter inflation fee vs. financial savings development fee

- from a monetization perspective, there’s alternative for the app to counsel higher locations to park one’s financial savings for the short-term e.g. hyperlink up with fastened deposit suppliers, Singapore Financial savings Bonds, and so on

Finance

One final thought could be so as to add a Credit score Playing cards part, which can enable customers to have the ability to monitor what bank cards they personal (and their respective credit score limits). It’ll additionally give them a greater view of their bills, which the app can use to hyperlink again to their retirement progress (are they spending an excessive amount of this month vs. earlier months?)

If syncing with SGFinDex is feasible, this must be simply executed.

Is Autumn app secure to make use of?

Autumn is financially backed by SC Ventures (a subsidiary of Commonplace Chartered Financial institution), and they also use the identical bank-level safety measures to guard its customers’ non-public info i.e. from their web site: from highly effective encryption to identification verification, we use recognised methodologies corresponding to ISO 27001 & CIS 20 to safe your knowledge.

Particularly, Autumn makes use of the SaltEdge API to hook up with your checking account – regardless that you key in your iBanking credentials, these are despatched immediately out of your browser and Autumn’s servers by no means see or retailer your login particulars or passwords, as Autumn’s system is constructed to solely parse and import the monetary knowledge. You can also read more details on their security policy here.

And naturally, should you’re nonetheless anxious and like to not disclose your iBanking login credentials, you possibly can merely skip the auto-sync operate and manually replace as a substitute!

Extra developments forward

Autumn has additionally shared that customers can stay up for 3 new upcoming options launching later in 2022:

- Information – it is possible for you to to add, retailer and share necessary paperwork with your loved ones and family members sooner or later right here e.g. insurance coverage insurance policies, medical paperwork, wills.

. - Well being – it’s troublesome to construct wealth while you’re unwell, so get evaluated in your wellness rating throughout your bodily well being (physique), psychological well being (thoughts) and life-style habits. Based mostly in your scores and the objectives you set, the app will then curate suggestions to information you in direction of enhancing your well being. Additionally, you will be capable of join the app to your exercise tracker (or exterior well being app) quickly sufficient.

. - Autumn Academy – an in-app monetary data and sources developed together with Franklin Templeton to assist enhance your monetary literacy via bite-sized movies and brief quizzes.

Total Ranking & Conclusion

I’m giving this app 4.5 out of 5 stars as a result of it’s most likely the perfect one out there proper now of its variety, and I actually need to see it succeed additional.

Nobody has executed a evaluate on use it for households thus far, however I actually like how one can add your family members and share necessary monetary knowledge with them. That method, you’ll at all times know the place to search out them, even when one thing ever occurs to the CFO in the future.

What’s extra, the app is free to make use of, so what are you ready for?

Severely, do your self a favour and go obtain the app. I’m fairly positive you gained’t be capable of discover something higher than this!

Wish to begin planning on your future, however undecided the place to start out?

Headquartered in Singapore and backed by Commonplace Chartered, Autumn is a holistic monetary, well being and life-style app. By means of Autumn, you possibly can seamlessly handle your cash via our single-view Finance Dashboard, share your funds and joint aspirations with family members via Your Circle, and take steps to prioritise your well being with our Well being Tab (launching quickly).

Download the app right here as we speak!

Disclosure: This publish is dropped at you in collaboration with Autumn.

[ad_2]

Source link