[ad_1]

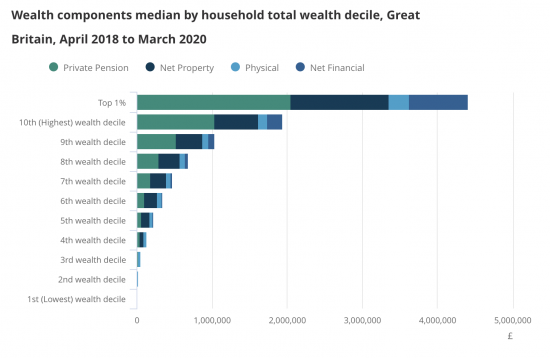

Barely frustratingly, the main target of the information printed was pitched to the family stage, besides that’s attention-grabbing. Organised by decile, with every decile having equal numbers of households inside it, the allocation of non-public wealth within the UK is, based on the ONS, as follows:

There may be nothing particularly shocking about this distribution. The truth that the UK is a deeply unequal society that’s massively skewed in direction of wealth being concentrated within the arms of comparatively few folks, will not be information.

There may be nothing particularly shocking about this distribution. The truth that the UK is a deeply unequal society that’s massively skewed in direction of wealth being concentrated within the arms of comparatively few folks, will not be information.

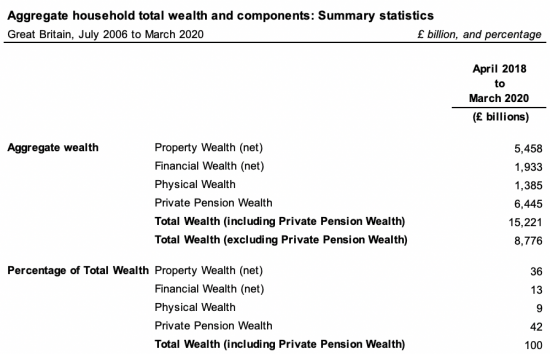

Information on the aggregated stage is, nonetheless, extra attention-grabbing to me. Information at this stage is simply accessible in a downloadable spreadsheet, with no hooked up press launch, however it’s a profit that the spreadsheet in query does embrace knowledge from 2006 onwards, which represents the complete interval over which the ONS has been accumulating this data.

Notice that this knowledge is said web i.e. liabilities are matched towards property, which is especially related with regard to non-public monetary wealth and property.

It’s helpful that the identical classes of allocation are used throughout the private knowledge set famous above. What is especially related is that 55% of whole UK wealth is monetary, with 42% being held inside pension funds and 13% as private monetary wealth.

Of the latter, which characterize about £1.9 trillion in whole, about £700 billion is held in ISA accounts, based mostly on ISA statistics. These are in fact tax incentivised financial savings accounts, which can also be a good description of what pension funds are. It is usually the case that the overwhelming majority of family possession of property additionally enjoys important tax incentivisation as a result of there is no such thing as a capital good points cost on the buildup of worth that home properties have accrued over time. If this mix of property, ISAs and pension funds are taken as a single group of tax incentivised property they characterize round 82.7% of whole UK family wealth, which is a rise since I final ready this calculation.

As I’ve lengthy argued, I can see no cause why these tax incentives needs to be supplied with out situations being hooked up to their use.

Within the case of personal home properties, I believe that limitations on the size of the property in query are acceptable, and it’s truthful to notice that some restrictions of this kind don’t exist, however nearly invariably with regard to the quantity of land that is likely to be thought of acceptable to be related to a house. It could appear acceptable to query now why properties above a sure dimension or worth additionally get pleasure from this reduction. What’s the level of the state subsidising the already rich by letting them get pleasure from enormously costly properties, tax-free?

Nevertheless, this situation will not be the main target of my concern on this submit. What las lengthy troubled me is the supply of tax reduction on financial savings with out situations being hooked up.

My first cause for this concern is that though financial savings is likely to be completely rational on the microeconomic stage of the family, and I’m not in search of to problem that truth, what we now know is that macroeconomically financial savings carry out a really restricted perform throughout the economic system as an entire. It is because nearly all enterprise funding is now funded by borrowing and as a matter of truth, and because the Bank of England acknowledged in 2014, enterprise lending takes place with none requirement for the financial institution making the mortgage to carry deposits of funds. New cash is created by all financial institution lending. In that case, there is no such thing as a relationship between most financial savings and any type of constructive funding in the actual economic system now. Very clearly that offers rise to a good query as to why we would need to spend greater than £60 billion a 12 months (about £60 billion for pensions £3 billion roughly for ISAs) subsidising all these financial savings.

Second, there may be an apparent additional drawback ensuing from the state subsidies. The consequence apparent subsidy is that inequality within the UK is elevated. That is clearly true. If the subsidy follows the saving, the overwhelming majority of the subsidy should go to these already rich. We’re, fairly actually, spending a fortune to make the UK extra unequal in consequence.

Third, additionally it is troubling that no situations are positioned upon the use that is likely to be made of those tax subsidised funds. They are often saved, in just about any method the taxpayer needs, with none essential benefit to UK society arising as a consequence. One perverse final result of that is the very apparent over-expansion of the exercise of the Metropolis of London throughout the UK economic system. There has additionally been the encouragement of short-term funding returns made by corporations.

However most of all there was the dramatic shift away from funding for social function in direction of funding for short-term achieve with the consequence that we’re seeing all through society, the place social housing, flood defences, low carbon power, efficient public transport techniques and different such initiatives that may ship social good points have been ignored in favour of share-based saving particularly, the place no essential benefit to society is evidenced

We now face a disaster within the UK. There is no such thing as a public debt disaster. Nor do now we have to pay for Covid, as a result of quantitative easing already settled all of the payments for that. However we do need to pay for the transformation of our society in order that it’s sustainable sooner or later.

The federal government is reluctant to make use of typical quantitative easing for this function due to the increase that it has supplied to inequality, and for that cause there are arguments to be made that the sort of funding shouldn’t be used for this function though inexperienced quantitative easing, which is kind of completely different in the way in which during which it really works, would stay acceptable.

What we all know is that the strain on taxation additionally implies that funding important funding out of this supply goes to be laborious.

In that case, and presuming that the federal government is reluctant to borrow generically, then by far the biggest pool of funding that’s accessible for the local weather transition is to be discovered throughout the financial savings accounts of the wealthier UK households.

As Colin Hines and I have long suggested, this requires that situations be hooked up to the tax subsidies given to those financial savings. If all ISAs had been required to be saved in bond accounts, with the proceeds getting used to fund the Inexperienced New Deal, roughly £70 billion a 12 months could be made accessible for this function. If 25% of all new pension contributions had been equally required to be invested for that function as a situation of the tax reduction granted it’s doubtless {that a} additional £30 billion of funding could be made accessible annually.

What this newest knowledge on wealth exhibits is that the influence of the ideas on the general allocation of wealth within the UK could be tiny, and wholly inexpensive. The social consequence would, nonetheless, be large.

The time for the transformation of the UK’s saving of its wealth within the curiosity of funding our inexperienced transition has arrived. If now we have greater than £15 trillion value of non-public wealth within the UK to counsel that we can not afford to save lots of the planet is kind of absurd. Easy modifications to the legislation may ship large social good points on this space. When will politicians step up and do them?

[ad_2]

Source link