[ad_1]

With cloud expertise of every kind in scorching demand throughout many industries, banks are having to return to grips with an uncomfortable fact. Hiring, by itself, won’t present them with the abilities they should maximize the worth of the cloud.

Our current Modern Cloud Champions analysis discovered that the long run cloud leaders in banking will make investments as a lot of their individuals as their expertise to remodel their companies with the cloud. And this funding is prone to be rewarded. One other Accenture survey—this one a cross-industry research—revealed that cloud leaders that remodeled their individuals together with their expertise achieved a mean 60 % greater ROI on their cloud investments than those who centered solely on the expertise.

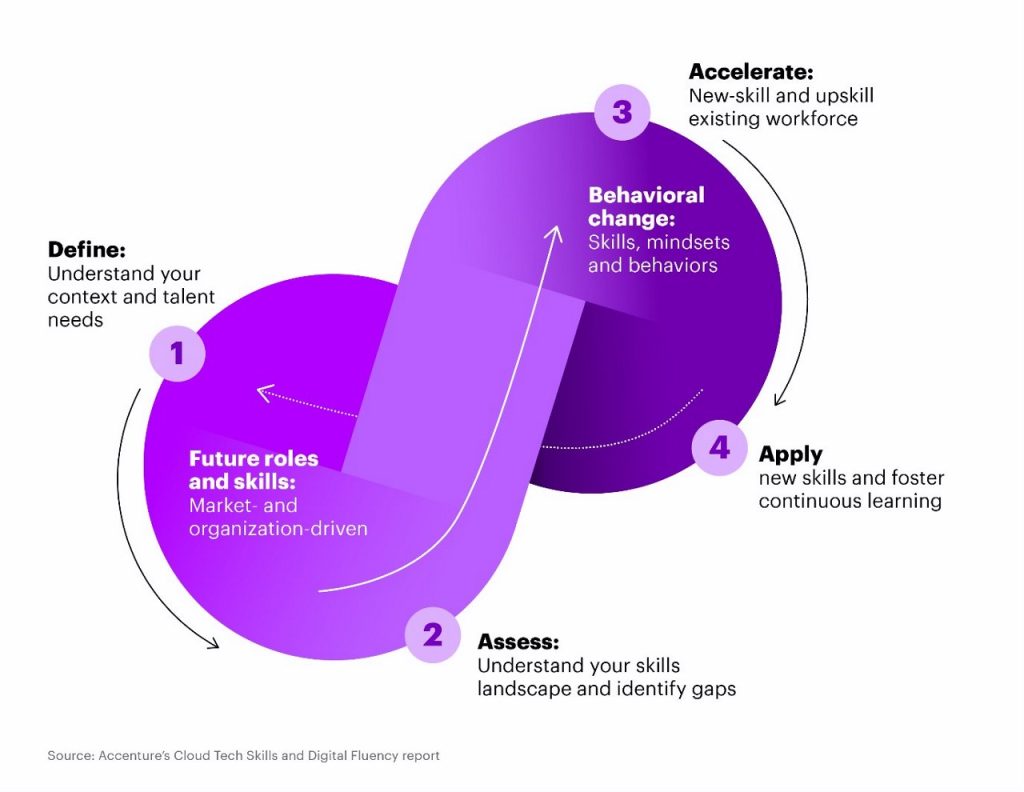

My earlier put up seemed on the particular must-have expertise recognized by Accenture evaluation for cloud success. On this put up, I’ll stroll by means of our four-step framework for rising these expertise inside a corporation. Right here’s a high-level visualization:

Earlier than I soar into every step, I wish to level out two necessary attributes of the framework.

The primary is that it’s a cycle. The largest good thing about the cloud for banks, in my opinion, is the higher organizational agility it makes doable. The truth is, our “Mainframe migration to the Cloud in Banking” analysis—which we define within the present concern of the Banking Cloud Altimeter—discovered that higher velocity and agility is the strongest motivator for banks migrating their mainframe capabilities to the cloud. This is smart, as agility is crucial to compete in at the moment’s fast-moving market. As a loop, this framework displays the dedication to fixed enchancment and adjustment that defines an agile mindset.

The second is that the primary two steps within the framework give attention to the group as an entire and the market, whereas steps three and 4 zoom in on the individuals throughout the group. Alternating between these two frames of study isn’t any accident.

Accenture’s cloud skilling framework

Step one is to outline who you’re and what you want. This could contain weighing enterprise technique, {industry} dynamics and geography. Wants evaluation ought to anticipate your future technical “energy expertise” and conduct wants in addition to future roles and a workforce plan to fill these roles. This plan ought to make use of the “4 Bs”—construct, purchase, borrow or bot.

The second step is to assess what you may have. This could embrace auditing your present expertise profiles in addition to the financial institution’s general digital expertise proficiency. The tip of this step ought to establish your group’s ability and capability gaps in addition to ability adjacencies.

The third step is to speed up your new-skilling and up-skilling packages. These will give attention to constructing your present expertise. The constructing element ought to incorporate customized studying packages and curated content material throughout a blended, multi-channel studying expertise. Learners ought to be divided into cohorts and supplied with teaching.

The fourth step is making use of the brand new expertise and fostering steady studying. This entails each connecting the brand new expertise to their acceptable duties and conducting job proficiency monitoring to observe efficiency. This monitoring ought to present insights for updating the group’s studying pathways and content material curation—and for a renewed understanding of your context and expertise wants, as described in the 1st step.

It is a high-level overview of our cloud-specific expertise and new-skilling framework. With cloud expertise in brief provide, utilizing this framework to construct your financial institution’s inner cloud expertise could make an amazing distinction to the success of your cloud journey.

Contact me here to debate how the framework might help your financial institution’s cloud journey. You too can discover extra on getting probably the most out of the cloud in Accenture’s Banking Cloud Altimeter.

Disclaimer: This content material is supplied for normal data functions and isn’t meant for use rather than session with our skilled advisors. Copyright© 2022 Accenture. All rights reserved. Accenture and its emblem are registered logos of Accenture.

[ad_2]

Source link