[ad_1]

It’s by no means a very good thought to be 100% invested in progress shares, however that’s precisely what many traders did – particularly new traders who began in the course of the pandemic. On prime of that, threat administration was thrown out of the window as traders put their cash into shares with lofty valuations, ignored diversification as they hankered after concentrated portfolios like a number of YouTubers who made the majority of their earnings from a concentrated wager on 1 or 2 shares alone, and dissed worth traders as “old-school” or “outdated”. There was even a problematic meme floating round on Reddit, giving the deceptive impression that shares solely go up.

All was nicely…till the tides shifted.

In spite of everything, a rising tide lifts all boat, however as Warren Buffett famously stated:

For those who made any of the above errors, now is an efficient time to replicate and recalibrate for the longer term.

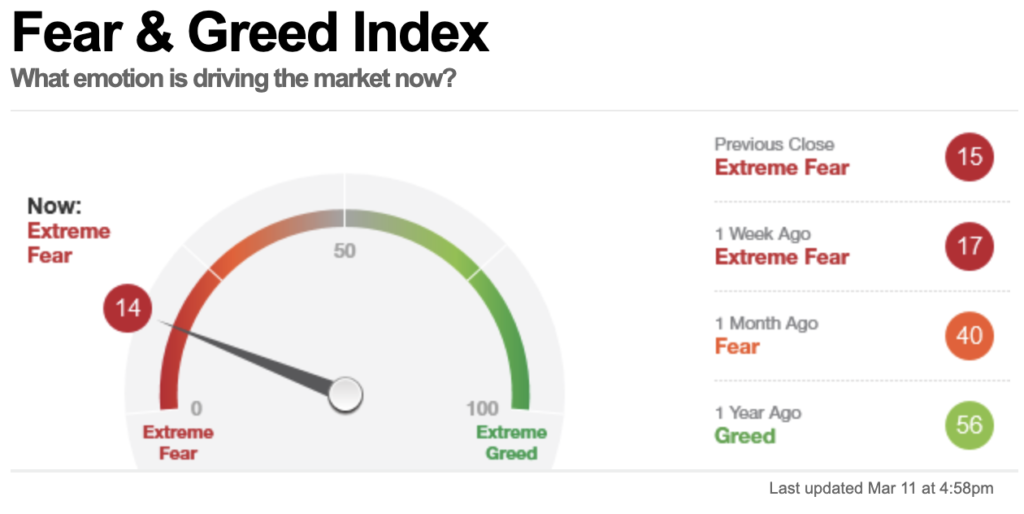

Causes for the present market downturn

Fed Hikes (increased rates of interest)

After years of injecting liquidity into the financial system (or what others time period as “printing cash”), the Fed has now introduced that it’s going to now be tightening its financial coverage and elevating rates of interest from as early as this month. Increased rates of interest means it turns into dearer to borrow, and this has an even bigger impression on progress shares as a result of they have a tendency to borrow to fund their aggressive progress and enlargement plans – notably for progress shares which have but to show worthwhile and have earnings nicely off into the longer term.

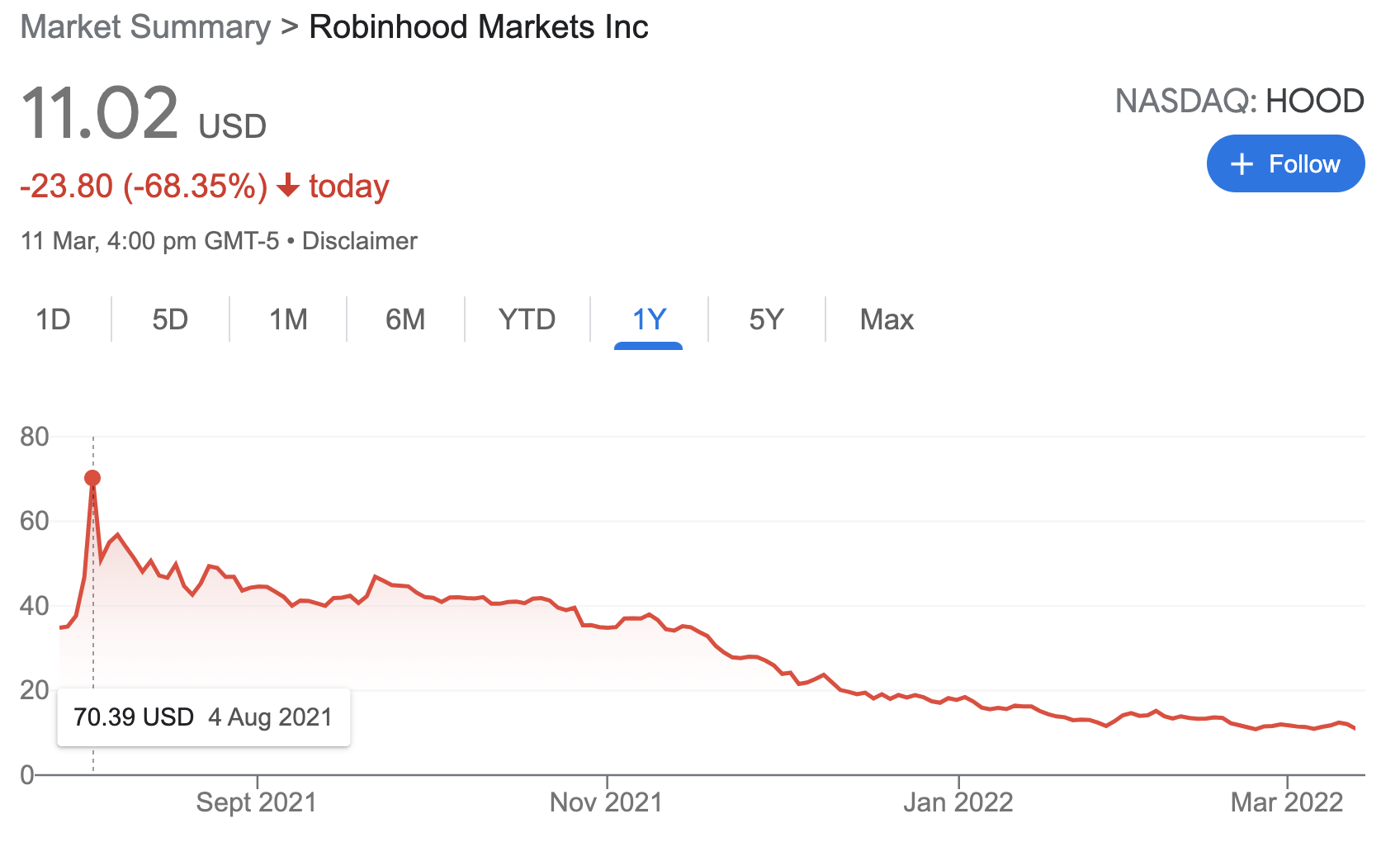

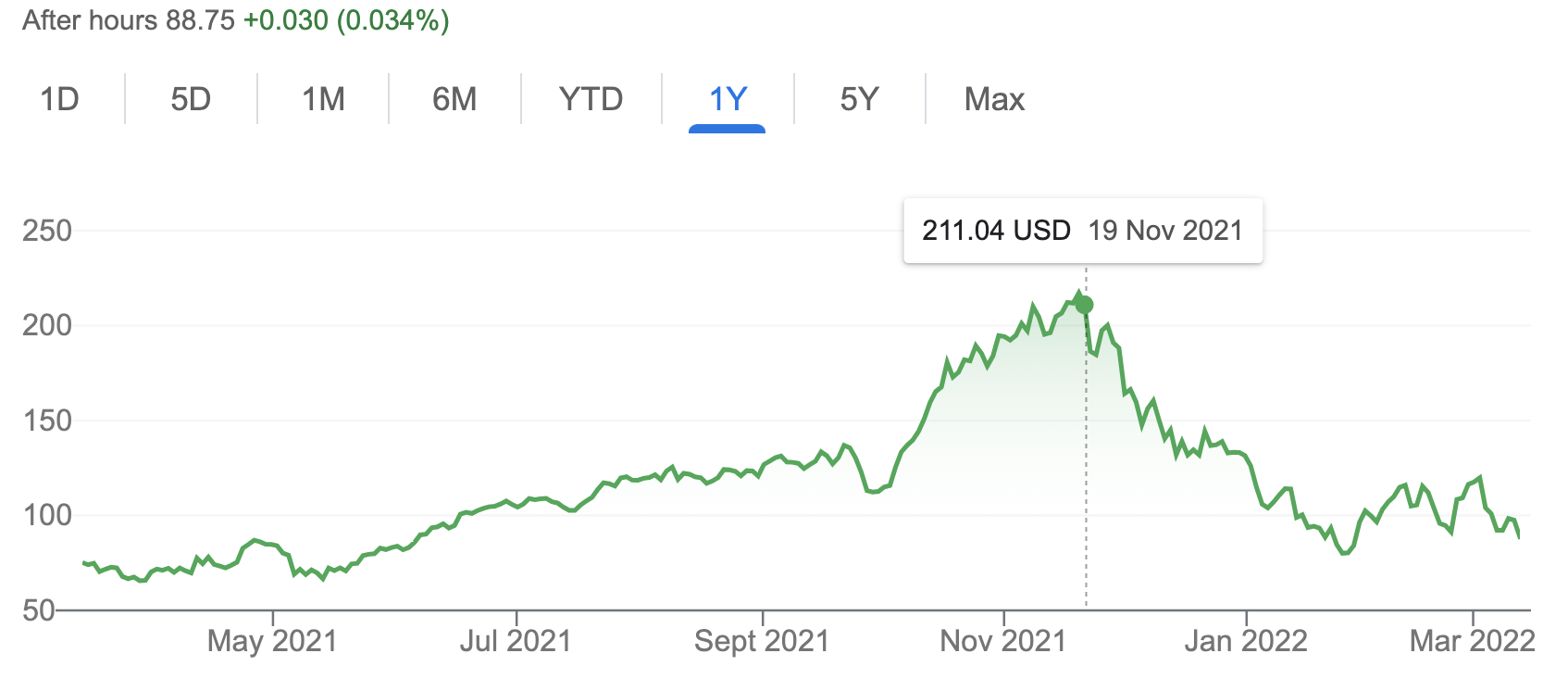

In consequence, the inventory market has pulled again – the S&P 500 and Dow Jones Industrial are each down greater than 10% vs. the tech-heavy Nasdaq Composite which is down by 20%. Excessive-growth tech shares comparable to Cloudflare has since fallen 60% whereas others like Robinhood are down by 80%.

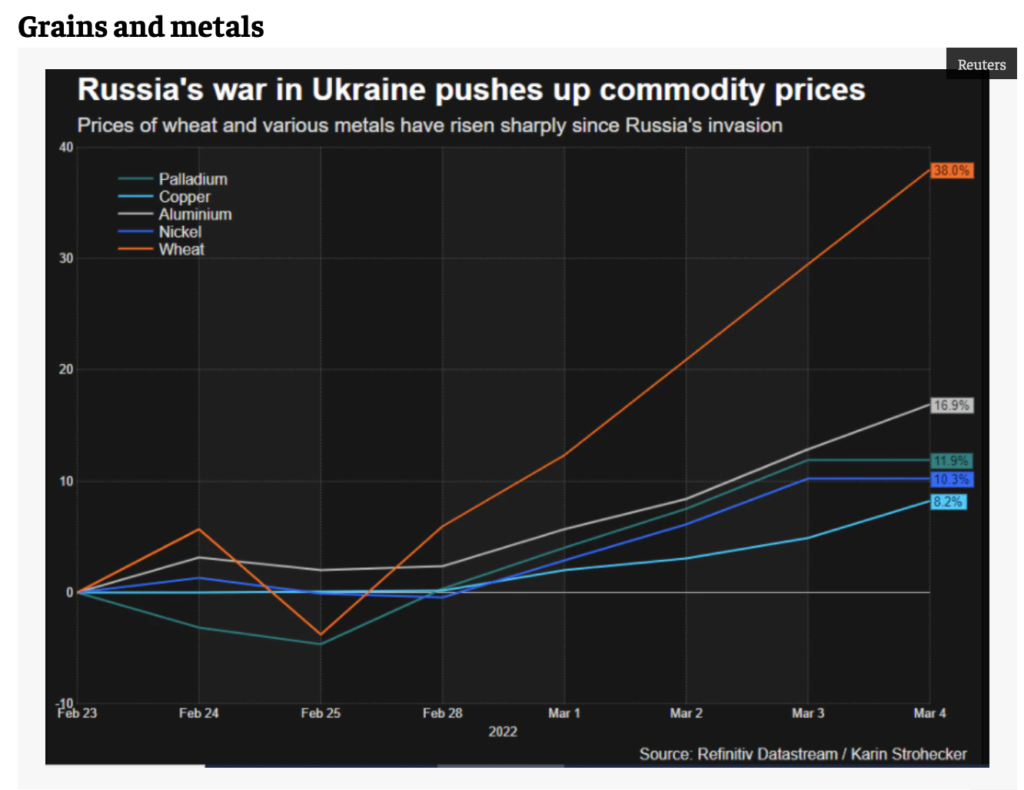

The Russia-Ukraine struggle

Russia’s invasion of Ukraine has despatched volatility hovering and unfold excessive worry throughout world markets. Threat belongings comparable to shares are being hit, whereas conventional protected havens like Treasury payments and gold are rising. Oil has hit ranges not seen in a decade, whereas different commodities are additionally spiking.

However who would have identified? Might you’ve seen this coming, or did you’ve entry to Putin’s resolution to invade Ukraine on the time that he began the struggle?

Don’t overlook that merely only a yr in the past, investing in commodities was seen as “unexciting” as traders chased after tech shares!

Inflation (and even stagflation)

We’re already seeing inflation play out – costs have elevated throughout most items and companies, and even taxis have raised prices not too long ago. And when the inflation fee exceeds what banks are paying out on our deposits, then savers endure probably the most. Now that increased and longer inflation is nearly a certainty, staying in money alone won’t be best. In truth, you’ll rapidly see the worth of your financial savings get eroded by inflation. For conservative of us, even mounted deposits could no longer be adequate to mitigate the upper inflation charges forward. What’s worse than inflation? Presumably stagflation, which has been alluded to in Singapore’s MAS Chief Tharman’s recent speech.

However investing throughout instances of excessive(er) inflation will not be simple, both. If we’re to be taught from historical past, it’s price remembering that the beforehand excessive inflation period within the US (within the late Nineteen Seventies – early Eighties, the place inflation spiked to 14%) led to a misplaced decade for shares. As Warren Buffett defined, “a enterprise incomes 20% on capital can produce a adverse actual return for its homeowners beneath inflationary circumstances” and that “excessive inflation charges won’t assist us earn increased charges of return on fairness”.

Rising inflation might be pricey for not simply customers, but additionally bode dangerous information for shares and the financial system. Development shares have loved a bull run in recent times as inflation remained low, however traditionally, worth shares are inclined to carry out higher in excessive inflation intervals. Whereas we don’t know what is going to occur from right here, what we do know for certain is that shares are extra unstable when inflation is excessive.

Pandemic

The COVID-19 pandemic harm the world financial system and disrupted provide chains. Whereas the world is shifting in the direction of reopening and working in a “new regular”, we’re nonetheless not but out of the woods – as evident in the latest lockdown in Shenzhen. We additionally don’t but know if Omicron is, or can be, the newest variant. And not using a clear steerage, inventory markets stay unstable and bearish as nicely.

Options to Discover

For those who’re a short-term investor, this spells dangerous information as most of your investments at the moment are seemingly within the pink. However for long-term traders, these pullbacks might signify engaging shopping for alternatives. Promoting right into a falling market (particularly for the reason that S&P 500 is formally in correction territory now) is the precise reverse of what most profitable traders do.

With inflation on our doorstep, there’s never been a more important time than now to start investing. And in the event you’re already invested, then it’s equally essential to stay by means of this era and never throw within the towel.

Listed below are some options you may discover proper now:

Relook your portfolio allocation

Is your portfolio too closely concentrated in progress shares, or maybe you’re overly uncovered to a sure trade?

For those who’re panicking now and feeling uneasy over your present ranges of allocation, then maybe it’s best to evaluation, rebalance and presumably reallocate. For example, adopting a core-satellite portfolio strategy (like what Syfe advocates) might be a greater thought if it’ll calm your nerves.

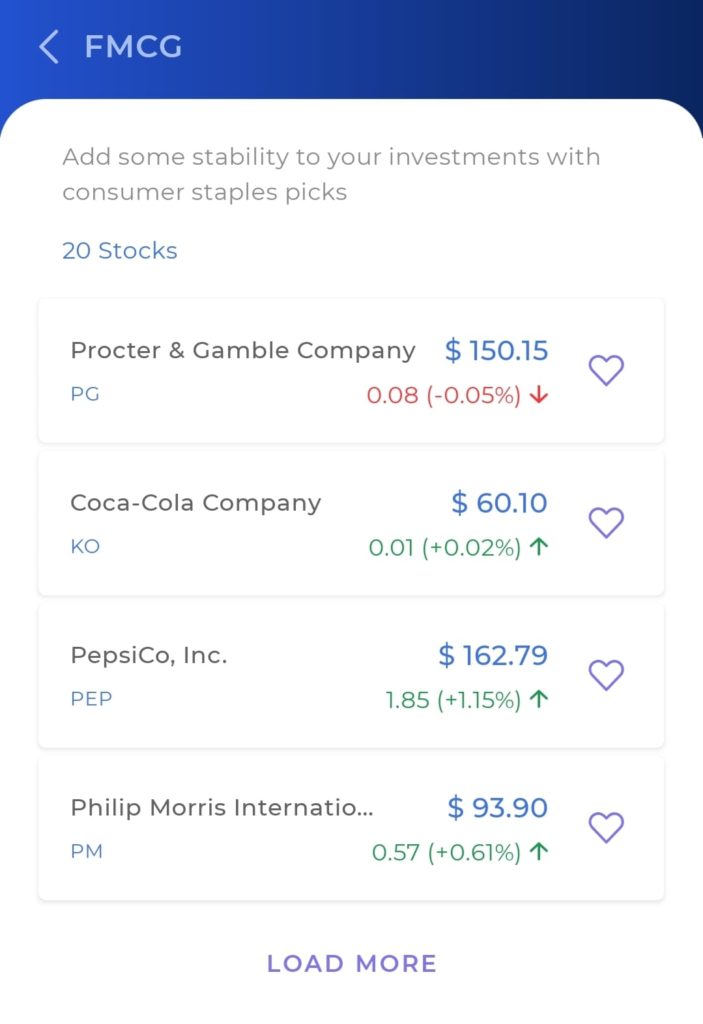

Don’t be too fast to dismiss defensive shares

Defensive performs comparable to shopper staples, utilities, healthcare, real estate investment trusts (REITs) and powerful dividend shares could change into more and more common if the present worry and volatility persists. In spite of everything, you may seldom go incorrect with them. No matter whether or not we’re dwelling by means of a recession or an inflationary interval, folks will nonetheless be consuming and consuming, consuming medical companies and utilities, and many others.

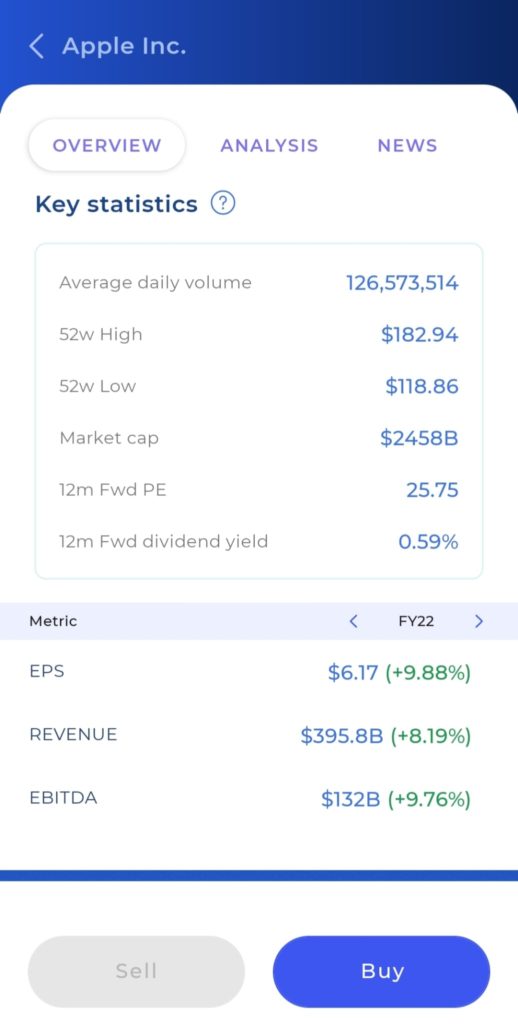

Begin searching for undervalued shares

As a result of broader market decline, even basically sturdy corporations have been bought down on this local weather. It is a good time to start out attempting to find undervalued shares i.e. corporations which can be buying and selling for what they’re truly price. Some widespread metrics to have a look at embrace price-to-earnings or price-to-book ratio and web asset worth, however simply be sure you use the suitable metric for the suitable trade and firm.

For those who don’t know the right way to perform elementary evaluation, then go and LEARN! Whether or not you select to learn through books or programs is as much as you (and if you would like a crash course to carry you up to the mark within the shortest potential time, check out my Academy here). Learn to fish, so that you just don’t should hold counting on inventory suggestions from others.

Don’t attempt to time the market

As an alternative of attempting to time the market, it’s possible you’ll be higher off with common dollar-cost averaging (DCA) to cut back your price per foundation. What’s extra, adopting a DCA technique can even be much less demanding for you because it doesn’t require you to react instantly to market occasions or modifications.

Having stated that, DCA could be troublesome to execute if you’re invested within the Hong Kong market because of the minimal order measurement, which differs throughout every inventory. However there’s an answer for US equities – Syfe Trade is likely one of the solely native brokerages providing fractional investing, which allows you to DCA throughout these unstable instances extra successfully. What’s extra, you too can DCA into shares which can be priced increased (e.g. Amazon or Alphabet) with out having to make use of up a big capital every time. Click here to read on the important role that fractional investing plays in building a truly diversified portfolio e.g. with out it, a month-to-month money injection of S$3,000 would solely be capable to afford 1 Amazon share with little to spare for different corporations in your portfolio.

Preserve your bullets

If the present market local weather persists, or if the struggle drags on, or if we enter stagflation, or if investor sentiment in the direction of progress shares stay muted…

Whatever the state of affairs, so long as the market continues its downtrend for now, you’ll need to have adequate money as a way to proceed deploying at each flip and common down. The excellent news is, if in case you have revenue nonetheless coming in from different sources throughout this time (e.g. out of your company job or enterprise), you get recent capital every month to deploy once more as soon as extra.

Psst, if you should deploy a number of trades every month, doing so through Syfe Commerce is sensible since you get free monthly trades and the flexibility to purchase fractional shares, thus permitting you to profit from your recent capital each single time.

For DIY traders: give attention to sturdy corporations

You’ll be able to by no means go incorrect once you put money into basically sturdy corporations, and much more so once you purchase them on the proper (or low) valuations. As such, proceed to give attention to corporations that generate (slightly than devour) money, in addition to corporations which have the ability to extend costs with out worry of serious losses. (Apple and McDonald’s are some good instance of corporations with sturdy pricing energy.)

TLDR: Don’t panic and keep the course

No matter occurs, the inventory markets have confirmed to be pretty resilient over time, so traders will do nicely NOT to panic. For those who’re made a poor funding, take into consideration whether or not it is best to common down (if the thesis continues to be legitimate) or lower loss and redirect the funds elsewhere. If nothing has modified in your investments apart from common sentiment, you then’ll seemingly do finest to remain the course.

I’ll go away you with this picture (from LPL Analysis) that just about reiterates this level:

Sponsored Message from Syfe

On the lookout for an efficient option to do dollar-cost averaging? Check out Syfe Trade here. Spend money on US shares and ETFs with as little as US$1, and get commission-free trades every month. For March 2022, you get to get pleasure from 5 free trades and a super-low price of US$0.99 per commerce thereafter!

Use code BUDGETBABE to get an extra $10 bonus once you make your first commerce! New Syfe Commerce prospects can even obtain $60 in money credit after they fund $1,000 of their account and begin buying and selling. T&Cs apply.

Disclaimer: This submit was written in collaboration with Syfe. All writings (save for the sponsored message) and opinions are that of my very own. This isn't monetary recommendation and all data is for academic and informational functions. Previous performances will not be essentially indicative of future performances and you shouldn't interpret my returns as what you may get. All the time do your individual analysis earlier than investing! This commercial has not been reviewed by the Financial Authority of Singapore.

[ad_2]

Source link