[ad_1]

Among the many totally different robo-advisors in Singapore, Phillip SMART Portfolio has one of many lowest charges for people wanting to take a position with simply S$300. By leveraging synthetic intelligence and private profiling, it recommends an acceptable portfolio for you, which is then mixed with their funding managers’ experience who choose and rebalance portfolios each time market situations name for it. However how precisely does it work, and will or not it’s an excellent robo possibility for you? Learn on to search out out.

Introduction: How to decide on a robo-advisor

The invention of robo-advisors has been a godsend to each beginner traders in addition to of us too busy to do their very own investments, however but don’t want to pay the sometimes excessive charges for wealth administration companies (or wouldn’t have that stage of capital to get began). Up to now 5 years alone, we’ve seen varied banks and brokerages launch their very own robo possibility for traders as nicely, to the purpose the place Singaporeans now discover themselves spoilt for alternative.

With regards to selecting a robo, it’s best to intention to search out one which meets the next standards:

- Do you belief the supplier?

- Do you might have the minimal capital wanted to get began?

- Do you are feeling the charges charged are affordable?

- Do you perceive their investing methodology?

#1 has been a delicate subject amongst Singaporeans ever since fintech robo-advisory service Smartly shut down in March 2020. This is the reason some folks nonetheless desire to go along with a supplier that has been round for a for much longer time – Phillip SMART Portfolio stands out because of this as it’s being supplied by Phillip Securities (a member of PhillipCapital Group), which has been round since 1975. With their prolonged historical past and expertise within the discipline, the model has gained belief amongst many Singaporeans for his or her high quality of service, dedication and even having buyer hubs (Phillip Investor Centres) situated round Singapore for traders to go to in-person.

#2 and #3 usually go hand-in-hand, as many robos have a tiered pricing system i.e. the extra money you make investments with them, the decrease charges you pay. And for #4, this got here to mild lately when Stashaway (got unlucky) and sold KWEB literally right before a rebound.

Phillip SMART Portfolio isn’t new, however whereas it hasn’t been as aggressively marketed vs. its different rivals, it has been a silent however regular performer for fairly a while – see its prior mentions in the Business Times here and its user reviews on Seedly here.

Let’s dive into how this robo-advisor works to see if it could possibly be an excellent match for you immediately.

How does Phillip SMART Portfolio work?

Phillip SMART Portfolio refers to itself as “the brand new wave of investing”, which mixes know-how, human experience and low charges to make investing extra accessible in order that even full rookies can get began simply.

SMART makes use of synthetic intelligence to handle its portfolios, that are invested in unit trusts throughout totally different geographic areas, thematic sectors and asset courses.

What’s attention-grabbing is its “Cyborg Methodology”, which primarily refers to their proprietary algorithm constructed by their Principal Information Scientist. This algo digests greater than 1,000 information factors every day at a breadth and depth (that can’t be merely interpreted at a human stage) to choose up strong and actionable alerts:

- Breadth = the variety of distinctive securities studied

- Depth = the variety of discretized inputs per safety being monitored each day

- Strict place limits for danger administration are then put in place to make sure optimisation for funding efficiency

With this, it permits the crew to react rapidly and dynamically to altering market developments world wide.

How usually is Phillip SMART Portfolio rebalanced?

Not like another robo advisory companies available in the market, Phillip SMART Portfolio doesn’t have a set rebalancing schedule, and there are no charges charged each time rebalancing takes place.

The rationale behind it’s because PhillipCapital has designed it such that the SMART algorithm can react in a well timed method each time market situations change. Their rebalancing frequency is predicated on market volatility. In consequence, traders’ portfolio efficiency doesn’t undergo (from charges) even when there’s a greater frequency of rebalancing utilized.

FYI: Utilizing myself for instance, I occurred to take a position proper earlier than the current rate of interest hikes, and the markets’ anticipation prompted greater volatility within the markets. In consequence, Phillip SMART Portfolio had a powerful rally final month which resulted in a 4.4% improve for the excessive danger portfolio (in a single month!) whereas mounted revenue holdings had been retracing for the previous few weeks. My account buy-in was due to this fact delayed, and my capital solely obtained deployed through the market’s momentary retracement (which Phillip SMART Portfolio measured from the 5.6% drop within the S&P and MSCI World Index). This was an excellent begin for my portfolio and I appreciated the transfer.

You’ll be able to view the portfolio schedule here.

Who’s appropriate for Phillip SMART Portfolio?

In case you’re

- new to investing

- too busy to watch the markets

- want to diversify your investments

- in search of a low-cost supplier

- want to begin investing although you don’t have quite a lot of capital but

- in search of inexpensive Wealth Administration options to develop your wealth

you then’ll wish to severely take into account if Phillip SMART Portfolio could possibly be good for you, particularly given its low minimal beginning capital of S$300, which suggests virtually anybody can make investments with Phillip SMART Portfolio. And for those who want to do dollar-cost averaging, there’s additionally an optionally available month-to-month common top-up from S$100.

Funding capital (you’ll be able to fund this utilizing both money or SRS):

- minimal beginning capital of S$300

- (optionally available) month-to-month DCA from S$100

I can think about that folks who want to begin educating their youngsters about investing may even arrange an account on their behalf and begin investing your youngsters’ ang pao cash. Observe: there aren’t any joint accounts as a result of KYC functions, much like many different robos.

All of the funds in your Phillip SMART Portfolio are your property, that are held beneath your title within the custody of Phillip Securities Pte Ltd.

How a lot are charges?

Phillip SMART Portfolio prices simply 0.5% every year for its companies, which is among the many lowest of all robo companies in Singapore proper now. What you pay for primarily is to have your portfolio managed by skilled portfolio managers, who curate the portfolio holdings and execute rebalancing methods for you.

There’s no entry or exit charges, which means you’ll be able to terminate at any time with out a penalty for those who realllllly wanted the money urgently for one thing else.

Methods to get began

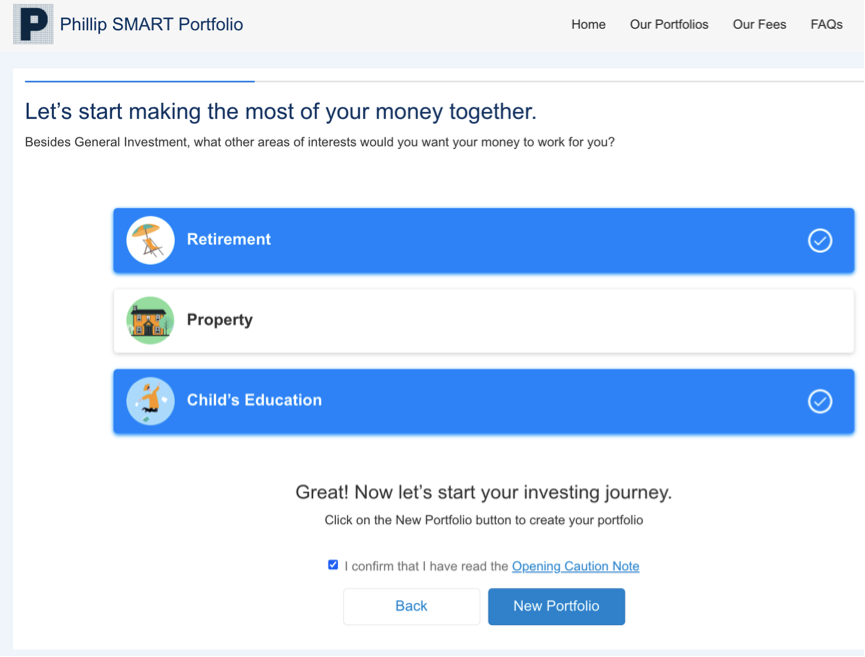

It’s straightforward to get began with simply 3 steps:

- Full a web based danger evaluation

- Submit your private particulars within the software

- Fund your account

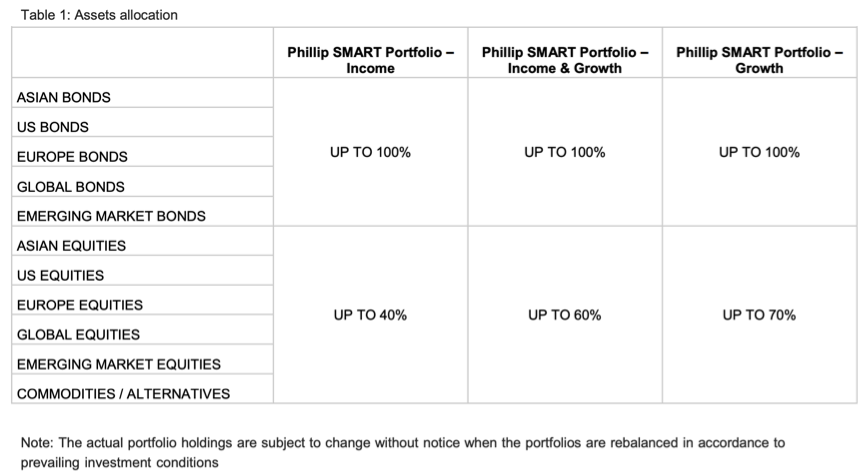

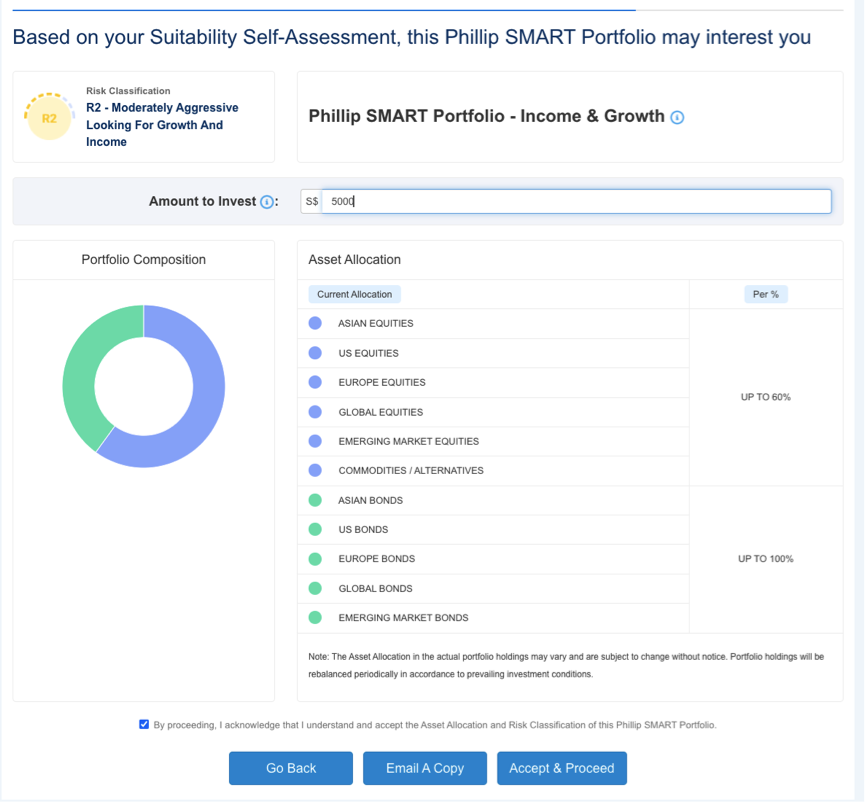

When you’ve accomplished the suitability evaluation to find out your danger profile, you’ll get a proposed portfolio suggestion. Typically, there are 3 danger profiles:

- Low danger – with excessive liquidity wants

- Reasonably aggressive – in search of progress and revenue

- Aggressive – in search of progress

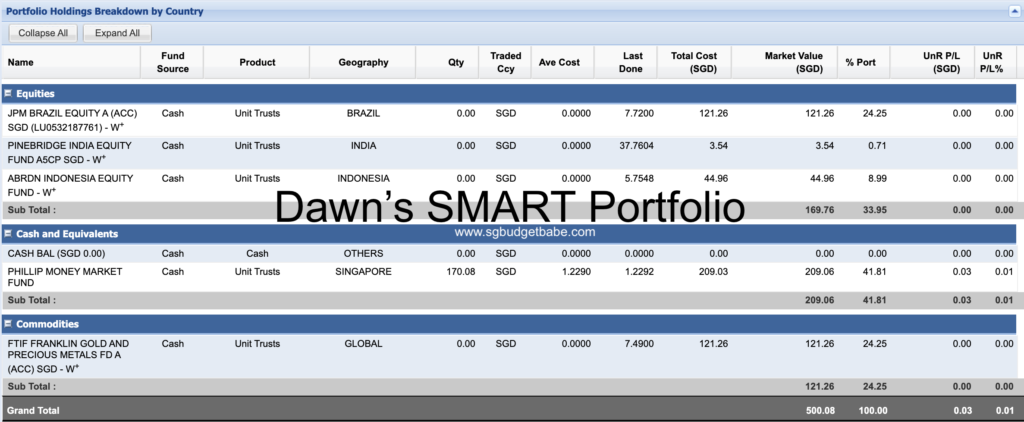

Right here’s a view of my funded portfolio:

P.S. Ought to your life’s priorities change and also you ever want to regulate your danger profile to tackle one other portfolio possibility, you are able to do so by following the instructions here.

TLDR: Verdict of Phillip SMART Portfolio

Phillip SMART Portfolio makes it straightforward to take a position your cash, particularly when you have little time to take action your self however want to outsource that for a low value. The important thing advantages are:

- Low beginning funding quantity of solely SGD 300

- No upfront payment, no brokerage & no platform payment

- Low administration payment of 0.5% p.a.

- Managed by skilled portfolio managers

- Quick and easy on-line account opening

- On-line entry to your portfolio holdings

Opening an account is free, and the low beginning capital makes it straightforward for even traders with a smaller sum to get began.

Sponsored Message Begin investing in Phillip SMART Portfolio with simply S$300 with a low administration payment of 0.5% p.a. (no hidden charges). Go away the onerous work to us. Your journey to fuss-free investing begins right here. Open an account here now!

[ad_2]

Source link