[ad_1]

Why does inflation matter?

If inflation is anticipated to common 5% a 12 months over the subsequent 10 years, our $100 can be value simply $55. Our banks and glued deposit charges usually are not paying us sufficient curiosity to even sustain with inflation, which suggests the worth of our money simply will get eroded over time.

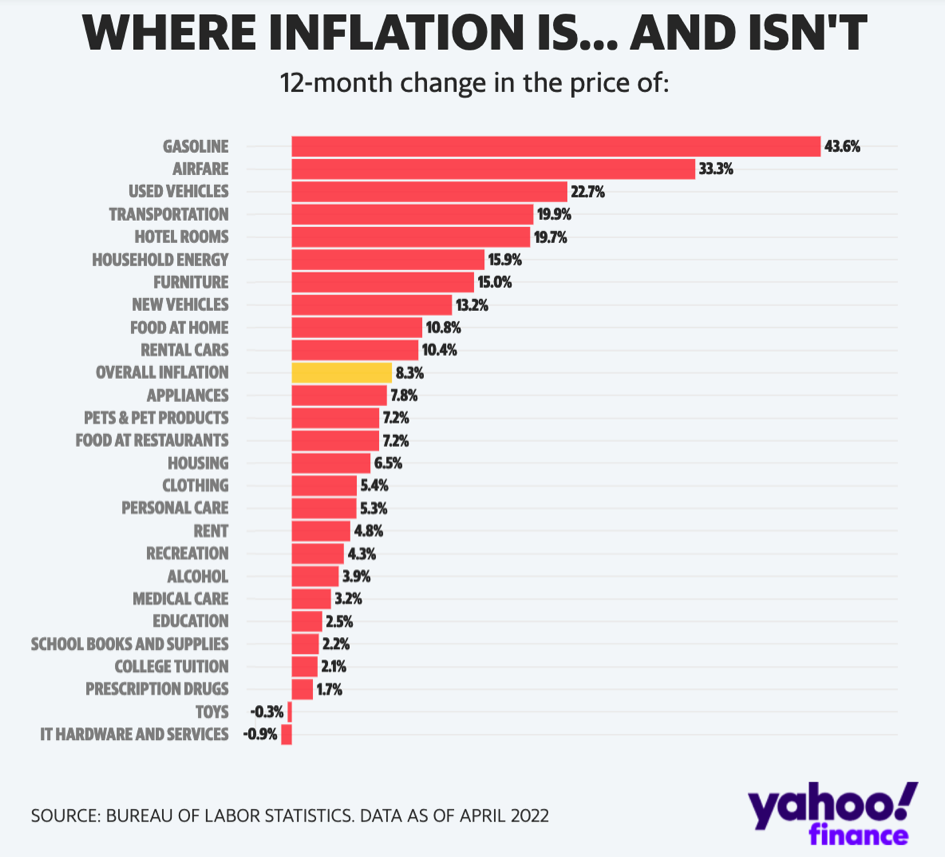

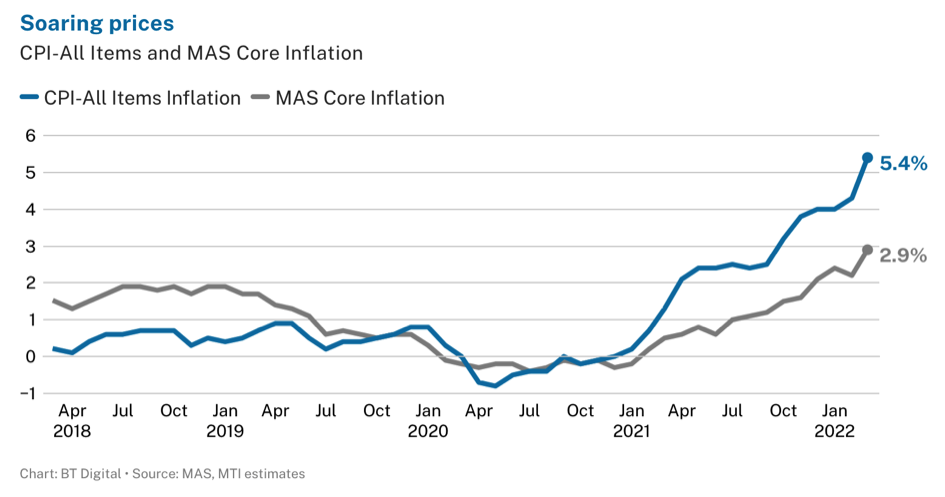

Even should you haven’t been monitoring, you will have realized that your month-to-month family bills have been rising over the previous couple of months. From greater electrical energy payments to costlier groceries, most customers haven’t been spared from the consequences of inflation. And for these whose incomes are unable to maintain up, we now face a really actual danger of getting much less buying energy (each now and within the close to future) as the costs of products and companies proceed rising.

Inflation erodes the worth of money

By now, it is best to already know that staying in money alone would be the worst transfer to make within the subsequent few years – particularly with inflation not going away anytime quickly.

A great way to hedge in opposition to inflation can be to extend our earnings. In the event you’re a salaried worker, you’d need to begin fascinated about how one can ask for a increase, and even change jobs should you get a greater provide elsewhere. In the event you’re a enterprise proprietor, you’d want to consider the best way to preserve or enhance your revenue margins – particularly as your suppliers increase their costs and drive your working prices greater.

But when rising your earnings isn’t potential (or extraordinarily troublesome at this level), then one other approach to hedge in opposition to inflation can be to take a position your money for greater returns as an alternative.

Find out how to make investments to beat inflation

In any case, many companies offset greater inflationary prices by elevating their costs and passing them on to prospects. This in flip will increase their income and earnings, which tends to drive greater inventory costs over time, thus benefiting each the corporate and its traders.

Historically, development shares are likely to do poorly in inflationary environments. It is because rising rates of interest results in a better low cost fee being utilized to a inventory’s future earnings, thus decreasing valuation multiples. As future earnings develop into much less precious and present earnings develop into extra vital, traders shift their focus again to worth shares as an alternative (usually valued on present earnings). Particularly, worth shares within the shopper staples area (like meals or vitality) usually are likely to do effectively throughout inflation as a result of the demand for requirements are inelastic, which supplies these corporations greater pricing energy to extend their costs.

However simply because inflation is excessive now doesn’t imply it’s going to final ceaselessly. If you’re making an attempt to handle your portfolio for what could also be a really brief time period, you could possibly probably find yourself doing extra hurt to your returns as an alternative.

What’s extra, there isn’t any simple relationship between inflation and shares. Reasonably, historical past has proven that investing in shares might help outpace inflation in the long run. During the last 3 a long time, the S&P 500 had a median annualized return of 8.1% even after adjusting for inflation.

Annual inflation-adjusted returns of S&P 500 Index vs. inflation, 1992–2021

Traders with an extended time horizon due to this fact do not need to fret an excessive amount of concerning the affect of inflation on their portfolio.

Merely sticking to a diversified asset allocation technique will serve you effectively.

How ought to I make investments?

With inventory costs taking a beating in latest months, this can be time to begin on the lookout for undervalued bargains. And should you personal (or intend to personal) any development shares, watch their debt ranges and be certain that they’ve pricing energy to help returns. Except for reviewing the annual studies and quarterly earnings calls, you might also need to spend a while watching their opponents to verify that they’re nonetheless forward of the league.

But when conducting detailed inventory evaluation isn’t your cup of tea, a better means could possibly be to spend money on ETFs (change traded funds) as an alternative. These observe a basket of shares and mean you can trip on broader market indexes, business publicity and even thematic performs.

One other means could possibly be to make use of funds, which lets you outsource and make investments into a spread of corporations managed by skilled fund homes as an alternative. A simple means to take action can be through moomoo’s Cash Plus, which presents varied funds by Blackrock, Lion World or Franklin Templeton with none subscription charges.

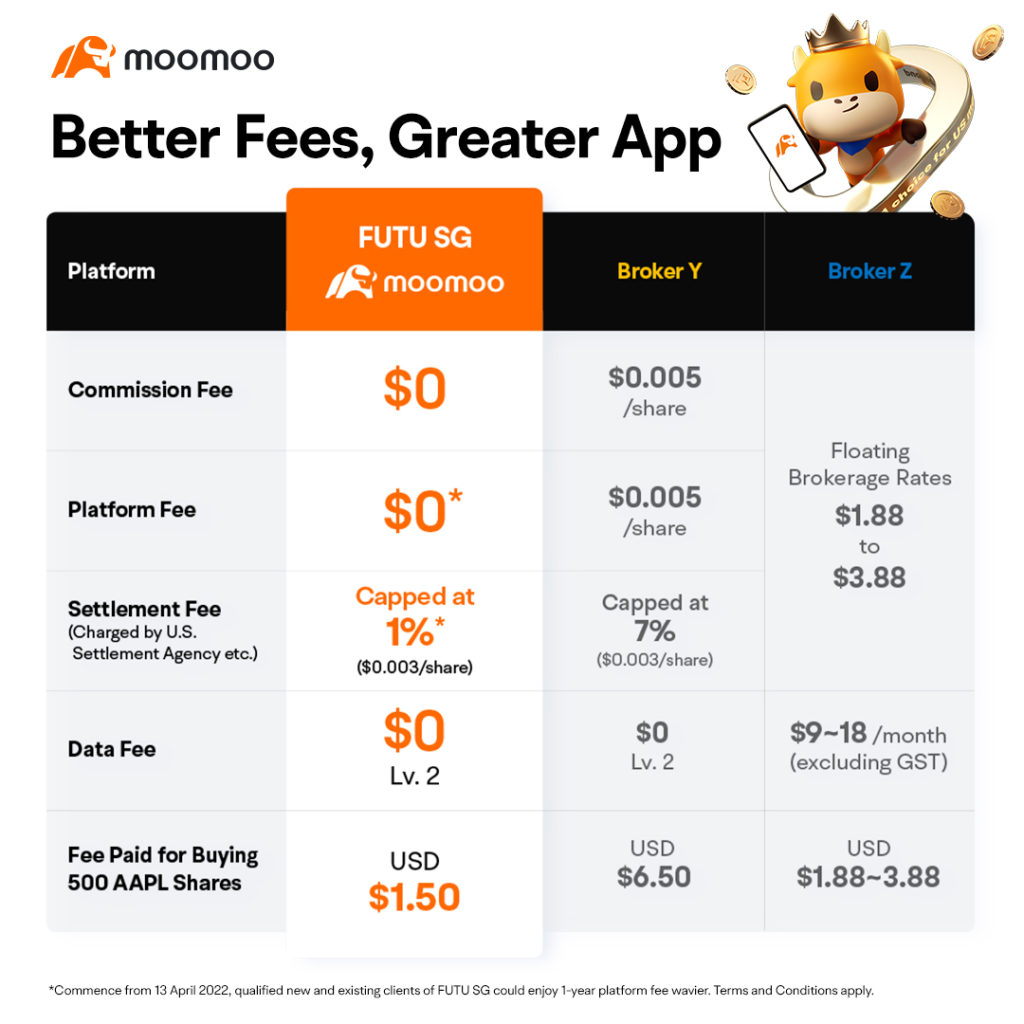

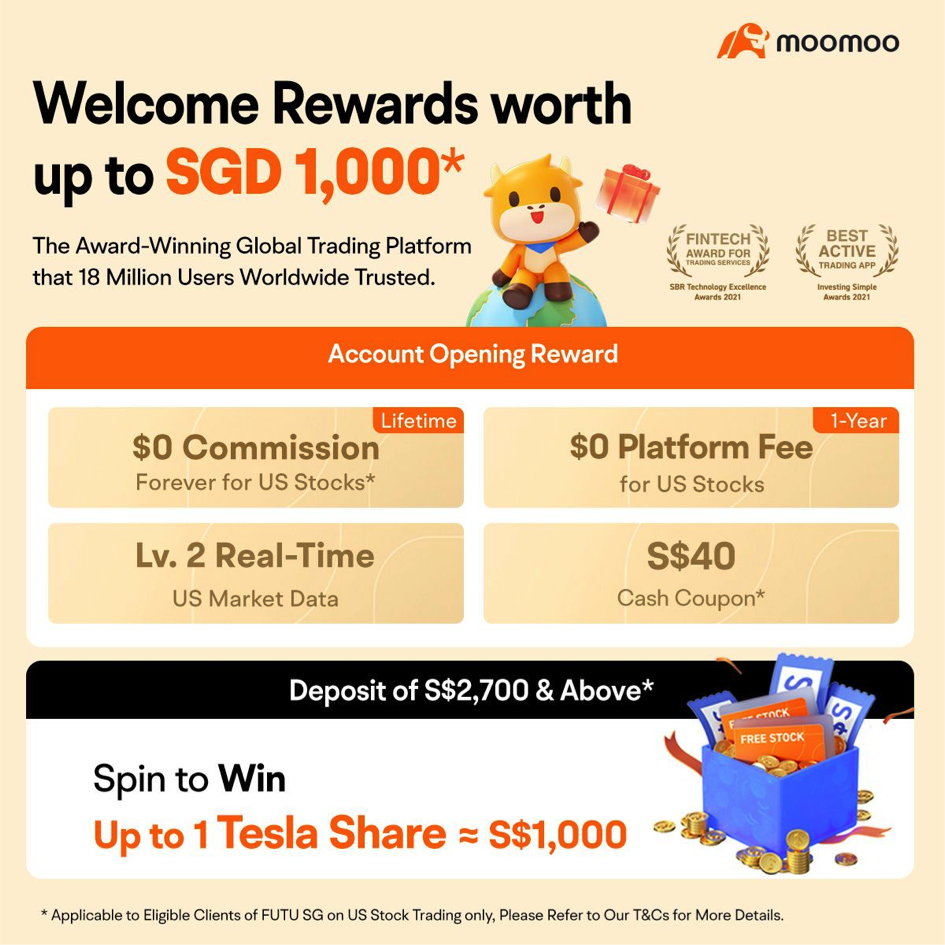

Use a low-cost brokerage like Futu SG (moomoo) so that you just pay much less

Buying and selling charges can shortly add up should you’re not cautious, so make sure you use a low-cost brokerage like moomoo so that you just pay minimal transaction charges every time you purchase or promote any shares.

Think about moomoo, which is the primary digital brokerage in Singapore to supply a $0 platform price, $0 knowledge price, and lifelong $0* fee for US shares.

On moomoo, you'll be able to freely purchase and promote your shares as you do dollar-cost averaging to decrease your general price per share in the long term. All these for a low price, since no commissions* are charged on US inventory buying and selling.

What’s extra, one great point I like is that whereas US Stage 2 market knowledge is usually not offered free by most brokerages, you’ll be able to truly get it on moomoo at no cost, which might help provide the market depth and sample of transactions so you’ll be able to higher modify your costs as an alternative.

Sponsored Message With $0* fee charges on US shares ceaselessly, take pleasure in buying and selling and investing with only one highly effective app – moomoo. Get entry to superior app options right now together with charting, inventory screeners, AI displays, heatmaps and extra…with NO knowledge charges!

Open an account here and deposit S$2,700 or extra (S$1,000 for college kids) to get a welcome bundle of:

- Lifetime commission-free* trades on US shares

- 1 free share (value as much as S$1,000)*

- S$40 cashback

*Phrases and situations apply. The moomoo app is an award-winning buying and selling platform supplied by Moomoo Inc., a subsidiary of Futu Holdings Restricted (NASDAQ:FUTU) and backed by Tencent. Futu SG is regulated by the Financial Authority of Singapore and has acquired approvals-in-principle for all SGX memberships. Disclosure: This submit is dropped at you together with Futu SG. All opinions are that of my very own, primarily based on my buying and selling expertise with moomoo. Please be at liberty to click on on my affiliate links if you’ll like to sign up for an account! This commercial has not been reviewed by the Financial Authority of Singapore.

[ad_2]

Source link