[ad_1]

Startup investing is a high-risk alternative that may assist traders earn a living by supporting rising corporations. Nonetheless, discovering these investments could be laborious since small companies don’t have the identical promoting attain as publicly-traded corporations.

Fortuitously, you should utilize StartEngine to get publicity to this asset class. Abnormal traders can make investments as little as $100 in early stage startup corporations and collectibles.

This StartEngine assessment can assist you resolve if the service is true on your investing targets.

Abstract

It’s attainable to put money into startups and collectible with funding minimums as little as $100. Buyers can obtain bonus shares and rewards. Sadly, these property are high-risk and require holding for a number of years.

Execs

- Unaccredited traders can make investments

- $100 minimal funding

- Many funding choices

- Earn investor bonuses

Cons

- Excessive-risk property

- Illiquid shares

- No retirement accounts

- No telephone help

What’s StartEngine?

StartEngine is an fairness crowdfunding platform that lets particular person traders put money into early-stage corporations. Sometimes, this funding sector is just for accredited traders who’ve a excessive internet value.

Fortunately, with StartEngine, there are not any minimal earnings or internet value necessities to affix.

Plus, it’s additionally attainable to make use of the platform to put money into collectibles like artwork, buying and selling playing cards and watches.

The location is a well-liked equity crowdfunding platform because it presents many funding choices and has low funding minimums.

For instance, you possibly can make investments as little as $100 into particular choices. That mentioned, different alternatives might have a $1,000 minimal funding.

Moreover, it has the help of Kevin O’Leary (often known as Mr. Fantastic), a well-known angel investor from the Shark Tank tv collection.

The service presently solely has an iOS cell app. Android customers should entry the platform from a pc or cell browser.

Is StartEngine Legit?

Sure, StartEngine is legit. It’s owned by StartEngine Capital, LLC, which is registered with the US Securities and Alternate Fee (SEC) and is a member of the Monetary Business Regulatory Authority (FINRA).

The SEC guidelines require that corporations present correct and truthful info. FINRA is permitted by Congress to guard America’s traders by ensuring the broker-dealer business operates pretty and actually.

How Does StartEngine Work?

Whether or not you’re a monetary skilled or within the non-accredited traders class, you possibly can put money into a number of alternative assets utilizing this platform. Sometimes, most non-stock investing apps solely supply one funding possibility.

All of the choices on StartEngine allow you to buy an fairness place, just like shares. When you gained’t obtain recurring dividend funds, you’ll earn a living if you happen to can promote your shares for a revenue.

Fairness crowdfunding is the primary investing section for early development corporations which might be attempting to boost capital. It’s additionally one of many riskiest funding alternatives.

That mentioned, it could actually have extra reward potential than late-stage investing or ready to purchase shares on the inventory market.

It’s often greatest to open a small place in a number of corporations to restrict your threat. StartEngine gives many funding choices and a number of other analysis instruments that will help you be a profitable investor.

Moreover, all investments are made via a taxable account. The platform doesn’t help tax-advantaged retirement accounts or self-directed IRAs but.

Right here’s how the method works when utilizing StartEngine.

1. Signal Up

It’s simple for accredited and non-accredited traders alike to securely create a StartEngine account. To make an account with this fairness crowdfunding platform, you possibly can join on a cell system or desktop.

You’ll be able to register utilizing:

- Apple ID

- Fb

- E mail

You’ll must confirm your e mail deal with to complete creating your account if you happen to register utilizing this feature.

2. Browse Investments

When you join StartEngine, you’ll have the chance to browse various kinds of investments to do your individual due diligence. That you must consider these choices by yourself as you gained’t have entry to a strategic advisor for funding recommendation.

The choice buying and selling system presents two funding choices, together with startups and collectibles.

Startups

Startup corporations which might be attempting to boost cash are StartEngine’s commonest funding possibility.

You may get publicity to varied enterprise sectors and firms which have aspirations to both develop into publicly traded or be acquired by a purchaser.

Yow will discover choices for brand spanking new startup corporations in lots of industries, together with:

- Synthetic intelligence

- Biotechnology

- Clear know-how

- Clothes

- Schooling

- Electronics

- Monetary providers

- Gaming

- Music

- Retail

- Sports activities

- Journey

The funding minimal for these enterprise startups is often between $100 and $500 for many choices. You should purchase shares whereas the funding spherical is open.

Moreover, this funding alternative might give you particular rewards if you happen to make investments a selected sum of money. For instance, you may obtain free clothes, product samples or experiences as a token of appreciation on your loyalty.

Collectibles

It’s additionally attainable to purchase shares of bodily and digital collectibles that may recognize in worth.

Chances are you’ll wish to think about this feature if you happen to don’t have sufficient money or the storage functionality to buy costly uncommon objects.

A few of the choices embrace:

- Artwork

- Cash

- Comedian books

- NFTs

- Sports activities buying and selling playing cards

- Watches

- Wine

The choices could be for contemporary productions or classic editions.

Plan on investing between $100 and $500 for many collectible choices. Curiously, watches can solely require a buy-in between $2 and $10, which makes it simple to invest small amounts of money.

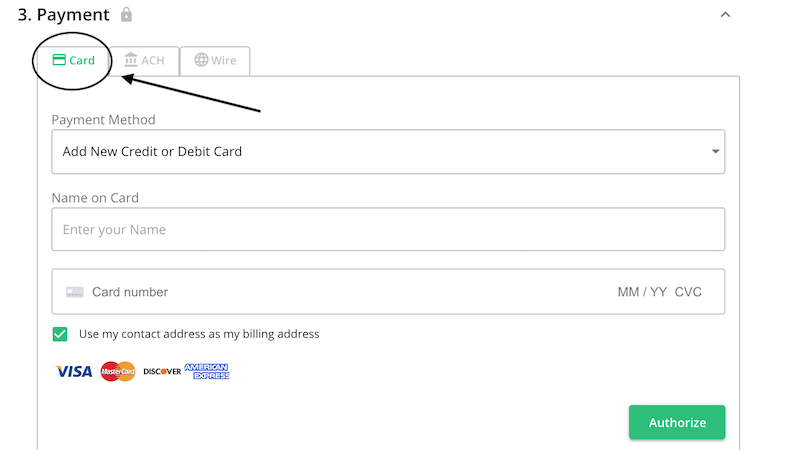

3. Make an Funding

With StartEngine, you might be your individual account supervisor. When you resolve what you’d prefer to put money into, you’ll must pay on your funding.

You may make a fee by way of:

- Automated Clearing Home (ACH)

- Bank card

- Wire switch

Relying in your fee technique, processing can vary from on the spot to 4 enterprise days.

Needless to say if you happen to put money into a startup and the marketing campaign doesn’t attain its fundraising aim, the corporate refunds your dedicated funds and gained’t concern shares.

Because of this unsuccessful funding campaigns are a non-taxable occasion as you’re not liquidating shares.

4. Maintain or Promote

After paying on your funding, you possibly can proceed to put money into future rounds, maintain your place or promote eligible securities on StartEngine’s buying and selling platform.

It’s vital to notice that, whether or not you put money into corporations or tangible property, investments on StartEngine often require a long-term holding interval of at the least 5 years to be able to promote your shares for a revenue.

Ideally, you’ll have the ability to keep your funding for the total holding interval. Nonetheless, StartEngine does let you promote your place early via its buying and selling platform.

Buying and selling Platform

One draw back of startup investing is its inherent illiquidity. You need to solely make investments cash that you simply don’t anticipate needing for a number of years.

Fortunately, this fairness crowdfunding platform presents a secondary change the place you should purchase and promote shares. In consequence, you possibly can promote your shares early if you have to elevate capital.

Nonetheless, the minimal holding interval nonetheless is dependent upon the deal construction. Deal constructions embrace Regulation A+ and Regulation Crowdfunding.

Listed here are the minimal holding durations for every construction:

- Regulation A+: Might be bought after marketing campaign funding closes

- Regulation Crowdfunding (CF): Should maintain for at the least one 12 months earlier than promoting

Earlier than you select a Regulation Crowdfunding construction, ensure you are comfortable with holding your place for at the least one 12 months.

You may also purchase shares for corporations that aren’t presently fundraising. Shopping for shares lets you get shares at a possible low cost.

A 3rd possibility for liquidating your funding early is swapping shares between two corporations if one individual doesn’t desire a money settlement.

Not each firm that raises funds via this service presents share buying and selling via the StartEngine Secondary platform. However, it’s a constructive step towards making this sector simpler to put money into.

How A lot Does StartEngine Value?

It’s free to open a StartEngine investing account. Nonetheless, you may pay a charge to purchase or promote shares.

These charges might embrace:

- As much as a 3.5% processing charge to purchase shares (the corporate may pay this charge)

- $5 transaction charge per sale when promoting shares

The transaction charge reduces to $4 for premium Proprietor’s Bonus members.

These charges are aggressive with different startup investing websites however could be increased than inventory buying and selling apps.

Solely having to invest $100 for a lot of choices makes this an reasonably priced platform. In consequence, you possibly can simply diversify your portfolio to follow sound threat administration.

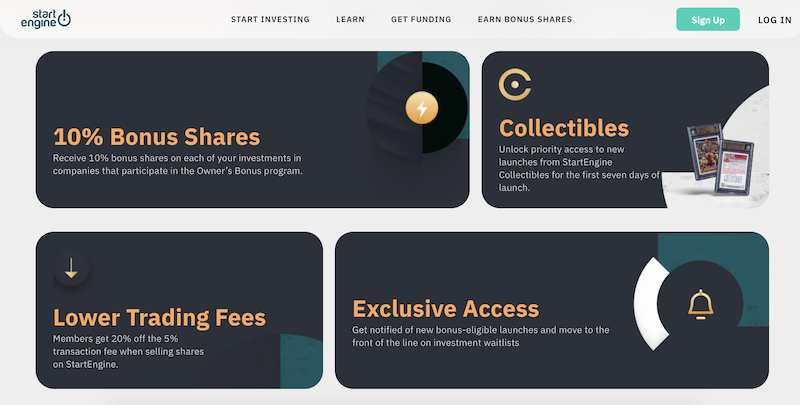

Proprietor’s Bonus

Should you plan on investing recurrently on the platform, it may be value buying an annual premium membership. StartEngine’s Proprietor’s Bonus program prices $275 per 12 months.

The premium advantages embrace:

- Obtain 10% bonus shares on choose choices

- 20% low cost on the $5 transaction charge when promoting shares

- Precedence entry to waitlists

It’s greatest to check out the positioning first to find out how a lot you’ll really use it earlier than signing up for the Proprietor’s Bonus program.

Key Options

These options can assist each accredited and non-accredited traders maximize their StartEngine membership and get publicity to hard-to-access investments.

Discover Investments

There are at all times funding choices which might be elevating funds on StartEngine. The location makes it simple to kind via the choices.

Particularly, there are 4 useful search filters:

- Most Momentum: Corporations elevating essentially the most cash in the previous couple of days

- Just lately Launched: The platform’s latest listings

- Most Funded: Choices which have raised essentially the most cash total

- Closing Quickly: Funding campaigns that can shut quickly

You may also browse listings by business with a drop-down menu. An interactive search filter lets you discover corporations and collectibles by key phrase.

When you establish a possible funding, the platform gives a number of particulars that allow you to study extra concerning the firm.

These embrace:

- Management crew bios

- Progress updates

- White papers and SEC disclosures

- Exit technique

- Investor rewards

Every of those assets makes it simpler to carry out your due diligence. Nonetheless, it’s nonetheless smart to analysis an organization (and the competitors) with different instruments as effectively since this info doesn’t essentially present monetary recommendation.

Distinctive Collectibles

With the ability to put money into collectibles and startups on the identical platform helps make StartEngine distinctive. This stuff can have comparable funding returns, and also you’re investing in objects which might be in demand.

Like startup investing, investing in collectibles is often laborious to entry due to the excessive funding minimums. Historically, it’s important to purchase the complete asset, which might simply require investing $100,000 or more.

With StartEngine, it’s attainable to get publicity to those laborious property via fractional shares.

A few of the current choices embrace:

- Michael Jordan rookie card

- Jackie Robinson Leaf rookie card

- Batman #1 1940 comedian e-book

- Banksy Snort Now NFT

- Picasso artwork

- Funding wine

- Rolex watches

Every providing particulars the merchandise’s historical past and up to date public sale worth historical past. You may also view product pictures and specs to study extra.

Make investments with a Credit score Card

There are a number of methods to fund your funding, together with the normal choices of ACH financial institution transfers and wire transfers.

The platform additionally helps bank cards and debit playing cards for fast funding. That is totally different from the normal funding course of.

The transaction restrict is $10,000, and StartEngine doesn’t cost further charges.

Sadly, not each firm accepts card-based transactions due to the extra processing charges. You must also confirm that your card issuer gained’t cost further charges for this transaction.

Job Board

Together with being profitable from thriving early-stage investments, there’s additionally a job board with companion corporations. These corporations have raised funds with StartEngine and are giving again to the neighborhood by hiring high expertise.

Yow will discover some remote jobs on this job board, whereas others are location-dependent.

The job openings could be for the next duties:

- Blockchain developer

- Buyer help

- Cloud engineer

- Mechanical engineer

- Operations supervisor

- Gross sales account government

Every posting lists the job location and the age of the posting. You’ll be able to filter job openings by sector, place and placement.

Frequent traders and people keen to take a position the next stability can qualify for the Proprietor’s Rewards Bonus. Your annual dues are $275, however you possibly can obtain 10% bonus shares on choices with the lightning bolt icon.

For instance, you obtain 10 bonus shares while you buy 100 shares.

Not each firm participates on this bonus program. Should you resolve to put money into a non-participating startup, you possibly can nonetheless obtain particular rewards which might be obtainable to all potential traders.

Buyer Critiques

Startup investing is an thrilling sector, however it’s naturally high-risk and never best for everybody. Whereas there will not be many opinions for StartEngine, these buyer insights can assist you establish if it’s best for you.

Right here’s how StartEngine stacks up on the totally different ranking platforms:

| Web site | Ranking | Whole Critiques |

| Apple App Store | 4.8 out of 5 | 1.1k |

| TrustPilot | 2.5 out 5 | 12 |

| BBB | 1.06 out of 5 | 16 |

The general scores will not be the most effective amongst various funding apps. Frequent complaints embrace sluggish buyer response, a multi-year funding dedication and funding volatility.

Listed here are some opinions from individuals who have used the platform:

“I’m an unaccredited investor, and it’s loopy to assume how just a few years in the past I wasn’t even in a position to put money into startups! StartEngine has considerably democratized finance and all us retail traders stand to profit tremendously.” — TS

“Nice website for investing in up and coming startups. Lots of the opinions appear to be from individuals not being conscious of what they’re going into. This sort of middleman is your solely possibility if you wish to put money into up and coming startups – there are not any different decisions on the market!” — Alex H.

“It’s a promising platform, nevertheless if this firm continues to cost traders 3.5% charge for each funding they make, it is going to ultimately lead to its demise.” — life_goes_on

“Invested $500, This platform appears to have solely entry NO EXIT. No telephone buyer help. Looks like a entice.” — Arul P.

Options to StartEngine

Should you aren’t satisfied this platform is the best possibility for you, there are numerous different corporations you possibly can think about using on your funding wants. These alternate options to StartEngine can assist you put money into startups and different asset courses.

Fundable

Accredited traders should purchase fairness or debt shares in small companies via Fundable.

The minimal funding quantity begins at $1,000, which is increased than StartEngine. Nonetheless, it’s nonetheless reasonably priced for high-net-worth traders.

Every open providing features a firm abstract and marketing strategy. This platform can present extra funding choices for certified customers.

Mainvest

Mainvest is open to all potential traders and has a $100 minimal. Many companies supply debt financing, so you should purchase revenue-sharing notes to estimate your funding returns via the fairness a number of.

This function makes it simple to calculate your potential funding returns. Most funding phrases are for 5 years, and also you obtain dividends throughout compensation.

Different funding choices have an fairness construction just like StartEngine. On this scenario, you purchase shares and don’t gather income till you promote them as soon as the corporate goes public or will get acquired.

Learn our Mainvest review for extra info.

Yieldstreet

Yieldstreet has a various set of funding alternatives. Nonetheless, you should be an accredited investor to obtain full entry to the platform.

Accredited traders can make investments immediately in these portfolios:

- Artwork

- Collateral-back loans (i.e., bikes, small companies)

- Actual property

- Provide chain

Retail traders can’t make investments immediately in these property, however they will get oblique publicity via the Yieldstreet Prism Fund. The minimal funding is $500, and it has an annual historic distribution fee of 8%.

You may additionally desire investing via the Prism Fund in order for you entry to various investments however don’t have the time or ability to analysis particular person tasks.

Learn our Yieldstreet review for extra particulars.

FAQ

Since StartEngine presents entry to an unique asset class, it’s important to grasp how the platform works to be able to defend your wealth.

Early-stage startups are inherently high-risk as a result of they’re small companies with fierce competitors and probably unsteady money circulate. Moreover, your shares are illiquid and tough to promote.

It’s vital to completely analysis every firm to grasp its strengths and potential dangers. Corporations elevating cash are legit companies, however they might not have the most effective monetary well being.

You’ll be able to contact StartEngine customer support brokers by e mail or clicking a dialog field on any web page after logging in. It could possibly take as much as 24 hours to obtain a response.

Sadly, reside telephone help isn’t obtainable

The cancellation window is dependent upon the providing construction. For Regulation Crowdfunding, you possibly can cancel as much as 48 hours earlier than the providing closes. For Regulation A+, you possibly can cancel inside 4 hours of committing to purchasing shares.

Listings might also have a rolling closing interval. If that’s the case, traders obtain advance discover when the interval closes and have 5 days to cancel an order.

Sure. Buyers have the chance to fund corporations which might be elevating capital and earn more money if their investments are profitable.

Nonetheless, potential traders ought to pay attention to the dangers concerned with investing via StartEngine crowdfunding.

Abstract

When you’ve got a excessive threat tolerance and a long-term investing timeframe, StartEngine gives many funding choices for startups and collectibles. It’s additionally one of many few locations that permit non-accredited traders put money into various property.

That mentioned, accredited traders might discover extra enticing alternatives elsewhere.

Whereas the platform is ideal, people can diversify their portfolios with low funding minimums.

[ad_2]

Source link