[ad_1]

The place do I start? Everybody ought to know there was an enhance within the inflation price, driving up prices and placing immense strain on Canadians.

Probably the most affected are low-income families who have been already struggling to start.

If there was ever a time when an emergency savings account would turn out to be useful, now’s the time.

Stashing money isn’t new to those that lived by way of the 80s and 90s, however it’s powerful for many who haven’t.

I don’t imagine we’re as dangerous off as within the ’80s when many householders couldn’t pay their mortgage and needed to stroll away.

That’s to not say it gained’t occur once more however getting ready for the worst isn’t a nasty concept for cash issues.

For the reason that pandemic, Canadians are seeing elevated power, grocery prices, rising rates of interest, and labour shortages.

If I have been to weblog about debt compensation, you’ll most likely inform me there isn’t sufficient cash to pay it off.

As wages go up, the numbers are nonetheless behind the inflation price, and Canadians proceed to wrestle for monetary steadiness.

I’m scripting this weblog publish in mid-July 2022, and the Financial institution of Canada governor Tiff Macklem says we should always count on the inflation price to hit over 8% within the subsequent week and to remain there for months.

- The inflation price to eight% or 8.3% in July, sticking round for a number of months

- Fall to three% by the top of 2023

- Goal 2% in 2024

As you may see, we are going to all face powerful instances for a bit and have to plan accordingly.

An inflation price enhance of over 8% is the very best Canadians have ever skilled since 1983.

Each facet of our month-to-month price range exhibits the indicators of inflation, together with renovation supplies.

Right this moment, I’d wish to rapidly focus on how the inflation price has eaten a gap within the Canadian price range.

Influence Of The Inflation Fee On Canadian Households

Who’s at fault for not controlling the inflation price? It’s not like Canada hasn’t been by way of a recession earlier than that there weren’t protocols in place.

Maybe the Financial institution of Canada is pulling again the reigns now with the elevated inflation price.

<iframe width="560" top="315" src="https://www.youtube.com/embed/t_karu8j0Wg" title="YouTube video participant" frameborder="0" permit="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>Inflation Fee Hitting The Housing Market

Associates of ours remortgaged their variable price to a 5-year fastened price earlier than one other enhance in inflation would drive them to promote.

The place would they go?

Lease is at an all-time excessive and, for some, simply as a lot or greater than a mortgage would value.

Being house poor takes on a brand new definition, particularly for these Canadians who overpaid the previous yr.

Homes sometimes promote for $700,000 in our space, but owners have been getting over a million {dollars}.

As I write this publish, in mid-July, properties listed for over a million {dollars} in our space have dropped beneath that quantity.

I’m speaking about 1.3 million to 950,000 {dollars}, a large value lower and stumbling in direction of correction.

Many owners missed the boat, particularly those that have been retiring or plan to retire and have someplace to go till then.

The phrase “Take the Cash and Run” involves thoughts.

It has been insane to look at house-for-sale indicators go up with a value that didn’t make sense.

Sadly, folks purchased these properties and probably confronted proudly owning extra debt than house.

One individual instructed me, “You may simply bury me within the yard,” which says quite a bit in regards to the overpayment disaster.

In Might, gasoline costs elevated by 12%, the very best I’ve ever seen since transferring to Canada.

Nevertheless, as meals costs enhance, they proceed to be a high concern amongst readers of Canadian Funds Binder.

Why is that?

Properly, we are able to management what we purchase on the grocery retailer week to week to regulate prices.

Does that imply we at all times get what we wish? No, it means planning meals across the amount of cash out there.

Shoppers could must abort snacks except it’s for teenagers’ lunches and eat varied meals based mostly on gross sales or decreased product gross sales.

How Can I Afford To Eat As The Inflation Fee Will increase?

Whether or not on Fb, the place I’m most lively on social media, conversations are usually round grocery value will increase.

Additionally, by way of natural search on the weblog, I’ve seen visitors spikes for grocery ideas because the inflation price continues to climb.

Associated: The Ultimate Canadian Grocery Guide With Over 300 Blog Posts

Canadians continued to really feel the influence of rising costs in Might as client inflation rose 7.7% yr over yr. This was the biggest yearly enhance since January 1983 and up from a 6.8% acquire in April. Excluding gasoline, the CPI rose 6.3% yr over yr in Might, after a 5.8% enhance in April.

Shopper Value Index Factors Out Inflation Fee

Every little thing from housing to grocery bills impacts many Canadians with little to no additional money.

Over 12 months, the chart beneath exhibits 5 important parts that elevated at a excessive tempo, in keeping with Stats Canada.

If you happen to’re working with a tight budget, wait till September, when grocery costs enhance once more.

How can we put together for extra grocery value will increase?

The one approach is to construct a price range and discover out what must go so you may afford the fundamentals of life.

Even the,n Canadians could have to complement with meals banks, group assist and donations.

| April 2022 | Might 2022 | |

|---|---|---|

| All-items Shopper Value Index | 6.8 | 7.7 |

| Meals | 8.8 | 8.8 |

| Shelter | 7.4 | 7.4 |

| Family operations, furnishings and tools | 4.1 | 5.5 |

| Clothes and footwear | 0.2 | 2.2 |

| Transportation | 11.2 | 14.6 |

| Well being and private care | 3.4 | 3.6 |

| Recreation, training and studying | 4.1 | 5.4 |

| Alcoholic drinks, tobacco merchandise and leisure hashish | 3.1 | 3.0 |

| Gasoline | 4.28 | 190.5 | 251.7 | 281.9 | 12.0 | 48.0 |

|---|

Fuel has a relative significance of 4.28 on the Shopper Value Index with a large 48% enhance.

All through Might 2021- Might 2022, gasoline costs alone have despatched Canadians to consider cheaper travelling to work choices.

Fortunately my work is near our home, however we additionally make fewer journeys into the town than we have now to.

I even go so far as to fill two large crimson gasoline tanks to high up my truck when it wants it.

Once I achieve this at Costco, my invoice Is nothing wanting $200 and never crammed from empty.

Methods To Work With Greater Costs And The Inflation Fee

Do you have to change the best way you price range? Possibly.

Which may sound like I’m asking the not possible of you, however I’m not.

All I’m saying is to guage your bills and begin dumping stuff.

What issues me probably the most are Canadians who don’t know the place their cash goes.

If you happen to’ve by no means thought of utilizing a price range, now is a superb time to grasp your financial habits.

Whereas ending our price range for June, I had the information on the tv and felt anxious for the primary time in a protracted whereas.

I perceive we’re in a superb monetary place with a mortgage-free house, however it nonetheless impacts us watching costs enhance.

Virtually all of our retirement investments took a nostril dive, which didn’t assist us.

Renovation Supplies Hit By The Inflation Fee

As an avid price-watching nerd, I see the rise in costs, particularly groceries and residential renovation supplies.

Two weeks in the past, I had to purchase one bag of Rockwool insulation as I used to be brief one from my earlier buy two years in the past.

I used to be shocked at how the worth had nearly doubled and was glad I used to be solely brief one bag.

At present, I’m renovating our grasp rest room and taking it right down to the studs.

We estimate that the renovation will value round $10,000, and sure, it wanted doing.

The bathe leaked into the basement, and mildew was underneath the bottom unit.

I’ll be doing all of the work and might wager it will value greater than double had I employed a contractor.

How We Can Assist Battle Inflation Collectively

My readers are of the utmost significance concerning frugal dwelling, and studying about their monetary dilemmas is hard.

What can I do to assist?

I can’t change what’s occurring with the economic system, however I may be part of a group (that’s all of you) that helps share their concepts with one other.

All of us should be a part of a motion in Canada the place we assist one another get by.

Even the smallest gesture could make a distinction in somebody’s life.

There are a lot of methods you may assist a neighbour, buddy, stranger or member of the family throughout instances of want.

I’m not speaking about handing out cash, as not everybody has spare money.

Suppose, donations, volunteering, listening and serving to to unfold good vibes.

If you happen to use a price range, don’t be shy to clarify what you’ve discovered about budgeting.

These are all of the conditions I take into account after I log into CBB each day.

What is going to I write about that may share our experiences and subjects my readers need to learn?

Decreasing Grocery Costs To Enhance Gross sales

For all of the merchandise a grocery retailer sells, they make up for non-sale objects.

Consider your taxes growing after getting excited the federal government is providing you with cash.

It sounds incredible since you’re getting a cheque within the mail, however it’s by no means a freebie.

We are going to all pay for it in some type or one other, and the identical goes for groceries, though we have now choices.

Loss leaders, for instance, are merchandise that grocery shops show on the entrance of a grocery flyer or web site.

These merchandise are decreased in value to deliver prospects to the grocery retailer in hopes they’ll spend more cash.

We additionally want to contemplate these of you who dwell in a small city with one grocer and restricted transportation.

You both drive into the town or pay the upper value on the grocery retailer in your city or village.

Shopper Grocery Bills Revisited

Ideally, grocers need Canadians to decide on their retailer over the remaining to construct a strong buyer base.

Properly, I’m certain many struggling Canadians will flock to the cheapest grocery stores in Canada.

Nevertheless, even the most expensive Canadian grocery stores should promote higher gross sales.

It’s value including the Flipp App to your cell phone to compare prices in your favorite merchandise.

Given the worth enhance, it wouldn’t shock me to see Canadian shoppers go from retailer to retailer.

Battle The Inflation Fee With out Losing Time

It’s exhausting to be optimistic, however we should work with what we have now out there now.

Cease losing time complaining about it as a result of there’s not a lot we are able to do what’s already performed.

For some, which may imply a budget reassessment and eliminating unaffordable bills.

A lot of these bills are typical “needs.”

General, I hope you discover the grocery information I’ve written about over the previous ten years a option to encourage your decision-making course of.

Dialogue: What ideas are you able to share for Canadians fighting elevated meals costs?

Please share your feedback beneath for everybody.

Now, on to our June 2022 Funds Replace.

CBB Household Funds Report

June 2022 Funds Abstract

Virtually all the pieces in our June price range that spiked was resulting from rising prices.

Our largest hit class was groceries; though we did store at Costco, I stocked up in our defence.

The less instances I have to buy groceries at Costco, the higher.

To call a number of bills, I needed to refill objects akin to pet meals, chicken seed, and gardening provides.

The costliest bills went to our grasp rest room renovations. We plan to purchase higher high quality merchandise, so we don’t must cope with issues for a few years.

Summer season clothes was one other price range class that was excessive in June.

We purchased garments for summer time and did some back-to-school buying.

We additionally each wanted a pedicure whereas we have been on the mall.

We did, and caring for your ft is crucial to keep away from issues.

As we age, we discover that we’re not devoting sufficient time to self-care, though we plan to vary that.

I seen we didn’t have the price range, so issues fell by the waist.

Each Mrs. CBB and I struggled with dry ft and to no avail so we booked a pedicure.

I’m glad to say we solely go yearly, however it has change into important for us to stroll fortunately.

Lastly, our son is being checked out by our eye physician with a complete eye examination not coated by advantages or the Ontario Health and Insurance Plan (OHIP).

I’m certain as soon as we get monetary assist for his Autism, we are able to use the cash to pay for such companies.

His eyes have modified since we final had them performed in senior kindergarten, so there might be a change in prescription.

Mr. CBB

Funds Bills Percentages

It was good to see our financial savings ratio rise because it was beginning to get iffy however anticipated this time of yr.

Month-to-month House Funds Breakdown

Under is a breakdown of our bills which helps us perceive the place our cash goes.

- Chequing– That is the checking account from which we pay our family payments. We use Simplii Financial, TD Canada Belief, and Tangerine Bank. Join Simplii Financial today! Learn extra about the very best Canadian online virtual banks.

- Emergency Savings Account– This cash is in a laughable high-interest financial savings account.

- Common Financial savings Account– This financial savings account holds our projected expenses.

- Month-to-month Budgeted Complete: $6564.18

- Monthly Internet Revenue Complete: $11,667.97

- (Try the Ultimate Grocery Guide to see the place our grocery cash goes)

- Projected Expenses: These are bills we all know we pays for all year long = $905.00

- Complete Bills Paid Out: $8,006.27

- Complete Bills Paid Out: Calculated is $11,667.97 (whole internet month-to-month earnings) – $905.00 (projected bills) – $2,756.70 (Financial savings to emergency fund) = $8006.27

- Precise Money Financial savings going into Emergency Financial savings: Calculated is $11,667.97 (whole month-to-month internet earnings) – $8006.27(precise bills paid out for the month) – $905.00 projected bills) = $2756.70

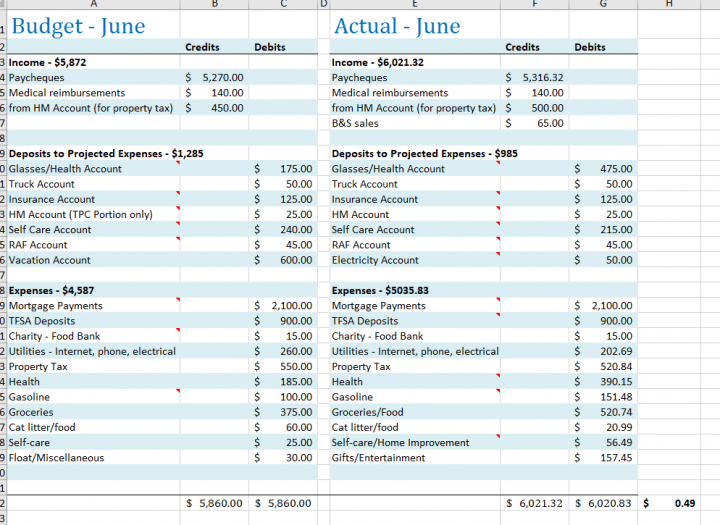

Estimated Funds and Precise Funds

Under, you will note two tables: Our month-to-month and precise budgets.

Our month-to-month price range represents two adults and a 7-year-old boy.

Funds Color Key: It’s a projected expense if highlighted in blue.

Since Might 2014, we’ve been mortgage-free, redirecting our cash into investments and renovations.

Spending lower than we earn and budgeting has been the best option to pay off our debt and save money.

Month-to-month Funds Quantities June 2022

Precise Month-to-month Funds June 2022

One other month underneath our belt for 2022, however I’ll be again in August to share our July Funds Replace.

Maintain studying beneath to see how our 2022 Funds Challengers are doing with their month-to-month price range report.

Thanks for studying,

Mr.CBB

Month-to-month Funds Problem 2022

Welcome to the 2022 Funds Reviews from our 2022 price range problem.

Over the previous two years, this problem began with many optimistic CBB readers who wished to hitch.

For 2022 we started with six folks prepared to vary their lives by difficult how they handle a price range.

Every price range abstract will at all times fall underneath the identical Funds Challenger quantity beneath.

If you happen to plan to depart feedback about one of many budgets beneath, at all times use the price range challenger quantity, in order that they understand it’s for them.

Funds Challenger #1

Hello. June was busy.

I labored, exercised and simply bought exterior to get stuff performed round the home.

Though I couldn’t get any extra time at work, I misplaced eight kilos which is at all times a nice shock.

In June, I additionally held a yard sale efficiently and made 100 {dollars} which got here in useful.

My son paid me 80 {dollars} which went proper into my checking account.

No, sarcan this month as a result of the bag isn’t full.

I acquired a Caddle app cheque for twenty-four {dollars} which was a nice shock.

I’m budgeting $100 month-to-month for the subsequent ten months to repay $1000 of owed earnings tax.

I’m attempting to not use the ac or wastewater if I don’t must so we are able to lower your expenses.

Shifting ahead, I not have overdraft safety with my checking account. I plan to make sure I’ve sufficient funds within the account always.

I don’t have any birthday financial savings as a result of I’ve somewhat stockpile.

After some consideration, I cancelled Netflix and TSN as they’re unaffordable for us. Nevertheless, I’ll get Crave which is 16 {dollars} monthly.

I plan to have one other yard sale at my buddy’s home in July.

I’m wanting into free issues to do across the metropolis.

My checkout 51 app is nearly 100 {dollars}, and I plan to money out in July.

I might be getting the carbon tax rebate in July.

I may also take some good previous garments to a consignment store.

Thanks.

Hey,

Do I’ve to ask why your cellphone invoice is so excessive?

Who’s your supplier, and the way your month-to-month expense covers many cell telephones?

We don’t have Netflix however pay for Prime on Amazon and watch what films they provide.

Our cable was cancelled over a yr in the past, as was our house telephone. One of the best choice we made was to chop down our bills.

A buddy of ours has a marriage gown that she had cleaned and boxed and requested us one of the best ways to promote it. I don’t know a lot about consignment shops, so it’s definitely a subject I’d make investments my time in studying.

Good Luck in July, and we are going to chat then.

Mr. CBB

Funds Challenger #3

Hello Mr. CBB,

Now that we have now had a superb six months of monitoring, there may be one factor we wished to regulate in our price range.

Beginning in July, we are going to embody the rents from the earlier month in order that we all know what quantities minus the payments are remaining in a extra well timed method.

We famous no rental earnings for June, which makes us brief -104.73 in June.

We selected this month to start out because it was a 3 paycheck month for me, plus some RRSP contributions from previous years have been reassessed, giving us a number of extra {dollars} to work with.

That approach, our account stays balanced primarily.

We misplaced a renter from our items however may have a brand new one by July 1.

And the advert for our present home, a bachelor unit, was posted on the College web site, and we hope to have a pupil there by September.

As everybody has felt, gasoline costs took an enormous chunk of the price range this month, from a tenting journey, two highway journeys and the common driving performed within the month, ouch!

We might be heading out on one other trip shortly, so I’m sending this a number of days early.

I should end including in the previous few days after we return.

Hey,

No downside; you may add after you get again when you’d like. Did you discover it exhausting to discover a renter?

Are you able to enhance the hire as soon as somebody leaves? I don’t know a lot about being a landlord in Canada.

I do know what you imply about gasoline; occurring highway journeys is dear for everybody. We are going to keep near house this summer time after I’m performed with the lavatory.

Once I learn that you just discovered one thing from monitoring your cash, it made me smile.

Doing so will at all times provide you with an even bigger image of what’s occurring as an alternative of not figuring out.

Congratulations on that, and I hope your new turnaround for the price range is profitable for you.

See you in July.

Mr. CBB

Funds Challenger #4

Howdy, CBB!

June threw me a little bit of a loop with off-the-charts meals spending, sudden well being bills, and a present request for household.

Let’s begin with meals – groceries are getting dearer, I used to be low on staples that wanted stocking up, and I ate extra junk meals than I wanted.

On Canada Day, a part of the freeway between BC and the Yukon washed out, so getting groceries right here might be difficult. I anticipate July’s grocery spending might be even worse.

Well being-wise, I needed to pay for a CT scan of my jaw in preparation for hopefully getting a dental implant within the fall.

I’m making an attempt to see if that may be coated underneath my insurance coverage by way of work – X-rays are, however I’m unsure about CT scans.

Lastly, my sister requested if I may make a rainbow quilt for my niece, who’s transitioning out of her crib right into a Massive Woman Mattress.

How may I say no? I didn’t have sufficient material in my stash, so I spent some cash that I had supposed to go to my trip account.

I’m horrible at remembering Christmas and birthdays, so bringing a present on my journey this summer time ought to redeem me a bit J

July is the Uber Frugal Month Problem with The Frugalwoods, which is at all times enjoyable.

I’ll see you all in a month.

Properly performed together with your June price range. The place will that $0.49 go? I seen that you’ve a self-care class, and I’d love to listen to extra about that when you can electronic mail me.

In case you are a CBB reader and price range for self-care, I’d additionally like to listen to from you.

Mr.CBB

Funds Challenger #5

So I seem like locked out of my bank card data on-line – is that Rogers factor not fastened but?

It makes it exhausting to discuss my funds with out appropriate data in entrance of me, however I’ll do my greatest. I used to be somewhat unfastened with cash, not on goal, however issues have been tough this month.

As we approached my fortieth bday, we have been going to take a brief trip; effectively, my father-in-law had a stroke after which had a second a number of days later.

We have been in one other province, so we rushed house. Every little thing that occurred that week was performed with money, and I didn’t observe my cash as I often do.

It helped to indicate how a lot financial savings are wanted. We didn’t have to consider something; it was merely charging it or taking it out of money we had put apart for firewood deliveries.

Once more, with out seeing my funds, I’m going off reminiscence. Every little thing stayed the identical apart from consuming out and gasoline cash.

These have been barely increased as we have been on trip for a number of days and travelling to the hospital. Though my mother gave me birthday cash, so it most likely equals out.

Fuel being up in value is hurting with how a lot journey I’ve to do, however I’m fortunate that some days I journey for work.

I get journey cash, which helps, and my automotive is gas environment friendly one other bonus.

Sadly, I’m sorry that Air Miles has ended at many retailers. I often make between $100 to $250 a yr in Air Miles.

Though this isn’t quite a bit for some individuals who do collector playing cards, I don’t do something additional to earn it, so it’s a pleasant bonus.

I hope to get a greater concept of how Scene and the PC Optimum work, after which we’ll see what occurs.

The excellent news is that I nonetheless have $400 in money miles to spend.

At present, I’m attempting to determine if I ought to maintain on to it for the one retailer that appears to be persevering with to make use of it or use it to money out at shops I desire now.

Ugh, I’m not too keen on change.

That’s my replace for this month; hopefully, Roger’s is up and working once more quickly so we are able to all do our banking like regular!

Hey,

Thanks for sharing this with us, and it’s straightforward to see how necessary it’s to have emergency financial savings.

I’m sorry to listen to about your FIL, and I hope he’s recovering. It’s by no means straightforward, and I take into consideration the day I have to make the journey again house.

We use Air Miles and PC Optimum, and I’d assist PC Optimum as it’s a incredible program.

I had no concept in regards to the Air Miles, so I’ll must look into that. Ours are transferred to Trip Miles or one thing to that impact.

We by no means put a lot effort into this system, however I used to be at all times intrigued by how a CBB would money in on her Air Miles rewards.

Right here’s a publish in regards to the PC Optimum program I wrote; nevertheless, we’re over 6.5 million factors in and unsure the place to spend it but.

I hope you will have a greater July.

Mr. CBB

Funds Challenger #6

Hey everybody,

So issues are somewhat bit loopy right here this yr. It will have been fairly easy if I had performed this final yr. However this yr poses issues.

- Separated from January till June

- Surgical procedure on my ankle on Might 25

My partner and I now have separate financial institution accounts from the separation.

The cash I loaned to my youngest son final yr for his enterprise has issues, and we should go after the corporate he tried to purchase tools off of—so legal professionals’ charges will now be paid out.

All this makes budgeting advanced and dwelling tough. I’m on sick advantages and solely get the cap portion of assist, not even 60% of my earnings (due to the federal government).

My plan when my partner got here again was to maintain dwelling on my earnings, however every of us paying into financial savings weekly that will equal his earnings–then these financial savings would lastly repay our mortgage in 4 years.

With me being on sick advantages, dwelling could be very tight, and that plan is on maintain. I is probably not going again to work till September.

Lengthy story brief with my son: he paid simply over $100,000 for tools from an organization in Montreal.

He by no means acquired it, so now we have now to undergo legal professionals to attempt to get it again if the corporate doesn’t go bankrupt.

We deliberate to make use of that cash which might have paid off our mortgage.

Within the meantime, we paid some hefty lawyer charges to get issues rolling.

Now with the separate financial institution accounts, my hubby isn’t a finance man and doesn’t see the issue that I can not see what we spend.

If this doesn’t get remedied, I could must drop out of this contest since I can’t ensure all the pieces is correct.

Loads is happening right here! I’ve dipped into our emergency fund to repay bank cards and different financial savings for lawyer charges.

So it does pay to place cash into financial savings which I’m nonetheless attempting to do.

I acquired annual trip pay finish of June, however that may pay for the charges for the leased land we have now a trailer on in Haliburton Forest.

We simply bought the trailer fall of 2020, so I hope we are able to keep this.

Hopefully, issues will enhance subsequent month!

Hello,

Wow, you will have a lot in your plate proper now, and I’m sorry you’re going by way of this.

If it’s a must to drop out, be at liberty to; nevertheless, writing about it could provide you with an outlet and maybe optimism.

In powerful instances generally it’s good to have folks hearken to your story with out figuring out who you might be.

My solely suggestions is that all the pieces will fall into place because it ought to.

With the $100,000 cost for the tools, did he get a receipt?

Take excellent care, and you’ll at all times message me privately.

Mr. CBB

Subscribe To the Canadian Funds Binder

Subscribe To the Canadian Funds Binder And Get My Unique CBB Emergency Binder FREE!

Have a superb price range month, everybody.

[ad_2]

Source link