[ad_1]

9.1% – That’s the present common inflation fee within the US as of June 2022. It signifies how way more costly commodities at the moment are, on common, in contrast with 12 months in the past.

Power and meals costs particularly are rising quickly. In line with the Consumer Price Index, groceries account for 10.4 %, and vitality for as a lot as 32.9 % of inflation.

Nonetheless, these knowledge are primarily based solely on the inflation fee of an common American. That doesn’t imply that your private inflation is equally excessive. Quite the opposite, inflation fee strongly will depend on your way of life and spending habits.

For instance, in the event you don’t have a automobile, you don’t spend cash on gas and car upkeep. Due to this fact, your “private” transportation inflation index might be decrease than the common particular person.

So what’s your private inflation fee? Get an concept with our pattern calculations. We’ve calculated the inflation index of three people primarily based on their vitality consumption, vehicles and journey, weight-reduction plan, meals, and childcare, and subtracted it from their revenue.

Spending habits decide your “Private Inflation Index”

Allow us to introduce you to Mary, Javier and Robert. These three pattern people will assist to point out completely different existence and their affect on private inflation indices.

You’ll see beneath that every one among them spends completely different quantities of cash on completely different items. These embrace meat, gas and journey, for instance. Those that spend so much on these classes are experiencing stronger inflation than the others.

Our calculations bear in mind their fee of inflation, relying on how a lot roughly they spend on numerous items than the common American.

Meet Mary

Mary is 44 years outdated, lives in San Francisco, California, and has a internet revenue of $152,827. With this wage, she belongs to the higher center class in America. This permits her quite a lot of flexibility in her purchases, as she has sufficient cash to purchase costly items that aren’t so affected by inflation.

You’ll be able to see this in her selection of automobile. Since she drives an electrical automobile, she doesn’t need to spend cash on gasoline, which is at present exorbitantly costly.

Additionally, the share of her revenue that she spends on different every day requirements, comparable to pure fuel and groceries, is just not as excessive relative to her complete revenue as it’s for low-income earners. Thus, she spends solely a small portion of her cash on at present costly items.

Plus, she’s capable of preserve her degree of consumption by drawing on her financial savings.

When calculating her private inflation index, we primarily thought-about her investments, comparable to (new and used) vehicles, and her spending on gas, journey, groceries, heating, restaurant meals, and baby care, as these are the classes which have the best influence on the inflation fee.

As a benchmark, we now have taken the inflation fee of April 2022, which was 8.5% at the moment. As a knowledge foundation, we used the inflation calculator of the New York Times.

| Mary | |

| Age | 44 |

| Residence | San Francisco, California |

| Internet Earnings | $152,827 |

| Automobile Purchases Final Yr | 1 (Electrical Car) |

| Miles Per Week | 120 Miles |

| Journey | 3 Journeys a Yr |

| Eating regimen | Vegan |

| Heating | Pure Gasoline |

| Consuming out | 5x a Week |

| Little one Care | Non-public college (1 baby) |

Now the query is, to what extent does inflation cut back Mary’s disposable revenue? Does she expertise a better or decrease fee of inflation than the common American?

Common Inflation: 8.50%

| Automobile Purchases Final Yr | 8.40% |

| Miles Per Week | 7.90% |

| Journey | 9.10% |

| Eating regimen | 9% |

| Heating | 9% |

| Consuming out | 9% |

| Little one Care | 8.60% |

| Mary’s Inflation Price | 8.60% |

| Month-to-month Deduction As a consequence of Inflation | $1095 |

| Yearly Deduction | $13,143.00 |

| Obtainable Cash | $139,684 |

Excessive Earners Undergo Much less From Inflation

Automobile Purchases

The numbers could shock you at first: Mary’s buy of a brand new automobile ends in a decrease inflation fee than the common. That’s as a result of the demand for cars is greater than the supply. And a scarcity within the provide of latest autos instantly drives up demand for used vehicles, making a bottleneck that drives up costs right here, too.

Whereas the cost of a new car has risen 12.6% since final 12 months, used car and truck prices have risen 35%. In lots of instances, proudly owning a used automobile is now dearer than a brand new one of many similar mannequin. That is additionally as a result of new vehicles devour much less gas and so Mary, because the proprietor, spends lower than homeowners of older fashions.

Gasoline

Talking of gasoline. The subsequent issue that reduces Maria’s inflation fee is her mileage and gas. With 120 miles per week and an electric-powered engine, her consumption is way beneath the common. Gasoline, however, raises common inflation a lot that electrical energy as a gas can decrease your inflation fee.

Journey

What raises Mary’s fee above the nationwide common is her journey. With at the least three worldwide journeys per 12 months, she achieves 9.1% inflation. The value enhance is generally attributable to excessive demand following the 2020 and 2021 Covid measures and the present jet gas costs.

Eating regimen

Her vegan weight-reduction plan reduces Mary’s inflation fee from 9.1% to 9%, as her purely plant-based diet means she’s not affected by at present’s excessive meat, milk and egg costs. These have increased by 15% and 15% and 22.6% respectively in comparison with final 12 months, whereas common meals costs have “solely” elevated by 11%.

Heating

Heating Mary’s dwelling by pure fuel, versus oil, which is utilized in solely 6% of American houses, doesn’t change Mary’s inflation fee, as it’s consistent with the common.

Consuming Out

One fascinating issue, nevertheless, are her many restaurant visits. Opposite to expectations, these don’t enhance her inflation fee, however depart it unchanged at 9%. It’s because whereas grocery inflation is up about 12% year-over-year, restaurant value inflation is barely 6.8%.

Little one care

The final class, baby care, is one other fascinating one. As a result of though Mary has a baby attending personal college, her inflation fee drops from 9.0% to eight.6%. It’s because day care and preschool prices are up 3.6% on common over the previous 12 months. This can be a burden for a lot of households, nevertheless it’s decrease than the overall enhance, thus decreasing the speed of inflation.

- Mary’s private inflation fee is 8.6%, simply 0.1% greater than the overall common, though she has a excessive lifestyle. Like all individuals in the intervening time, her financial system suffers from value will increase, however her excessive revenue and wealth permit her to restrict her inflation fee, e.g. by shopping for an EV.

- Inflation thus reduces Mary’s annual revenue from $152,827 to $139,684. Per thirty days, she has almost $1,100 much less to spend.

Meet Javier

Javier is 35 years outdated, lives within the small city of Ann Arbor, Michigan, and has a internet revenue of $64,355. With this wage, he belongs to the center class in America. Not like Mary, Javier has much less flexibility in his funds due to his revenue and site, which provides him less room to reduce his discretionary spending when costs rise.

He has been capable of put some cash apart over the previous couple of years, which he now plans to spend on elevated heating and electrical energy prices. Nonetheless, it’s not sufficient to keep up the usual of residing he and his spouse and two young children have loved lately.

To calculate Javier’s private inflation fee, we checked out his automobile purchases, gasoline consumption, journey, weight-reduction plan, heating, restaurant visits and childcare, simply as we did for Mary.

| Javier | |

| Age | 35 |

| Residence | Ann Arbor, Michigan |

| Internet Earnings | $64,355 |

| Automobile Purchases Final Yr | 0 |

| Miles Per Week | 270 Miles |

| Journey | 1 Journey a Yr |

| Eating regimen | Not Vegetarian |

| Heating | Oil |

| Consuming out | 1x a Week |

| Little one Care | No |

With this in thoughts, to what extent does inflation of those items cut back Javier’s disposable funds? Does he expertise a better or decrease fee of inflation than the common American?

Common Inflation: 8.50%

| Automobile Purchases Final Yr | 7.60% |

| Miles Per Week | 7.70% |

| Journey | 7.90% |

| Eating regimen | 7.90% |

| Heating | 10.70% |

| Consuming out | 10.70% |

| Little one Care | 10.80% |

| Javier’s Inflation Price | 10.80% |

| Month-to-month Deduction As a consequence of Inflation | $579 |

| Yearly Deduction | $6,950 |

| Obtainable Cash | $57,405 |

Rising Costs of Requirements Hit the Center Class Hardest

Automobile Purchases

Taking a look at classes comparable to automobile purchases or journey, Javier’s inflation fee seems comparatively low at first look. Since he didn’t purchase a brand new (or used) automobile final 12 months, he can reduce his inflation fee by nearly one proportion level, to 7.6%, in comparison with the common.

Gasoline

Javier’s bills are nonetheless very excessive. Though he hasn’t purchased a automobile within the final 12 months, he drives lengthy distances daily in an older car as a result of public transportation isn’t accessible in his area. Given the various miles he drives and the excessive gas consumption of his outdated automobile, his inflation rises to 7.7%.

Journey

However that’s not all. His trip at Lake Michigan, to which he and his household journey by automobile, causes his inflation fee to rise from 7.7% to 7.9% – primarily as a result of the price of gasoline is so excessive.

Eating regimen

His fee stays at 7.9% whenever you think about his non-vegetarian weight-reduction plan.

Heating

His inflation is skyrocketing in one more class: heating his dwelling with heating oil. As heating oil has elevated by 2.5 instances within the final 12 years, households like Javier’s spend a big portion of their revenue on heating their houses. Though the price of heating oil fell by one dollar per gallon from $4.4 to $3.4 between June and July 2022, specialists predict that costs will rise once more, particularly within the fall and winter.

Consuming Out

Additionally, the costs of on a regular basis meals gadgets comparable to meat, dairy and eggs, which Javier consumes at dwelling, have elevated a lot in current months (from 3.7% in August 2021 to 10.4% in June 2022) that they depart his inflation fee at its 10.7% excessive.

Little one Care

The class of kid care will increase his last inflation fee by one other proportion level. It’s because, as described in Mary’s instance, baby care amenities expertise a decrease inflation fee than the common 8.5%. Youngsters like Javi’s who attend a state establishment face common inflation and subsequently can’t decrease his fee.

- With a private inflation fee of 10.8%, Javi has nearly $7,000 much less in his pockets in a single 12 months. His month-to-month revenue drops by $579 and the annual disposable funds to $57,405.

- Javier is thus a very good instance of how a comparatively low revenue can restrict flexibility and contribute to excessive private inflation.

Meet Robert

Final however not least, we’d prefer to introduce you to Robert. He’s 27 years outdated, lives in New York Metropolis and has an annual wage of $33,048. This locations him on the decrease finish of the decrease center class in the USA.

Though Robert doesn’t reside an costly way of life and has at all times been frugal, present inflation is severely affecting him. This is because of his comparatively low wage, which makes it troublesome for him to cowl his rising mounted prices.

It’s Costly to Be Poor

Economists imagine that that is primarily attributable to the truth that decrease revenue teams need to spend more cash on meals and vitality in relation to their general revenue. They spend comparatively a lot on exactly these items which have change into much more costly in current months. If disposable revenue doesn’t develop together with it, there may be much less and fewer left to avoid wasting.

However how does Robert’s inflation fee examine to Mary and Javier, and to the remainder of the American inhabitants? Let’s take a better take a look at Robert’s spending.

| Robert | |

| Age | 27 |

| Residence | New York Metropolis, New York |

| Internet Earnings | $33,048 |

| Automobile Purchases Final Yr | 0 |

| Miles Per Week | 0 |

| Journey | 1 to 2 Journeys a Yr |

| Eating regimen | Vegetarian |

| Heating | Gasoline |

| Consuming out | As soon as in Two Weeks |

| Little one Care | No |

Robert additionally faces the query of how a lot inflation will shrink his disposable cash and the way a lot can be left of his wage. Does he expertise a better or decrease fee of inflation than the common American?

Common Inflation: 8.50%

| Automobile Purchases Final Yr | 7.60% |

| Miles Per Week | 6.00% |

| Journey | 6.20% |

| Eating regimen | 6.10% |

| Heating | 6.00% |

| Consuming out | 6.00% |

| Little one Care | 6.10% |

| Robert’s Inflation Price | 6.10% |

| Month-to-month deduction attributable to inflation | $168 |

| Yearly Deduction | $2,016 |

| Obtainable Cash | $31,032 |

Robert’s private inflation fee is 6.1%, greater than 2% beneath common. This will not sound like a lot at first look, nevertheless it’s nonetheless a major reduce in Robert’s funds. However first, let’s perceive the extent of his inflation fee.

Automobile Purchases and Gasoline

Since Robert didn’t purchase a automobile final 12 months and doesn’t personal one, he reduces his fee from the common 8.5% to six%. It’s because he doesn’t need to pay exorbitant fuel costs which might be hitting the remainder of the inhabitants arduous in the intervening time.

Nonetheless, he spends fairly a bit of cash on public transportation in New York, which has additionally change into dearer in current months.

Journey

Nonetheless, his travels enhance his fee to six.2%. Nonetheless, his fee will increase to six.2% attributable to his travels. He travels primarily by airplane or rental automobile, for which he has to pay not directly for jet gas and gasoline.

Eating regimen

His avoidance of meat and choice for tofu and greens nonetheless helps preserve his fee down.

Heating, Consuming Out and Little one Care

The remainder of his way of life helps stabilize this 6%, as he heats his small house with fuel, eats out as soon as in two weeks, and has no youngsters to pay for childcare for.

- His fee means a lack of $2,016, which reduces Robert’s accessible funds to $31,032 per 12 months.

Find out how to calculate your private inflation fee

We hope our examples have given you an concept of how way of life and habits impacts your private inflation fee and what a distinction your revenue and belongings could make to your monetary well-being.

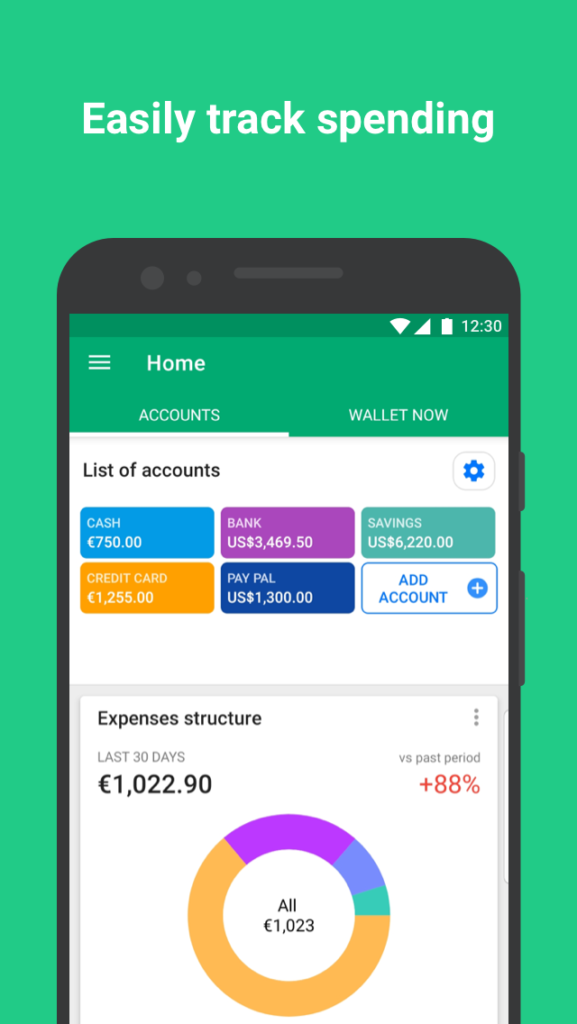

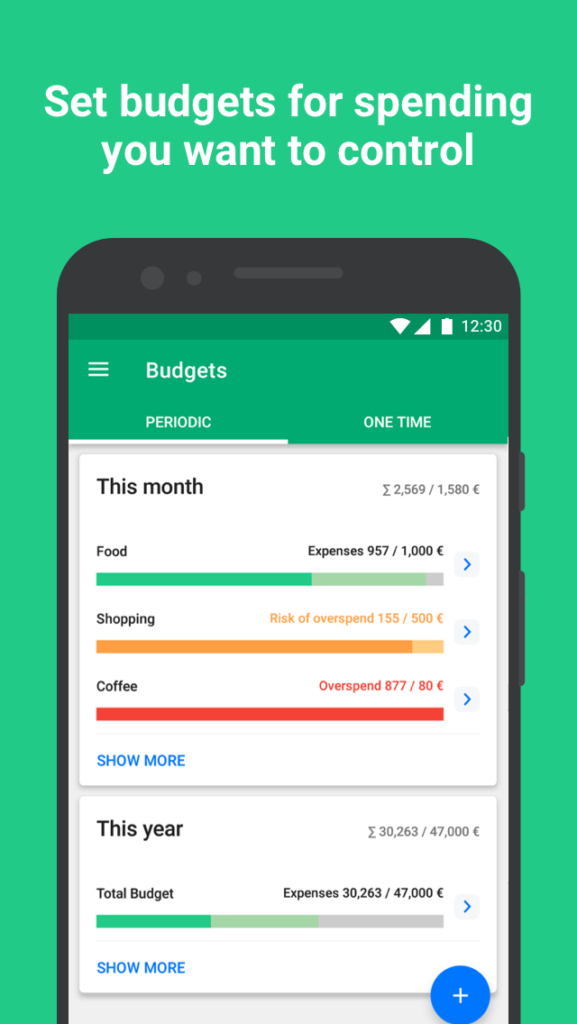

However our samples are simply examples. If you wish to calculate your individual inflation fee, you may both create a desk and listing your bills in essentially the most inflationary classes. Or you need to use a budgeting app like Wallet by BudgetBakers, which robotically exhibits you which of them classes you spend cash on and the way your spending has elevated over the previous few months.

The one factor it is advisable to do is to securely join your checking account(s) to Pockets. The app will then present you the place cash goes and the way a lot.

You must pay explicit consideration to the classes which might be at present experiencing the best value will increase. These are groceries, transportation, housing, medical care, recreation, training and communication.

Add up your expenses in these categories for the last month. Make sure that to additionally embrace any main bills you pay much less often, comparable to annual automobile and residential insurance coverage premiums, by tallying them up and dividing by 12 to get the month-to-month value.

Now subtract your complete month-to-month spending from a 12 months in the past out of your present month-to-month spending. Then divide this sum by your month-to-month bills from a 12 months in the past.

As an example, in case your spending final month was $3,000, and a 12 months in the past it was $2,800, the distinction is $300. Divide $200 by $2,700 and also you land at 0,074 which suggests a fee of seven.4%.

This fee is admittedly not very correct, because it assumes that you simply purchased precisely the identical quantity of products final 12 months as you probably did this month. Nonetheless, if there have been no main adjustments in your life, comparable to a transfer, you need to use the calculated fee as a information.

To study extra about inflation from our monetary specialists, learn our article on what inflation is and what you can do to protect yourself from it, and take a look at our picks for learning about inflation.

[ad_2]

Source link