[ad_1]

In the event you thought the title Webull sounded acquainted, you most likely learn it in passing in 2021; within the aftermath of the Gamestop saga on Robinhood the place many US retail buyers flocked to Webull as a substitute.

The excellent news is, Webull has lastly launched in Singapore and is officially the cheapest brokerage you can use, as a result of it’s FREE^ to commerce with them. No fee charges and nil platform charges^!

The unhealthy information is, you solely get entry to the US and Hong Kong markets – for now.

Particulars under.

No commissions or platform charges^

Webull isn’t the primary low-cost, digital brokerage in Singapore.

However they’re definitely disrupting the market with their entry, since you don’t should pay something for Webull’s companies. No fee charges, and no platform charges both^.

If you’re looking for the cheapest broker to buy US shares / US options / HK stocks in Singapore, there’s no competitors for now – Webull wins, arms down.

In fact, the rationale why I can’t say it’s fully free is as a result of the standard charges which are payable to regulatory authorities and clearing homes apply – these are fairly normal throughout each dealer you utilize, so there’s no escaping that. Even when you use one other dealer, you’ll nonetheless be incurring these sort of charges.

Most of the different platforms have since moved to providing zero commissions on US shares, however their platform charges stay. Webull, however, costs nothing for his or her platform, and has prolonged the zero commissions for not simply US shares, but in addition US choices and ETFs as nicely^!

Key Advantages

Except for being the cheapest brokerage at the moment, there are additionally different options to love:

- Straightforward and intuitive person interface

- Fractional shares for many US shares and ETFs – from as little as US$5

- Inventory screener – filter primarily based on monetary metrics reminiscent of PE ratios or EPS to get inventory concepts

- Technical charting instruments – the app provides you 17-line chart choices and 60 technical indicators so that you’ll be spoilt for selection.

- Get real-time quotes with entry* to NASDAQ TotalView and NBBO quotes, and OPRA information subscription

- Aggressive international foreign money conversion charges – solely a small unfold over the Interbank fee

- Quick deposits – by way of digital DDA (nearly immediate), FAST or telegraphic transfers. (Tip: go for eDDA or FAST as a substitute, and keep away from TTs which comes with financial institution costs)

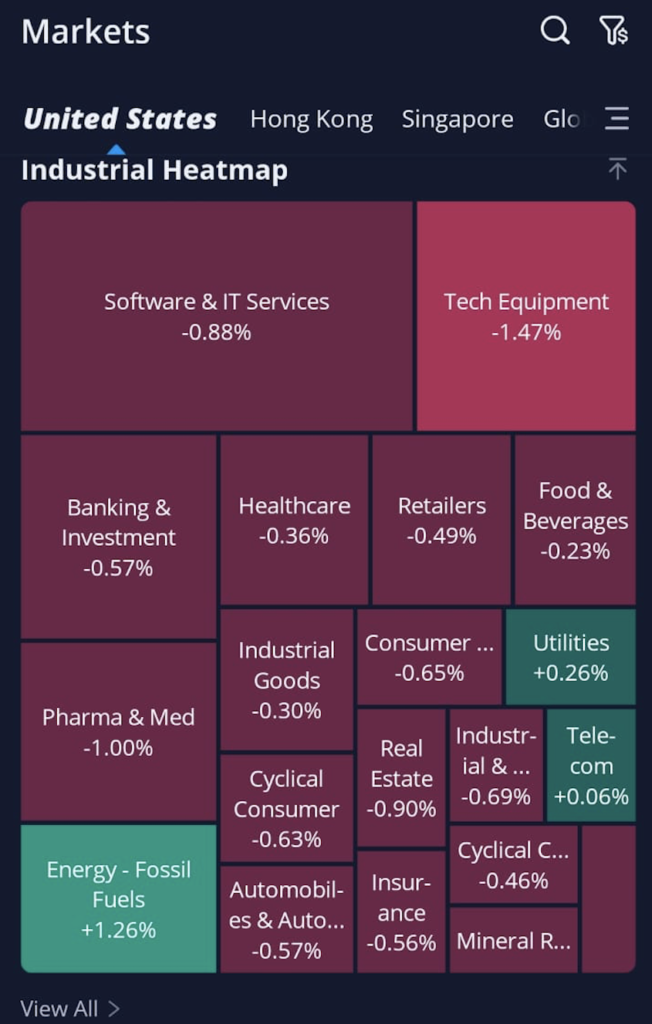

I fairly just like the Business Heatmap, which offers me with a simple overview to get a way of which sectors may be overbought or oversold in the mean time. One other characteristic that a few of you who’re extra into index investing could like could be the In style ETFs web page, which may give you concepts on extra ETFs to discover on your personal portfolio.

Don’t simply take my phrase for it, download to try it out for yourself and see how straightforward it’s to navigate the app!

And in relation to withdrawals, pay attention to the dealing with charge; that is S$20 and charged by the remitting financial institution (not Webull).

*Complimentary entry to Degree 2 US market information (NASDAQ TotalView) for the primary month. Complimentary real-time information subscription to Choices Worth Reporting Authority (OPRA) for 1 month, which may be prolonged for an infinite variety of instances so long as you execute 1 choices commerce each 30 calendar days.

Most cost-effective for US / HK markets

In the event you’re primarily based in Singapore, Webull is undisputedly the cheapest brokerage you can find when you’re investing or buying and selling within the US or Hong Kong markets.

It doesn’t make a lot sense to make use of the native brokers for abroad shares, due to the hefty custodian charges (often $2 per counter monthly!) and dividend dealing with charges that they cost. As a newbie, these charges can add up actual fast and restrict the strikes / shareholdings you may make! That’s why for abroad markets, I like to recommend going with a low-cost digital brokerage as a substitute.

You should purchase or promote any US inventory, possibility or ETF on Webull with zero fee or platform charges^. For Hong Kong, that is restricted to shares and ETFs solely.

Sadly, Webull at the moment doesn’t have entry to SGX shares, so I like to recommend that you just pair it with one other brokerage that may give you low-cost entry.

For these of you adamant about proudly owning your SGX shares as a substitute of getting it in custody, I like to recommend DBS Vickers (Money Upfront) for its low $10 charges.

Any downsides?

For inexperienced persons, I do suppose you guys ought to undoubtedly think about using Webull as a result of:

- The interface is tremendous intuitive and straightforward to navigate, making it much less probably so that you can by chance make errors.

- Its fractional shares characteristic will assist you to construct your portfolio throughout a number of US shares and ETFs, even when you have a smaller beginning capital.

- The charges are

tremendous lowthe most affordable.

Having mentioned that, when you’re a seasoned investor who’s gotten used to buying and selling on desktop, then Webull may not be as interesting to you as they solely have a cell app for now.

For buyers who need entry to a number of markets inside a single dealer, word that Webull solely has the US and HK markets for now. This will likely change sooner or later as they develop, although.

Is Webull protected to make use of?

In the event you have been questioning, Webull Securities (Singapore) Pte. Ltd. is regulated by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Companies (CMS) Licence to function right here.

When it comes to its background, Webull was based by ex-Alibaba worker Wang Anquan, and its mum or dad firm is Fumi Know-how – a Chinese language holding firm with monetary backing from Xiaomi, Shunwei Capital, and different personal fairness buyers in China.

Their global Twitter account has over 117k followers, and so they’re fairly mainstream / common within the US amongst retail buyers. So whereas they could be pretty new to the Singapore market, they’re undoubtedly not a beginner within the international scene in any respect.

When it comes to your belongings, they’re held in custody and any monies that you just deposit with Webull are held in belief. These are the necessities as a MAS licensed custodian, and Webull is required to adjust to the Securities and Futures Act and all subsidiary legislations. Within the US, Webull has additionally constructed a robust and safe title for itself as it is usually regulated by the SEC and is a member of the Securities Investor Safety Company (SIPC), so I reckon there’s little incentive for them to jeopardize their enterprise in any means.

And for these of you who’re tremendous fearful, even within the uncommon occasion of insolvency, liquidators may have no declare to your belongings held by Webull. You’ll be able to learn extra about these rules binding Webull here.

Personally, all my Singapore shares undergo the native (financial institution) brokers and are owned immediately in my CDP account, whereas I exploit a mixture of low-cost brokers for my US and HK trades.

Now that Webull is offering FREE trades for US stocks, options and ETFs as well as HK stocks and ETFs^, I’ll be utilizing them as nicely.

Welcome Supply

As a part of their sign-up provide, now you can get up to USD 100 worth of TSLA fractional shares while you register and commerce with Webull^.

Notice: The welcome affords change periodically, so make sure you verify this page for his or her newest promotion earlier than you join.

In brief, I do suppose it’s price signing up with Webull, particularly given the way you get charged the bottom charges on your trades on the US and HK market.

Eager to get began?

Sign up for an account here today.

Disclosure: I’ve included my own affiliate links within the article. This text is written in collaboration with the Webull Singapore workforce, particularly for fact-checking! All opinions are impartial and that of my very own.

^Phrases and Situations Apply. Please discuss with https://www.Webull.com.sg/ for extra info.

[ad_2]

Source link