[ad_1]

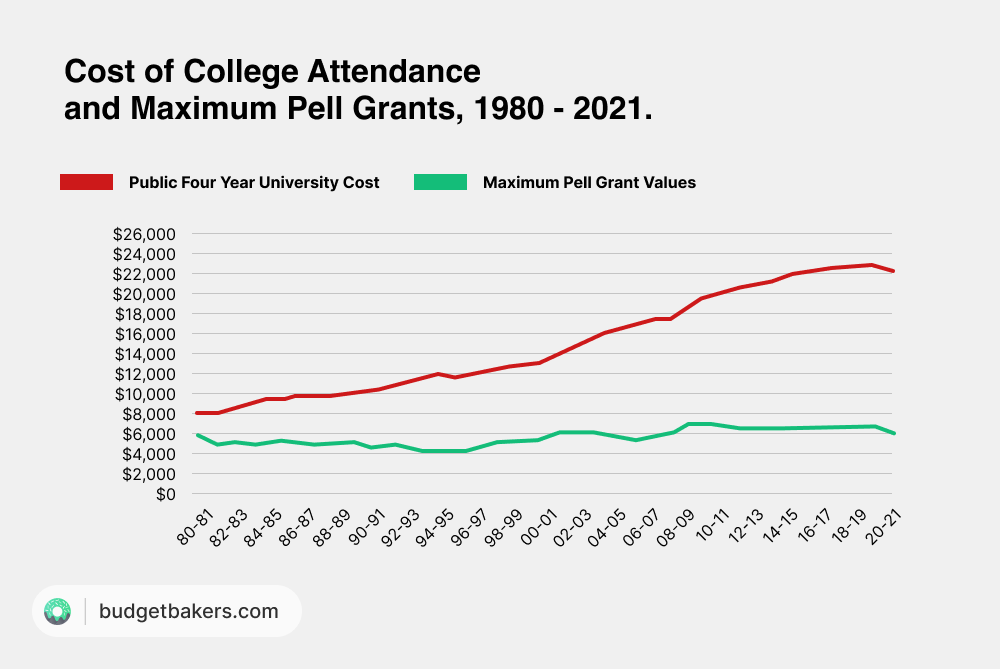

“The burden is so heavy that even if you happen to graduate, chances are you’ll not have entry to the middle-class life that the faculty diploma as soon as offered.” This assertion is from President Joe Biden on August 25, 2022, the day of the discharge of one of the vital payments of his time period: the Pupil Debt Aid Plan. An extended-awaited invoice that gives partial forgiveness of exorbitant mortgage debt that has skyrocketed for many years. It’s a response to the longstanding failure to extend state assist by Pell Grants.

College students within the U.S. depart school or college with a considerable amount of debt. For bachelor’s diploma holders, debt of at the least $25,000 is typical. Those that go on to earn a better diploma usually have tens of hundreds of {dollars} extra in debt.

To know the magnitude of this nationwide downside, two numbers suffice: 45 million People have scholar debt with the federal authorities, totaling $1.6 trillion. That’s about 1/10 of the earnings all People earn in a 12 months. So to pay again that quantity, we must sacrifice 10% of all residents’ earnings for a complete 12 months.

Since this isn’t an choice, the federal government has opted for a debt aid plan to lastly deal with the American scholar debt disaster. The White Home claims that just about 43 million would profit from scholar mortgage forgiveness; roughly 20 million can have their balances canceled fully.

Along with protecting his marketing campaign promise (and the upcoming midterm elections, which he hopes will appeal to younger voters specifically), Biden justifies his debt forgiveness on two grounds. He needs to alleviate school graduates of the burden of at present skyrocketing costs and provides them the freedom to make investments.

“All this implies individuals can lastly crawl out from beneath that mountain of debt, to get on high of their lease and utilities, to lastly take into consideration shopping for a house or beginning a household or beginning a enterprise,” Biden mentioned. “When this occurs, the entire financial system is best off.”

How A lot Debt Aid Are You Entitled To?

So right here it’s, the brand new Mortgage Debt Forgiveness Plan from the Biden-Harris administration. The concept is to forgive or scale back the money owed of present debt repayers.

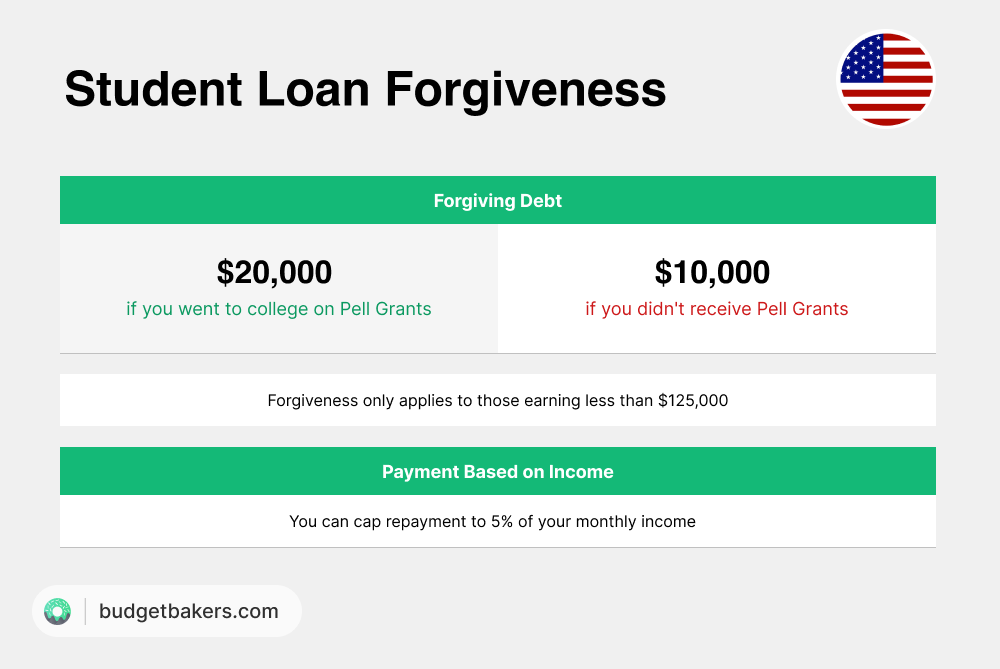

However not all college students obtain the identical forgiveness. Quite the opposite, the quantity depends upon your earnings, and whether or not or not you acquired Federal Pell Grants whereas in school.

As an instance how the scholar debt aid plan works and the way a lot forgiveness you’re personally entitled to, let’s check out 4 pattern college students. Every of them have a unique kind of mortgage and a unique earnings, which is why all of them qualify for various forgiveness – or no forgiveness in any respect.

The Low-Earnings Graduate

Let’s think about a university graduate who earned a bachelor’s diploma in 2020. Throughout her 4 years of research at a public college, she amassed $24,000 in debt. This places her consistent with the U.S. common. Amongst debtors with excellent scholar debt, the median debt amount in 2021 was between $20,000 and $24,999.

Now, two years after incomes her diploma, the younger graduate remains to be paying off her scholar mortgage debt. Below the brand new Pupil Debt Forgiveness Plan, nonetheless, she doesn’t should pay again all the quantity. We’ll clarify why.

With a gross earnings of $96,000 a 12 months, she falls into the “low-income” class, incomes not more than $125,000 a 12 months. As well as, the receipt of federal Pell Grants performs a job within the calculation of her debt forgiveness. Throughout her research, she acquired $3,980 in monetary help from the state – cash she doesn’t should pay again. Nonetheless, the cash has a optimistic influence on her present debt.

That’s as a result of beneath the brand new debt aid plan, the graduate will now obtain $20,000 in debt forgiveness. This offers her twice the debt aid in comparison with college students with out Pell Grants. The Division of Schooling explains this determination by saying that grant recipients like her “sometimes expertise more challenges repaying their debt than different debtors.” The numbers show it. Within the educational 12 months of 2020-21, round 30% of all college students that enrolled in undergraduate packages in the USA had been awarded Pell grants and practically each recipient got here from a household that made lower than $60,000 a 12 months.

Below Biden’s forgiveness plan, her debt is now $4,000, down from $24,000. Now it’s time to pay again this $4,000. On the present rate of interest of 4.99% for undergraduate college students with a 10-year mortgage time period, that’s $42 monthly. Earlier than forgiveness, it was $254.

Debt forgiveness provides the scholar huge freedom to spend her cash on different issues, akin to a grasp’s diploma. Free of the monetary burden, she will now significantly pursue a better diploma – one thing many individuals had been reluctant to do prior to now due to their loans.

| Debt to Date | Month-to-month Cost to Date | Debt After Pupil Mortgage Debt Forgiveness | Month-to-month Cost After Pupil Mortgage Debt Forgiveness |

| $24,000 | $254 | $4,000 | $42 |

The Married Graduate Couple

Let’s now check out one other kind of scholar: A married couple with a university diploma – and scholar debt. Each have grasp’s levels and $70,000 in graduate college debt every. For them, calculating their debt aid generally is a bit tougher.

Below the brand new reform, single debtors with annual earnings of lower than $125,000 are eligible for $10,000 in aid. So are married {couples} who file a joint tax return and whose mixed earnings is less than $250,000. Earnings is outlined as a borrower’s adjusted gross earnings in 2020 or 2021.

Our instance couple has two completely different incomes. One accomplice earned $150,000 in 2021, the opposite $60,000. So collectively they earned lower than the $250,000 allowed, however one partner is over the person restrict of $125,000. Does this make them eligible for debt forgiveness of $10,000, along with the lower-income partner?

The reply is sure, based on the White Home.

Nonetheless, issues look completely different with a unique earnings distribution. Let’s assume one partner earns $80,000 and the opposite earns $180,000. Their mixed earnings of $260,000 exceeds the $250,000 earnings restrict. This implies the couple shouldn’t be entitled to debt forgiveness. However does the lower-earning partner have the best to debt aid primarily based on their particular person earnings?

As of now, the reply seems to be no, tax consultants say. They declare they’re ineligible, except some new rule permits the adjusted gross earnings to be reported individually.

So for married {couples}, all of it depends upon how a lot they earn TOGETHER. Thus, the person earnings of a partner is irrelevant, whether or not it’s larger or decrease than the allowed $125,000.

What does that imply for our pattern couple? They each get $10,000 in debt forgiveness, which reduces their scholar debt from $70,000 every to $60,000 and $140,000 to $120,000, respectively. On the present rate of interest of 6.54% for graduate college students with a 10-year time period, that’s $683 monthly per individual. Earlier than forgiveness, it was $796.

Whereas this gives some aid, the majority of the debt stays. Nonetheless, debtors now have the chance to benefit from a brand new cap that permits them to repay their debt at 5% of their month-to-month earnings.

This doesn’t assist our instance couple at first look, since 5% of their mixed earnings is $875 monthly, $200 greater than they must pay and not using a cap. Nonetheless, if solely the partner with an annual earnings of $60,000, or a month-to-month earnings of $5,000, had been thought of, they might solely should pay $250 as a substitute of $683 monthly.

| Debt to Date | Month-to-month Cost to Date | Debt After Pupil Mortgage Debt Forgiveness | Month-to-month Cost After Pupil Mortgage Debt Forgiveness | Month-to-month Cost with 5% Cap for the Decrease-Earnings Partner |

| $140,000 / $70,000 | $796 / $1,592 | $140,000 / $120,000 | $683 / $1,366 | $250 |

The Dropout With out a Diploma

Roughly 39 million students never finish college. However what they’ve in frequent with graduates is in addition they take out loans throughout their research, which they should pay again. We need to take a better have a look at this case.

Let’s think about a undergraduate scholar who went to varsity from 2018 to 2020, however dropped out as a consequence of private causes. Throughout his school years, he amassed $13,000 in scholar debt. Is he entitled to debt cancellation?

Below the brand new plan, every former scholar is eligible for $10,000 in debt forgiveness, or $20,000 if receiving Pell Grants. No matter whether or not they graduated or not. This covers most or all balances of debtors and not using a diploma, who on common owe $15,000.

That is additionally true for our instance scholar. Of his $13,000 debt, $3,000 stays. At an rate of interest of 4.99 % for undergraduate college students with a 10-year time period, that’s $32 monthly. Earlier than forgiveness, it was $138.

For dropouts, receiving $10,000 not solely means larger monetary freedom, however presumably a path back to college. That’s as a result of many former college students drop out as a result of they will not afford it. They sometimes then work low-paying jobs for years and even many years to repay their debt. Those that need to proceed their research now have the chance to take action because of mortgage forgiveness.

| Debt to Date | Month-to-month Cost to Date | Debt After Pupil Mortgage Debt Forgiveness | Month-to-month Cost After Pupil Mortgage Debt Forgiveness |

| $13,000 | $138 | $3,000 | $32 |

The Non-public Mortgage Borrower

Simply as there are private and non-private universities, there are federal and personal scholar loans. Each might be obtained at private and non-private universities.

Federal scholar loans are made and funded instantly by the federal authorities. Non-public scholar loans, additionally known as non-federal or different loans, are made and funded by private lenders, akin to banks and on-line lenders. And each should be repaid. However does it make a distinction whether or not you could have a authorities mortgage or a personal mortgage relating to the lately introduced cancellation of scholar loans?

For the final time, we’re introducing an instance scholar. Let’s think about a scholar who took out a personal mortgage at a public college along with her federal mortgage. So do many debtors who’ve exhausted their choices for federal scholar loans and nonetheless want money to cover funding gaps of their training.

The younger graduate racked up over $80,000 in federal debt and $12,000 in personal debt over the course of her 7 years in school. After commencement, she began a job making $133,000 a 12 months.

Now she’s paying off her debt questioning how a lot aid she’ll get beneath Biden’s new plan. Whereas there nonetheless are some questions, there’s one factor we all know for certain: The Biden-Harris administration shouldn’t be canceling personal scholar loans.

Thus, the younger lady shouldn’t be entitled to any debt aid. Her earnings exceeds the restrict of $125,000 and personal money owed received’t be canceled. This leaves her with a $92,000 mountain of debt till there could also be a brand new plan sooner or later to remove personal scholar debt.

| Debt to Date | Remaining Debt After Pupil Mortgage Debt Plan | Month-to-month Cost |

| $92,000 | $92,000 | $1,047 |

The Backside Line

Pupil Mortgage Forgiveness is a long-overdue debt aid initiative that can lastly give college students partial aid from their monetary burdens. Hundreds of thousands of former college students will obtain as much as $20,000 in forgiveness, enabling them to make use of their hard-earned earnings to assist themselves and their households, purchase a house or begin a enterprise.

Though praised for its focusing on of low-income and middle-class people, the invoice’s critics say that some who bitterly want mortgage forgiveness received’t profit from it, or not sufficient to alleviate them from their huge monetary misery.

Furthermore, the extra cash that graduates now have at their free disposal is reigniting the inflation debate. Economists from each political camps are vital of the scholar mortgage rebate as a result of the extra buying energy it creates might fuel inflation as a consequence of bigger shopper spending. Nonetheless, based on many consultants, elevated shopper spending will improve inflation by only some base factors – they estimate a 0.1%, or one-tenth of one percent, increase in inflation.

You need to know extra about inflation and its results? Learn our article on what inflation is, what causes it and what you can do about it.

[ad_2]

Source link