[ad_1]

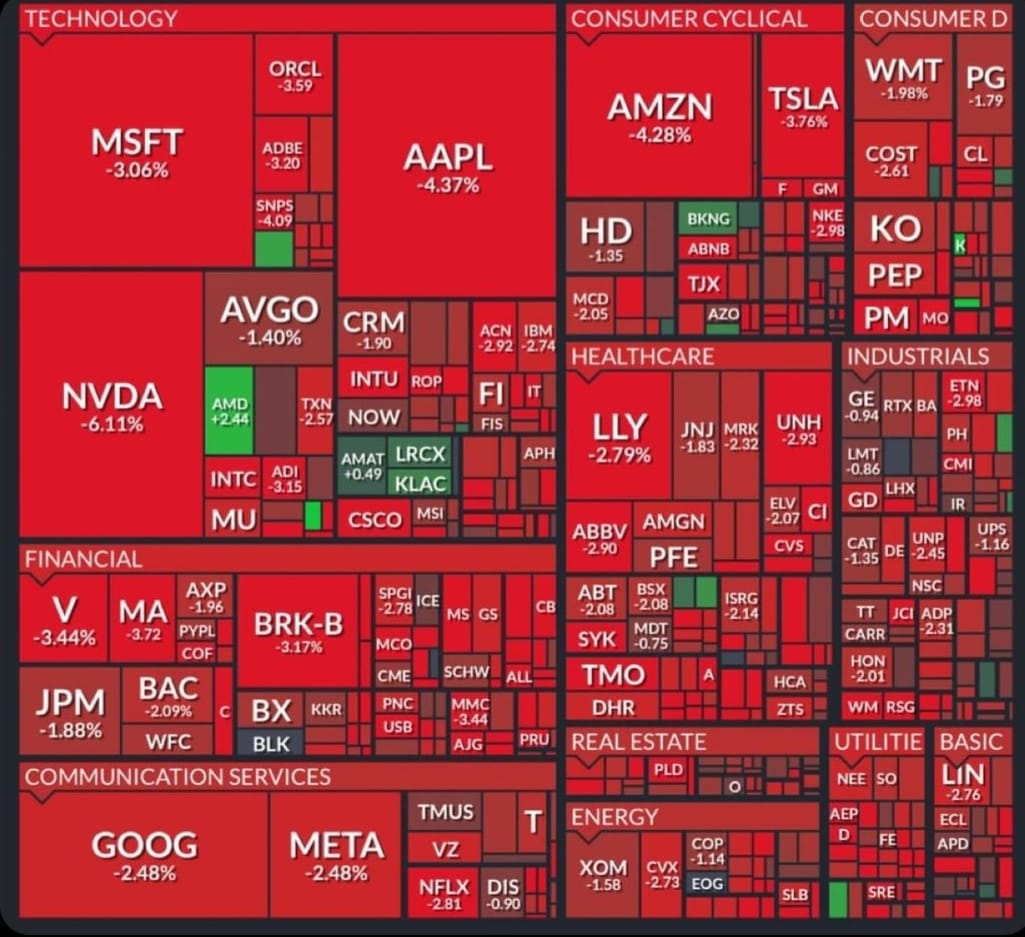

When you’ve at all times questioned why we, as customers have to leap by so many hoops simply to earn a excessive rate of interest on our financial savings, you aren’t alone. The truth is, I do know of many mates who simply let their money lie idle of their financial institution incomes a paltry 0.05% p.a. just because they are too lazy haven’t any time or can’t be bothered to do all the mandatory steps simply to get just a few hundred {dollars} extra in curiosity annually.

Whereas 2.5% to three% p.a. high-yield curiosity financial savings accounts are a fantastic transfer – and one which we customers have benefited from lately – the truth stays that NOT everybody can meet the factors wanted.

What if a financial institution may create a financial savings account possibility that can permit us to earn larger curiosity with out having to emphasize about assembly a number of situations? One which doesn’t require us to do any wage crediting, clock bank card spend, buy insurance coverage or funding merchandise that we don’t need, and many others.

What if we simply wish to deposit our financial savings and watch them develop?

It’s about time {that a} financial institution made it simpler for people to earn larger curiosity on our financial savings, and with minimal effort too.

So think about my pleasure when a reader launched me to CIMB StarSaver – one which provides larger curiosity with out you needing to leap by any of the same old hoops in at present’s market.

For these of you who discover it a problem to need to handle every of your high-yield financial savings accounts each month (simply to ensure you have met the factors for extra curiosity)…you’re gonna love this.

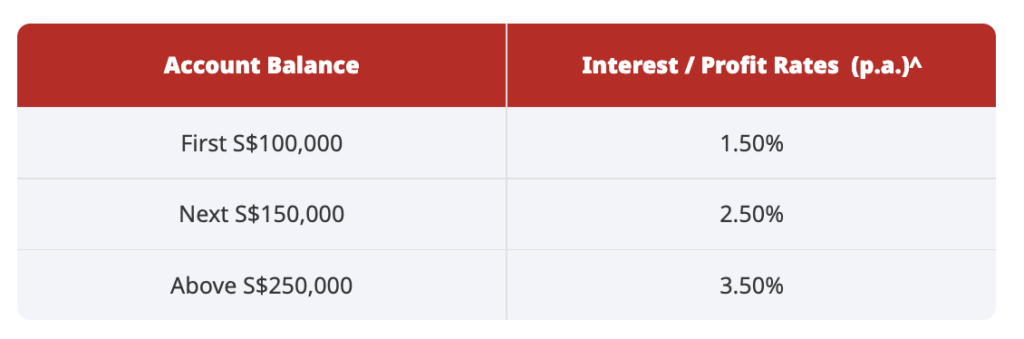

Now you can earn as much as 3.50% p.a. financial savings curiosity with CIMB StarSaver

Psst, learn on to search out out about their newest bonus 1% promotion!

Wanna know easy methods to earn a simple 1.50% to three.50% p.a rate of interest with CIMB StarSaver?

- Step 1: Open an account on-line

- Step 2: Deposit >S$1,000

And…that’s it!

I child you not.

It truly is that easy. You now not have to fret about fulfilling wage deposit / bank card spend / shopping for insurance coverage merchandise that you just aren’t actually eager on…while you open a CIMB StarSaver account.

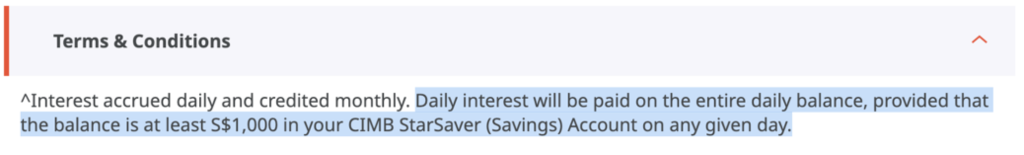

Don’t consider me? Go check out how refreshingly short and sweet their T&Cs are .

One of many solely accounts that means that you can earn curiosity past your first S$100k

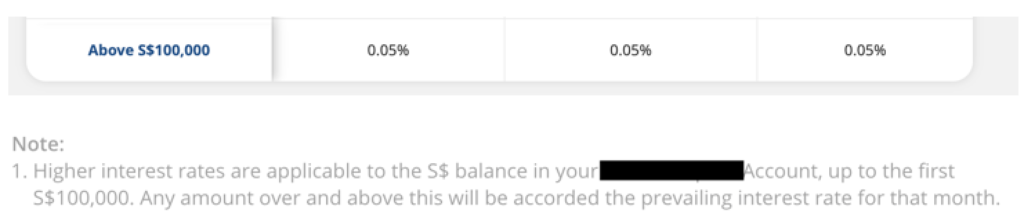

When you’ve ever questioned why most Singaporeans personal greater than 1 high-yield financial savings account, that’s as a result of sometimes, the excessive rate of interest solely applies on our first S$100,000. Right here’s a screenshot from 2 different banks:

Past your first S$100k, you earn a meagre 0.05% p.a. on the identical account. Unhappy however true.

Which is why in distinction, CIMB StarSaver is extra superior, as a result of it has no restrict on how a lot you wish to deposit to earn the complete 1.50% p.a. to three.50% p.a. rate of interest.

(The one different exception I discovered was BOC, the place you earn as much as a most of 0.60% on S$80k – S$1M while you fulfil their card spend / wage credit score / invoice cost necessities.)

P.S. If you wish to earn as much as 3% p.a. and with out locking your cash up in a hard and fast deposit or a short-term bond, learn until the tip of the article to search out out about CIMB’s bonus 1% p.a. provide.

No fall-below charges

The very last thing you’d need is to open one other financial savings account, deposit your cash, after which depart it apart with out realising the financial institution is deducting cash from it every month for numerous charges, proper?

Properly, that’s what occurred to me a number of years in the past once I opened a financial savings account particularly for my abroad alternate. I stored the remaining S$1,000 within the account and left it untouched upon my return to Singapore, however shortly after, the bank started to impose fall-below fees. As a result of I wasn’t actively monitoring the account, I used to be left in the dead of night! You’ll be able to wager that I terminated my account in a match of anger once I discovered (and after kicking myself for overlooking this within the first place), lol.

So I’m now extra appreciative of banks who do NOT cost any fall-below charges or month-to-month charges, and CIMB StarSaver will get my vote for that.

Here’s the proof, in their fees schedule here.

What if I need extra?

At this level you should be questioning, CIMB StarSaver is THAT good? What about CIMB’s different financial savings accounts then?

After all, there’s an account for each want:

Right here’s what I might recommend, primarily based in your age and life stage:

When you’re in your 30s – 50s, then CIMB StarSaver can be nice as a result of you possibly can simply earn 1.50% p.a.- 3.50% p.a., and with out having to give up your liquidity (comparable to to fastened deposits).

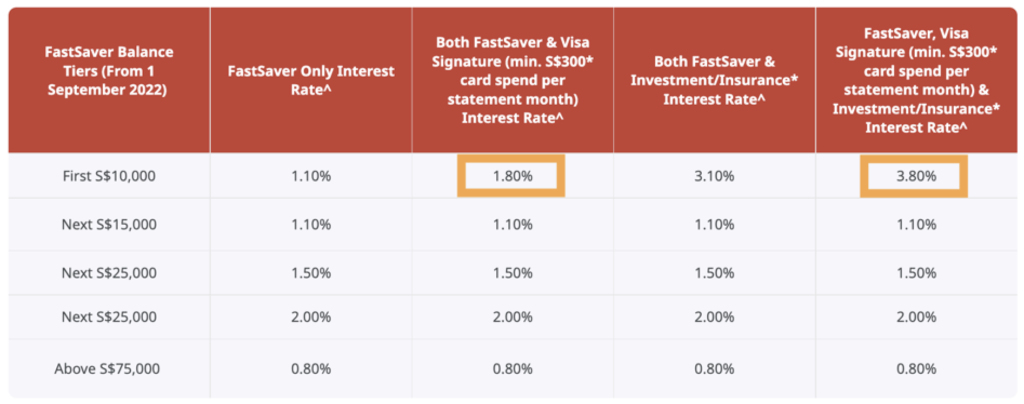

FastSaver can be higher for the youthful people who’re simply getting into the workforce and have lesser money financial savings, as merely spending a simple S$300 in your CIMB Visa Signature provides you with 1.8% p.a. straightaway in your first S$10k:

And naturally, for folks , there’s even an account on your little ones. Try the specifically created CIMB Junior Saver Account just for those under 12 years of age with interest rates of 1.50% p.a. – 3.50% p.a., additionally with no different standards wanted.

Abstract

CIMB StarSaver stands out for its refreshing simplicity, as one of many solely few financial savings accounts the place we will now earn a simple 1.50% p.a. – 3.50% p.a. just by depositing our cash.

I can consider 2 teams of people that will love this:

- Those that have gotten uninterested in leaping by hoops

- Those that have greater than S$100k and usually are not capable of earn larger curiosity on this on their main high-yield financial savings account as a result of financial institution’s limits

What’s extra, there’s no lock-up interval, so we get to retain full flexibility over our money as nicely. That is actually vital in at present’s local weather, the place the market may current us with funding alternatives anytime.

I hope this text helps you perceive extra about CIMB StarSaver now. It will not be talked about as typically, so most individuals aren’t conscious of its advantages, however hopefully, this text will begin altering that.

Sponsored Message from CIMB New to CIMB? Earn an additional 1% bonus curiosity and money credit score while you deposit into StarSaver at present. Learn how right here. Merely deposit recent funds of S$250K or extra to be part of CIMB Most well-liked, and luxuriate in enroll presents as much as S$12,460! Right here’s how that works:

TLDR: Cease working so arduous only for further curiosity – open a CIMB StarSaver Account here today.

Disclosure: This text is written in collaboration with CIMB Singapore. I've additionally personally been a CIMB buyer since pre-COVID. This commercial has not been authorized by the Financial Authority of Singapore.

[ad_2]

Source link