[ad_1]

DollarBreak is reader-supported, whenever you join by way of hyperlinks on this submit, we could obtain compensation. Disclosure.

Trim is a cash saving service that goals to assist folks cut back their spending and save more cash. The app does so by analyzing a person’s spending patterns and making suggestions on how the person can lower your expenses, resembling by cancelling pointless subscriptions. As well as, the platform additionally supply negotiation providers to assist customers cut back their spending on payments resembling medical and cellphone payments.

Professionals

- Potential to save cash – Trim has some ways that can assist you save a mean of $620, resembling by figuring out and cancelling pointless subscriptions.

- Develop your cash with a financial savings account – Trim additionally affords its customers a goal-based financial savings account function that’s insured as much as $250,000 by the FDIC.

- Comparatively low charges – the platform solely expenses 15% of all the cash it helps you save, which is comparatively decrease than different comparable platforms.

- Extremely safe platform – Trim makes use of 256 bit encription to make sure that your delicate knowledge resembling your spending doesn’t get leaked.

Cons

- Not out there in all US states – the platform’s hottest service, invoice negotiation, is just not at the moment out there in AK, AR, CT, DC, MA, RI & VT.

- You may DIY Trim’s providers – you may keep away from paying the 15% price if you happen to take the effort and time to do the issues that Trim affords as providers your self.

Leap to: Full Review

Examine to Different Cash Saving Apps

Swagbucks

18 methods to earn cash – surveys, coupons, cashbacks + $5 join bonus

As much as 10% cashback from shops – Walmart, Amazon, Finest Purchase, JCPenney

Most members can earn an additional $50 – $200 a month utilizing Swagbucks

Tada

Get $10 money again bonus after spending $25 with any of 1000+ manufacturers

Simple to rise up to twenty% money again – merely scan your receipt and add it

Declare your money again by PayPal or from over 80+ reward card choices

How Does Trim App Work?

Trim App, or Ask Trim is an automatic private finance assistant that appears by way of your month-to-month expenditure and alerts you each time your payments might be negotiated and additional prices might be eradicated.

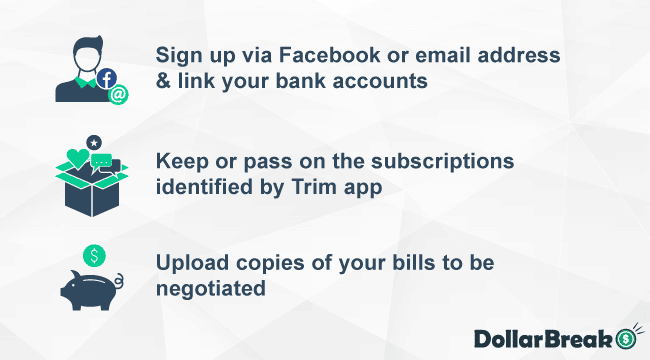

It’s very straightforward to get began with Trim App. Merely sign up for Trim to and hyperlink your checking account(s) in order that Trim will get entry to your month-to-month bills.

Trim App makes use of Synthetic Intelligence to watch your month-to-month spending whereas saving you some huge cash on the best way.

By now, you have to be questioning: however how does trim decrease payments in any case? Let’s check out the two primary options Trim makes use of to decrease your payments.

Utilizing Trim App to Cancel Subscriptions

The subscription financial system has emerged since 2015 and has captured the market fairly effectively. Many individuals together with me, have subscribed to those subscription providers at the very least as soon as.

I’m fairly positive you’ve got subscribed to some providers’ free trials that are actually over and charging a big quantity on a recurring foundation.

That is the place the Trim app comes into play. It makes use of an AI to undergo your month-to-month expenditures and finds recurring transactions. Then it’s going to ship you a textual content together with the main points of those subscription-like transactions asking you whether or not you could maintain them as it’s or get them canceled.

In case you choose to cancel these, the Trim app will do this for you. Trim will both ship an electronic mail, place a name and even ship a licensed letter to the actual subscription service and get it canceled for you.

Alternatively, you may select to cancel subscriptions your self – and Trim will simply level you in that route.

Negotiating Your Payments with Trim

Negotiating the payments your self is perhaps time-consuming and worsening for you. However Trim takes this course of off your shoulders and does it for you.

First, you could hyperlink service supplier accounts (cellphone, cable, or web) with Trim or you may add a duplicate of your invoice to the Trim platform. Upon getting achieved this, Trim will routinely begin discovering methods to save your money.

How A lot Cash Can Trim Save You?

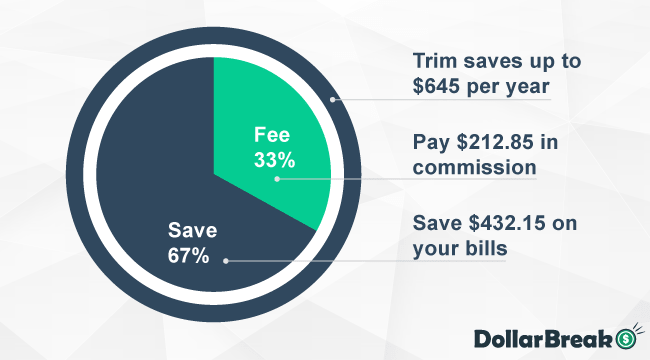

As Trim advertises on its web site, it could actually prevent a mean of $645 per yr.

Let’s break down the payments by class and see how a lot Trim app can prevent in every class.

| Invoice Class | Anticipated Financial savings per Yr |

|---|---|

| Invoice Negotiation: Web, Cable, TV, Satellite tv for pc | $290 |

| Subscriptions Scanning & Cancellations | $120 |

| Financial institution Negotiation: Decrease Curiosity on Credit score Playing cards | $290 |

| 4% Excessive-Yield Financial savings Account | $80 |

| Medical Invoice Negotiation | $300 |

| TrimPay: Pay down bank card debt sooner | $71 |

| Automotive Insurance coverage Evaluation | $247 |

| Complete common yearly financial savings | $1,498 |

Is Trim App Legit, Secure & Safe?

You is perhaps not sure whether or not to belief a 3rd celebration with entry to your delicate monetary info. However Trim is a legit firm that has saved over $20 million to its customers. Having stated this, you’re not betting your cash and security on an unpopular firm right here.

In the case of the safety of your account, I’ve to say that Trim’s platform makes use of 256-bit SSL encryption which is the everyday business normal. Even so, they don’t share your private info or monetary info with another celebration.

Furthermore, Trim solely will get read-only entry to your monetary info. That means they gained’t have the ability to do any modifications with out your approval. You may take away this entry if you happen to really feel it’s not protected or value it at any time.

The Trim app has additionally been accredited by the Better Business Bureau, holding a B score and a rating of three.8 out of 5-star score on Trustpilot. The primary purpose for decrease Trim critiques on Trustpilot is that some folks aren’t actually happy with their providers and complain that Trim couldn’t save them a lot cash.

Trim Premium

Trim affords some premium providers for a not-so-premium value. You may get a 14-day trial to an annual plan of $99 per yr which packs in so many different advantages than the essential ones stated earlier.

Carry on studying to seek out out all in regards to the debt calculator, monetary teaching, and lots of different providers provided by Trim for premium shoppers.

Easy Financial savings

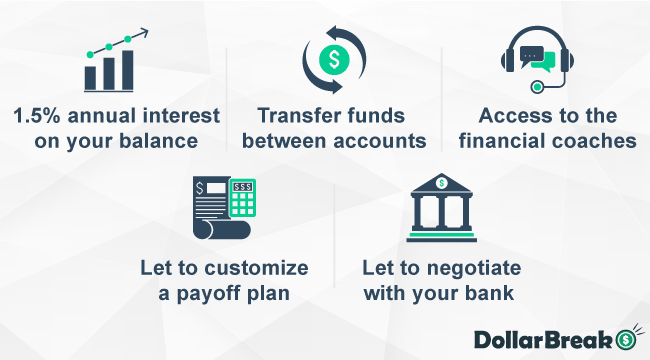

That is an automatic financial savings account that provides 1.5% annual curiosity in your stability.

You may even automate to switch funds out of your checking account to the Easy Financial savings account weekly.

It may not be the best yield possibility on the market, however it’s protected and straightforward to make use of.

TrimPay

You may arrange this function to switch funds out of your checking account to TrimPay after which set a date to switch these funds to pay your bank card debt.

You probably have extra cash in your checking account, you might be more likely to spend it on one thing unimportant. The motive behind TrimPay is to forestall this from occurring and in flip taking down your bank card debt.

Monetary Teaching

In case you join with the premium plan you get limitless entry to Trim’s crew of economic coaches. They are going to present you steering on the monetary selections or strikes you might be keen to make like acquiring a mortgage, investing, or paying off debt.

Debt Calculator

Having all of your monetary accounts linked to Trim is a giant plus if you happen to’re utilizing the Trim Premium plan. Trim will calculate and customise a payoff plan that may reduce the curiosity it’s important to pay on all of your money owed.

Financial institution Negotiation

The Trim Financial institution Negotiation function lets Trim personally name your financial institution to barter and discover any potential financial savings in your bank card charges, different financial institution expenses, and so forth.

Trim App’s Different Options

As soon as logged in, you’ll discover some additional options within the Trim app that don’t prevent cash instantly however will help you make higher monetary selections.

Right here’s what Trim app has to supply:

- Spending evaluation – This function lets you monitor your month-to-month spending and evaluate it with these of different months for a precise date or class. This function is helpful if in case you have many recurring bills or many one-off bills every month.

- Finances your spending – Because the identify suggests, you may plan a price range with the Trim App utilizing this function. Trim will notify you of the progress each month.

- Trim Easy Financial savings account – This automated financial savings account makes you earn an annual curiosity of 1.5% in your stability.

Notice: The funding supply for the Trim Easy Financial savings account is automated weekly transfers. You may set any weekly switch quantity to fund your financial savings account, which you’ll change at any time.

Trim Buyer Help

Since Trim supplies monetary providers, it’s important that they supply buyer assist. Whether or not you’ve got a query or a problem concerning your membership or an app itself, you may electronic mail the Trim buyer assist at [email protected].

Banking providers are supplied by Evolve Financial institution – so if in case you have a grievance about their banking providers, you need to ship an electronic mail to [email protected].

How A lot Does Trim App Value??

Trim will cost you a price of 33% of the cash they’ve saved you. Let’s say you save $50 a month for a yr, that’s $600 for the entire yr, Trim will solely cost you $198 out of that for the entire yr.

And what’s finest about Trim charges is that you just don’t need to pay something out of your pocket. They simply take a proportion of what they prevent, which is a reasonably honest deal.

Trim Premium Pricing

You too can get the Premium plan for $99 a yr to get entry to the premium options that they provide. There’s a 14-day free trial out there so that you can strive premium options out.

Whether or not you’re an everyday or a premium person, there aren’t any hidden prices that you could fear about.

The desk beneath sums up all of the charges related together with your Trim membership:

| Membership Plan: | Flat Charge | Membership Charge |

| Free | 33% | $0 |

| Premium | 33% | $99 |

How Does Trim Make Cash?

In case you’re nonetheless questioning what profit does Trim see in decreasing your payments and the way it makes cash, the reply is easy. Trim expenses you a price of 33% of the overall annual financial savings.

However that’s not all. Trim additionally recommends you sure monetary merchandise that match your wants and preferences. Because of this, these monetary merchandise suppliers pay Trim a fee for bringing you (and different customers) to them.

Trim App Professionals & Cons

Professionals

- Identifies undesirable subscriptions and cancels them for you

- Negotiates with service suppliers to attenuate your payments for you

- You’re paying Trim from the cash they’ve saved you so that you don’t need to pay them out of your pocket

- Is a safe app that doesn’t share your monetary info with different events

Cons

- The web site is optimized for cellular gadgets, however there’s no app

- Won’t be helpful if you happen to’re already doing all of the issues Trim affords your self

Trim App Options

Trim App vs. Rocket Cash

Each Trim App and Rocket Cash present very comparable providers to save lots of your cash. Rocket Cash too has options to determine and eradicate any pointless recurring expenses and automatic invoice negotiation.

The one distinction is Trim App will cancel your subscriptions without spending a dime however with Rocket Cash it’s important to have a premium plan to try this.

Trim App vs. Billshark

Identical to the Trim app, Billshark additionally affords invoice negotiation. However in comparison with Trim, Billshark expenses you the next price of 40% for the cash they’ve saved you. Furthermore, the Trim app is a bit forward because it supplies extra providers. For instance, Billshark is lacking the function to cancel your subscriptions.

Trim App vs. Readability Cash

Readability Cash additionally has virtually equivalent options to Trim. They provide invoice negotiation and subscription canceling like Trim App and different options resembling credit score rating monitoring as effectively.

Nonetheless, Trim is the higher possibility out of the 2 as a result of moreover, you get free skilled monetary teaching with the Trim premium plan.

Is Trim App Value it?

In case you’re on the lookout for methods to eradicate your month-to-month bills and need assistance monitoring your funds, Trim is the right match for you. You gained’t find yourself spending some huge cash on a private finance app, since you’re solely giving them a portion of what they’ve saved for you.

Nonetheless, if you happen to’re somebody who all the time retains monitor of your month-to-month spending and providers you subscribed to, then Trim may not be a terrific worth for you.

What’s a Trim App?

[ad_2]

Source link