[ad_1]

The tempo of change isn’t slowing down. Clients’ expectations have radically modified, and so they count on rather more from their banking services and products than ever earlier than. To keep up relevance, banks must be on the heart beat of those wants and create merchandise to unravel them—to unlock worth for each their clients and the financial institution.

The truth is that, over the previous decade, banks’ merchandise have converged towards useful equivalence whereas changing into emotionally devoid. And as banks elevated their reliance on digital touchpoints throughout the pandemic, they turned even much less related with their clients.

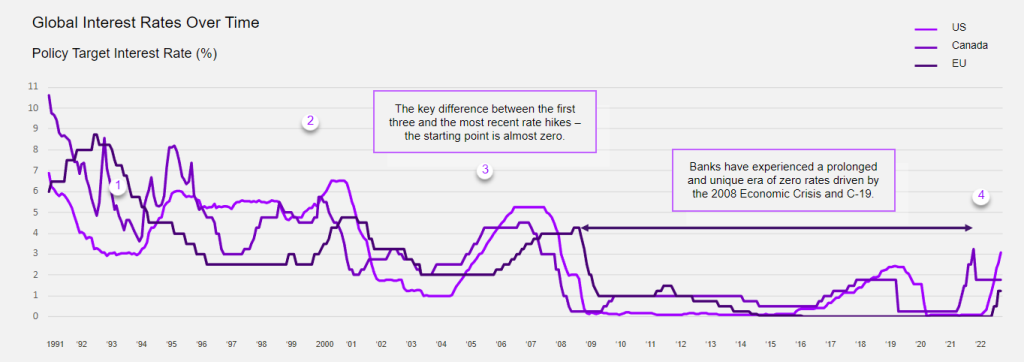

So as to add to this paradox, zero charges have distorted the market, driving many banks to concentrate on particular person merchandise as a substitute of the client as an entire. As charges proceed to rise, the restrictions of this strategy will likely be uncovered, proving a brand new actuality of worth for banks.

How can banks spark this modification, benefiting from a rising charges atmosphere to innovate for as we speak’s wants and buyer values? We consider there has by no means been a greater time to be within the banking business, and banks have each the chance and the restored profitability to prioritize product innovation and gasoline progress.

Banks are properly positioned to take a proactive function as they face altering laws, shifting client preferences and rising rates of interest. As we speak, they have to rediscover their artistic mojo and innovate for as we speak’s clients.

On this information:

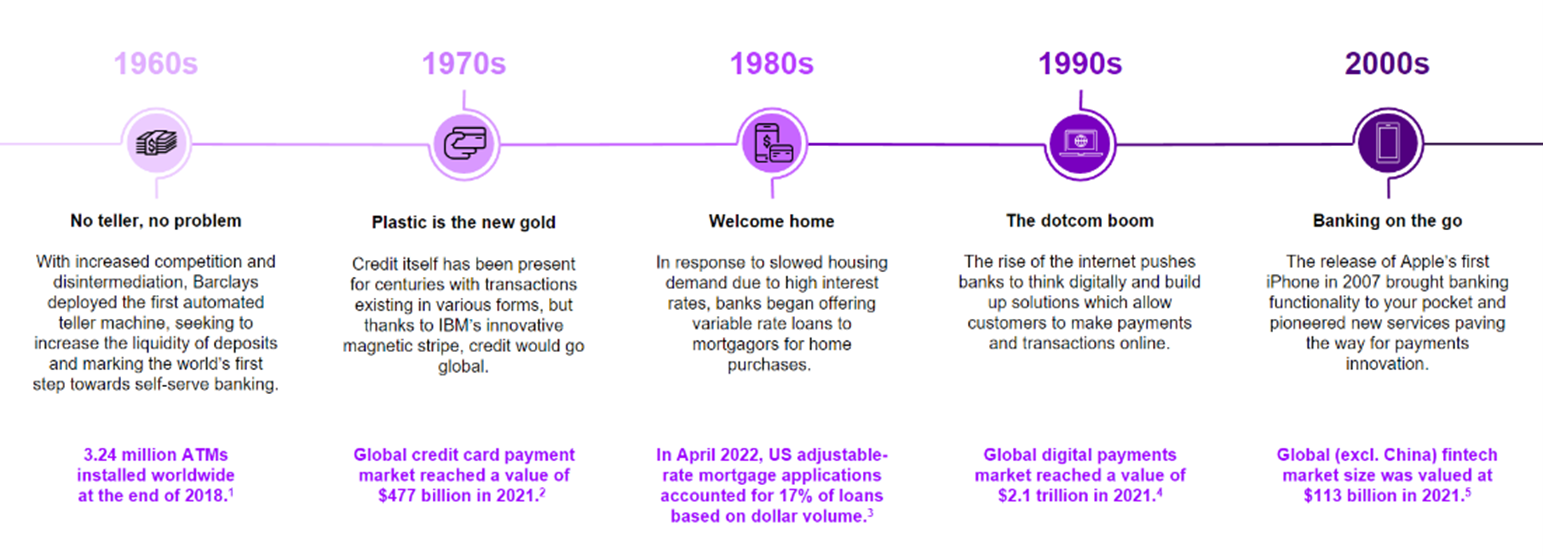

The historical past of product innovation in banking

Within the many years earlier than the Nice Recession, banks relied on unrelenting product innovation to drive progress. From reward playing cards and no-fee checking to adjustable-rate mortgages, debit playing cards and immediate credit score, this innovation has benefitted clients and banks alike.

However over the past twenty years, banks have shifted their focus away from innovation. The 2008 monetary disaster turned the eye of banks towards financial restoration, adhering to new regulatory requirements and driving down prices by digitizing their processes and experiences.

In parallel, adjustments in client wants and the rise of recent applied sciences set the stage for a brand new working atmosphere. However innovation didn’t decelerate. Neobanks, fintechs and bigtechs began driving business improvements comparable to purchase now, pay later lending fashions and early payday lending.

As we speak, new aggressive threats proceed to emerge in all sizes and styles. Bigtechs are leveraging their client information, superior analytics capabilities and enormous community results to accomplice with nimble fintechs, capturing important market share throughout their increasing world footprint—all with out a banking license. These non-traditional opponents present ambitions past changing into digital banks, and their foray into monetary providers focuses on creating new sources of worth and strengthening their ecosystem by reimagining enterprise fashions.

What impression have zero charges had on banking product innovation?

A decade of zero charges distorted the market by inflicting a flood of low-cost money and enabling various lenders and venture-capital-backed fintechs to gasoline the acquisition of rising and underserved buyer segments. Throughout this era, the product calculus modified quickly, forcing banks to concentrate on optimizing and advertising and marketing particular person merchandise somewhat than creating built-in propositions for patrons.

That is revealed within the shrinking function of banks relative to the general monetary system, new opponents and different intermediaries. This development is clear in developed economies such because the US, the UK, Europe, Japan and others. This has been partly engineered by regulators in search of to scale back danger inside the banking system that turned evident within the 2008 monetary disaster.

Whereas these laws and danger controls aimed to construct a extra resilient financial system, the authorized, regulatory and coverage requirements haven’t advanced to deal with the brand new aggressive banking atmosphere. The final decade noticed an explosion of non-regulated gamers, comparable to fintechs, bigtechs and non-banks, and these opponents have attacked the banking worth chain to construct and serve all of the merchandise of a financial institution with out the constraints of banking laws.

Moreover, throughout this time, the persistence of zero rates of interest resulted in 4 main directional adjustments that drove clients and progress outdoors the banking business:

- The rise of neobanks

- Private banking skilled a proliferation of recent fintech banks, reaching 250 globally in 2022. Low-cost deposits and streamlined experiences powered by greater than $300bn in funding helped neobanks open greater than 33mn accounts since 2019.

- The explosion of digital lending

- Rock-bottom charges fueled huge off-balance-sheet funding. The variety of private and client lenders exploded, whereas new entrants comparable to neobanks quintupled the worth of digital lending since 2010. (Even Goldman received into the sport with Marcus providing private loans and financial savings.)

- The disaggregation of SMB merchandise

- Fintechs systematically disaggregated small enterprise banking, with entrants like Sq. and Kabbage rising. PayPal acquired Swift Monetary to bolster its SMB lending enterprise. Brex constructed a SMB bank card enterprise. And Shopify and Uber began providing built-in banking.

- The substitute of banks by personal fairness (PE) corporations

- Non-public credit score took off as corporations appeared to fill the void brought on by the retreat of banks from middle-market and different varieties of ‘riskier’ lending alternatives. PE corporations supplied excessive yields for institutional and rich buyers, outperforming the S&P500, the Russell 2000, and enterprise capital throughout a interval of low rates of interest.

Sources: The Monetary Model, Accenture Analysis, S&P Capital IQ, CB Insights, SVB, Insider intelligence, Bloomberg

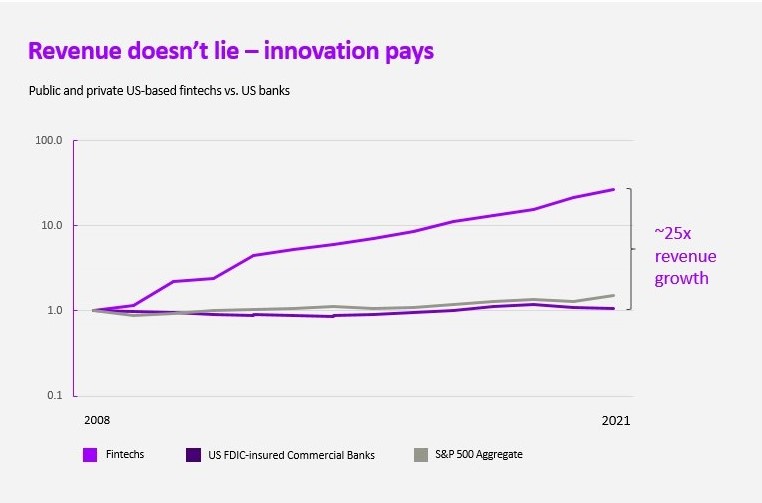

And income doesn’t lie—innovation pays. The post-recession distinction is evidenced within the hovering income progress of fintechs whereas banks stagnated. Accenture analysis reveals fintech revenues have grown to a fabric share: $100bn within the US alone. This development isn’t distinctive to the US; new opponents have captured the next share of income within the UK and China, additionally residence to among the world’s main neobanks and bigtechs.

What’s the alternative for banking product innovation in a rising charges atmosphere?

Today, amid rising interest rates, macroeconomic volatility and a altering regulatory panorama, banks have the benefit. Robust and diversified steadiness sheets, belief, economies of scale and expertise adapting to alter collectively set the stage for banks to return to their progressive roots.

And simply as zero curiosity distorted product economics, we see the rising rates of interest because the gravity pulling enterprise and product methods again collectively. This may have various impacts:

- Deposits are the brand new rocket gasoline: Low beta deposits are the premium legal responsibility each financial institution needs. Rising charges will drive separation between hot-deposit banks and diversified banks that successfully use digital experiences to handle front- and back-book spreads.

- From product siloes to the overall buyer: Banks will start providing holistic worth propositions and end-to-end performance, creating merchandise that hyperlink deposits and lending and amplify worth.

- Unbundling and rebundling of banking: Banks will ship progress by unbundling their legacy tech and product distribution and rebundling with companions at decrease prices and sooner instances to market.

- A neo-normal: Neobanks funded by scorching deposits are dealing with pullbacks in investor funding and falling valuations. Banks have a once-in-a-generation alternative to amass fintechs to search out new clients, speed up innovation and take up fascinating fintech expertise.

- The latent digital dividend: Popping out of the pandemic, 97% of buyer touchpoints are both on-line or cell. Discovering a option to leverage fashionable information and know-how techniques to cross/up-sell merchandise in a similar way to a department expertise will unlock monumental worth in buyer relationships.

Qorus-Accenture Innovation Awards main the best way in banking innovation

It’s price noting the Qorus-Accenture Banking Innovation Awards, an annual world awards program that acknowledges the most effective in banking innovation, not too long ago celebrated unimaginable improvements at its 2022 ceremony in Barcelona.

Banco do Brasil is reaching unimaginable success by reimagining the client expertise and fascinating with new market segments. With its Open Finance on Whatsapp, it was the primary financial institution on this planet to make use of the messaging utility to finish the client consent journey. Moreover, Banco do Brasil Brablox is partaking potential clients within the metaverse by turning it right into a relationship-nurturing platform.

As many people know, there should be a metaverse point out relating to banking innovation. Trade gamers are additionally boosting model fairness on this rising digital world. Spain’s imaginBank is specializing in the metaverse as a connection to its youthful clients by “offering immersive content and experiences in imaginLAND, its product in the metaverse.”

The awards additionally highlighted the rising use of ‘forgotten information’. BNP Paribas, for instance, is leveraging geospatial information to detect the local weather impression of enterprise actions and gives recommendation to its SME clients primarily based on its findings. Moreover, Intesa Sanpaolo is creating a brand new progressive path in the usage of sustainability as an engine for progress via its ESG coaching for SMEs.

We encourage you to take a second and browse the full list of this year’s winning innovations.

What are some progressive product concepts that banks can discover now?

To kickstart the ideation course of, we requested our world banking workforce: “How may we tackle the evolving monetary wants and behaviors of shoppers with services and products that may drive income progress in an more and more unsure atmosphere?”

We pitched over 150 product concepts, with the objective of progress and assembly the wants of as we speak’s clients. We’re sharing virtually 50 on this information, categorized by eight product themes, to assist banks rediscover their artistic mojo for product innovation.

[ad_2]

Source link