[ad_1]

Within the mild of FTX’s collapse, plenty of blame has gone in direction of the shortage of regulation, governance controls, and the ways in which its founder-CEO used its buyer funds. A variety of you will have been asking me, may the identical occur to digital inventory brokerages? Are the shares or money holdings in your account secure?

This text explains that, and delves into the variations in controls that digital brokerages are subjected to, which FTX lacked.

At first, I assumed it was pointless to check a crypto alternate with a digital inventory brokerage. In any case, that’s like evaluating apples to pears.

However with so a lot of you readers sharing the identical issues (and you’re not the only ones), it will definitely led me to sit down down and write this text. So for these of you who already know why each are completely different, then you may skip this. However for the remainder of you who’re nonetheless anxious about whether or not digital inventory brokerages are secure to make use of, that is for you.

Firstly, let me begin by caveating that nearly nothing in life is 100% risk-free. The identical goes for platforms – be it a crypto exchange, a robo-advisory (bear in mind Smartly?) and even bike-sharing apps.

And the one factor all of them have in frequent is that we, as customers, put our hard-earned funds on these platforms. It’s only pure that we fear about getting our funds again ought to they collapse or disappear.

FTX vs. digital inventory brokerages

Much like FTX, digital inventory brokerages like Robinhood, Tiger Brokers, moomoo Singapore (by FUTU) and WeBull are a reasonably new phenomenon that cropped up solely in recent times.

FTX, till its current demise, was among the many largest crypto exchanges on the earth with prominent financial investors and many celebrities / popular influencers who promoted it to their audiences. However but, inside per week of occasions, FTX is now bankrupt and most customers will probably never get back their funds (or their crypto).

The investigations into FTX are nonetheless ongoing, however right here’s what we all know to this point:

- The corporate was arrange within the Bahamas, structured in a manner such that prospects of FTX truly haven’t any declare on any of the tokens that they purchased from FTX (due to the best way the regulation works throughout borders)

- Founder-CEO Bankman-Fried is claimed to have used prospects’ funds to make dangerous bets for his hedge fund

- Crypto exchanges commerce unregulated monetary property

- No exterior audits or governance controls

I’ve highlighted the above in daring as a result of that’s the place the similarities finish.

In fact, even the strictest laws can’t 100% remove the potential of a participant committing fraud, however no less than within the securities market, the working laws makes it tougher for that to occur.

Except for investor safety insurance policies, the segregation of roles between buying and selling venues, market makers and asset custodians are a key function of regulated inventory exchanges just like the New York Inventory Change (NYSE). Exchanges are also prohibited from owning brokerages (at most, a 20% stake). Nonetheless, this isn’t the case for a lot of crypto exchanges, and most actually not FTX.

Right here’s 5 explanation why you will have much less to fret about.

1. Your deposits and property are insured.

Insurance coverage for crypto property are nonetheless new, and most prospects of crypto exchanges usually are not protected by any insurance coverage which might cowl in opposition to their losses. However that’s not the case on the subject of the securities market. Utilizing moomoo SG for example,

Observe: If the brokerage you’re utilizing affords you the option to “sweep” your cash into individual FDIC-insured bank accounts, then you definitely’ll even be entitled to $250k of USD cash protection. Nonetheless, this solely applies for US banks and brokerages with a US financial institution sweep program, so sadly none of our native gamers can present this.

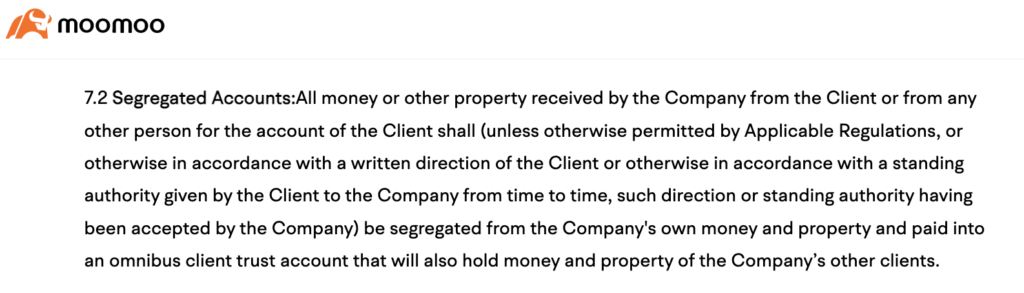

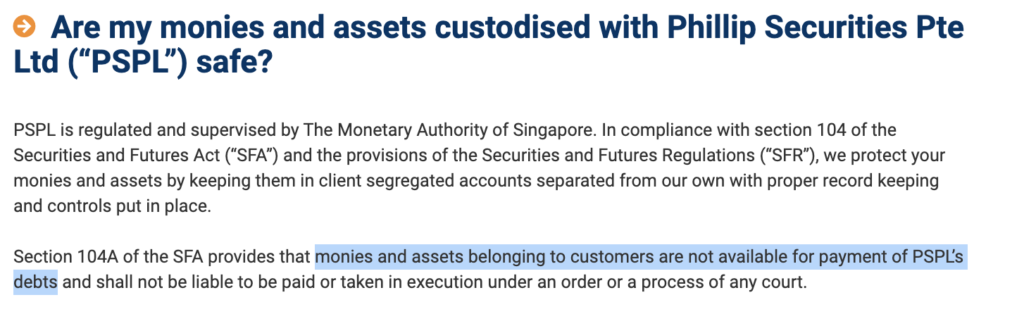

2. Your funds are segregated and stored separate from the brokerage’s personal funds

Most crypto exchanges maintain your property on-chain, on their very own scorching wallets. These go away them prone to being doubtlessly drained by the corporate’s workers (those that maintain the pockets keys), or hacked by outsiders anytime.

However quite the opposite, all digital inventory brokerages that function in Singapore are required by law to be kept separate from the company’s own funds. Your brokerage shouldn’t be allowed to make use of your funds for their very own enterprise actions, nor can your funds be ordered (not even by regulation) to repay the corporate’s money owed or loans.

If you happen to recall, that’s fully reverse of what allegedly occurred with FTX, who’s being

3. Your property usually are not held by the dealer.

Opposite to what some individuals imagine, not all of your shares are beneath your authorized title or rights, despite the fact that you paid for these shares. Most often, the rationale why we are able to purchase and promote shares electronically (inside seconds) is as a result of we solely maintain and switch our helpful curiosity within the securities, fairly than our authorized title or rights to .

In fact, this isn’t the case for Singapore residents, the place you legally personal the SGX shares held in your Central Depository (CDP) (however not whenever you purchase by way of custody brokers such as Standard Chartered). That is additionally why some people are prepared to pay increased brokerage commissions simply in order that they’ll legally personal it of their CDP accounts.

As on your US shares, the SEC has made it such that your shares are not owned by the broker, but rather, held in custody by the Depository Trust Company (DTCC) – the one home depository with over 800 custodial banks and brokers. Whether or not or not you purchase your US shares by way of moomoo or Robinhood, your property are nonetheless custodised by the DTCC.

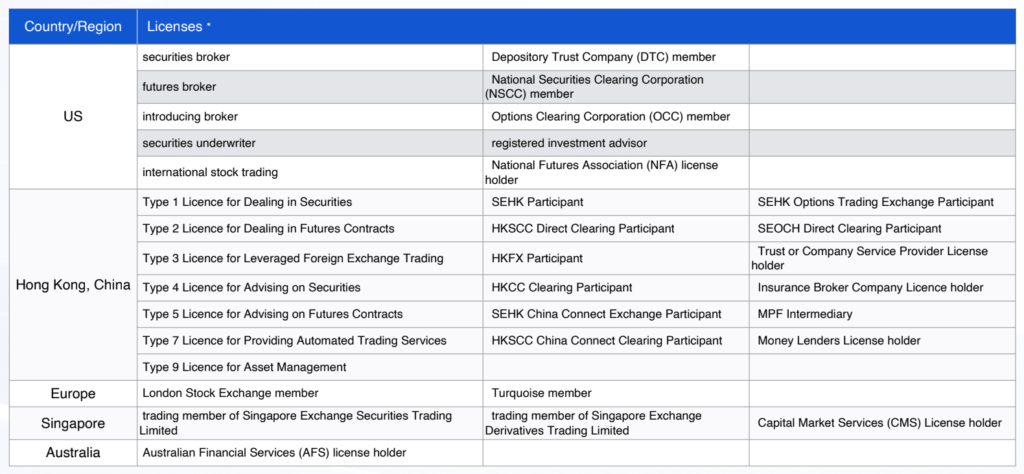

4. Strict controls for regulatory licenses and memberships.

Evidently, it’s a lot tougher to arrange and function a digital securities alternate than to arrange a crypto alternate. There are stricter controls and a complete multitude of regulatory licenses that it is advisable to get approvals for. And on the subject of the US markets, because of the monetary mayhem that brought about the Nice Despair, statutes had been applied to revive investor confidence by offering clear guidelines of sincere dealing. Right now, the Securities and Change Fee (“SEC”) enforcement mandate covers all securities brokers, switch brokers and clearing companies, together with the Nationwide Affiliation of Securities Sellers, which operates the NASDAQ system.

Comparable laws exist in different international locations, the place you may solely get licenses to function after clearing the related guidelines.

Right here’s a have a look at what Futu Holdings has:

5. Optimistic income and earnings

When putting your cash with a dealer, you’d need to make sure that your brokerage is financially steady to face up to even giant market drawdowns. Most brokerage corporations are additionally required to satisfy minimal web capital necessities, in order to cut back the percentages of insolvency.

You’d additionally desire a brokerage which is worthwhile, in order that they’re much less inclined to commit fraud.

Right here’s a fast have a look at Futu Holdings Limited financials (they are the parent company of moomoo SG)an organization which has had optimistic earnings since its itemizing:

| $ in US greenback | 2020 | 2021 | 2022 First 3Q |

| Non-GAAP adjusted web revenue | $175 million | $374 million | $269.8 million |

We can’t rule out all chance of unhealthy actors, however no less than this helps to reduce the chance.

What occurs if a brokerage goes bust?

By no means say by no means. Large brokerages went bust in 2008, so we can’t rule out the potential of it taking place once more, though newer controls and laws have been put in place since to stop the identical. All of the laws and legal guidelines on the earth, although, can’t forestall fraud.

However usually, ought to a brokerage agency stop to function, the a number of layers of safety step in to safeguard prospects’ property:

- The brokerage can’t run away along with your funds, since it’s held in segregated belief accounts

- SIPC insurance coverage kicks in for US securities

- Your SGX securities are secure in your CDP (supplied you used a CDP account)

As on your US property, the SIPC oversees the liquidation of failed US broker-dealers, with the first operate of returning cash to prospects as shortly as potential.

Conclusion: how can traders shield themselves?

If you happen to make investments with a digital securities dealer, your property are a lot safer vs. these held in a crypto alternate, so I hope this text lets you perceive why you may really feel just a little extra reassured.

Having stated that, I’d by no means rule out any chance, in order an investor, listed below are some suggestions for the tremendous kiasu and kiasi:

Tip 1: Examine the regulatory licenses and memberships.

If the brokerage you’re utilizing shouldn’t be exhibiting up as a registered member or licensed operator (or worse, reveals up on the MAS Investor Watchlist), then you must rightfully be involved.

But when the dealer has managed to clear the regulatory controls and obtain the licenses, then there’s much less to fret about.

Tip 2: Restrict your property to the protected limits

Similar to how some Singaporeans select to place not more than S$75k in every financial institution (as a consequence of SDIC limits), within the US, some traders select to carry not more than US$500k of money and securities in a single dealer, and US$250k of money per financial institution.

It’s completely as much as you in case you discover it safer to separate your property throughout a number of platforms in order that within the worst case situation, you’re protected by the utmost insured limits.

Tip 3: Diversify throughout completely different brokers

It might not be a nasty thought to have a secondary account, particularly if it’ll make you’re feeling psychologically higher about your property.

And do you have to be in search of a low-cost and controlled dealer to open an account with, check out moomoo – I exploit them too.

Message from our Sponsor: New Person Promotion: • Rise up to 1 free Apple Inventory* + S$20 cashback* whenever you deposit > S$2,700! *Terms and conditions apply. Stack that with an Unique Promotion (Dec 1, 2022 – Jan 31, 2023): • Fee-Free* Choices Buying and selling Legitimate for 30 days • Diminished Margin Requirement - As much as 100% discount for buying and selling particular choices methods • Exclusive offer via this link: 3-month free depth quote for US options

All views expressed on this article are my very own unbiased opinions and analysis notes primarily based on publicly obtainable data put out by every of the regulators and brokerages. Safety measures might change over time and this text is not going to be up to date transferring ahead, so please use this merely as a reference and you're to do your personal due diligence you depend on prevailing retail investor safety measures as a key think about your funding choices.

The knowledge on this article/video is only for informational functions and shouldn't be relied upon as monetary recommendation.

Disclosure: This publish is dropped at you in collaboration with moomoo SG. All opinions are that of my very own, primarily based on my buying and selling expertise with moomoo. Please be happy to click on my affiliate links if you’ll like to sign up for an account!

This commercial has not been reviewed by the Financial Authority of Singapore.

[ad_2]

Source link