[ad_1]

There’s little question that electrical automobiles (EVs) are the long run. However the query is, who will win the EV race? Will it’s Tesla, Nio, Rivian, Xpeng, BYD, Hyundai or maybe Ford?

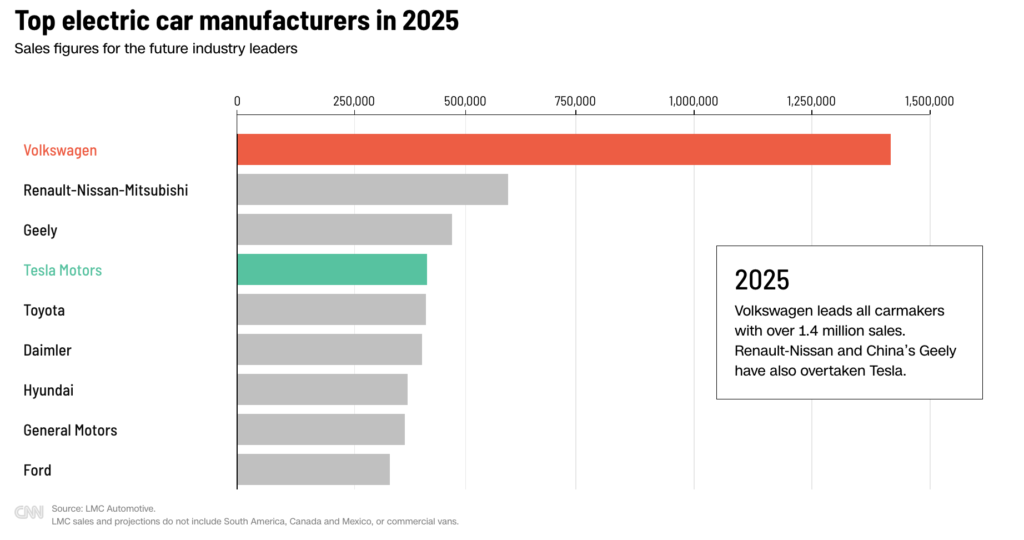

A couple of weeks in the past, the Web was abuzz after Elon Musk said that he expects Tesla’s main rival to be a Chinese player. May that be BYD, Nio or Geely? Whereas solely time will inform which Chinese language participant will emerge champion, one factor is for certain: we can not underestimate China with regards to the rising EV trade.

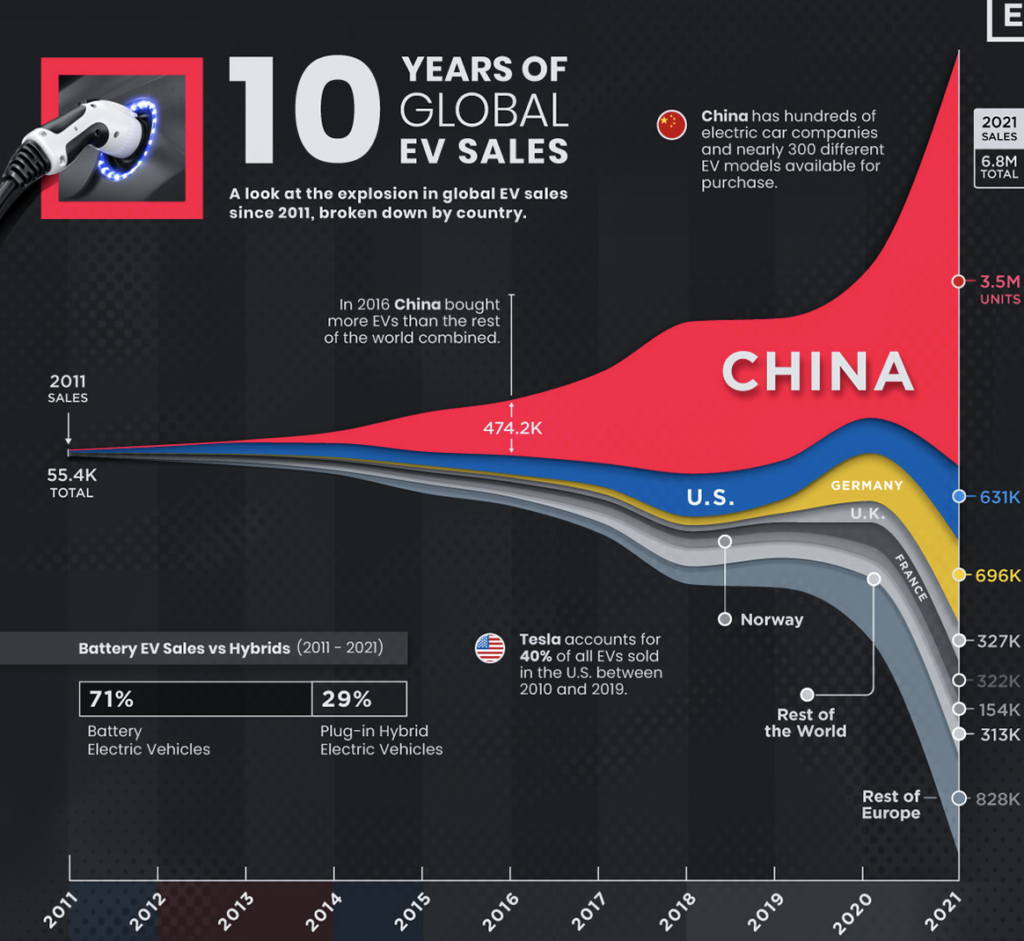

In any case, China’s plans were already underway more than a decade ago (whereas different international locations have been nonetheless debating over whether or not local weather change was certainly an actual risk), and the government began subsidizing EV sales as early as 2010 when the industry was still in its infancy. And in 2015, China issued its plan to build charging infrastructure and pushed its main state utility companies to build out a network of chargers across the nations.

In distinction, different international locations have solely simply begun to leap on the bandwagon lately.

Sponsored Message China EV makers are main the worldwide EV race and are prone to proceed their dominance for a lot of extra years to return. Get publicity to this fast-growing sector once you put money into the NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF.

Are EVs actually the long run? Sure.

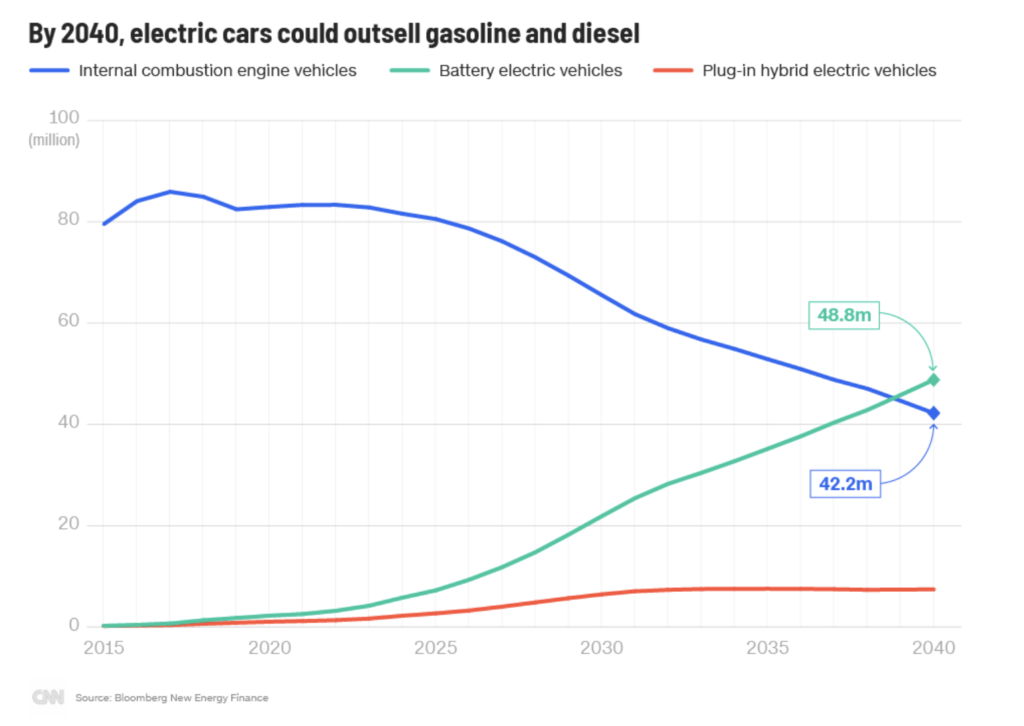

It is going to take time, however we’ll seemingly quickly see a future the place solely clean-energy automobiles dominate. Some developments are clearer than others, and traders who’re capable of spot and put money into these early earlier than they develop to dominate the long run can doubtlessly make a sizeable revenue.

The global EV industry is presently worth USD 250 billion, however is projected to triple to USD 800 billion by 2027. A 12 months in the past, trade consultants predicted that 10 million new electrical automobiles (EVs) can be offered in 2022 worldwide, virtually 10 instances from 2017. Because it turned out, their estimates have been spot on. Immediately, with local weather change, authorities insurance policies, client developments and the rising costs of gasoline coalescing, there’s little doubt that this pattern will proceed in 2023 and past.

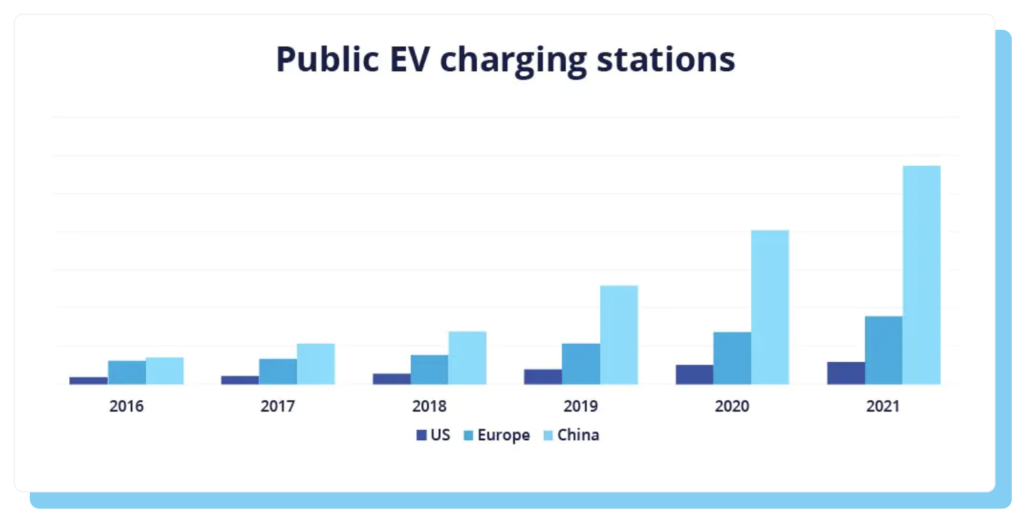

Around the globe, many policymakers have already laid out concrete plans to decarbonize and shift demand in the direction of EVs. In Europe, an EU-wide ban on sales of petrol and diesel cars will be implemented by 2035, whereas the UK has recently brought forward their own phase-out date to 2030. China is aiming for 40% of vehicles sold to be electric by 2030, whereas Singapore aims higher at 100% cleaner energy vehicles by 2040. As for customers, how far an EV automobile can go and easy accessibility to charging factors are essential concerns earlier than they select to buy an EV. On this regard, the Singapore government has committed to building 60,000 charging points by 2030, whereas China already has 1.8 million vs. the 53,000 in the US.

Which EV inventory would be the winner?

As an investor, if you’ll be able to spot what you imagine to be “sure-win” shares which are using on a powerful tailwind and also you put money into them early, doubtlessly you stand a fairly good likelihood of profiting handsomely. As an illustration, those that recognized Amazon for e-commerce, Google (Alphabet) for on-line search, Apple for client smartphones and even TSM for 4G and sensible gadgets…have made a killing within the inventory markets.

Nonetheless, the truth is that’s simpler stated than executed. And within the enterprise world, plenty of corporations will fail within the race to international dominion (who nonetheless remembers Yahoo or GoTo in the online search engine race?). There isn’t a assure that in the present day’s leaders will nonetheless be tomorrow’s winner. Though Tesla is, and has been, #1 when it comes to market share for a number of years, other players like Ford are now starting to catch up.

What’s extra, even if you happen to had invested in market-leader Tesla, the ride would have been a shaky one:

- Tesla’s share worth went up by 12 instances (1200%) in 20 months throughout the pandemic.

- The inventory then shed 70% in simply 14 months, after its peak.

- Traders who waited to speculate solely after Tesla turned worthwhile (Jan 2021), are nonetheless within the purple in the present day.

- Many traders who entered after Tesla rose to mainstream recognition on Youtube are nonetheless within the purple in the present day.

- Those that went in (together with funds) after Tesla entered the S&P 500 (Dec 2020), are principally nonetheless within the purple in the present day.

Actually, solely a small handful of traders managed to revenue from Tesla e.g. those that dared to put money into Tesla throughout final month’s issues (CEO being distracted by Twitter and assuaged with calls for his resignation, protests against price cuts, Elon Musk being sued for fraud, and many others), and people who invested earlier than Tesla’s inventory turned mainstream.

Investing by way of EV ETFs

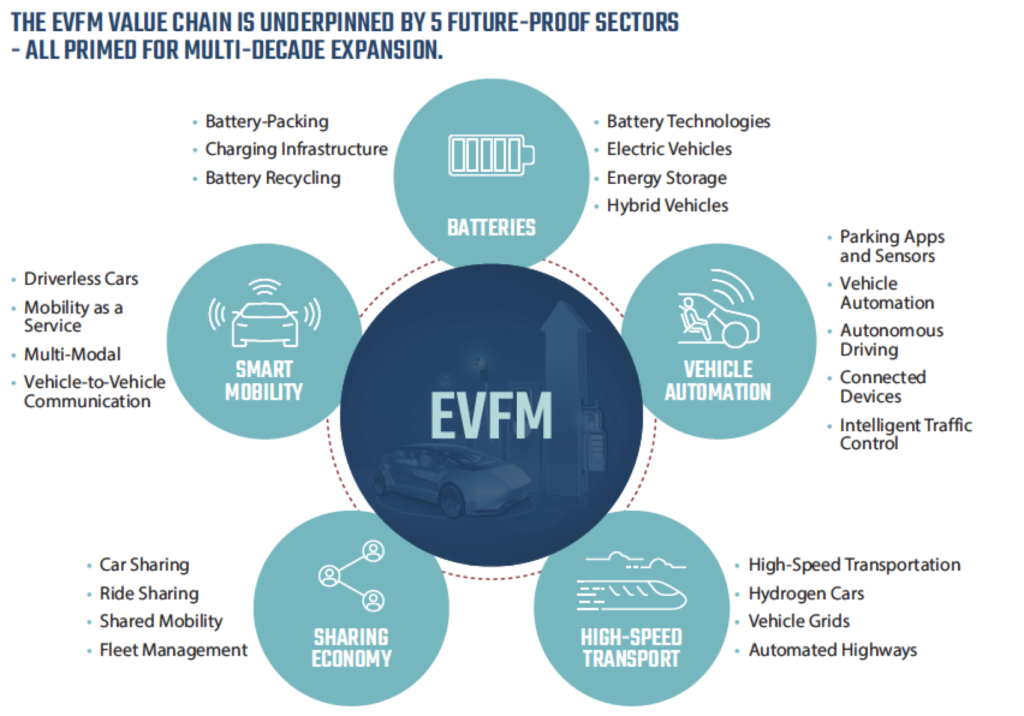

So for individuals who desire to keep away from the volatility that comes with particular person EV shares, one other method is to speculate by way of EV exchange-traded funds (ETFs). There are numerous choices so that you can select from, and it’s also possible to go for ETFs that help you diversify throughout the completely different gamers on this worth chain – producers, battery expertise corporations, builders of charging infrastructure, and many others that assist all the ecosystem.

However whereas plenty of the world’s consideration is on US producer Tesla, the reality is that America is lagging far behind China with regards to EVs when it comes to gross sales, charging infrastructure, price and coverage assist. For instance, last year, the US passed the crucial tipping point of EVs accounting for 5% of new car sales, but China already passed that level in 2018.

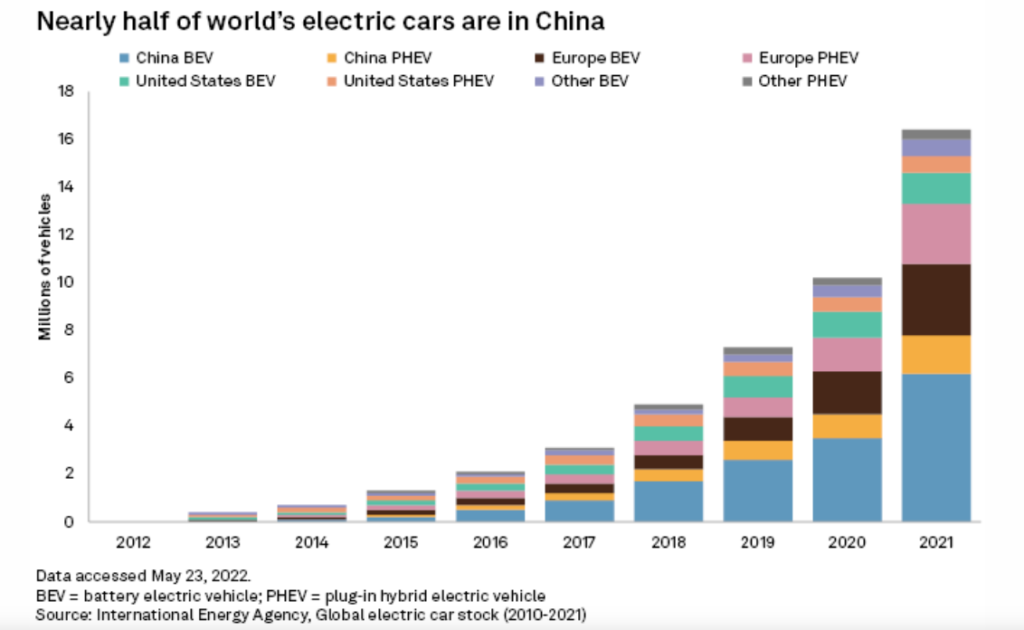

Even Elon Musk has acknowledged that Tesla’s biggest rival will likely be a Chinese player. That’s hardly shocking when you think about how China is main international EV gross sales – 1 out of each 2 EVs offered in 2021 went to China, and the nation at the moment leads the world in client acceptance for EVs at 30% of new car sales. Actually, many experts believe China can seize as much as 60% of global EV sales!

On the subject of the provision chain, China also dominates; it currently accounts for 70% of global battery cell production capacity. With supportive authorities insurance policies, together with the 2060 carbon neutrality goal and a mandate on automakers requiring EVs to account for 40% of all new car sales by 2030, these all level to how development within the Chinese language market is ready to proceed at breakneck velocity.

Which is why I feel the larger funding alternative might be in China as an alternative, particularly as Chinese language gamers have already got an enormous runway for development be it domestically (China is already the largest EV market worldwide) and even increasing to change into international market chief, on par with Tesla. However since I don’t know which firm will emerge because the winner finally, an ETF that provides me publicity to those largest gamers will be the most secure solution to play it.

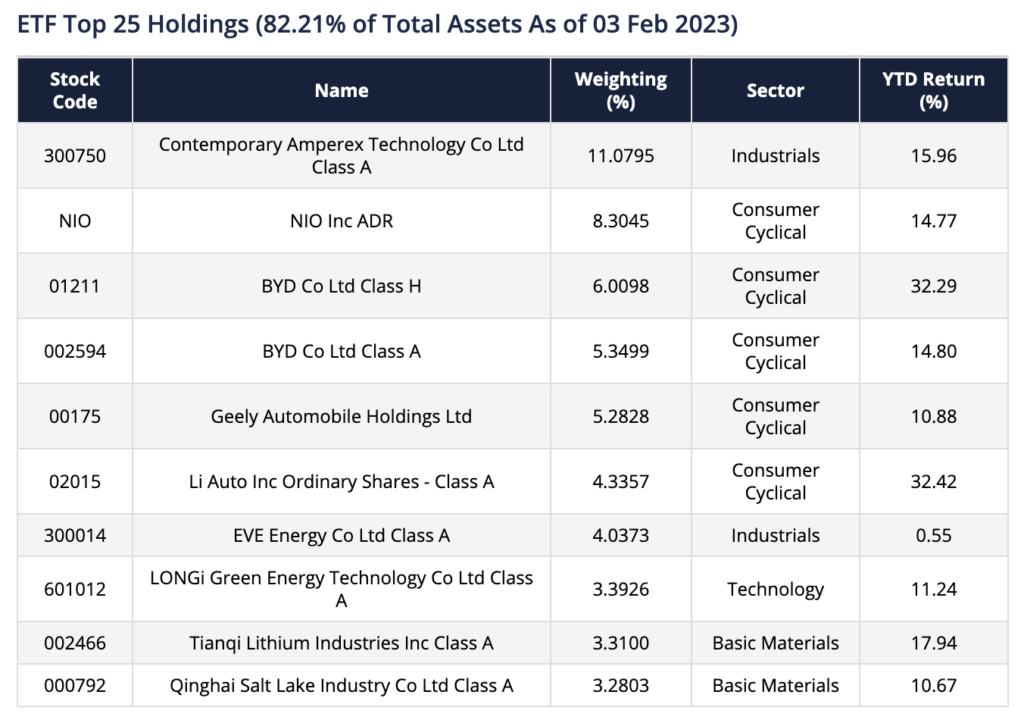

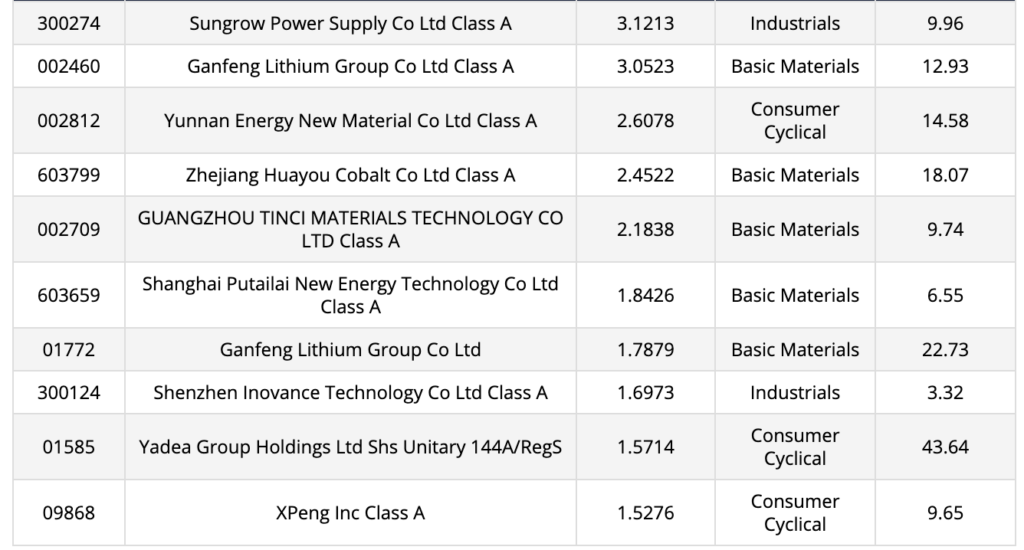

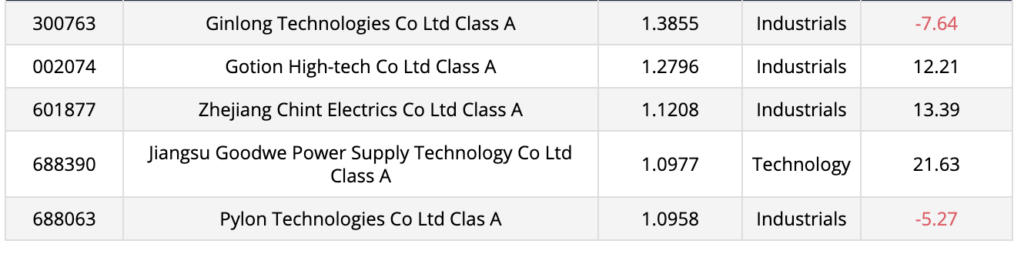

That’s why I’m watching the NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF (SGX:EVS (SGD main foreign money) or EVD (USD secondary foreign money)). This ETF tracks the MSCI China All Shares IMI Future Mobility Prime 50 Index and greatest represents the broader China’s EV and future mobility ecosystem, with not solely EV producers but additionally different gamers throughout the worth chain.

From an index methodology perspective, the shares chosen to create the index are based mostly on the dad or mum index – the MSCI China All Shares Investable Market Index (IMI). MSCI makes use of pure language processing and algorithmic instruments to display out key phrases and phrases from knowledge sources to establish the highest 50 largest corporations that match within the theme of China EV and future mobility ecosystem.

Other than getting diversified publicity to high Chinese language carmakers together with NIO, BYD, Geely and Li Auto, the ETF additionally consists of corporations throughout the trade’s broader worth chain, reminiscent of lithium battery producers, photo voltaic inverters, automation management (for autonomous driving), and many others. These can embody corporations listed within the US, Hong Kong, China and different markets.

When it comes to charges, the ETF’s expense ratio is 0.70% p.a., which is aggressive inside the thematic ETF area, however the perfect half is that the fees are capped and any expenses in excess of the 0.70% per annum will be borne by the manager, Nikko Asset Administration Asia (NikkoAM), somewhat than the fund itself.

A few of you may acknowledge the ETF supervisor, as NikkoAM is outstanding within the native ETF scene and already has 5 different well-known ETFs listed on SGX, together with:

- NikkoAM Singapore STI ETF

- NikkoAM-StraitsTrading Asia ex Japan REIT ETF

- ABF Singapore Bond Index Fund

- Nikko AM SGD Funding Grade Company Bond ETF

- NikkoAM-ICBCSG China Bond ETF

Do be aware that this ETF is usually greater danger (restricted to at least one sector) and extra unstable in nature, particularly in distinction to most of the different ETFs listed above by the identical ETF supervisor. This can be a function of it being a thematic ETF and centered on a subset (China) of a standalone trade (EVs and Future Mobility), so you shouldn’t count on it to provide the similar stage of stability or diversification as a broader ETF or a complete nation market index-based ETF.

Sponsored Message NikkoAM is one in all Asia’s largest asset administration companies, and was not too long ago awarded the perfect ETF supplier in Singapore for 2022 on the Asset Asian Awards 2022.

Similar to its different ETFs, you will get entry to the NikkoAM-StraitsTrading MSCI China Electric Vehicles and Future Mobility ETF (SGX:EVS or EVD) by means of FundSupermart, or by way of any brokerage that provides you entry to the SGX market and ETFs. Or, if you happen to’re a whale and you plan to speculate 50,000 models or extra, you will get entry by way of taking part sellers for direct subscriptions:

- CGS-CIMB Securities

- FSMOne

- Futu Singapore (moomoo)

- iFast Monetary

- Phillip Capital

- Tiger Brokers

- UOB KayHian

When you’re considering of doing dollar-cost averaging into this ETF, it’s also possible to do this by way of the common saving plans (RSP) choices supplied by Phillip Securities (Share Builders Plan) or FundSupermart as effectively.

In fact, I’m conscious that there are potential dangers concerned as effectively. The central Chinese government has recently phased out its subsidies for EVs, though some local cities (like Shanghai) continue to offer them. Whereas I typically imagine the Chinese language authorities will proceed to assist the expansion of the EV trade, there’s no telling what coverage adjustments might occur down the street. Particular person shares within the EV area will also be fairly unstable, and in the end, the success of every inventory boils right down to the execution of enterprise plans by every EV firm.

Conclusion

The way forward for transport will very seemingly embody not simply mass adoption of EVs, but additionally autonomous automobiles, distributed power storage, clever transport methods, extra superior batteries, and extra. There’s little question that on the fee of which authorities insurance policies and automotive gamers are transferring, we’ll see this future arrive sooner somewhat than later.

When you’re inventory picker, do begin figuring out corporations that you just suppose will seemingly outperform and dominate, whether or not that’s Tesla, BYD, Nio, or another participant. Personally, I’m not a fan of Tesla and discover it overvalued even at in the present day’s costs, whereas I really feel an even bigger alternative may sit with the Chinese language producers and suppliers.

However if you happen to’re not so certain, otherwise you desire to not take care of the uncertainty and volatility that comes with particular person inventory picks, a fuss-free strategy to entry a portfolio of corporations that greatest represents the EV and future mobility ecosystem inside a single commerce is perhaps a greater method. And if you happen to’re satisfied China will proceed its development trajectory, then an ETF like SGX:EVS or EVD is perhaps an effective way to journey on that wave.

What do you concentrate on this ETF? Share your ideas with me beneath!

Read more details about the ETF (SGX:EVS or EVD) here that will help you resolve!

Disclosure: This put up is written in collaboration with Nikko Asset Administration to lift consciousness about their EV ETF, which was efficiently listed on SGX just over a year ago. All analysis and opinions are that of my very own. It is best to learn extra in regards to the ETF here and here, or communicate with a licensed monetary advisor, to be able to allow you to arrive at your personal determination whether or not this fund is perhaps appropriate to your funding aims.

Vital Info: This doc is only for informational functions solely for granted given to the particular funding goal, monetary state of affairs and explicit wants of any particular particular person. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a advice for funding. It is best to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you just select not to take action, you must think about whether or not the funding chosen is appropriate for you. Investments in funds are usually not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”). Previous efficiency or any prediction, projection or forecast is just not indicative of future efficiency. The Fund or any underlying fund might use or put money into monetary by-product devices. The worth of models and earnings from them might fall or rise. Investments within the Fund are topic to funding dangers, together with the doable lack of principal quantity invested. It is best to learn the related prospectus (together with the danger warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to put money into the Fund. The data contained herein is probably not copied, reproduced or redistributed with out the specific consent of Nikko AM Asia. Whereas cheap care has been taken to make sure the accuracy of the data as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both specific or implied, and expressly disclaims legal responsibility for any errors or omissions. Info could also be topic to vary with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc. This commercial has not been reviewed by the Financial Authority of Singapore. The efficiency of the ETF’s worth on the Singapore Change Securities Buying and selling Restricted (“SGX-ST”) could also be completely different from the web asset worth per unit of the ETF. The ETF can also be suspended or delisted from the SGX-ST. Itemizing of the models doesn't assure a liquid marketplace for the models. Traders ought to be aware that the ETF differs from a typical unit belief and models might solely be created or redeemed instantly by a taking part seller in massive creation or redemption models. Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.

[ad_2]

Source link