[ad_1]

Jelle Barkema

How involved ought to policymakers be as UK business insolvencies have soared to 60-year highs? This phenomenon has been extensively lined within the media; with media shops attributing the record-breaking numbers to a ‘excellent storm’ of vitality costs, supply-chain disruptions and the price of residing squeeze. Insolvencies are a preferred measure of financial misery as a result of they’ve implications for each the monetary system and the true economic system. For the monetary system, an insolvency usually means collectors will incur losses. Bancrupt corporations should stop buying and selling and lay off employees, which impacts the true economic system. On this weblog publish, I assess the evolution of company insolvencies over time, together with the post-Covid surge to grasp what these document numbers imply for the UK economic system.

What’s an insolvency?

Allow us to begin with the fundamentals – what’s an insolvency? An insolvency happens when an organization can now not meet its debt obligations. These obligations could be financial institution loans, however may embody excellent electrical energy payments or tax liabilities. A director of an organization is obliged to file for insolvency as soon as they realise that their firm can’t pay its money owed. Therefore, most insolvencies are voluntary and instigated by the corporate itself. These insolvencies are known as collectors’ voluntary liquidations (CVLs). In most different instances, the corporate in query has did not abide by this obligation and collectors are compelled to go to court docket and problem a so-called winding-up petition. A choose will then think about the petition, and, if deemed legitimate, will problem a winding-up order. Following both CVL or a winding-up order, a liquidator will take management of the corporate and try to liquidate its belongings – the proceeds of which will probably be used to repay (a few of) the money owed. Within the the rest of the weblog, I’ll discuss with winding-up orders and CVLs as liquidations. Insolvencies, in distinction, will embody all insolvency procedures, even these that don’t end in liquidation (like administrations).

Insolvencies over time

Within the UK, the liquidation fee, which measures the variety of liquidations per 10,000 corporations, is cyclical and has adopted a transparent downward development. Chart 1a beneath exhibits will increase within the liquidation fee (orange line) after the early Nineteen Nineties and 2008 recessions. Overlaying this development with a line depicting Financial institution Fee (blue line) exhibits that the long-term decline within the liquidation fee coincides with a loosening in financing situations. That is according to the probability of a agency going bancrupt being a operate each of the financial atmosphere and the price of their debt. The literature corroborates this: Liu (2006) finds that rates of interest are robust predictors of the liquidation fee within the UK, each within the brief and long run. In distinction, a measure of company dissolutions because the mid-Eighties (Chart 1b, inexperienced line), which tracks all firm exits (whether or not they had debt or not), appears extra stationary and follows actual economic system developments – as measured by actual GDP progress – extra intently. You will need to add that structural modifications to the insolvency regime and/or firm register additionally play an necessary function in figuring out insolvency and dissolution tendencies. For instance, Liu finds that the 1986 Insolvency Act, which launched the administration course of as an alternative choice to liquidation, precipitated a structural downward shift in UK liquidations.

Chart 1a: Company liquidation fee and Financial institution Fee over time

Chart 1b: Inverse actual GDP progress and company dissolution fee

Sources: Financial institution of England, Corporations Home and Insolvency Service.

Be aware: Liquidation fee equals the variety of liquidations per 10,000 corporations. Dissolution fee equals the full variety of dissolutions divided by the full variety of incorporations.

Setting the document straight

So provided that Financial institution Fee was at an all-time low till 2021, how did insolvencies attain an all-time excessive? Some mandatory nuance to this document is that it solely pertains to voluntary insolvencies and, importantly, doesn’t account for the expansion of the corporate register over time. The liquidation fee talked about within the earlier paragraph does issue this in and exhibits the 2021 numbers are nowhere close to their all-time most. Furthermore, insolvencies are solely a fraction of all agency exits (4% in 2022) so by themselves are usually not a dependable gauge of actual economic system threat.

That isn’t to say that each one is effectively. UK corporates are going through a singular collection of shocks with Covid adopted by a pointy enhance in vitality costs. As well as, monetary situations are tightening quicker than they’ve in many years, making refinancing tougher and thus insolvency extra doubtless. Enterprise insolvencies can set off defaults and vital write-offs, which, in idea, might threaten monetary stability if occurring in giant numbers or particularly sectors of the economic system.

Analysing insolvencies at a company-level

To raised perceive the steep enhance in insolvencies and potential monetary stability threat, it’s useful to maneuver away from combination numbers and to take a look at insolvencies at a micro-level. I do that by internet scraping particular person insolvency notices from the Gazette and matching them to firm stability sheets obtained via Bureau van Dijk. Having this matched, firm-level knowledge permits us to analyse patterns throughout insolvency sorts, sectors, age and measurement bands.

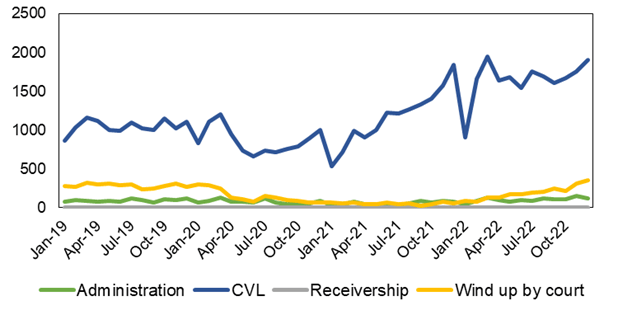

A primary take a look at the information reveals insolvencies are partially making up for misplaced floor throughout the pandemic. Focused laws meant that Covid-related insolvencies had been quickly suspended. The suspension of lawful buying and selling guidelines (focusing on CVLs) was in impact from March 2020 till June 2021 whereas restrictions on winding-up petitions (focusing on obligatory insolvencies) remained in place till March 2022. After these measures had been lifted, insolvencies elevated quickly. Chart 2a beneath demonstrates this clearly: month-to-month voluntary insolvencies (blue line) fell considerably in 2020, however have since moved previous their pre-Covid common, reaching all-time highs. In the meantime obligatory liquidations (yellow line) had been slower to recuperate however at the moment are surpassing 2019 ranges. As of 2022 This fall, the distinction between cumulative insolvencies within the 11 quarters earlier than Covid and the 11 quarters since Covid (the ‘insolvency hole’) has virtually disappeared.

Chart 2a: Enterprise insolvencies by class (variety of insolvencies)

Chart 2b: Enterprise insolvencies by firm measurement (variety of insolvencies)

Sources: Insolvency Service, Gazette and Bureau van Dijk.

Be aware: Micro corporations have <£316,000 in complete belongings, small corporations between £316,000 and £5 million, medium corporations between £5 million and £18 million, and huge corporations over £18 million.

Micro corporations drive the latest surge in insolvencies

Analysing the post-Covid insolvency surge throughout firm measurement bands exhibits that it’s largely pushed by micro corporations – these with lower than £316,000 in belongings (Chart 2b). In 2022, 81% of insolvencies comprised micro corporations, in comparison with 73% in 2019. This uptick can partially be attributed to timing. The insolvency course of tends to be extra drawn out for giant corporations, so it is going to take longer for the affect of Covid and the vitality worth rises to be mirrored within the statistics. However that’s solely a part of the story. Knowledge from responses to the ONS Enterprise Insights and Circumstances Survey (BICS) exhibits that smaller corporations (fewer than 50 staff) think about themselves at a considerably larger threat of insolvency in comparison with their bigger friends (Chart 3a). On the newest wave (ending December 2022), small corporations perceived the danger of insolvency to be twice as excessive. This corresponds with the disproportionate affect of rising vitality costs on small companies (Chart 3b).

Chart 3a: BICS – Enterprise at average/extreme threat of insolvency (share; by variety of staff)

Chart 3b: BICS – Vitality costs as principal concern (share; by variety of staff)

Supply: ONS BICS.

Be aware: Totally different BICS waves is not going to essentially comprise the identical questions, therefore the distinction in x-axes between the 2 charts.

The prevalence of small corporations within the insolvency numbers is reassuring from a monetary stability perspective; the UK banking sector is effectively capitalised and publicity to those firms is just not giant sufficient to current a cloth threat. Furthermore, due to the unprecedented monetary help supplied throughout the pandemic within the type of mortgage schemes, a few of this debt will probably be assured by the federal government. Certainly, close to 60% of all insolvencies between May 2020 and March 2022 were incurred by firms who had also taken out a Bounce Back Loan. That is additionally mirrored within the company-level knowledge with small corporations boasting larger debt ranges previous to insolvency in comparison with pre-Covid (Chart 4). The debt to belongings ratio of younger corporations going bancrupt is 2 occasions larger in 2022 than it was in 2019.

Chart 4: Indebtedness previous to insolvency by measurement (complete debt/complete belongings)

Sources: Gazette and Bureau van Dijk.

Sectoral and age distributions remained unchanged

Monetary threat might additionally come up if insolvencies are concentrated particularly components of the economic system. There isn’t a proof of this to date: the sectoral distribution of insolvencies, for instance, appears to be like similar to 2019 regardless of the heterogenous affect of the pandemic. One clarification for that is that industries significantly laborious hit by the pandemic, like accomodation and meals, are additionally vital beneficiaries of presidency help schemes. The identical goes for the age profile for bancrupt corporations, which has largely remained the identical in comparison with earlier than the pandemic regardless of widespread dissolutions among newly incorporated firms.

A succession of macroeconomic shocks has pushed UK enterprise insolvencies to all-time highs. Insolvencies solely represent a small share of all agency dissolutions so it’s not an correct illustration of actual economic system threat. Moreover, nearly all of corporations going bancrupt are small whereas exposures are partially government-guaranteed, so I can’t conclude they represent an imminent monetary stability problem both. Nevertheless, this will change as macroeconomic challenges proceed to build up, authorities mortgage funds change into due, monetary situations tighten, and bigger, extra advanced insolvencies begin to crystallise. That is positively an area price watching.

Jelle Barkema works within the Financial institution’s Monetary Stability Technique and Danger Division.

If you wish to get in contact, please e mail us at [email protected] or depart a remark beneath.

Comments will solely seem as soon as permitted by a moderator, and are solely revealed the place a full title is provided. Financial institution Underground is a weblog for Financial institution of England workers to share views that problem – or help – prevailing coverage orthodoxies. The views expressed listed below are these of the authors, and are usually not essentially these of the Financial institution of England, or its coverage committees.

Picture supply: Shutterstock.

[ad_2]

Source link