[ad_1]

There’s a variety of buzz about next-gen funds rails globally, however the place does North America stand in terms of adopting these new choices? Accenture’s latest client funds analysis—which you’ll discover in our report, Payments gets personal: strategies to stay relevant—revealed that North Individuals have a transparent desire for cost strategies they belief, from suppliers they know. Greater than 3,000 customers in the US and Canada had been surveyed, together with one other 13,000 customers throughout different areas, to search out out what cost strategies they’re at present utilizing, and what they’re in search of from funds suppliers.

Right here’s what we discovered.

Playing cards and money are nonetheless king

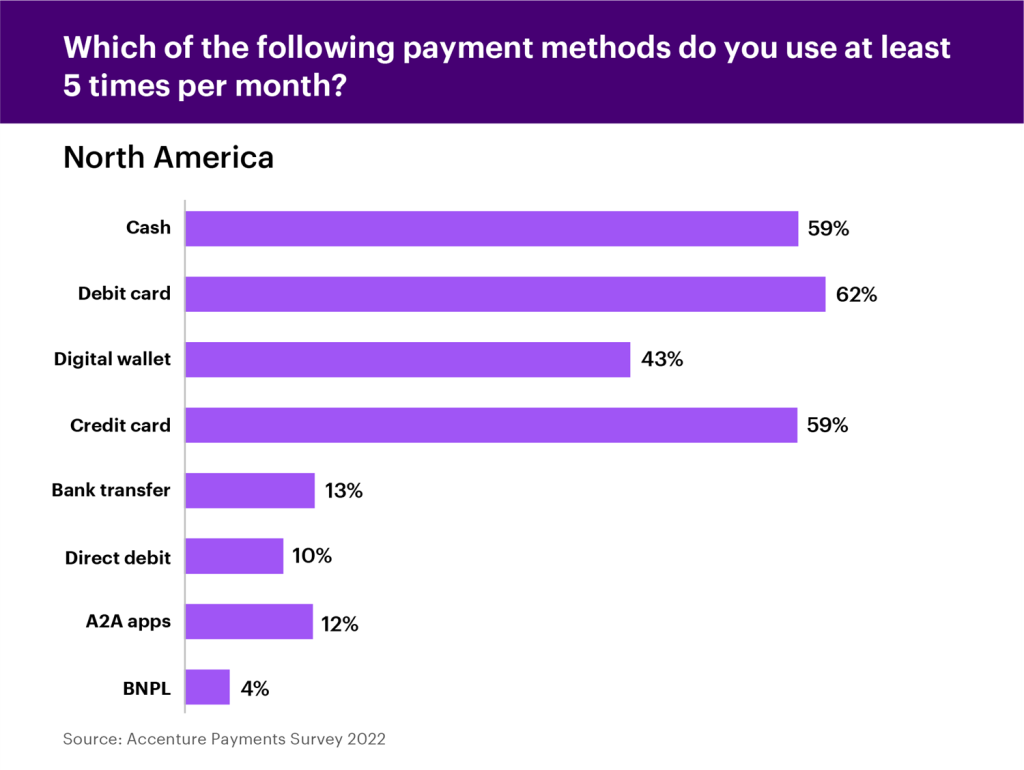

North Individuals proceed to make use of debit and bank cards, in addition to money, way more usually than another cost strategies. Money and bank cards are used no less than 5 instances monthly by 59% of our survey respondents, and 62% use debit playing cards that usually.

This can be partially as a result of the cardboard networks within the area are properly established and have largely met prospects’ wants. Card suppliers have continued to innovate by facilitating fast and contactless “faucet” funds and introducing BNPL-style installments, for instance. In different areas, the place playing cards should not in broad use, digital wallets, super-apps and different new applied sciences fill a necessity within the funds area. In North America, these choices are competing with a trusted card cost system and attempting to beat client inertia.

Nevertheless, survey respondents are additionally in search of comfort, velocity and management, which can cause them to check out next-gen improvements like account-to-account (A2A) and even machine-to-machine (M2M) cost methods. However customers might want to imagine these transactions are safe and dependable earlier than embracing them. Subsequent-gen methods that carry the branding of established banks or credit score suppliers may need a better time gaining the arrogance of skeptical prospects.

A matter of belief

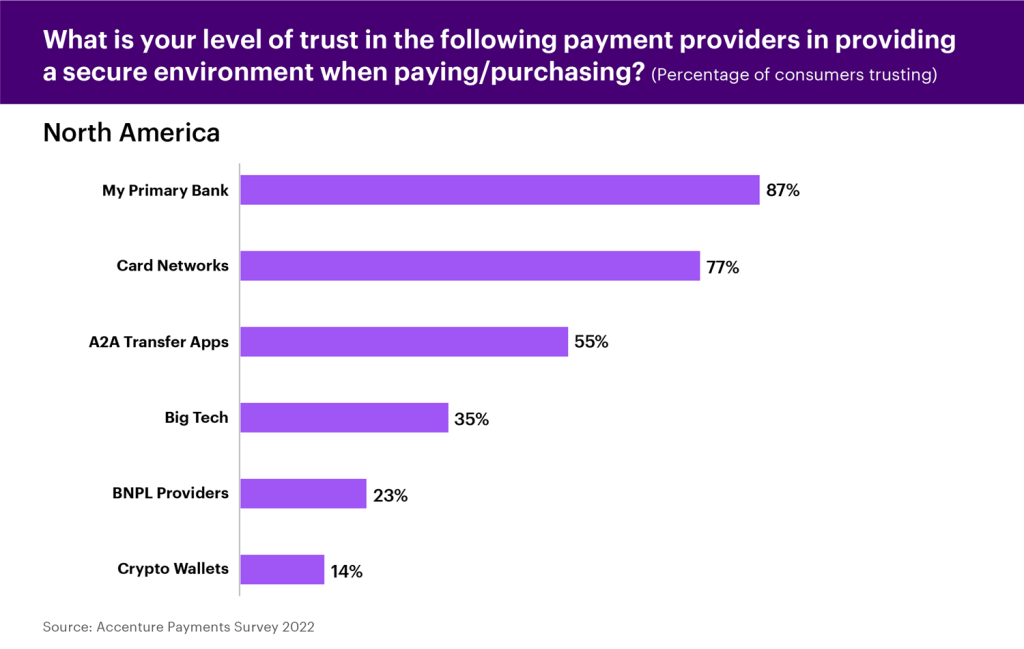

In our survey, 77% of North American respondents stated they belief their card networks to safe their transactions, and a whopping 87% belief their main financial institution. Alternatively, solely 35% belief huge tech firms with their funds, whereas 21% belief BNPL suppliers. The much-hyped rise of crypto has been shaken by latest headlines about mismanagement and potential fraud. Because of this uncertainty and instability, a mere 14% of North American respondents belief crypto wallets as a cost technique.

However banks should not immune to those issues; the latest US financial institution seizures are prone to make prospects more and more cautious about who handles their cash. This belief hole might account for a lot of the hesitation amongst North Individuals to undertake next-gen cost strategies.

This belief situation may also assist predict how super-apps created by huge tech firms may very well be obtained within the North American market. With customers’ strong belief of their banks, it is sensible for super-apps on this market to accomplice with trusted financial institution manufacturers to win the arrogance of customers.

This concern additionally impacts client opinions concerning the metaverse (which at this stage is basically managed by huge tech). Globally, 69% of respondents stated they had been involved about sharing private data for cost within the metaverse—but 50% stated they might be extra snug with it if their main financial institution facilitated the transaction. The chance for banks to make use of buyer belief to their benefit stays sturdy, so long as the excessive stage of belief in banks is maintained.

Responding to client wants

Rising costs and rates of interest are making it tougher for customers to remain in charge of their spending and debt. Options that give them extra management and a greater overview of their monetary state of affairs are very engaging on this local weather. North American customers are in search of funds suppliers that may assist them keep on observe with their funds whereas making funds fast and handy. Listed here are some options which can be possible to attract them in:

BNPL: Purchase now, pay later choices provided by trusted suppliers might give customers a technique to unfold out the funds for bigger purchases with out paying curiosity. As this sector develops, customers will likely be in search of suppliers who can present them the whole quantity of debt they’ve taken on and all of the funds they should make, quite than having to compile data from a number of sources. Banks that have already got a powerful overview of their prospects’ monetary state of affairs will likely be in a superb place to supply this.

Actual time: Controlling the timing of funds may assist customers who wish to at all times know the place they stand with their funds. Customers will likely be in search of cost methods that work in actual time and supply immediate updates to dashboards and different account data.

Interoperability and reliability: Customers get annoyed when their cost technique of alternative isn’t accessible, takes too lengthy or has a low restrict hooked up to it. In keeping with our survey, customers need the power to hyperlink the playing cards they already must a digital pockets. Additionally they need their most popular cost technique to be accessible in any respect retailers and so they anticipate dependable cost networks that gained’t fail once they’re wanted or that decline bigger purchases. Principally, they need to have the ability to buy no matter they need, every time they need, nonetheless they need.

To study extra about focusing on your funds providing for at the moment’s customers, contact me here. To study extra about client traits and opinions throughout the funds world, learn the total report, Funds Will get Private:

Disclaimer: This content material is supplied for basic data functions and isn’t supposed for use instead of session with our skilled advisors. Copyright© 2023 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]

Source link