[ad_1]

Until you’ve been residing beneath a rock for the previous few years, you’re conscious that international commerce and provide chains have been going through a collection of challenges, from lockdowns to inflation, from geopolitical upheaval to the transformational energy of generative AI. Are these short-term challenges for the trade, or is there a necessity for everlasting evolution to adapt to a brand new actuality? And what function ought to banks be taking part in to maintain international commerce shifting effectively?

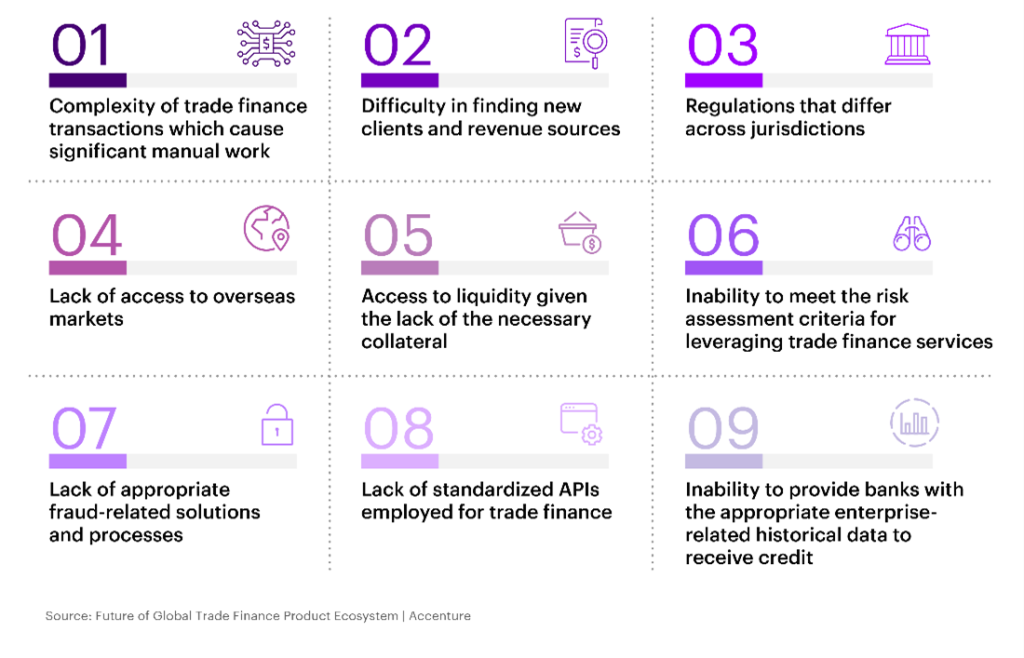

Accenture undertook analysis on commerce finance by surveying 675 international commerce and provide chain finance shoppers. Our report, “Find Your Competitive Advantage in Trade Finance,” particulars the breadth of challenges which are inflicting companies—particularly newer and smaller companies—to search for trendy, environment friendly financing options from banks, and to show to fintechs the place their banks are falling brief. Banks nonetheless play a dominant function in commerce and provide chain finance. Addressing right now’s challenges in revolutionary and focused methods will assist maintain this dominance and maintain prospects happy.

Prime ache factors in commerce and provide chain finance

Final yr, I participated in a panel dialogue on the Global Trade Review convention in New York, the place we talked about right now’s key challenges, what the way forward for commerce would possibly seem like and what the trade wants from financers and banks. Listed below are a few of my ideas on the actions that might make the most important distinction for banks on this space.

Digitalization and automation

Once we surveyed companies about their enterprise practices, solely 16% of respondents mentioned that their processes are absolutely digital. Guide paperwork is a serious ache level, and international commerce is way behind most industries in relation to digitalizing their processes.

The complexity of commerce finance transactions has made them troublesome to automate, however as know-how turns into extra refined, options are rising to remove a number of the handbook work—and the danger that comes together with it—from commerce finance. Cloud, blockchain and synthetic intelligence are among the many instruments which are starting to allow banks to scale operations and remodel their commerce finance enterprise. Actually, our current analysis reveals that the banking industry has the highest potential for transformation from Generative AI.

As Open Finance and Open Banking proceed to develop in additional markets, and straight-forward processing will be attainable, together with higher use of a number of information sources.

Ecosystem partnerships

9 out of ten companies in our survey are prepared to contemplate new commerce finance services. Two-thirds of them mentioned they’re planning to alter their roster of companions within the subsequent 12 months and 76% mentioned they may change the variety of companions they work with.

This would possibly sound like dangerous information for banks, however these similar companies have been overwhelmingly happy with their banks: 82% mentioned their expectations have been both being met or exceeded.

62% of the companies surveyed use greater than 5 banks for his or her commerce and provide chain financing wants.

– Accenture analysis

The takeaway is that banks ought to discover it simpler to retain prospects in the event that they develop their partnerships all through the commerce finance ecosystem. Attempting to be all the pieces to everyone seems to be a really costly proposition, however discovering revolutionary and reliable companions that provide merchandise the financial institution doesn’t is a brilliant technique to develop your companies with out an enormous upfront funding. To make these ecosystems work effectively, the trade and its monetary companions might want to standardize APIs to make techniques suitable wherever attainable.

Innovation and sustainability

Sustainable enterprise practices have gotten more and more necessary to companies of all sizes, banks included. Nearly 80% of the debtors we surveyed have at the very least one environmental coverage in place that applies throughout their provide chains. It might appear unlikely that banking is on the radar for firms fearful about their carbon footprint from transport items around the globe, however extra firms are each hyperlink within the chain—together with their monetary companions. Actually, more than two-thirds of borrowers said that sustainable financing is very important to their business.

One problem that banks will help with is offering sturdy information to trace the sustainability of their monetary options. As extra processes go digital, information needs to be simpler to gather and analyze. Banks are already creating, and partnering with fintechs to implement, revolutionary merchandise that reward environmentally pleasant practices with most well-liked charges and different advantages.

And that’s not all…

Commerce finance is going through a lot disruption proper now that I’ve solely been in a position to contact on a couple of elements on this put up. For extra, learn our full report, Find your competitive advantage in trade finance. And for extra on our view of the present financial setting and the way it’s prone to unfold, learn our Commercial Banking Top Trends for 2023 report. In it, we take a look at the six tendencies we consider could have the best affect on business banking within the yr ahead.

Thanks to Steven M. Nocka, Venkat Ramaswamy, and Kevin Torno for his or her contributions to this text.

[ad_2]

Source link