[ad_1]

A number of daring banks are starting to see the advantages of working collectively to tame provide chain emissions. They’re sharing concepts about how they will extra precisely measure these Scope 3 emissions which might be generated by their suppliers. And, most vital, they’re exploring methods to cut back them. The discussions contain a number of large retail banks they usually’re being co-ordinated by Accenture.

If all goes effectively, the talks will produce suggestions earlier than the top of this yr that may assist banks throughout the UK curb emissions from their provide chains. The suggestions might present organisations such because the Carbon Disclosure Project (CDP), the Greenhouse Gas Protocol and the Net Zero Banking Alliance with priceless views on how the banking business in lots of international locations may classify, baseline and finally cut back such emissions.

“Cuts in provide chain emissions within the banking business would probably set off reductions in different sectors.”

Motion to assist banks deal with emissions by their suppliers is significant. As mentioned in our Rising to the Challenge of Net Zero Banking report, Scope 3 emissions are by far the most important supply of financial institution emissions—greater than 95%. And a piece of those are “upstream” emissions produced by financial institution suppliers and contractors. Banks are more and more addressing “downstream” emissions, generated by corporations of their lending and funding portfolios. However they’ve tended to carry again on tackling provide chain emissions.

By stepping up efforts to curb greenhouse gasoline emissions generated by this explicit supply, banks might advance their quest to develop into sustainable organisations. They’d transfer nearer to decreasing their carbon footprint to web zero. Larger cooperation with suppliers and contractors may also allow banks to share value financial savings and to capitalise on new enterprise alternatives.

Furthermore, cuts in provide chain emissions within the banking business would probably set off reductions in different sectors and assist the worldwide shift to sustainability. Our analysis reveals that supply chains across all industries produce 60% of global greenhouse gases.

Why have many banks been reluctant to deal with their provide chain emissions?

The primary large problem banks encounter when attempting to deliver down their provider emissions is figuring out the huge variety of companies inside their provide chains. Then, they face the advanced downside of measuring emissions generated by these suppliers.

“If banks maintain inaccurate details about their provide chains, they’re extra uncovered to

And not using a true image of all the businesses that function of their provide chains, banks can be unable to accurately measure emissions from these sources, not to mention begin decreasing them. They’d probably battle to allocate sources successfully and will miss alternatives to raised align their procurement operations with the wants of their suppliers. Moreover, banks that maintain inaccurate details about their provide chains can be extra uncovered to danger.

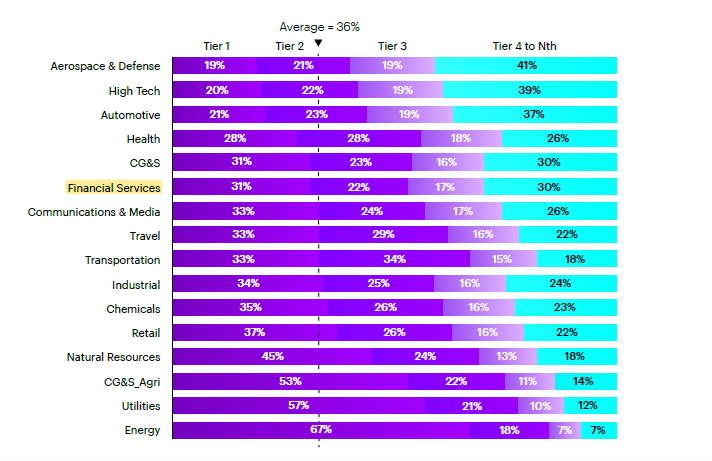

We discovered that little more than 30% of the emissions generated by the provision chains of economic companies companies was attributable to their direct (tier 1) suppliers. The rest was produced by subcontractors (tier 2), suppliers to subcontractors (tier 3) and corporations additional down the provision chain (tier 4 – Nth). An astonishing 30% of the emissions generated by monetary companies provide chains is produced by corporations in tier 4 or past.

Banks and different monetary companies corporations have to look far down their provide chains when attempting to get a repair on their output of emissions.

Distribution of upstream emissions by tier provider

Click on/faucet picture to enlarge.

Usually the “scorching spots” that generate an enormous portion of a financial institution’s provide chain emissions are corporations which might be effectively past the establishment’s conventional enterprise boundaries. Typically they’re in a distinct nation. To considerably curb their provide chain emissions, banks have to forge nearer ties inside a community of suppliers that reaches effectively previous their rapid product and repair suppliers. With out such relationships, they’ll probably battle to encourage suppliers to curtail their emissions.

Greater than 60% of the CEOs we surveyed with the United Nations Global Compact report that difficulties in measuring environmental, sustainable and governance (ESG) information throughout their provide chains are an impediment to advancing sustainability of their business. Whereas 55% of CEOs say their corporations have began measuring Scope 3 emissions, solely 16% state that such monitoring is at an “superior stage”.

The latest talks amongst UK banks about how greatest to curb provide chain emissions have highlighted potential enhancements within the methods these emissions are measured, reported and curtailed. Points addressed within the discussions embrace:

- Aligning a typical set of classes for the calculation of provide chain emissions.

- Shifting to supplier-specific calculation methodologies.

- Simplifying the gathering and submission of emissions information from suppliers and contractors.

- Embedding ESG necessities into the banks’ sourcing and contracting actions.

- Incentivising suppliers to enhance their sustainability.

- Aligning the sustainability assist, schooling and accreditation given to suppliers.

The suggestions which might be as a result of emerge from these discussions will equip banks to eventually confront and tame provider emissions.

You’ll be able to be taught extra in regards to the interbank discussions on provide chain emissions by contacting my colleague, Benjamin Oswin. Our Rising to the Challenge of Net Zero Banking report supplies priceless insights into how banks can speed up their progress in the direction of changing into sustainable organisations. You too can contact me. I’m eager to listen to from you.

Disclaimer: This content material is supplied for common data functions and isn’t meant for use instead of session with our skilled advisors. This doc might consult with marks owned by third events. All such third-party marks are the property of their respective homeowners. No sponsorship, endorsement or approval of this content material by the homeowners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]

Source link

%20(1).png)