[ad_1]

Technical debt is a well known challenge within the software program world, however it’s turning into more and more high of thoughts for banks—notably banks endeavor a cloud transformation. Deciding what to do about tech debt normally includes an evaluation of the tradeoffs between totally different approaches.

What’s tech debt?

Tech debt happens when both:

1. Software program merchandise are launched earlier than they’re absolutely debugged and do every part they have been supposed to do, with the intention of getting them into operation rapidly and fixing the minor issues later; or

2. Software program turns into outdated and doesn’t work nicely with extra superior programs, so “fast and soiled” workarounds are applied to keep away from ranging from scratch with a more recent model. Software program that isn’t actively managed can rapidly accrue this sort of debt.

Evaluating tech debt with monetary debt, you’ll be able to think about the defective or outdated code because the principal that must be repaid finally. The tech debt is the curiosity—the rising value of working round and patching up the outdated code—that retains including up as you delay the compensation. The longer you wait to repay your debt, the extra you find yourself paying ultimately.

Banks know that they should replace their know-how recurrently, however as a result of they want to do that with out taking their system offline, it’s a complicated course of and the prices could be enormous. A serious improve prices not simply cash however workers, time and focus—all of that are in brief provide in lots of banks. Because of this, they have a tendency to place off these vital updates for so long as potential. Many banks would slightly prioritize the event of latest merchandise that might generate income rapidly, slightly than spend the money and time to repair the problems inflicting tech debt. Within the meantime, they both make do with their outdated programs or patch them up utilizing momentary options.

The price of tech debt

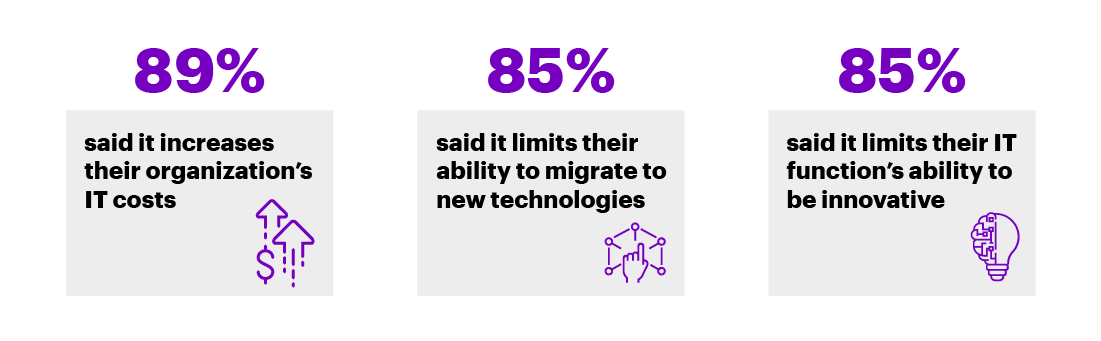

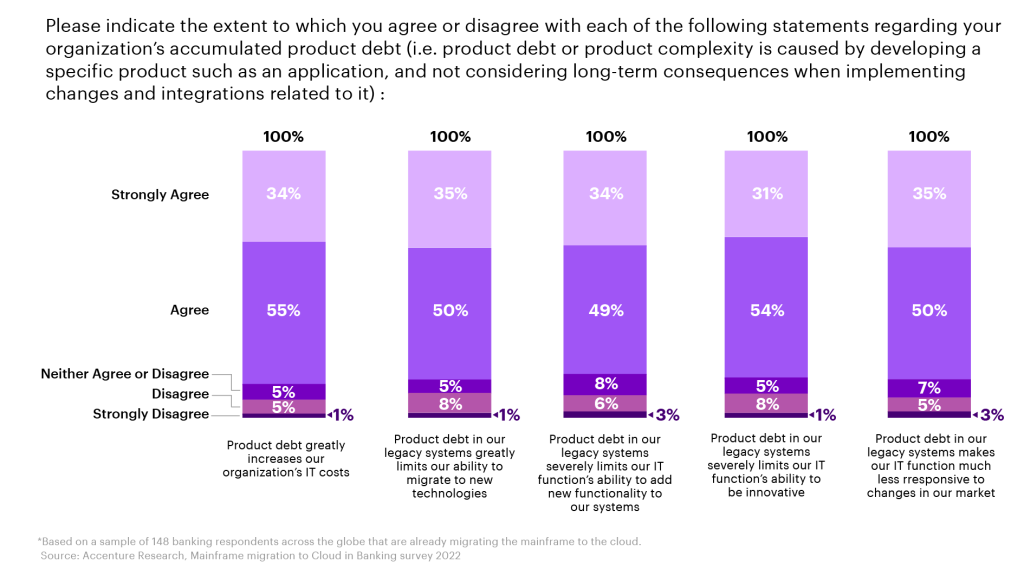

We surveyed 148 banks which are migrating to the cloud, about how product debt / tech debt impacts them.

What occurs when banks accumulate tech debt?

The longer tech debt is left to build up, the costlier and sophisticated it turns into to right. Additionally, as tech debt spreads all through varied programs and enterprise items, the enterprise turns into much less aggressive, slower, and extra susceptible to safety dangers.

Among the fundamental issues than can come up with tech debt embrace:

Inhibited innovation and new product improvement: Tech debt leaves the financial institution’s builders with out the most recent instruments to create cutting-edge merchandise. It additionally slows the product cycle as a result of legacy code is prone to create bugs and make sturdy testing tougher.

Buyer dissatisfaction: When tech debt impacts customer-facing merchandise like cellular banking apps, clients could also be unable to finish their transactions or may discover the app too sluggish. Tech debt within the again finish can even trigger buyer frustration if it slows the financial institution’s processing of credit score purposes and different time-sensitive operations.

Ballooning prices: When the prices of sustaining software program usually are not recurrently budgeted for, the result’s a a lot bigger one-time expense when all of this work should be executed inside one 12 months’s funds, maybe with nice urgency.

Safety dangers: Banks know that fixed vigilance is required to maintain their information and programs safe in opposition to cyber assaults. Code that’s patched incrementally over time (or worse—ignored) can depart a financial institution extra susceptible to assault.

Expertise loss: Banks with important tech debt create a more difficult work setting, each inside their DevOps staff and all through the financial institution. Builders are much less prone to be drawn to a office with outdated and buggy software program, as a result of they are going to be spending extra of their time fixing issues than engaged on thrilling new initiatives. In different components of the financial institution, poorly functioning programs are prone to frustrate workers and speed up burnout and turnover.

Can banks use AI to battle tech debt?

“The actual holy grail in banking will probably be utilizing generative AI to radically scale back the price of programming whereas dramatically enhancing the velocity of improvement, testing and documenting code.”

– Mike Abbott, Accenture International Head of Banking

Generative AI is shaking up many enterprise features, and software program isn’t any exception. In 2021, GitHub Copilot was launched as an AI-assisted instrument for writing code. Amazon has since adopted go well with with its personal instrument, CodeWhisperer. Utilizing these instruments, some improvement groups have considerably diminished the time it takes to generate new code by having AI generate the primary draft. In a single GitHub experiment, coders utilizing Copilot accomplished a programming activity round 55% quicker than coders with out Copilot. Whereas packages will nonetheless have to be reviewed, debugged and tweaked to suit the person’s precise necessities, the up-front time financial savings might scale back the funding wanted to deal with tech debt and speed up timelines. Nonetheless, questions stay about who owns AI-generated code, and about legal responsibility associated to errors in it that have an effect on the top person. Gen AI coding instruments could be a cheap method to get by a considerable amount of work, however as with all new software program, the ensuing code ought to at all times be fastidiously reviewed and examined earlier than implementation.

What can banks do about their tech debt?

Many banks are actually going through important ranges of tech debt, which have develop into more and more obvious as these banks orchestrate their plans to maneuver operations into the cloud. Banks are typically their choices as a tradeoff between two priorities:

1. Prioritizing modernization by settling their tech debt as quickly as potential in order that they don’t deliver it into their new cloud infrastructure.

2. Prioritizing velocity to the cloud by briefly carrying their tech debt into the cloud in order that it doesn’t decelerate their transfer.

Let’s take a look at the advantages and downsides of every strategy.

Prioritizing modernization: advantages

- Tech debt is cleared away completely in order that the financial institution can begin with a clear slate.

- The financial institution positive factors the instruments to be extra progressive and get cutting-edge merchandise to market extra rapidly.

- Banks can construct a greater protection in opposition to safety breaches as a result of legacy software program is eradicated.

- Prime expertise could also be drawn to the financial institution as a result of they are going to be working in a debt-free cloud-first setting that helps extra agility and innovation.

Prioritizing modernization: drawbacks

- Clearing away tech debt can considerably sluggish the progress of a cloud migration as a result of extra work must be executed up entrance.

- Modernizing every part without delay will enhance the preliminary expense of cloud migration.

- This strategy might enhance the quantity of disruption, or perceived disruption, in the course of the migration as a result of legacy programs will disappear. Coaching and up-skilling of workers will probably be extra crucial.

Prioritizing velocity: advantages

- The financial institution can understand the worth and value financial savings of cloud extra rapidly.

- Cloud-only purposes could be applied sooner.

- The pliability and scalability of cloud will probably be obtainable to the financial institution because it tackles tech debt.

- Present workers may have extra time to adapt and up-skill.

Prioritizing velocity: drawbacks

- Tech debt continues to build up for longer, growing the general value of addressing it.

- The financial institution might migrate problematic software program, comparable to packages with safety vulnerabilities, into its cloud-based programs.

- Older software program and purposes might not work as nicely throughout the new cloud framework.

What strategy ought to your financial institution take?

There is no such thing as a one-size-fits-all resolution to tech debt. As a substitute, it’s crucial to grasp the tradeoffs and the way they have an effect on the financial institution’s enterprise targets. Tech debt conversations needs to be a part of any cloud technique planning.

We work with banks to find out the extent and value of their tech debt, which features could be most simply up to date and moved to the cloud, and easy methods to resolve their remaining tech debt to allow them to meet their targets for cloud migration.

To debate your financial institution’s tech debt and easy methods to handle it throughout your cloud migration, contact me. To study extra concerning the many elements to contemplate throughout your financial institution’s cloud journey, you should definitely maintain studying our newest analysis within the Banking Cloud Altimeter.

Disclaimer: This content material is supplied for normal info functions and isn’t supposed for use rather than session with our skilled advisors. This doc might check with marks owned by third events. All such third-party marks are the property of their respective homeowners. No sponsorship, endorsement or approval of this content material by the homeowners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]

Source link