[ad_1]

Properly over a decade in the past, I used to be lucky sufficient to land a banking management position in business and company banking operations. I instantly seen two issues which have caught with me ever since.

First, the individuals in operations are a number of the greatest and most well-intentioned, albeit typically missed, workers within the agency. After we discuss placing shoppers first, within the again workplace it’s a mantra and a significant supply of motivation for the groups finishing a number of the extra routine operational duties important to the day-to-day work of the financial institution.

Secondly, many of the work in operations, together with the expertise profile, is geared to finishing operational duties outlined inside a transparent coverage and process handbook. Importantly, as lower-complexity work was automated and the remaining duties turned extra advanced, operations groups had a tougher time successfully finishing these duties.

Each of those factors have solely change into extra vital as automation, now additional bolstered by the current creation of generative AI, takes on extra advanced work, leaving solely essentially the most difficult duties for operations workers to finish. This, coupled with the regular lack of abilities because of an getting older workforce, exposes operations to appreciable danger.

So, what ought to a future-ready operations group seem like? How will operations leaders upskill their workers to handle a higher-complexity workload? What about these workers who can’t make the leap? Ought to extra of our future operations leaders come from the entrance and center workplaces? And the way will operations groups cope with an unprecedented stage of change administration and coaching?

My colleague Colette Prior joins me for this have a look at Business Banking Operations: Tech and expertise transformations as a strategic alternative.

As we mentioned in our Commercial Banking Top Trends in 2023 report, the demand for expertise is rising as one of many main forces shaping the banking trade this 12 months. A scarcity of the higher-complexity abilities wanted to fill operational roles was evident in business banks even earlier than the pandemic. Since then, the Nice Resignation and a wave of early retirements have mixed to create much more openings. In the meantime, business banks proceed to wrestle to draw younger expertise, and with unemployment charges traditionally low, the expertise hole might change into a disaster.

In some methods, that disaster has already arrived. Our analysis exhibits that some business banks have skilled attrition charges amongst operations employees of greater than 50% over the previous two years.

We’ve heard studies of employees shortages and coaching points inside operations contributing to an increase in transaction errors and reporting errors. Inefficiencies within the again workplace run the danger of eroding belief and customer support—irritating for groups and management alike. Workforce challenges are even draining the profitability of some banks. A number of corporations are having to steer income into unhealthy debt reserves to cowl doable operations missteps.

AI and generative AI will remodel the position of operations

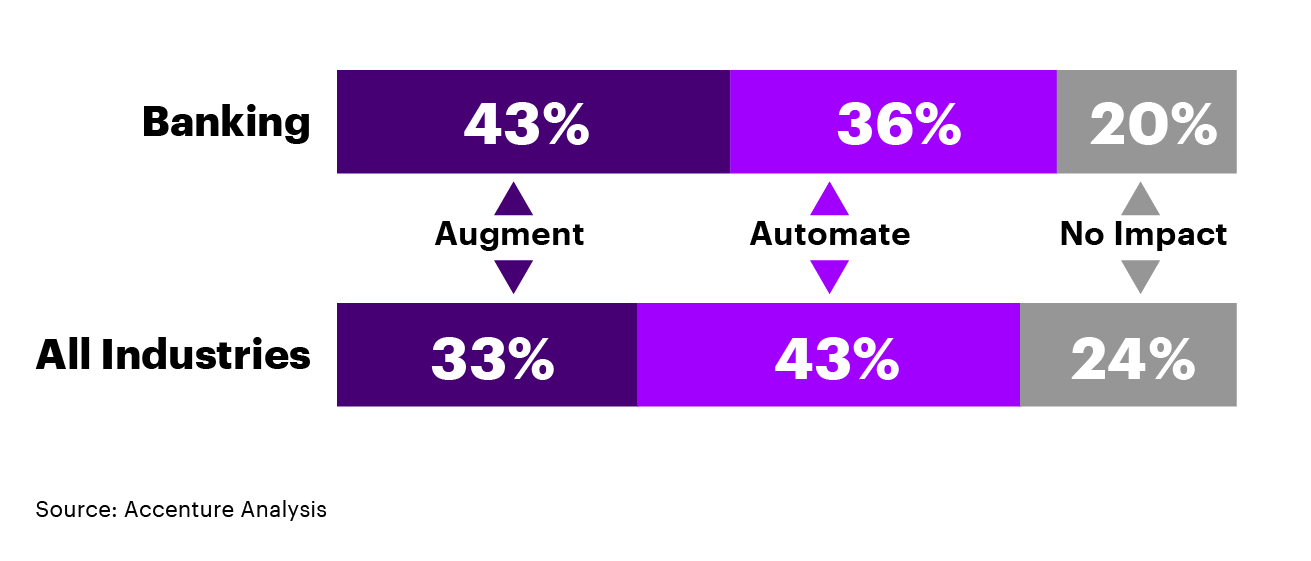

Analysis exhibits that AI’s affect on banking is predicted to be very vital, with greater than half of workers’ present duties (by time spent) displaying excessive potential for automation.

Determine 1. The share of US staff’ duties that could possibly be augmented or automated by generative AI.

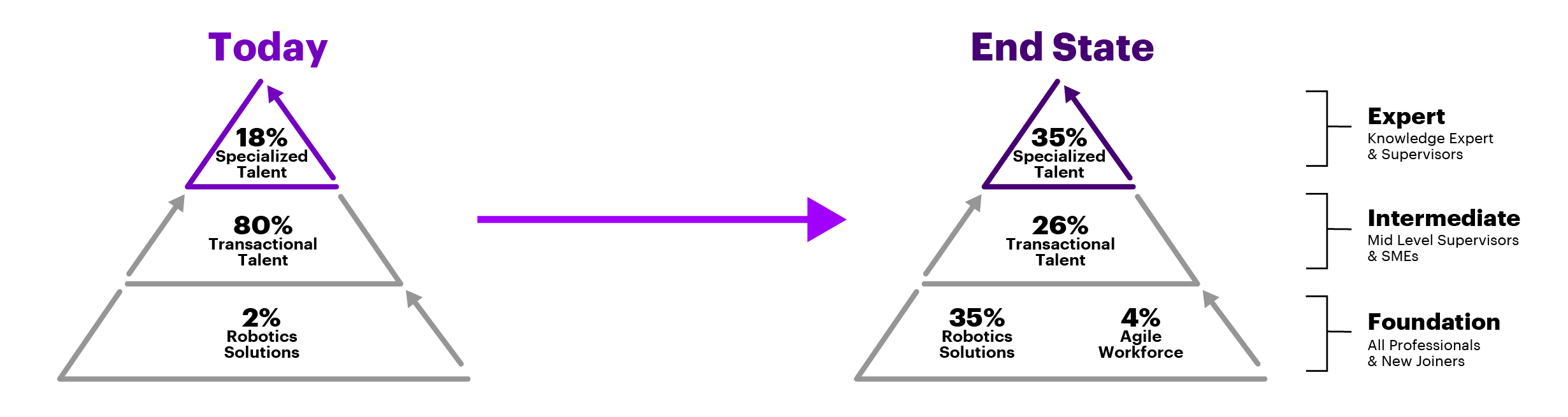

As each AI and generative AI fundamentally shifts the way companies address manual operations, and as a lot of our valued workers contemplate retirement, banks will want a deliberate, complete, and very human expertise technique to construct operations groups which might be match to objective. The full affect on operations of latest automation applied sciences and genAI will possible unfold over the subsequent few years, however the transformation of the operations workforce should begin now. The way forward for operations expertise will proceed to shift from tactical to value-add as robotic options allow the automation of transactional actions.

Determine 2. How the composition of the banking operations perform is more likely to change.

Some banks are outsourcing all or a part of business and company operations to assist simplify the transition.

For example, one giant US-based financial institution has outsourced almost all of its middle- and back-office business lending capabilities to Accenture. The financial institution’s targets in doing so have been to scale back prices, and in addition to make the operation future-ready. The financial institution labored with us on the onset to simplify its working mannequin and additional centralize essentially the most advanced duties, leaving these with the financial institution. Then it partnered with us to drive ongoing automation and effectivity, which we’ve been doing for the previous 5 years.

This has led to a mannequin the place financial institution workers are rewarded with higher-complexity, value-adding roles and each the financial institution and Accenture are collectively accountable for driving ongoing automation and effectivity. When undertaken mindfully and strategically, versatile managed companies will help a financial institution de-risk its attrition drawback and enhance its potential to maintain up with demand for higher-skilled staff.

For different banks, retaining their mortgage operations is the smarter play.

For these banks, we advocate a three-part expertise technique:

1. Take a contemporary strategy to accessing expertise from inside and outdoors the group. To draw and preserve expert employees, banks should bolster the work atmosphere and profession alternatives they provide new hires. Align recruitment and improvement with the group’s long-term human capital necessities. And don’t neglect about reskilling your present workforce, together with groups from exterior operations. Look to the center and entrance workplaces to boost operations expertise. By bringing in middle-office workers, and even combining business and company middle-office and back-office operations, banks can create the synergy and suppleness wanted to pivot to a smaller but extra expert operational workforce. Bringing front- and middle-office expertise—in any respect ranges—into operations drives shared accountability for outcomes, improves the understanding of processes throughout the broader group, builds power for sooner transformation and will increase profession path choices.

2. Apply clever expertise to assist deal with your individuals. Automated processing techniques relieve operations employees of repetitive duties and free them to interact in additional advanced, high-value actions that present higher work satisfaction. It’s very important that staff obtain ongoing coaching to maintain tempo with upgrades and advances in these techniques. Middleware functions incorporating AI can improve communication and collaboration throughout groups and pace up workflows. Importantly, operations groups needs to be establishing data-driven automation factories staffed with consultants who perceive the instruments accessible and the distinctive processes throughout the operation.

3. Broaden staff’ capabilities and abilities by retraining and profession improvement. Enhance morale, enhance worker satisfaction and scale back churn with coaching alternatives. Empower back-office staff to increase their abilities and supply significant alternatives to use their capabilities in different areas of the enterprise. Complete succession planning will assist nurture and retain expertise and offset the results of the present wave of retirement.

Banks that retain their mortgage operations will profit from dedicating appreciable assets and management oversight to the transformation of their mortgage operations workforce.

The rewards for banks that implement this three-part technique could be substantial. Banks with strong and environment friendly operations, staffed by expert and motivated staff who’re supported by superior applied sciences, will enhance customer support, improve profitability and curtail their publicity to danger.

Whatever the strategy banks take, one factor is for certain: operations would require a smaller and better-skilled expertise pool sooner or later. It is going to be onerous, and also you should be trustworthy, and you could convey your group together with you. Planning for this now—and in a really human means—is crucial to main the group by its transformation journey.

In the event you’d like to speak about your financial institution’s operations expertise technique, please contact both of us: Jared or Collette.

To study extra in regards to the tendencies we anticipate to form our trade, learn our Commercial Banking Top Trends in 2023.

[ad_2]

Source link