[ad_1]

DollarBreak is reader-supported, whenever you join via hyperlinks on this submit, we might obtain compensation. Disclosure.

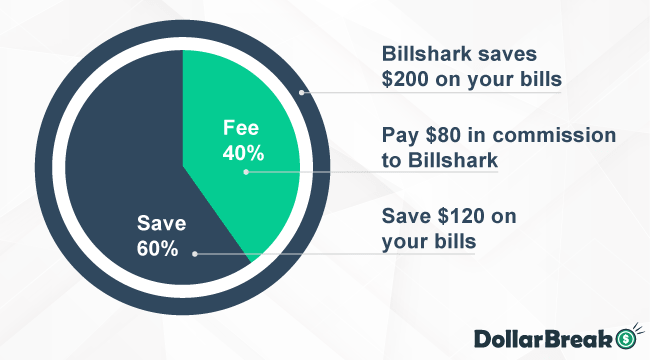

Billshark lets you get your funds in verify. This service might help you to get rid of pointless spending and undesirable subscriptions, saving a median of $300 to $500. It may well additionally negotiate higher charges in your payments. Though there’s a 40% fee, if Billshark is unable to save lots of you any cash, you’ll pay no charges.

Execs

- No Financial savings, no fee

- 90% success charge

- Obtain $10 per referral

- Saving on common $300 per 12 months

Cons

- Must add payments

- Hefty 40% fee

Leap to: Full Review

Evaluate to Different Cash Saving Apps

Swagbucks

18 methods to earn cash – surveys, coupons, cashbacks + $5 join bonus

As much as 10% cashback from shops – Walmart, Amazon, Greatest Purchase, JCPenney

Most members can earn an additional $50 – $200 a month utilizing Swagbucks

Tada

Get $10 money again bonus after spending $25 with any of 1000+ manufacturers

Simple to stand up to twenty% money again – merely scan your receipt and add it

Declare your money again by PayPal or from over 80+ reward card choices

How Does Billshark Work?

Most individuals don’t monitor their month-to-month payments, so they could not even concentrate on the place they’re spending an excessive amount of. Billshark is a platform that may show you how to to get financial savings in your payments and subscriptions. The corporate can negotiate and cancel bills in your behalf.

Whereas it’s potential to barter together with your suppliers your self, this generally is a time consuming and irritating course of. Billshark takes all the effort out of negotiating financial savings in your payments.

Once you open a Billshark account, you’ll be able to obtain the cellular app. You may then use your cellular gadget to take photos of your payments and add them to the platform. Billshark will ask you to verify the components of the invoice that you just give permission for them to barter.

After Billshark has all the mandatory data, together with a few of your private particulars, they are going to begin to negotiate in your behalf. You’ll obtain a telephone name or e mail to let you understand how a lot it can save you and when the financial savings will go into impact. Billshark may also generate an bill to point out its charges.

Find out how to Decrease Payments with Billshark?

Negotiate Payments

Cancel Subscriptions

Insurance coverage

Is Billshark Protected?

For the reason that firm is coping with your private monetary data, you have to really feel assured that the platform is protected. Billshark appreciates this and goals to reassure all potential customers that its platform is protected.

Billshark employs normal 256 bit web site encryption. It additionally has safety finest practices to guard your knowledge shared together with your payments. Billshark staff have restricted entry to your knowledge and the corporate doesn’t permit any third social gathering entry to private data.

How A lot Does Billshark Price?

Billshark expenses a 40% fee on any financial savings it will possibly make for you. So, if Billshark can prevent $200 in your payments, you’ll be able to count on to pay $80 in fee. Nevertheless, you’ll nonetheless make financial savings of $120.

Whereas this may occasionally appear steep, the Billshark charges are solely relevant for the related contract interval. So, the fee will solely apply for the primary 12 months. You gained’t proceed to pay fee for lifetime financial savings together with your service supplier.

Usually, you’ll have to pay the Billshark fee as soon as the financial savings are confirmed. However, within the case that Billshark can prevent a big sum, you’ll be able to unfold the fee over a two to 6 month interval. This attracts a one time charge of $9.

Find out how to Open Account with Billshark?

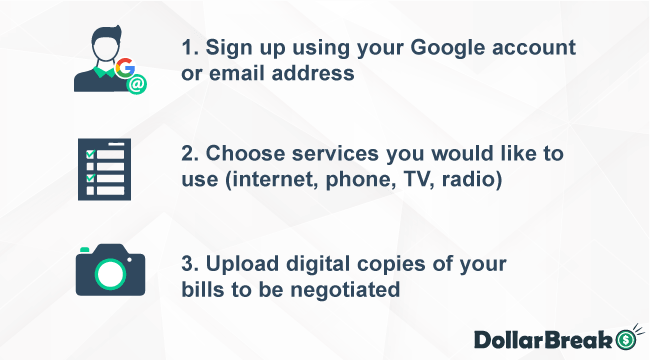

Step 1- Create Your Account

Step one to opening up a Billshark account is to sign up. You’ll want to supply your identify, e mail handle and telephone quantity. There may be the choice to enroll utilizing your Google account profile.

You’ll then have to create a password. Keep in mind that Billshark requires offering your private monetary data. So select a safe password like one you’ll use for on-line banking, relatively than the identify of your loved ones pet!

Billshark gives a free financial savings calculator as a part of the account creation course of. This can show you how to to discover the potential financial savings. Bear in mind that these figures are an estimate and there aren’t any ensures Billshark will be capable of accomplish these financial savings.

Step 2- Select a Service

When you create your account, you’ll be able to select the negotiation companies you wish to use. The checklist of choices consists of web, satellite tv for pc radio, pay TV and wi-fi.

If you wish to negotiate a number of payments, you’ll be able to repeat this course of as many instances as crucial. Keep in mind that the extra contracts you allow Billshark to barter, the upper the potential financial savings.

Step 3- Add Payments

You’ll then have to add digital copies or images of your payments. The app makes this straightforward, as you should use the digicam in your cellular gadget and add them rapidly.

You may as well add the payments through the web site. Billshark requires these digital copies, so a consultant can achieve all the mandatory data to barter a discount.

Forms of Payments Billshark Can Decrease?

Web

Cellphone Companies

Pay TV

Whether or not you could have cable or a pay TV subscription bundle, Billshark can negotiate a extra aggressive worth in your behalf.

Satellite tv for pc Radio

Billshark may negotiate to decrease your payments for satellite tv for pc radio companies.

What are the Billshark Execs & Cons?

Execs

- Free Signal Up: There aren’t any charges or expenses to enroll in Billshark.

- No Financial savings, No Fee: If Billshark is unable to barter any financial savings in your payments, you’ll not have to pay for its companies.

- 90% Success Charge: Billshark has a 90% success charge at decreasing its purchasers’ payments.

- Referral Program: Billshark has a referral program the place you’ll be able to obtain a $10 reward card for every member of the family or buddy you confer with the service. Your referral may also obtain a $10 low cost on their bill.

Cons

- Hefty Price: Billshark expenses a 40% fee on any financial savings the corporate is ready to negotiate in your behalf.

- Upfront Charges: Billshark negotiates financial savings in your annual payments, however all charges will must be paid upfront. There may be the choice to unfold the price of your Billshark bill, however this may incur a charge.

- Must Add Payments: In contrast to another platforms, Billshark requires that you just add copies of your payments relatively than linking to your financial institution accounts and playing cards.

Is Billshark Price it?

Billshark is definitely price a strive. If the corporate is just not capable of make any financial savings in your behalf, you gained’t have to pay a cent.

You may as well be very clear about what you desire to Billshark to barter. This firm means that you can specify which payments you wish to decrease and whether or not you wish to enter into contracts longer than one 12 months.

If Billshark is ready to negotiate a big saving in your payments, you’ll be able to unfold the fee value throughout two to 6 months, for a $9 charge.

Billshark has a stable trade status with BBB accreditation and an A+ ranking. The corporate employs protocols and procedures to guard your private data and it’s by no means shared with third events.

Billshark Options

Billshark vs Rocket Cash

Rocket Money has a really comparable enterprise mannequin to Billshark. If Rocket Cash can discover financial savings, you’ll pay a 40% fee. The place it differs is which you could not solely take photos of your payments and add them, but additionally join your billing accounts.

This can assist Rocket Money to scan your bills and find any promotional charges, hidden reductions or different financial savings. Like Billshark, Rocket Cash won’t take away or downgrade any companies with out your permission

There may be additionally the choice to improve to a premium Rocket Cash account. This prices as much as $48 per 12 months. It gives further performance and options akin to sensible financial savings, limitless budgets, cancelation concierge and premium chat.

Billshark vs. BillSmart

BillSmart is an alternative choice to economize in your telephone/cable payments. The place it differs from Billshark is that BillSmart might help prospects who’re late on their payments lower your expenses and maintain their service related.

BillSmart has a a lot decrease charge than BillShark at 25% of the financial savings they usually let you transfer or break up the charge for no additional cost.

Billshark vs. Billfixers

Billfixers means that you can add copies of your payments to seek out loyalty reductions, optimized credit, promotional charges and different financial savings. The corporate goals to finish invoice negotiations inside only one billing cycle.

The largest distinction when evaluating Billshark vs Billfixers is that Billfixers has a better charge. The fee is 50%. That you must pay this upfront through PayPal, verify or main bank card. There may be additionally the choice to separate the fee value and pay month-to-month.

Billshark FAQ

What’s Billshark?

How does Billshark earn money?

Billshark expenses fee for any financial savings they can negotiate.

How a lot does Billshark value?

Billshark expenses a 40% fee on financial savings, but when the crew can’t negotiate any financial savings, there is no such thing as a charge.

How do I cancel Billshark account?

You may cancel at any time by sending your request in writing to Billshark HQ.

[ad_2]

Source link