[ad_1]

How loyal are your clients? And do they really feel really rewarded for his or her ongoing relationship together with your financial institution? In response to current Accenture analysis, banking clients view loyalty as a two-way road: they’re open to being loyal to at least one main financial institution, however they need their financial institution to acknowledge and reward this loyalty. And whereas the vast majority of banks declare to be customer-centric, lower than 15% truly reward clients for his or her holistic relationship with a financial institution.

Accenture’s newest Global Banking Consumer Study of 49,000 customers in 33 nations highlights what banking clients need from their banks and their rising urge for food for brand new providers. Our analysis exhibits clients have optimistic however shallow ranges of satisfaction with their most important financial institution. And, after years of stagnation and restricted innovation, the banking trade has entered the proper storm as fee hikes and altering rules are stimulating greater adjustments in buyer expectations and belief of their financial institution than ever earlier than.

Regardless of lively curiosity, banks usually are not responding by rewarding clients for his or her loyalty. As clients are actually evaluating the connection they’ve with their present financial institution, banks have a golden alternative to deepen engagement by means of built-in services and products, and to really reward clients for his or her relationship throughout the financial institution.

With this potential on the horizon, banks have a selection: invest now or pay later as clients look elsewhere for banking services and products. How can banks act now to deepen engagement by means of built-in services and products? And the way do they should evolve to strengthen loyalty among the many subsequent generations of banking clients?

Fragmentation and its affect on banking

When our survey respondents have been requested about particular elements of their financial institution’s choices, solely 23% rated their financial institution extremely for its vary of services and products. And simply 30% scored their financial institution’s customer support a minimum of 9 out of 10. In consequence, clients usually tend to cut up their banking merchandise throughout a number of suppliers—a pattern that’s intensifying.

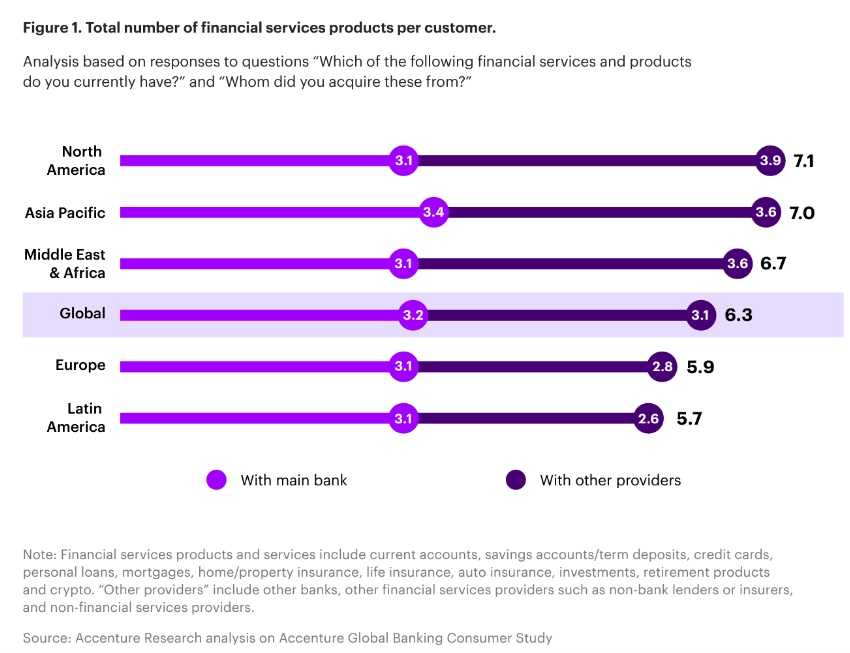

In response to our survey, low ranges of satisfaction contributed to clients subscribing to merchandise from new suppliers. In truth, 59% of shoppers acquired a monetary providers product from a brand new supplier prior to now 12 months. And clients in our pattern had a mean of 6.3 monetary merchandise, with solely half of those offered by their most important financial institution.

Moreover, the emergence of digital-only banks has modified the panorama, with 52% of shoppers having a services or products with a digital-only financial institution (with uptake being a lot increased in Asia and Latin America than in Europe). Most use their digital-only financial institution for particular functions, similar to funds or international forex change.

In an effort to entice, retain and develop clients within the present surroundings, banks might want to problem conventions round organizing and rewarding buyer lifetime worth. The banks that begin investing in built-in product propositions that bundle a sequence of merchandise round deposit clients to reward clients for whole worth of all services and products will come out forward.

Loyalty leaders in a brand new period of buyer rewards

With aggressive innovation being fixed and the post-digital age making it extraordinarily simple to change suppliers, it’s time for banks to reimagine buyer relationships and the way they reward loyalty. By bundling banking merchandise round clients, banks can set up loyalty that transcends transactional relationships. Whereas this sounds easy sufficient, solely 15% of banks worldwide really reward clients for his or her relationships throughout the financial institution, integrating their debit, credit score and different merchandise.

Our analysis discovered that over 60% of banks provide restricted rewards, principally for bank card transactions or having merchandise from two or extra classes. Most of those banks reward clients with a really tactical and practical profit: factors.

Shifting from practical loyalty packages to relationship-based packages which have extra emotional advantages, banks might take a more in-depth have a look at as we speak’s loyalty leaders and their integrated product innovation, adopting a reward mannequin that’s much like that of Amazon Prime and plenty of profitable journey packages.

Qorus–Accenture Banking Innovation Awards: a world competitors showcasing one of the best new concepts and practices reworking the trade. Uncover extra and enter your profitable innovation:

Let’s begin with journey loyalty because it hits near dwelling for me. After over a decade of labor journey, I’ve achieved lifetime “Ambassador Elite” standing with Marriot’s loyalty program, Marriot Bonvoy. This system is designed to reward loyal clients in tiered classes, so the extra members keep and spend, the extra customized advantages are unlocked. For me, the advantages of versatile check-out occasions, customized providers on arrival and complementary room upgrades have made my Bonvoy experiences stand out. In consequence, even in terms of private journey, I’m going out of my technique to keep at a Bonvoy model lodge, realizing that my ongoing loyalty can be rewarded. This kind of emotional, relationship-oriented loyalty program pays off. And lots of agree with me. Following the launch of this system, 52% of room occupants worldwide have been Bonvoy members.

Persevering with to look exterior banking, the communications and know-how industries are additionally main with relationship-based packages. Along with Amazon, Swisscom Blue Benefit bundles merchandise: it affords clients financial savings after they mix their cell and web subscriptions. This strategy noticed 80% of Swisscom’s broadband connections and 46% of its cell subscriptions being included in Blue Profit bundles. Google One additionally bundles based on the extent of a buyer’s cloud storage; this reportedly contributed $1.1 billion to the corporate’s income in 2021.

So, what can banks study from these reward packages? Some are already taking notes and shifting on this path. For instance:

- Lloyds Financial institution’s Club Lloyds is a tiered subscription mannequin that gives way of life advantages together with streaming subscriptions, film tickets, eating affords and extra. For example, members obtain credit score curiosity in the event that they arrange a number of direct deposits / automated transfers from their account. In the end, this will increase the quantity members are more likely to deposit into that account and rewards them for it. Immediately, Membership Lloyds has over 1.6 million members whose common deposit steadiness is 2.7 occasions higher than that of non-members.

- DBS Multiplier Savings Account affords bonus curiosity for patrons who join information from different banks. Moreover, the financial institution rewards clients for month-to-month transactions (>$2,000) throughout eligible merchandise and for spending a certain quantity month-to-month by means of the DBS super-app PayLah!

- Bank of America created an providing alongside the traces of Amazon Prime to extend retention. It achieved a 99% retention fee and doubled the variety of merchandise held by the typical program member.

My colleague, Michael Abbott, additionally lately highlighted the necessity for any such built-in proposition and mentioned the ways banks can grow through customer relationships. It is a crucial subject as we speak, and banks that transfer now to create significant product bundles can be higher positioned to deepen relationships for development. And as clients examine their loyalty experiences to these of non-banking manufacturers, they’ll count on their banks to fulfill ongoing loyalty requirements much like motels, Amazon and extra.

Constructing the onramp early

The subsequent technology of shoppers are rewriting the foundations of brand name loyalty, and it will basically change the way in which they interact with their financial institution. I’m all the time intrigued by how the youthful technology is bringing change to the trade and our report’s insights into their expectations are compelling proof of the necessity to act now. It exhibits how this technology is greater than prepared to change banks after they’re not glad and can readily select non-bank choices. And, with an estimated $60 trillion anticipated to be handed on to Gen Z and Millennials as inheritances over the following 25 years, banks have to adapt to fulfill the wants of as we speak’s youth and set up loyalty early.

Immediately’s youth are rising up in a way more complicated world than that of their dad and mom and the generations that got here earlier than. They’re extremely tech-savvy and vulnerable to social media and different societal pressures. And they’re going to study to flex their monetary independence by means of new channels, digital currencies, social platforms and experiences.

Youthful clients search genuine experiences from their banks, and need to collaborate with manufacturers as an alternative of being marketed to. The proof will be discovered within the rising reliance on ‘finfluencers’ on TikTok, YouTube and Instagram for monetary recommendation. As younger clients are crucial of selling ways, finfluencers are already embedded of their social lives and characterize extra genuine connections. Banks should study from this and collaborate with the youthful technology to construct connections with belief, leaving the extra conventional advertising strategies behind and rewarding younger clients for his or her relationships.

Finfluencer: noun. A social media influencer who offers recommendation on monetary investments.

To discover this subject extra, I’ve invited two respondents to share further insights into their technology’s expectations round buyer expertise. Let’s hear extra from their views.

[ad_2]

Source link