[ad_1]

Whereas unlucky, the rising tide of fraud isn’t essentially shocking. Monetary criminals have been focusing on digital transactions for over three a long time. As expertise has developed, so have their techniques.

The dial-up world of the Nineteen Nineties was a golden age for bank card phone fraud schemes. The smartphone explosion together with different digital units and the following digital revolution have been intently matched by an increase in phishing, ransom malware, using botnets and numerous types of e-commerce fraud. Within the 2020s we’ve seen fraudsters use deepfake voice tech to impersonate victims, construct elaborate app-to-app fraud methods, break digital locks with cell spoofing, and far, rather more.

And the longer term, arguably, appears much more fraught. In the event you assume fraudsters received’t make use of generative AI or quantum computing, or that the metaverse might be fraud-free, I’m afraid you’ll be dissatisfied.

In a current presentation on Breaking Down Fraud—an vital pattern in funds at this time, my discuss included some key information on the rising drawback of cell funds fraud. Listed below are among the highlights I shared:

Breaking down fraud:

- Digital funds fraud has grown 25% within the final three years.1

- Retailers spend, on common, 8 – 10% of their income combatting fraud.2

- 3.6% of worldwide GDP is misplaced to fraud annually.3

- 4 in 10 retailers have skilled phishing fraud assaults within the final 12 months.4

- Two in 10 monetary providers prospects shut their accounts after experiencing fraud.5

- On-line commerce is anticipated to lose $48 billion to fraud in 2023. 6

Nonetheless, the information isn’t all unhealthy. Fraud will most likely at all times be with us in a technique or one other, however that doesn’t imply that funds suppliers and their telecom companions are helpless.

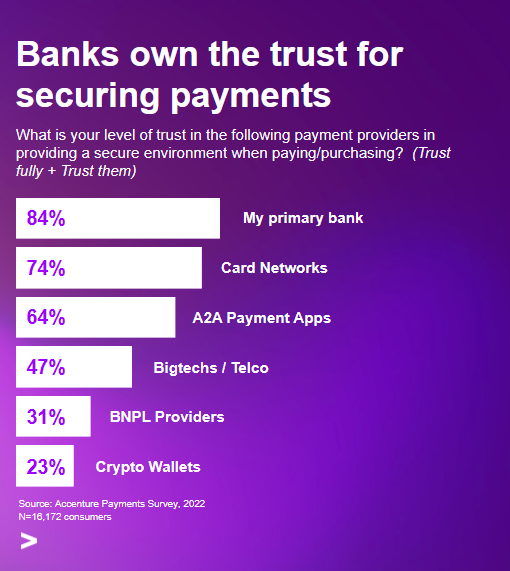

Accenture’s international funds shopper report, Payments gets personal, constructed on a survey of over 16,000 shoppers in markets around the globe, discovered that incumbent funds gamers have a big belief benefit for securing funds.

These information, in my view, are a powerful indication that conventional monetary establishments can flip our present tidal wave of fraud into a chance. That they haven’t finished so but is, I believe, principally right down to the challenges of coordinating motion throughout industries and, now and again, between rivals.

It’s extensively understood at this time that organizational silos inside a enterprise cut back effectivity and enhance the danger of fraud. In case your IT division and HR groups usually are not in shut contact, for example, it’s simpler for a foul actor to impersonate an worker and entry essential methods. Blinds spots like this are at greatest inefficient and at worst open invites to monetary criminals.

That is outdated information to each funds participant on this planet proper now. What’s much less well known is that almost all funds fraud at this time targets not the cracks inside organizations however these between them and even between industries.

For instance, the commonest phishing approach used at this time could be the digital impersonation of a authentic group. A fraudster tips a sufferer into considering that an e mail comes from, say, their financial institution, after which exploits this deception. Or a bunch of hackers would possibly persuade a fintech that they’re a authentic credit score bureau to realize entry to the fintech’s shopper information. These examples are hypothetical, however the level they make is actual—defeating digital fraud would require cross-industry collaboration on a better scale.

Historical past means that funds gamers can cooperate on this solution to advance mutual curiosity. SWIFT and central fee schemes are simply two examples that spring to thoughts. Whether or not they can attain the heights required to get forward of the seemingly always-growing energy of digital fraudsters, nonetheless, stays to be seen.

Download the total report, “Payments gets personal: How to remain relevant as customers seek control.” To debate how your funds organization can compete to win the longer term, contact me.

- Accenture analysis evaluation based mostly on International Information 2022

- Service provider Threat Council, Cybersource & Verifi, 2023 Global eCommerce Payments and Fraud Report

- Illicit Financial Flows from Developing Countries: Measuring OECD Responses 2014

- Service provider Threat Council, Cybersource & Verifi, 2023 International eCommerce Funds and Fraud Report

- Accenture analysis evaluation based mostly on International Information 2022

- Statista & Juniper analysis

Disclaimer: This content material is supplied for common data functions and isn’t meant for use rather than session with our skilled advisors. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered logos of Accenture.

[ad_2]

Source link