[ad_1]

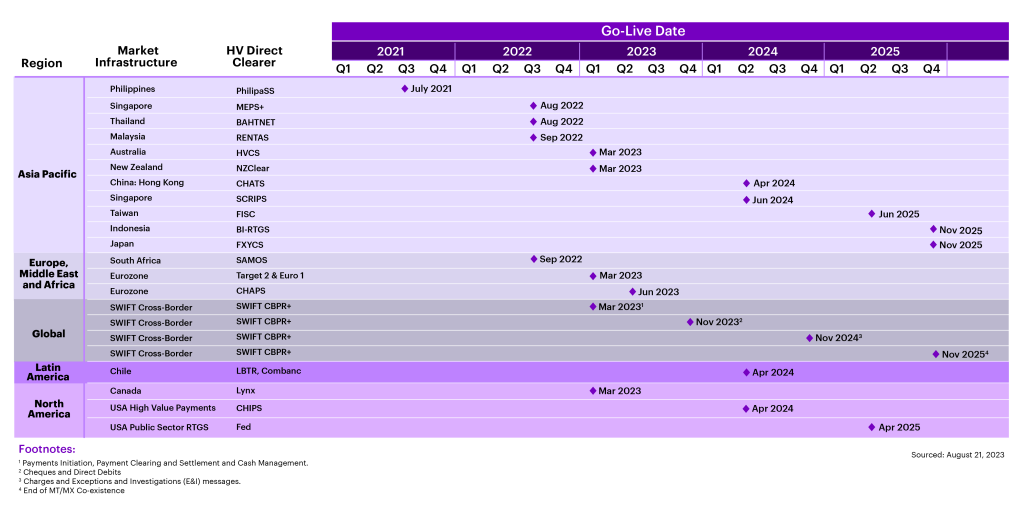

The years-long ISO 20022 journey has achieved a significant milestone this 12 months: it’s now getting used for cross-border funds. The brand new commonplace efficiently launched globally in March 2023 with SWIFT CBPR+, and on the European Market Infrastructures of T2 (March 2023), Euro 1 (March 2023) and CHAPS RTGS (June 2023). Early knowledge reveal a wholesome stage of fee site visitors within the new MX format flowing by means of these market infrastructures.

As an example, within the three months following the SWIFT CBPR+ implementation, a every day common of 600,000 ISO 20022 messages have been despatched between greater than 1,000 senders and 5,600 receivers throughout 200 nations. CHAPS, one of many largest high-value fee programs on this planet, processes a mean every day worth of £344bn (USD434bn) throughout 192,000 transactions using ISO 20022. For T2 we see a every day common of 373,468 payments representing €1,877bn (USD2,028bn) in worth, whereas Euro1 reports a every day common quantity of 176,418 representing €190bn (USD205bn) in worth.

For cross-border funds, the March 2023 implementation marks the start of a interval of legacy and new format co-existence.

“We needed to be an early adopter for cross–border funds and made the daring selection emigrate all of our fee programs and all of our outbound CBPR+ site visitors to ISO 20022. As of August 2023, J.P. Morgan signifys ~50% the overall ISO 20022 cross–border fee message site visitors on SWIFT.”

Colin Williams, World Clearing Transformation Lead at J.P. Morgan

Collectively, these launches are a collective step for monetary companies in the direction of a standard language throughout all monetary messages, each home and international. However the brand new commonplace’s true impression on the trade and the world remains to be to return.

That is true each in a common sense and inside the scope of cross-border funds. Proper now, SWIFT CBPR+ makes use of ISO 20022-derived message codecs for funds initiation, funds clearing, settlement and money administration. In November of this 12 months, the use instances will broaden to incorporate checks and direct debit. In November 2024, new expenses and E&I (enquires and investigations) might be added.

The worldwide monetary companies trade’s journey to ISO 20022 adoption is effectively below manner, with a number of market infrastructures already stay in APAC and extra following, and North America making ready for migration in H1 2024.

From compliance to worth

Most banks proper now are extra targeted on reaching regulatory compliance with the usual than deriving worth from it. Current Accenture analysis on industrial funds reveals that 60% of banks agree that maintaining with modifications like ISO 20022 boosts their industrial funds innovation, whereas 29% mentioned it limits their skills on this regard.

When considered within the context of preliminary ISO20022 message format adoption, this is smart as a good portion of the worth of ISO 20022 compliance will solely be unlocked when key classes of wealthy knowledge are exchanged throughout gamers within the funds ecosystem.

We count on the aim code, authorized entity identifier, remittance knowledge, structured tackle and prolonged character set classes to make the largest distinction, and their use might be mandated over the following few months and years. Taking the instance of latest CHAPS migration, function codes is not going to be mandated till November 2024. Structured addresses, that are anticipated to considerably enhance anti-fraud efforts, monetary crime administration and straight-through processing, might be optionally available until late 2025.

The true worth of ISO 20022 for many banks and funds gamers has but to be realized. However there’s good motive to suppose that proactive establishments will take pleasure in a first-mover benefit because the use and impression of the brand new commonplace unfold within the subsequent few years.

View the ISO 20022 Enhanced Data Adoption Regulatory Timeline [PDF]

A consumer pain-point and a possibility

To see how a proactive perspective to the usual can create alternatives, think about the scenario from the attitude of a industrial funds consumer. Accenture analysis discovered that 96% of business shoppers use ISO help companies at present (e.g., consumer testing, MT/MX message comparability, truncation recommendation). However solely 61% of banks globally present these companies, and consumer satisfaction for these companies sits at 48%.

The analysis additionally discovered a robust urge for food amongst industrial funds shoppers for value-added companies that might be constructed on the improved knowledge required by ISO 20022.

In different phrases, demand for companies is excessive. Provide is restricted and satisfaction mediocre at greatest. Relying on a financial institution’s perspective, this case is both a threat to consumer retention or a possibility to win new enterprise by means of superior service.

And the stakes will solely rise as extra company shoppers embark on their ISO 20022 migration journeys.

The supply of wealthy knowledge, ruled by regulatory necessities, will create new markets for brand new and improved banking services and products. Examples right here embody automated receivables matching powered by remittance info; improved personalization of services and products by analyzing transaction function codes in actual time; and discount in fee failures as a result of using structured addresses.

Key takeaways on the way forward for ISO 20022 and international funds

Whereas ISO 20022 didn’t launch in 2023, it has nonetheless damaged new floor this 12 months. It’s now extensively used for cross-border funds in addition to in key home fee infrastructures in Asia and Europe. For example, J.P. Morgan is now stay in 11 market infrastructures with ISO 20022, with a number of extra in progress throughout APAC, North America and LATAM.

ISO 20022 has already had a major impression, however its true worth is linked with the still-pending adoption of enhanced funds knowledge. A financial institution’s capability to seize, course of and change this knowledge will assist it not solely obtain compliance however additionally seize alternatives.

On this regard, notable alternatives are related to industrial shoppers, who want help migrating to and utilizing ISO 20022. A lot of them will not be thrilled with the service they’re receiving at present, which represents potential development for any financial institution with a proactive perspective and strong ISO 20022 help.

Which can also be the case for different areas of ISO 20022’s impression on funds. It’s straightforward to concentrate on compliance proper now, however the true benefit and pleasure related with ISO 20022, in our view, is its potential to unlock worth for banks, their shoppers, and markets as an entire.

We’d love to listen to about your individual expertise with ISO 20022. Please attain out to Sulabh or Colin.

Thanks to Ather Rizvi and Ciáran Byrne for his or her beneficiant contributions to this publish.

For insights from J.P. Morgan’s latest expertise of ISO 20022 migrations globally, please go to ISO 20022: First 120 days live

Accenture at Sibos – Accenture’s staff might be in Toronto for Sibos, September 18-21, showcasing our newest pondering and improvements in funds, AI and cyber-security. Study extra about our full program and request a gathering with one among our subject material specialists here.

Disclaimer: This content material is supplied for common info functions and isn’t meant for use instead of session with our skilled advisors. This doc might confer with marks owned by third events. All such third-party marks are the property of their respective homeowners. No sponsorship, endorsement or approval of this content material by the homeowners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

© 2023 JPMorgan Chase & Co. All rights reserved. The views and opinions expressed herein are these of the creator and don’t essentially replicate the views of J.P. Morgan, its associates, or its workers. The knowledge set forth herein has been obtained or derived from sources believed to be dependable. Neither the creator nor J.P. Morgan makes any representations or warranties as to the knowledge’s accuracy or completeness. The knowledge contained herein has been supplied solely for informational functions and doesn’t represent a suggestion, solicitation, recommendation or suggestion, to make any funding selections or buy any monetary devices, and will not be construed as such. Go to jpmorgan.com/paymentsdisclosure for additional disclosures and disclaimers associated to this content material.

[ad_2]

Source link