[ad_1]

One 12 months after ChatGPT’s public launch, generative AI might be nonetheless the most popular matter on the earth of enterprise—and with good purpose. Analysis suggests gen AI may add almost $7 trillion to global GDP.

So what, precisely, will gen AI imply for banks?

A lot of the dialog as we speak across the expertise generates extra warmth than mild. Our “Meet the Consultants” session at Sibos 2023—“How Gen AI Will Rewire the Banking Business”—included a presentation of our new analysis and evaluation, which goals to deliver some knowledge to the dialogue and transfer previous the hype and hypothesis.

These are key takeaways from our discuss.

Gen AI won’t change banking, however will change how banking will get executed

The headline of our evaluation is that gen AI will change banking—however banking itself won’t change. The expertise will remodel not the work of banking itself however moderately how that work will get executed.

Banking will at all times include the basics: taking in deposits, lending cash and managing funds. However gen AI goes to essentially rewire how that work will get executed.

Whereas there’s normal acceptance of the significance of gen AI throughout banking, there’s additionally trepidation about how and the place it ought to be used. However any financial institution that sits on the sidelines for lengthy will danger being left behind.

Actually, early adopters are already utilizing it to drive dramatic effectivity features. One international financial institution, for instance, has carried out an e-mail routing system that makes use of AI and machine studying; it eradicated 40% of e-mail site visitors in its first 12 months. GitHub’s generative AI Copilot coding software, in the meantime, might help a financial institution’s programmers write code up to 55% faster (and create 46% of the required code itself). And Morgan Stanley has deployed a gen AI software that offers its monetary advisors improved entry to the financial institution’s “mental capital” of round 100,000 experiences and paperwork throughout shopper conversations.

However use circumstances like these are solely the start.

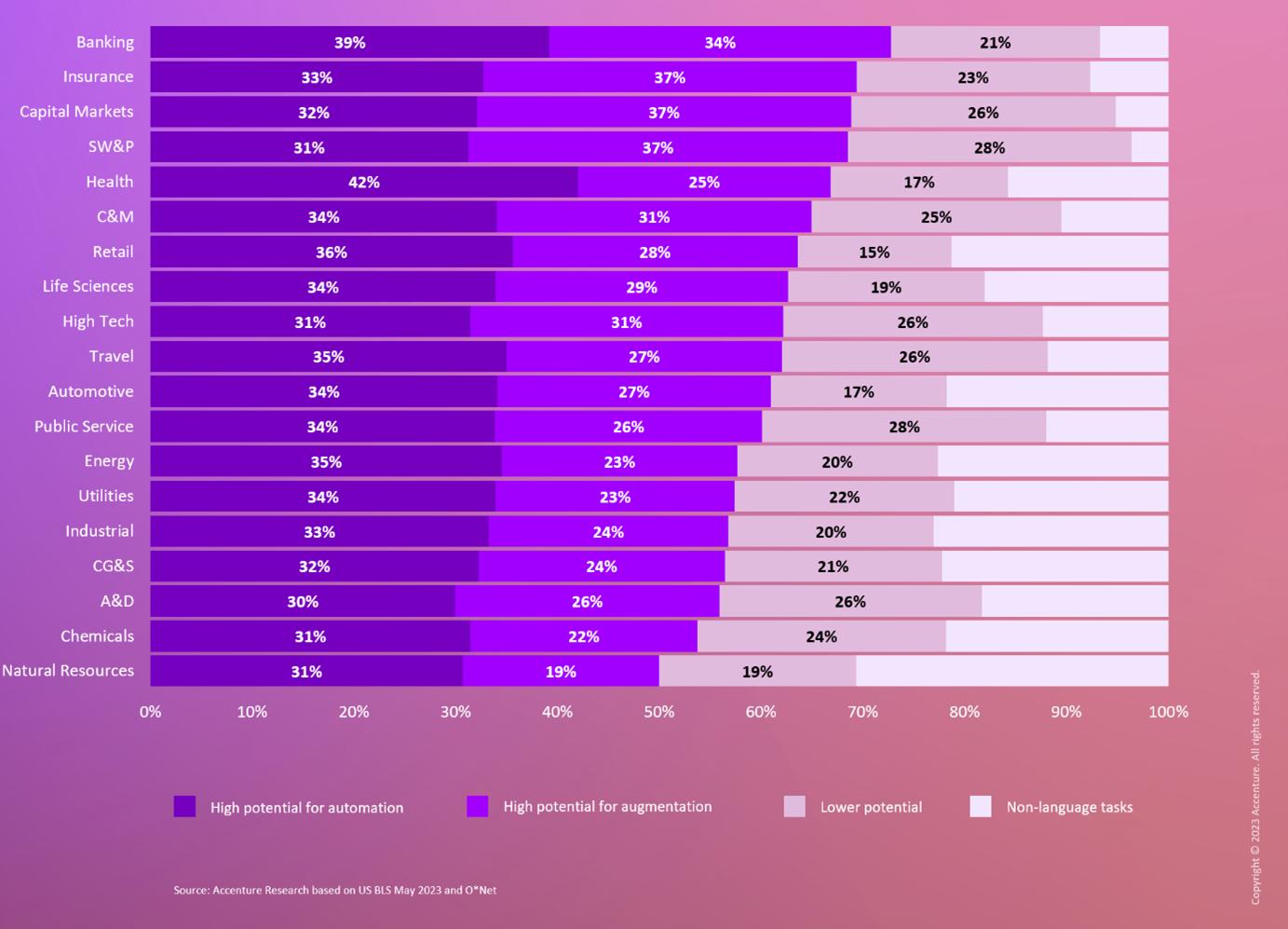

Our analysis on the potential affect of generative AI on completely different industries, based mostly on knowledge from the US Bureau of Labor Statistics and the Occupational Information Network, discovered that 61% of working time throughout 19 completely different industries might be reworked by new applied sciences together with massive language fashions (LLMs) like ChatGPT. In banking that portion jumps to 73%, which is the biggest of all industries in our evaluation. We discovered that 39% of all of the work executed at banks had a excessive potential to be automated (executed with out interpersonal or cognitive abilities) and 34% may readily be augmented (requiring interpersonal communication, proactive reasoning, or skilled validation).

Determine 1. The potential of US employees’ time that might probably be automated or augmented by expertise comparable to LLMs.

As early adopters leverage these features for effectivity and to ship superior buyer experiences at scale, the affect of the expertise will ripple out to rework the trade.

That affect will heighten the necessity for banks and different customers of gen AI to construct the best guardrails round these new instruments. Maximizing the affect of gen AI on banking can solely occur if the instruments are utilized in a accountable, safe method that complies with regulation.

We hint this wave of generative AI change throughout three main areas of affect. Gen AI will enable banks to:

1. Innovate and differentiate

Generative AI creates many new methods for banks to spice up income with insight-driven selections and higher buyer experiences. The Morgan Stanley instance we talked about above is one early use case right here.

One other comes from a big North American financial institution, which is utilizing gen AI to scrutinize buyer knowledge and monetary historical past to evaluate credit score publicity. This helps its analysts make higher lending selections and cut back the danger of mortgage defaults.

2. Remodel mid- and back-office operations

Generative AI goes to considerably contribute to how banks handle their mid- and back-office operations. This may each decrease operational prices, as within the e-mail routing instance talked about earlier, and release mental capital for innovation by automating repetitive duties like reporting, knowledge entry and transaction processing. This may enable financial institution employees to spend extra time on artistic duties and personalised buyer care.

We have already got an concept of what this appears to be like like, due to early adopters just like the European financial institution that’s as we speak utilizing an LLM to help customer support reps on buyer calls. The mannequin routinely takes notes for the rep and brings up related info, permitting the human to pay attention extra on serving to the client.

The extent of this affect will, in fact, range by position throughout the group. Our analysis discovered that 37% of customer support rep time in banking proper now might be automated by generative AI (consider the notetaking within the above instance), whereas 28% might be augmented (surfacing related info through the name).

3. Embed gen AI into operations and instruments to supercharge productiveness

The ecosystem of software program companions that energy banking as we speak are incorporating gen AI into each facet of what they do. This may radically increase productiveness for workers throughout the financial institution.

For instance, Microsoft started integrating LLMs into its Microsoft 365 suite of apps again in March 2023 with the launch of Copilot. Adobe’s Firefly tool can generate pictures from easy textual content prompts. Salesforce, likewise, affords a gen AI-powered CRM assistant referred to as Einstein proper now, and Workday recently announced plans to combine gen AI into its instruments.

These choices are all early efforts within the discipline. Distributors will iterate, enhance and compete on them in time. The one choice for banks right here is which gen AI options are well worth the further value.

Generative AI as a progress multiplier

Our evaluation additionally discovered that inside three years, generative AI may enlarge a financial institution’s working earnings by two to 3 occasions in contrast with present consensus forecasts by driving income progress and lowering prices.

On the income facet, we see a lot of the features coming from generative AI’s affect on client-facing actions. We anticipate that it may create a 17% enhance in time allotted to shopper interactions and recommendation, that are chargeable for round 80% of banking income. This extra time may translate right into a 9% surge in income.

For the price facet, we predict a 9 – 12% discount in mid- and back-office prices achieved by a productiveness enhance of seven – 10% in company capabilities.

Generative AI may end in a 17% enhance in time allotted to shopper interactions and recommendation, that are accountable for round 80% of banking income.

Compounding the affect of the expertise throughout each areas, we discover that generative AI’s potential uplift on a financial institution’s working earnings stands at 25 – 40%. That is greater than double or triple the prevailing progress forecasts for banks as much as 2026.

No financial institution can afford to disregard progress like that.

In case you’re undecided the place your financial institution’s generative AI journey ought to start, our prime piece of recommendation is to type a generative AI SWAT workforce as we speak. This could embody leaders from each the enterprise and tech sides of the financial institution, and its mandate ought to contact on technique, coverage, expertise, expertise and knowledge.

For extra detailed insights in your financial institution’s path ahead, we might love to listen to from you. Yow will discover Mike here and Keri here.

Disclaimer: This content material is offered for normal info functions and isn’t supposed for use instead of session with our skilled advisors. This doc might check with marks owned by third events. All such third-party marks are the property of their respective house owners. No sponsorship, endorsement or approval of this content material by the house owners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered logos of Accenture.

[ad_2]

Source link