[ad_1]

In the event you’re in search of passive earnings concepts, chances are you’ll assume the entire idea is a delusion – there is not any approach that you would be able to earn cash by doing nothing. It is why passive earnings is very wanted, but typically misunderstood.

The reality is, passive earnings streams require an upfront funding and a number of nurturing to start with. After a while and arduous work these earnings streams begin to construct and are capable of keep themselves, bringing you constant income with out a lot effort in your half.

Talking from private expertise, including passive earnings streams to your portfolio can assist you improve your earnings and speed up your monetary objectives in super methods. For instance, starting a savings account and incomes curiosity, or investing in dividend paying shares can all begin including earnings to your life with out having to work! Your cash is working for you!

For instance, you need to use passive earnings streams that can assist you get out of debt or obtain monetary independence sooner.

If you wish to get began incomes passive earnings right here’s what you need to know first.

If you wish to skip straight to the concepts, right here you go!

Promo: Ark7. Ark7 means that you can spend money on fractional shares of rental actual property. Earn $50 Ark7 bonus credit whenever you make investments $1,000 in property shares. Get started with Ark7 here >>

What It Takes To Earn Passive Earnings

Earlier than we get into the passive earnings concepts I feel it’s a good suggestion to first clear up a few misconceptions. Though the phrase “passive” makes it sound like you must do nothing to herald the earnings this simply isn’t true. All passive earnings streams would require a minimum of one of many following two components:

1) An upfront financial funding, or

2) An upfront time funding

You possibly can’t earn residual income with out being prepared to supply a minimum of considered one of these two. As a result of it is vital to recollect what passive earnings is NOT. Passive earnings isn’t your job, it isn’t freelancing, or working on-line. Passive earnings is doing one thing as soon as, then incomes rewards from it into the longer term.

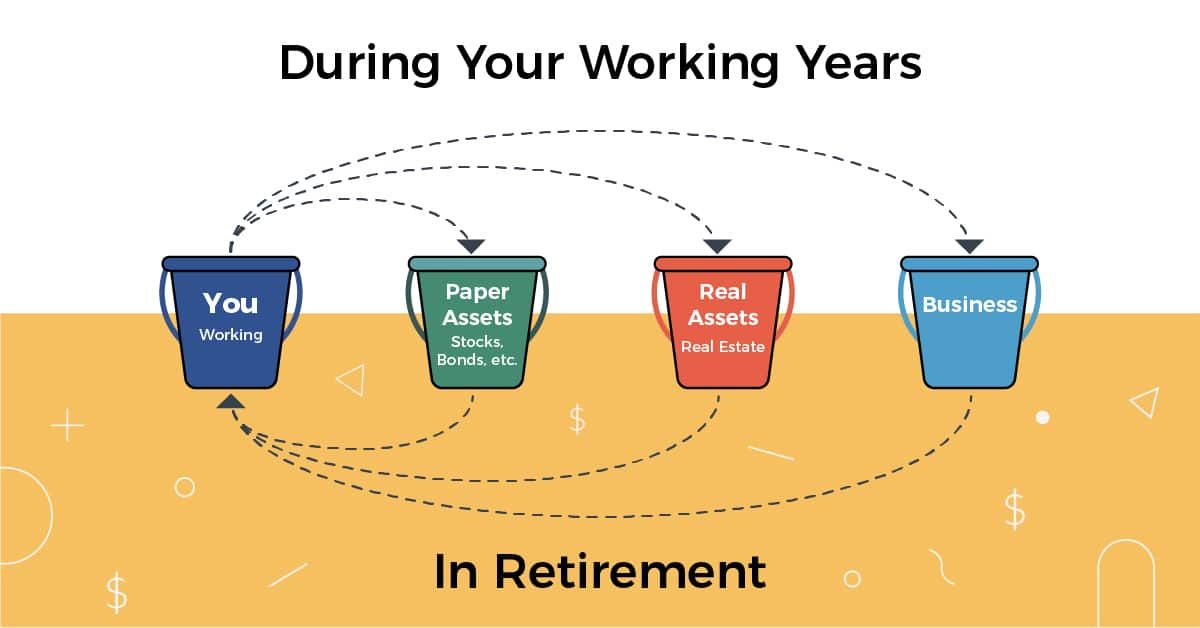

This is a very good instance of how I view passive earnings and the way it suits into your portfolio of property:

Learn our full information to What Is Passive Income?

Immediately, I’ve an enormous listing of passive earnings concepts you possibly can strive whatever the class you fall in.

Try the video on passive earnings concepts right here:

Passive Earnings Concepts Requiring an Upfront Financial Funding

These kinds of passive earnings require you to take a position cash up entrance to generate the passive earnings later. Do not be alarmed although – you can begin with as little as $5 with a few of these concepts, so it is achievable for everybody.

1. Dividend Shares

Are Dividend Shares Price It?

Dividend shares are tried and true solution to earn passive earnings. You’ll have to do loads of analysis to search out good shares and make investments a major sum of money to obtain massive dividend checks. Nevertheless, for those who constantly make investments cash into dividend shares you possibly can amass a pleasant residual earnings over time.

For any of those funding alternatives, be sure to open an account at the perfect on-line brokerage, and get rewards whereas doing it.

Our favourite place to take a position is M1 Finance. You may not have heard of M1 Finance, nevertheless it’s a FREE investing platform that means that you can construct a portfolio, and spend money on it totally free.

That is wonderful for investing in dividend shares as a result of you possibly can construct your portfolio of, say, 30 shares. Then, your investments can be auto-allocated to your complete portfolio each deposit – for FREE! You possibly can even auto-rebalance. Then, your dividends may also be reinvested. It is a improbable platform, and it was made for this. Plus, M1 Finance was an honorable point out on the perfect locations to take a position for 2023!

Learn our full experience with M1 Finance here.

How To Select The Proper Dividend Shares

- Search for corporations with a historical past of constant dividend funds

- Analysis dividend yield and payout ratios

- Diversify your portfolio to attenuate threat

In the event you’re unsure about selecting particular person shares, search for high dividend paying ETFs or mutual funds.

2. Single-Household Rental Properties

Are Single Household

Leases Price It?

A money flowing rental property is a improbable approach to herald a month-to-month earnings. To make this actually passive you possibly can outsource the working of the properties to a administration firm.

Nevertheless, the web has made investing in rental properties simpler than ever earlier than. There are a number of methods you possibly can spend money on rental properties relying on what your objectives and pursuits are. You generally is a restricted companion in massive residential or business properties, or you should purchase properties and be a landlord – all on-line!

Make investments In Single Household Properties

In the event you’re in search of a extra conventional path to actual property funding, take a look at Roofstock. This firm means that you can purchase cash-flow optimistic single household leases – on-line! You possibly can join and begin looking out properties right now. Check out Roofstock here.

The beauty of utilizing a platform versus doing it your self is that the earnings is much more passive. Try our full experience with Roofstock here.

Ideas For Profitable Rental Property Investing

- Select properties in high-demand areas

- Guarantee optimistic money circulation

- Think about using a property administration firm

3. Bigger Actual Property Developments

Is Actual Property Investing

Price It?

Do you not wish to be a landlord, however nonetheless need actual property publicity and earnings? Then contemplate being a restricted companion in a big improvement. With these choices, you possibly can spend money on multi-family or business properties. You get the earnings and tax remedy identical to common actual property possession, however you do not do any of the work!

Our favourite platform for that is RealtyMogul since you get the pliability to take a position as little as $1,000, however may take part in REITs and personal placements – sometimes not provided to the general public. Traders can fund actual property loans to achieve passive earnings or purchase an fairness share in a property for potential appreciation. Their platform is open to each accredited and non-accredited buyers.

Learn our full experience using RealtyMogul here.

Advantages of Crowdfunded Actual Property

- Entry to actual property investments with decrease capital necessities

- Diversification throughout a number of properties

- Skilled administration of investments

For Accredited Traders

One in every of my favourite methods to get began with rental properties is thru EquityMultiple. Just like LendingClub, you can begin investing in actual property for as little as $5,000 at platforms like EquityMultiple.

This platform has a pleasant mixture of smaller residential to blended use residential and business properties. Learn our full EquityMultiple review here.

4. Make investments In Farmland

Is Farmland Investing

Price It?

Farmland is not horny, nevertheless it has quite a bit going for it in terms of actual property investing. It is gradual, regular, pays constant hire, and everybody must eat. Plus, in comparison with different forms of actual property its a lot much less unstable. There’s two main corporations that assist you to spend money on farmland. FarmTogether and AcreTrader.

We lately did a behind the scenes assessment of our personal AcreTrader funding, and you’ll watch the AcreTrader review video on YouTube.

Try our critiques and get began:

Advantages of Leasing Farmland

- Regular rental earnings

- Land appreciation potential

- Minimal administration duties

5. Excessive Yield Financial savings Accounts And Cash Market Funds

Are Financial savings Accounts

Price It?

In the event you do not wish to assume a lot about your cash, however need it to be just right for you, a primary place to place it’s in a excessive yield financial savings account or cash market fund.

The distinction is within the account kind and the place it is situated. Sometimes, high yield savings accounts are situated at banks, and are FDIC insured. Cash market funds might be situated at each banks and funding corporations, and are solely generally FDIC insured.

Rates of interest have been rising, so placing extra money right into a financial savings account can generate a secure passive earnings stream.

American First Credit Union at the moment presents a strong yield at 5.27% APY with only a $100 minimal to open! Check out American First here >>

Traits of Excessive-Yield Financial savings Accounts

- Federally insured as much as FDIC Limits

- Accessible and liquid

- Low-risk funding

If you’d like the freshest charges on excessive yield financial savings accounts and cash markets, take a look at these lists that we replace the charges each day on:

6. Crypto Passive Earnings Alternatives

During the last a number of years, crypto financial savings accounts have turn out to be highly regarded – just because they supply the chance for greater charges of return in your cash. It is vital to notice that these aren’t actually “financial savings accounts”. These are funding and lending accounts that assist you to earn a excessive yield in your crypto “simply”. However they don’t seem to be with out threat!

Some common choices are Uphold and Nexo (solely accessible outdoors america). You possibly can earn upwards of 25% APY in your crypto at these corporations, however there are dangers. Try our full guide to Crypto Savings Accounts here.

You too can have a look at staking your crypto, lending your crypto, and even shopping for NFTs. There are a number of alternatives to earn passive earnings with crypto – we put collectively a full information right here: How To Make Passive Income With Crypto.

Well-liked Cryptocurrencies for Staking

7. CD Ladders

Constructing a CD Ladder requires shopping for CDs (certificates of deposits) from banks in sure increments as a way to earn a better return in your cash. CDs are provided by banks and since they’re a low threat funding in addition they yield a low return. It is a good choice for the danger averse to construct passive earnings streams.

For instance, what you do if you need a five-year CD ladder is you do the next. Look how the charges rise over completely different time durations (these are estimated):

- 1 Year CD – 4.00%

- 2 12 months CD – 4.250%

- 3 12 months CD – 4.50%

- 4 12 months CD – 5.00%

- 5 12 months CD – 5.25%

If constructing a CD Ladder sounds difficult, you can even follow a standard excessive yield financial savings account or cash market fund. Whereas the returns aren’t as wonderful as different issues on this listing, it is higher than nothing, and it is actually passive earnings!

We advocate constructing a CD Ladder at CIT Bank as a result of they’ve among the best CD merchandise accessible. Excessive charges and even a penalty-free CD option (which at the moment earns 4.90% APY). Try CIT Bank here.

You too can have a look at CD alternate options like Save. Save is a hybrid product that probably means that you can earn approach above market returns, however retains your principal secure in an FDIC-insured checking account. Check out Save here >>

Try these nice offers on the perfect excessive yield CDs on our full listing of the best CD rates that get updated daily.

Advantages of CD Ladders

- Increased rates of interest in comparison with financial savings accounts (normally)

- Common entry to funds

- Decreased threat of rate of interest fluctuations since you have locked in a price

8. Annuities

Annuities are an insurance coverage product that you simply pay for however can then present you passive earnings for all times within the type of month-to-month funds. The phrases with annuities fluctuate and usually are not at all times an awesome deal so it’s greatest to speak to a trusted monetary advisor for those who’re taken with buying an annuity.

These investments aren’t for everybody – they will include excessive charges, and never be value it. However you probably have zero threat tolerance for loss, and are in search of a passive income stream, this might be a very good potential concept for you your portfolio.

Try Blueprint Income for a market for private annuities.

Varieties of Annuities

- Fastened annuities

- Variable annuities

- Listed annuities

9. Make investments Robotically In The Inventory Market

Are Robo-Advisors Price It?

In the event you’re not taken with choosing dividend paying shares (and I can perceive that), there are nonetheless methods to take a position passively within the inventory market. You possibly can routinely spend money on numerous methods by what’s referred to as a robo-advisor.

A robo-advisor is rather like what it feels like – a robotic monetary advisor. You spend about 10 minutes answering a number of questions and organising your account, and the system will take it from there.

The preferred robo-advisor is Wealthfront – which you’ll setup to routinely spend money on and they’ll deal with the remainder for you. What’s nice about Wealthfront is that they cost one of many lowest charges within the robo-advisor business, and so they make it very easy to take a position routinely.

Plus, Wealthfront was lately named considered one of our high picks for the Best Robo-Advisors For 2023. They provide an awesome service plus you will get recommendation from an actual human, which is superior. Learn our full experience with Wealthfront here.

Sign up for Wealthfront here and get began investing for a passive earnings!

10. Make investments In A REIT (Actual Property Funding Belief)

In the event you’re involved about investing straight in actual property, or possibly you are not but an accredited investor, that is okay. You possibly can nonetheless make the most of actual property in your investments by REITs – Actual Property Funding Trusts.

These are funding autos that maintain property inside them – and also you because the proprietor get to learn from the beneficial properties, refinances, sale, earnings (or loss) on the property.

Our favourite platform to spend money on a REIT is Fundrise¹. They solely have a $500 minimal to get began and supply quite a lot of choices we love as effectively!

11. Make investments In A Enterprise

Are Enterprise Loans Price It?

One other solution to generate passive earnings is to take a position and be a silent companion in a enterprise. That is very dangerous, however with threat comes the potential for top returns. For instance, a number of years in the past each Lyft and Uber had been in search of personal buyers to spend money on their corporations. Immediately, they’re value billions – however you as an investor would solely reap that profit in the event that they go public through an IPO, or get acquired. So, it is dangerous.

However there are methods to cut back your threat. For instance, you possibly can make investments small quantities in lots of corporations by lending them cash in small bonds.

There at the moment are instruments accessible the place you possibly can mortgage cash to a enterprise and receives a commission a strong return for doing it!

Small Enterprise Loans

% is an organization that assist you to lend cash to companies in numerous methods. They’re a market for lending, and so they supply business loans, receivable loans, and extra. You have to be an accredited investor, however for those who’re in search of extra threat and reward, it might be an choice. Learn our full experience and Percent review here.

Income Sharing Notes

MainVest is an organization that means that you can spend money on a enterprise who agrees to share a proportion of their future income till their buyers obtain a return on funding. You can begin investing in companies for as little as $100, and also you get repaid your principal and curiosity over time. Learn our full MainVest review here.

12. Make investments In Scholar Earnings-Share Agreements

An Earnings-Share Settlement (ISA) is an alternative to student loans. Through the use of an ISA, a scholar’s tuition is paid for in change for a proportion of their future earnings.

Who’s funding these ISAs? Personal buyers and universities fund them. Traders principally take a guess on a scholar’s future.

You see these mostly at coding academies and commerce faculties, however they’re growing in popularity.

Edly is an organization that means that you can spend money on ISAs. They’ve two choices – one you possibly can make investments straight in a notice, and the opposite in a fund that they use for future notes. Relying on timing, there may not be any open notes accessible in to take a position.

You have to be an accredited investor to take a position, and there’s a $10,000 minimal. Nevertheless, they’re concentrating on 8-14% returns, which is superior. Learn our full Edly experience and review here.

13. Peer to Peer Lending

Is Peer-To Peer Lending

Price It?

P2P lending is the apply of loaning cash to debtors who sometimes don’t qualify for conventional loans. Because the lender you will have the power to decide on the debtors and are capable of unfold your funding quantity out to mitigate your threat.

Proper now, PeerStreet is among the greatest lending platforms on the market. However these loans are going for use for actual property, so hold that in thoughts. Try our full PeerStreet review here.

What’s nice about that is that you just lend your cash, and also you receives a commission again principal and curiosity on that mortgage.

The median return on money circulation is 4.1% – which is best than any cash market fund you are going to discover right now. Try different CD alternatives.

14. Exhausting Cash Loans

Is Exhausting Cash Lending

Price It?

Just like different forms of peer to see lending, arduous cash loans concentrate on a selected area of interest – actual property loans. These loans are sometimes used for repair and flip initiatives, or brief time period bridge loans.

Proper now, Groundfloor is among the oldest platforms within the area that has been making a market for arduous cash loans.

Nevertheless, understand it isn’t with out threat. In line with Groundfloor, there was been a 1% loss ratio since they began with their market.

In the event you’re , you will get began on Groundfloor for as little as $10.

15. Grow to be An Angel Investor

Is Angel Investing

Price It?

Have you ever ever watched the present Shark Tank, the place the 5 buyers take heed to pitches from small corporations after which make presents to take a position? That is referred to as angel investing – and for a lot of buyers, it would not appear to be the present Shark Tank in any respect!

As a substitute, most corporations pitch their concepts on-line through e mail introductions, zoom conferences, and small shows. And there are even some web sites that “syndicate” offers collectively – the place a bunch of individuals get to collectively to spend money on a startup. And you’ll be part of that too!

It’s important to do not forget that that is extraordinarily excessive threat, excessive reward – nevertheless it’s completely passive investing. Most startups do fail, and if the corporate you spend money on fails, you can lose all of your funding.

In the event you’re seeking to turn out to be an angel investor, take a look at AngelList or Propel(x). AngelList most likely has the best quantity of deal circulation accessible, whereas Propel(x) focuses on area of interest offers.

Ideas for Investing in a Enterprise

- Select a enterprise with development potential

- Assess the administration crew’s competence

- Perceive the exit potential and technique

16. Lend Towards NFTs

In the event you’re into the NFT-space, there’s a actually attention-grabbing approach that you would be able to make passive earnings by merely lending to others with NFTs as collateral. What this implies in apply is that you simply create a wise contract with somebody who owns an NFT, you agree on an quantity to lend to them, a compensation interval, and also you each digitally signal this contract.

Keep in mind that most NFT lending is finished through Ethereum, so that you present the funds in ETH, and so they repay you in ETH. If the borrower would not repay you in time (or in any respect), the good contract will switch you possession of the collateral NFT.

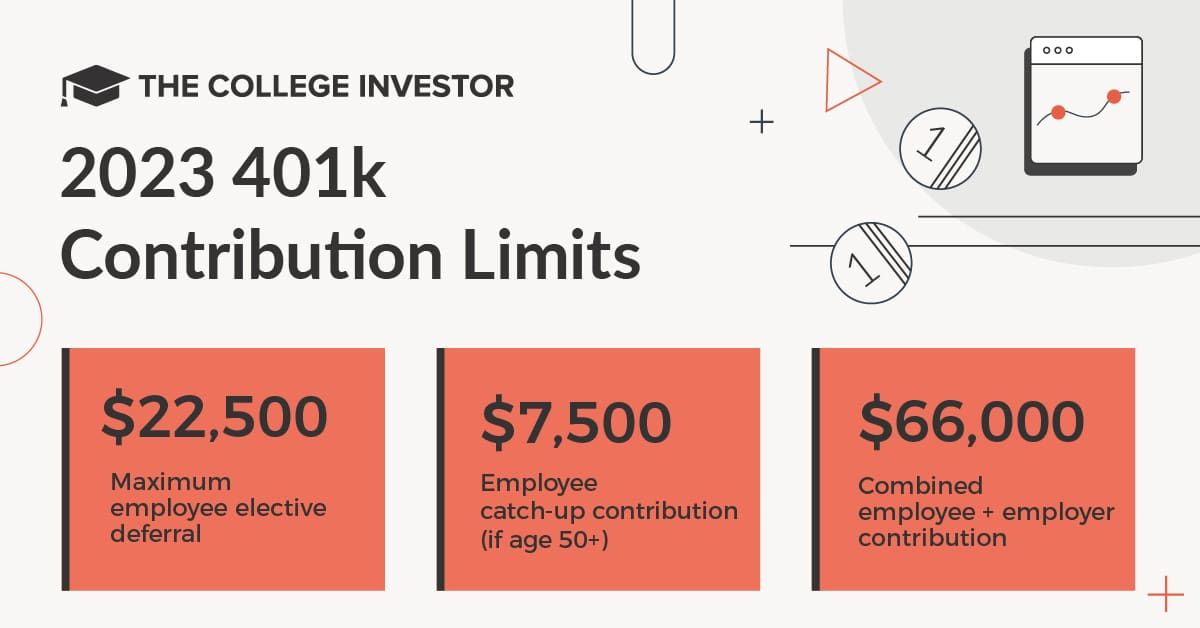

17. Do not Overlook Your Matching Contributions

Is 401k Matching

Price It?

That is considered one of my favourite passive earnings concepts, as a result of it is really easy, but so many individuals fail at it. It is easy – make the most of matching contributions in your 401k or HSA.

That is actually free cash for merely contributing to your individual retirement accounts. By not benefiting from the match, you are leaving free cash on the desk.

All you must do is be certain that you are contributing sufficient to your 401k or HSA so that you simply get the complete matching contribution. In your HSA, your employer additionally would possibly require you to take motion – like taking a well being evaluation or getting a bodily. However all that free cash can add up!

Passive Earnings Concepts Requiring an Upfront Time Funding

The following part of passive earnings concepts require a time funding. As a substitute of utilizing cash, it is advisable put in sweat fairness to make these occur.

Nearly all of those concepts require starting a personal blog or website. However the wonderful thing about that’s that it is extremely low-cost to do. We advocate utilizing Bluehost to get started. You get a free area identify and internet hosting begins at simply $2.95 per thirty days – a deal that you simply will not discover many different locations on-line! You possibly can afford that to begin constructing a passive earnings stream.

18. Promote an eBook On-line

Self Publishing is mainstream right now. Whenever you buy an eBook off of Amazon there’s a reasonably good likelihood you’re shopping for a self-published e book. Self-publishing can be ridiculously straightforward. I attempted this a number of years in the past and couldn’t imagine how easy the method was.

To self-publish a e book you’ll first want to jot down and edit it, create a canopy, after which add to a program akin to Amazon’s Kindle Direct Publishing. Don’t anticipate on the spot success although. There’ll have to be a number of upfront advertising and marketing earlier than you possibly can flip this right into a passive earnings stream.

An analogous choice is to create printables that you would be able to promote on-line. Printables aren’t as in-depth as a full eBook, so they’re simpler to create and you’ll nonetheless earn a passive earnings in your gross sales! Learn to create on-line objects to promote on Fiverr and Etsy in your first day of this on-line course that teaches you what to do: The E-Printables Selling Course.

Ideas for Profitable eBook Publishing

- Determine a worthwhile area of interest or subject

- Create participating, well-written content material

- Promote your e book by numerous channels

19. Create an On-line Course To Promote

Are On-line Programs Price It?

Udemy is a web-based platform that lets its consumer take video programs on a big selection of topics. As a substitute of being a shopper on Udemy you possibly can as an alternative be a producer, create your individual video course, and permit customers to buy it. It is a improbable choice in case you are extremely educated in a selected subject material. This may also be a good way to show conventional tutoring right into a passive earnings stream!

Just like Udemy, you can begin a YouTube channel the place you educate excessive demand topics, and you’ll monetize through adverts. You do the work up-front to create the movies, and you then benefit from the passive earnings steams from the adverts for years to return!

Check out Udemy here to get started >>

Ideas for Making a Profitable On-line Course

- Determine a high-demand topic

- Create participating and informative content material

- Market your course successfully

20. Promoting Inventory Photographs

Is Promoting Inventory Photographs

Price It?

Do you ever marvel the place your favourite web sites, blogs, and generally even magazines get their pictures? These are usually purchased from inventory picture web sites. In the event you get pleasure from pictures you possibly can submit your pictures to inventory picture websites and obtain a fee each time somebody purchases considered one of them.

One of many largest marketplaces to sell stock photos is DepositPhotos. You possibly can add your pictures are earn cash every time somebody makes use of them.

The truth is, take a look at this superior story of considered one of our scholarship contestants who turned photography into a stock photo business.

21. Licensing Music

Is Licensing Music

Price It?

Similar to inventory pictures you possibly can license and earn a royalty off of your music when somebody chooses to make use of it. Music is usually licensed for YouTube Movies, commercials, and extra.

With the quantity of YouTube movies and podcasts which might be being created, there’s extra demand than ever for music – and individuals are prepared to pay for it.

The important thing solution to do it’s to get your music in a library that folks can search. Try this guide on how to license your music.

If you have already got a license and wish to promote it for money, or for those who’re seeking to purchase music licenses to earn earnings, take a look at Royalty Exchange. This platform connects artists with these seeking to construct a royalty income steam.

Well-liked Inventory Audio Platforms

- AudioJungle

- Pond5

- PremiumBeat

22. Affiliate Advertising and marketing

Is Affiliate Advertising and marketing

Price It?

Internet online affiliate marketing is the apply of partnering with an organization (changing into their affiliate) to obtain a fee on a product. This methodology of producing earnings works the perfect for these with blogs and web sites. Even then, it takes a very long time to construct up earlier than it turns into passive.

Larry Ludwig is a 25 12 months skilled on advertising and marketing and he constructed (and retired early) by creating web sites that earned passive earnings with internet online affiliate marketing. We’re recognized Larry for a very long time and positively is aware of what he is speaking about.

If you wish to get began with internet online affiliate marketing take a look at this course on affiliate marketing and how to become a full time blogger.

The right way to Achieve Affiliate Advertising and marketing

- Select a distinct segment with a powerful viewers

- Promote merchandise related to your viewers

- Construct belief and credibility by high quality content material

23. Design T-Shirts

Is Promoting T-Shirts

Price It?

Websites like Cafe Press enable customers to customized design objects like T-shirts. In case your design turns into common and makes gross sales you’ll have the ability to earn royalties. Plus, the passive earnings stream of that is that you would be able to setup print on demand providers in order that you do not have to have any stock and orders merely get fulfilled when prospects organize them.

Even Amazon has gotten into this enterprise of print on demand. Amazon has a brand new service referred to as Amazon Merch, the place you merely add your designs and Amazon takes care of the remainder (making it, packing it, and transport it).

Well-liked Merchandise Platforms

24. Promote Digital Recordsdata

Is Promoting Digital Recordsdata

Price It?

I’ve been into house décor recently and I needed to flip to Etsy to search out precisely what I needed. I ended up buying digital recordsdata of the paintings I needed printed out! The vendor had made a bunch of wall artwork, digitized, and listed it on Etsy for immediate obtain. There are different common digital recordsdata on Etsy as effectively akin to month-to-month planners. In the event you’re into graphic design this might be an incredible passive earnings concept for you.

Adrian Brambilia is a web-based marketer that has developed an enormous quantity of passive earnings streams over the previous few years. If that is one thing you are interested in, take a look at this course by Adrian Brambila that can help you get started.

The truth is, we promote digital recordsdata too. I re-used my first resumes and canopy letters as a digital product in order that different school graduates might get a head begin. Try my professional resume templates here.

Well-liked Locations To Promote Digital Recordsdata

- Etsy

- Academics Serving to Academics

- Gumroad

Semi-Passive Small Enterprise Concepts

I name these semi-passive earnings as a result of they’re extra like a enterprise, much less just like the concepts above. All of them additionally require a small mixture of money and time funding. However when you make investments, you possibly can earn extra earnings and sometimes accomplish that passively.

Nevertheless, these all do require some ongoing time funding, so they are not 100% passive like having a financial savings account.

25. Listing Your Place On Airbnb

Is Itemizing On Airbnb

Price It?

When you’ve got a home, condo, spare room, and even yard, consider listing your property on AirBNB and begin incomes cash whenever you get your home booked. Sign up your place today.

AirBNB is nice as a result of you possibly can earn cash on an area you already personal. It does require just a little work up entrance to prep your home, listing it, and clear up after friends, nevertheless it’s fairly passive in any other case.

26. Hire Out Your Area

Is Renting Your Property

Price It?

Possibly you do not have a room to spare, or an entire different home (who can afford it)? However possibly you will have area that you would be able to hire for individuals needing storage. That is the place Neighbor is available in.

With Neighbor, you possibly can hire area you are not utilizing to others to retailer their stuff. Some frequent issues that folks hire are driveway area or parking area for automobile or RV storage, storage space for storing, and enterprise space for storing.

Check out the Neighbor app here and begin incomes passive earnings from renting out random area you will have. You too can check out our review and experience with Neighbor.

Ideas for Renting Out Storage Area

- Guarantee a safe and clear storage setting

- Set a aggressive rental price

- Promote your area on native platforms

27. Hire Out Your Automotive

Is Renting Your Automotive

Price It?

Just like itemizing your home for hire, you can even listing your automobile for hire. This may be actually passive as a result of when you listing your automobile, it could actually earn you earnings whenever you’re not utilizing it!

Our favourite companion to hire your automobile is Turo. Turo means that you can put your automobile out for hire, and when individuals hire it, Turo handles the remainder!

The cool factor with Turo is that, relying in your location and what sort of automobile you will have, you can also make a good passive earnings!

Check out Turo here and get began incomes passive earnings together with your automobile! Try our list of other ways to make money with your car as well (many of the others aren’t passive although).

Well-liked Automotive-Sharing Platforms

Simple Passive Earnings Concepts

Final on the listing I needed to level out a few straightforward passive earnings concepts. These require no cash and no upfront work. Whereas the earnings are menial you continue to can’t beat straightforward passive earnings!

28. Cashback Websites

Are Cashback Websites

Price It?

Similar to cashback rewards playing cards you need to choose to make use of a cashback website when buying on-line. In the event you don’t you’re giving up free cash that requires little to no work! We simply in contrast the 2 hottest websites – Rakuten versus TopCashBack.

All you must do is login to those websites earlier than you make a purchase order, click on the hyperlink, and you may earn the share cash-back the positioning presents.

If you wish to know which websites are providing the best cashback, take a look at Cashback Monitor – a free comparability website that finds you the perfect cashback offers on the market.

29. Get Paid To Have An App On Your Telephone

What for those who might set up an app in your telephone, and receives a commission for it? Sure, this app tracks what you are doing and it sells your information – however what’s extra passive than that?

In the event you do not wish to do something out of the norm, take a look at Neilson Digital. You merely obtain the app and do what you usually do. The app runs within the background and you might be entered to win rewards. Easy, straightforward solution to get cash for nothing! Download the app here.

Mobile Expression is the same app for iPad. You possibly can earn rewards for putting in it and leaving it in your machine for a minimum of 90 days. And growth! You receives a commission!

Well-liked Market Analysis Platforms

30. Use Cashback Apps

Are Receipt Apps

Price It?

Past bank cards and web sites, there are additionally cashback apps that may enable you to get passive earnings from the buying you are already doing.

Dosh, for instance, works with 10,000 retailers and all you must do is obtain the app and store. Learn our Dosh review here to learn more.

Honey is a browser extension that may discover coupon codes and different reductions for any merchandise you are shopping for. Learn our full Honey review here.

The right way to Get Began

Whereas it may be tempting to wish to choose 5 passive earnings concepts to get began with I’d actually encourage you to select one to start with. You want time and the power to focus to actually a develop a passive earnings stream. Master one thing earlier than transferring on to the opposite.

It’s going to take a considerable period of time or cash to start with however I promise incomes passive earnings is the whole lot it’s cracked as much as be! Choose an concept, make a plan, and dedicate your self till that earnings stream involves fruition.

Incessantly Requested Questions

How do I generate passive earnings?

Passive earnings is the concept that you deploy time and/or cash and obtain earnings with no additional work. It’s important to do one thing to generate passive earnings up entrance, however then you possibly can depend on that earnings into the longer term.

What are some examples of passive earnings?

Investing is a good instance of a passive earnings stream. You make investments cash in an organization inventory, and also you obtain a dividend cost and appreciation on the funding. One other common instance is actual property. You purchase a property, and also you benefit from the hire as passive earnings.

Does passive earnings actually work?

Sure! Passive earnings is how the wealthy proceed to construct wealth. Whenever you don’t have cash, you possibly can leverage your effort and time to create earnings streams that may develop into the longer term. As you accumulate cash, you possibly can deploy that cash (and even mix it together with your time) to generate increasingly more passive earnings.

The place can I make investments to have passive earnings?

If you wish to make investments to generate passive earnings, dividend shares and mutual funds are nice methods to do it. You too can spend money on debt devices, like bonds. If you’d like a safer strategy, you possibly can spend money on a cash market account or CD to get a risk-free return in your cash.

What are the most well-liked passive earnings concepts?

There are many common passive earnings concepts. The preferred embody investing within the inventory market, proudly owning actual property, investing in a enterprise, and even merely protecting your cash in a excessive yield financial savings account. All of those approaches generate passive earnings, however they do require up entrance capital.

Does passive earnings actually require “no work”?

It is a delusion. Passive earnings at all times requires one thing up entrance: time or cash. Nevertheless, the concept that it turns into passive after you do the work is what’s alluring about it. For instance, you spend 6 months writing a e book, and you’ll benefit from the royalty earnings out of your e book for the remainder of your life with none additional work. That’s to not say that doing extra work received’t increase your earnings, however there is a component that requires nothing extra to earn.

How do taxes on passive earnings work?

The Inner Income Service (IRS) classifies passive earnings as “unearned earnings”, and the way it’s taxed varies based mostly on the kind. For instance, atypical dividends and curiosity are taxed at your atypical earnings price, however certified dividends are taxed at long-term capital gains rates. Earnings streams like rental earnings or actual property funding trusts could also be taxed in quite a lot of methods, together with atypical earnings, capital beneficial properties, and extra. However with rental property, you get a number of tax advantages with depreciation and different deductions. It’s best to seek the advice of a tax skilled you probably have questions.

What are a few of your favourite passive earnings concepts?

¹ The data contained herein neither constitutes a suggestion for nor a solicitation of curiosity in any securities providing; nevertheless, if a sign of curiosity is offered, it could be withdrawn or revoked, with out obligation or dedication of any form previous to being accepted following the qualification or effectiveness of the relevant providing doc, and any supply, solicitation or sale of any securities can be made solely by the use of an providing round, personal placement memorandum, or prospectus. No cash or different consideration is hereby being solicited, and won’t be accepted with out such potential investor having been offered the relevant providing doc. Becoming a member of the Fundrise Platform neither constitutes a sign of curiosity in any providing nor includes any obligation or dedication of any form.

The publicly filed providing circulars of the issuers sponsored by Rise Corporations Corp., not all of which can be at the moment certified by the Securities and Trade Fee, could also be discovered at www.fundrise.com/oc.

The Faculty Investor receives money compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for every new shopper that applies for a Wealthfront Automated Investing Account by our hyperlinks. This may increasingly create an incentive that ends in a cloth battle of curiosity. The Faculty Investor isn’t a Wealthfront Advisers shopper. Extra info is accessible through our hyperlinks to Wealthfront Advisers.

[ad_2]

Source link