[ad_1]

With 2023 within the rearview mirror, we will look again on the yr with 20/20 readability. This yr noticed banks confronting a number of dangers, some foreseeable and others much less so. If the yr has taught us something, it’s that banks can do extra to protect in opposition to the danger they’ll predict, and danger they could not see coming.

In 2024, danger will stay one in every of banking’s best challenges. With rising residential and industrial actual property costs, mortgage funds are outpacing wage will increase, leading to default danger. World financial uncertainty continues to loom massive, whereas cyberattacks proceed to pose a major menace. The rise of gen AI has handed hackers a complete new set of instruments, enabling deep fakes, viruses and complicated phishing scams.

How do banking CEOs view cyber danger? A current survey to know banking CEOs’ views on cyber resilience produced some noteworthy outcomes.

Our analysis, “The Cyber-Resilient CEO,” explores the position of C-suite leaders in dealing with cybersecurity threats to their organizations. The survey concerned 1,000 CEOs of huge organizations (these with greater than $1 billion revenues) in 15 nations and 19 industries. 53 banking CEOs had been represented in our pattern.

Once we requested banking CEOs concerning the largest problem they’re at the moment going through, 41% of them recognized a capability to keep up digital belief with finish client and enterprise shoppers with the rising danger of fraud. And practically half of respondents cited modernizing know-how (26%) and regulatory compliance (21%) as the important thing problem. It means that banks merely can not afford to loosen their grip on digital danger and compliance.

And the rewards of being extra cyber resilient are price having. Our analysis finds that CEOs who undertake a extra cyber-resilient strategy than the remainder obtain 16% larger incremental income development, 21% extra value discount enhancements and 19% more healthy stability sheets. What’s extra they detect, comprise and remediate threats sooner and their breach prices are 2X and 3X decrease than others.

Difficult the established order

Sadly, the trail to gaining such advantages is just not at all times straightforward. The cyber menace panorama is advanced and influenced by more and more excessive ranges of disruption. The Accenture World Disruption Index—a composite measure that covers financial, social, geopolitical, local weather, client and know-how disruption—exhibits that ranges of disruption elevated by 200% from 2017 to 2022. It will not be banking industry-specific disruption, however the ripple impact is being felt wherever it lands.

Banking respondents are extra conscious than the worldwide common of the three key forces creating cyber vulnerabilities:

Know-how innovation: 62% of banking CEOs ranked the accelerated tempo of know-how innovation as one of many high dangers for cyberattacks, 10% greater than the worldwide pattern—with 89% ranking cyber belief and resilience as extremely related for rising applied sciences, like generative AI and quantum computing.

Provide chain disruption: 36% of banking CEOs rank provide chain because the second highest exterior danger, far lower than the worldwide pattern at 51%.

Environmental vulnerabilities: 92% of banking CEOs acknowledge the hyperlink to and vulnerability from environmental modifications and initiatives, vs 90% of the worldwide pattern.

It’s not as if banking executives are unaware of the vital position of cyber protection: 98% of banking CEOs acknowledge cybersecurity is a key enterprise enabler however solely one-third (36%) strongly agree they’ve deep data of the evolving cyber menace panorama. And two-thirds (66%) are involved about their group’s capability to avert or reduce injury to the enterprise from a cyberattack.

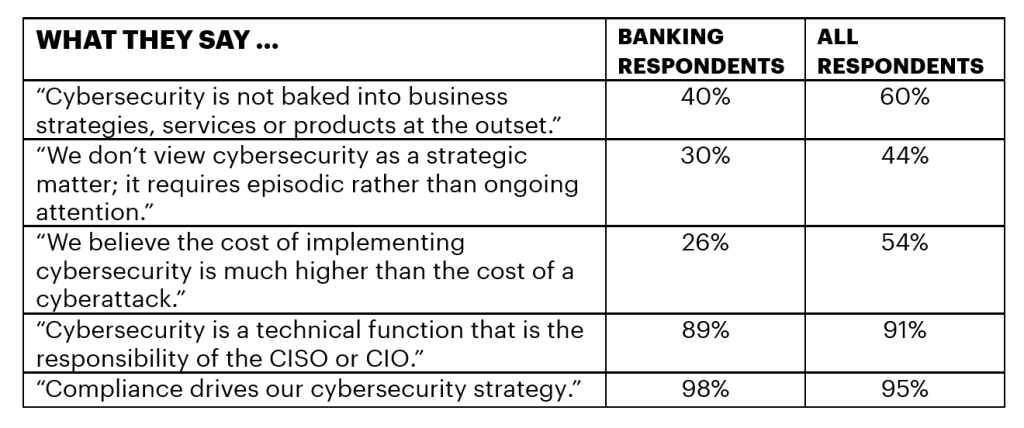

What banking CEOs say

There are some key traits that outline the cyber-resilient CEO and it’s good to see that CEOs within the banking {industry} look like making higher progress in cyber resilience than the worldwide common.

Right here’s the way it performs out:

These findings are supported by our conversations with C-suite banking executives internationally and it’s reassuring to see that banking is barely higher than the worldwide common by way of together with cybersecurity on the agenda; 26% of banking CEOs have devoted board conferences for discussing cybersecurity points, in opposition to simply 15% of world common respondents.

5 steps to the cyber-resilient banking CEO

Banking CEOs can watch and study from the core group of cyber-resilient CEOs who assess cybersecurity throughout their organizations from a broader perspective, together with expertise, innovation, sustainability and clients; they proactively take the next 5 actions:

- Embed cyber resilience within the enterprise technique from the beginning.

- Set up shared cybersecurity accountability throughout the group.

- Safe the digital core on the coronary heart of the group.

- Lengthen cyber resilience past organizational boundaries and silos.

- Embrace ongoing cyber resilience to remain forward of the curve.

Mitigating danger is a big a part of any financial institution’s remit and can proceed to play an vital position within the yr forward. Higher cyber resilience shall be a excessive precedence for the banking C-suite, particularly within the AI period.

In case you’d prefer to know extra concerning the sensible steps of learn how to grow to be a cyber-resilient CEO, we encourage you to read our report right this moment or get in contact to proceed the dialog.

What position will danger play within the subsequent yr? Look ahead to our High 10 Tendencies for 2024, Banking on AI in January.

Disclaimer: This content material is offered for normal data functions and isn’t meant for use rather than session with our skilled advisors. Copyright© 2023 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]

Source link