[ad_1]

Estimated studying time: 16 minutes

See the Canadian Finances Binder household’s March 2024 finances replace. Find out how we handle our cash, observe bills, and try for monetary success.

Should you’re new to CBB, it is a month-to-month finances breakdown so you may see how we spend and get monetary savings.

Why I Share Our Month-to-month Finances

For anybody new to CBB, this briefly explains our month-to-month finances replace.

I look ahead to placing this put up collectively because it lets us see the place our cash was spent.

A finances additionally acts as a diary to your bills so you may look again to see success and failure.

In spite of everything, we will solely achieve success if we study from the errors we make alongside the way in which.

Our finances replace additionally lets readers know that we’re not good and should make modifications like everybody else.

We use the instruments (Free budget Binder), and I hope you may have downloaded your free copy.

If there’s any data that you simply’d prefer to know or clarify about our finances, please share your feedback under or reply to this e mail.

Alright, let’s get into this.

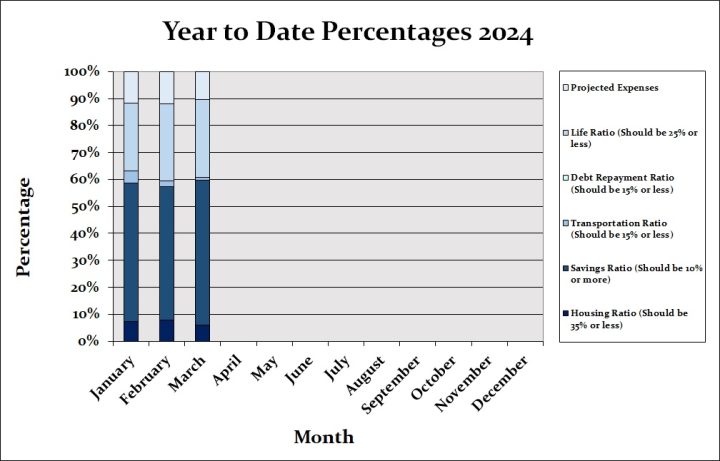

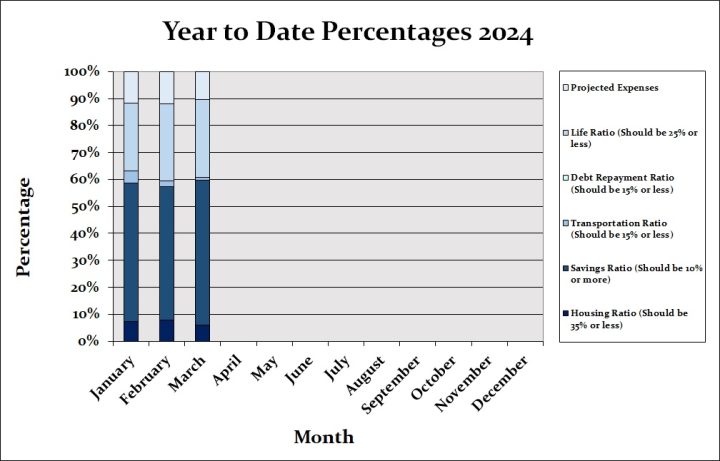

Percentages For Our March 2024 Finances

The year-to-date share chart is one other method to chart our family finances.

March 2024 Family Finances Percentages

Financial savings of fifty.8% embody investments and financial savings based mostly on our internet revenue.

Our life ratio of 27.06% accommodates every little thing from groceries, leisure, miscellaneous gadgets, well being/magnificence, clothes, and many others., all variable bills.

The life ratio is over once more in March, which we attribute to Costco, Well being and Magnificence, Prescriptions, and Pet finances classes.

I’ll clarify extra about these overages under.

Transportation covers fuel, insurance coverage, and upkeep for our car, which is absolutely paid.

Our house and vehicle are paid for, and we’ve zero client debt; nevertheless, we nonetheless pay property taxes and upkeep charges of 5.60%.

The projected expenses of 9.92% can change based mostly on what we encounter month-to-month, reminiscent of a brand new merchandise we have to save for.

52-Week Financial savings Problem

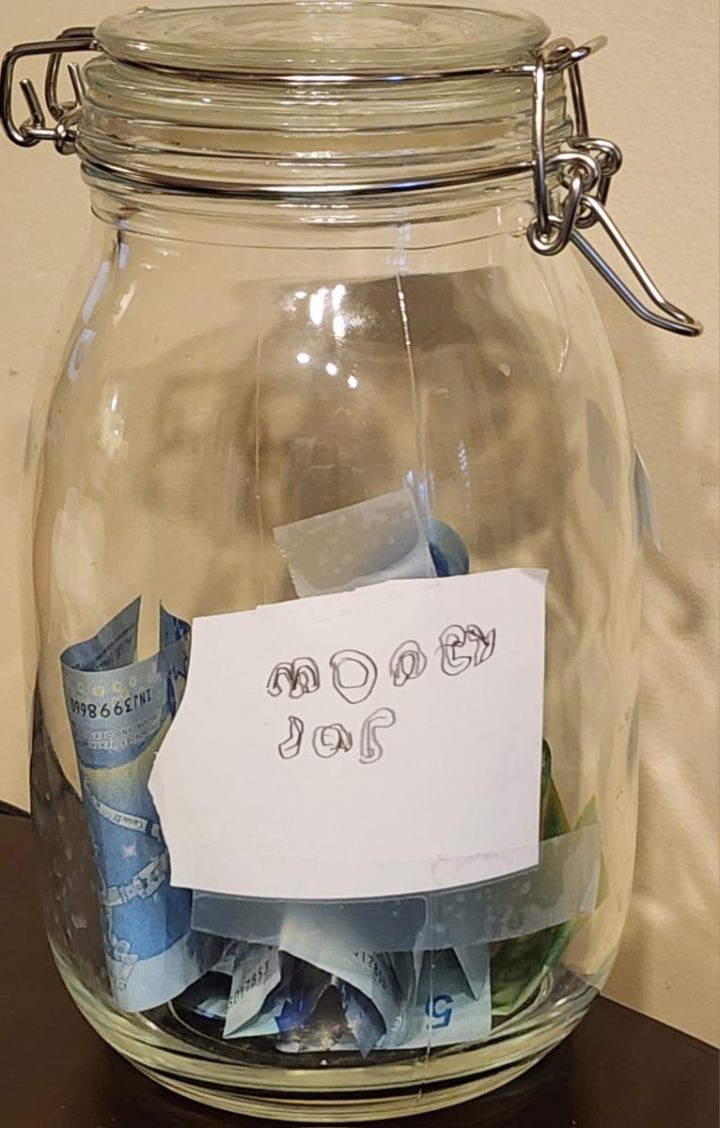

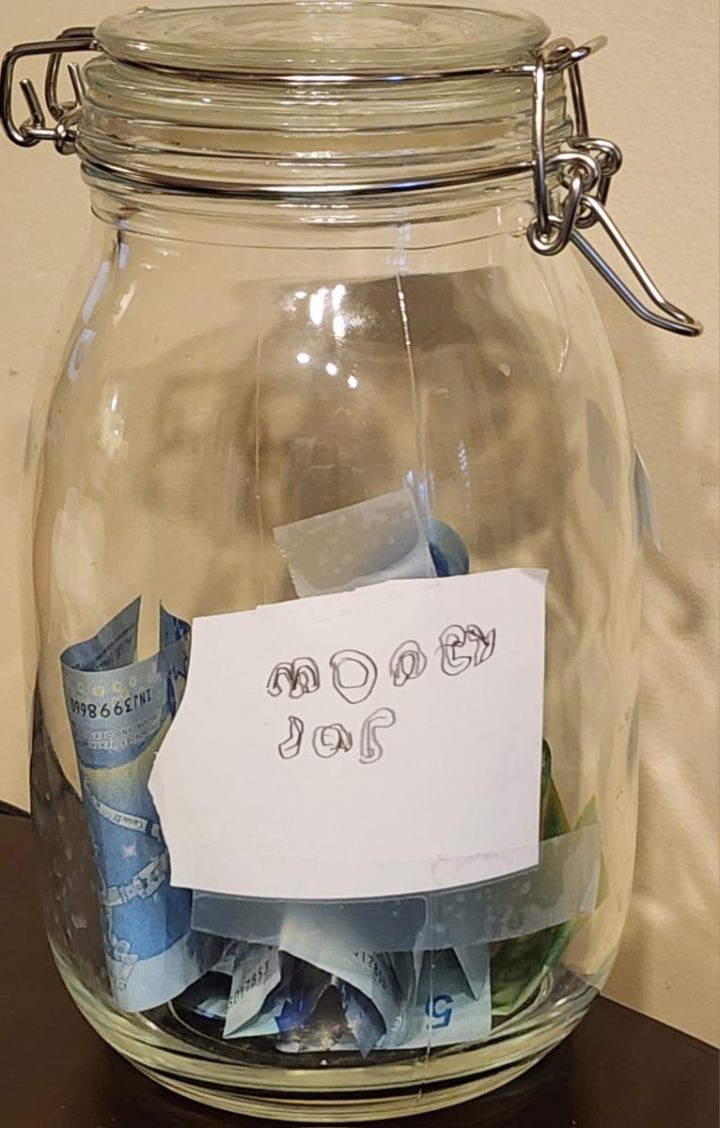

In December, I began a 52-week Savings Challenge and requested my readers in the event that they wished to take part.

Under is the jar we created to save lots of the cash for twelve months.

Our son acknowledged that he wished to take part, so it was determined that he would save his allowance or every other cash he earned.

Within the savings jar, he’s saving $5 weekly from his allowance, totalling $60 for March 2024.

He created a Moolah Jar label for his cash financial savings jar, which I assumed was humorous.

We don’t rely the additional days; we solely rely the complete weeks month-to-month.

CBB Fan 52-Week Problem Replace

Under is a CBB fan, TFSASaver, becoming a member of us for the 52-week financial savings problem and holding herself accountable by sharing with all of you.

Hey Mr CBB,

Right here’s a recap of my financial savings for March 2024.

- I offered a few gadgets for a complete of $50

- In March, I used $20 of PC factors, put the cash into my financial savings account

- Fortunate me, I discovered $1 in a cart (on a blizzardy day!)

- Complete for March = $71 into my financial savings account.

- My month-to-month aim is $62, so I’m proud of that.

TFSASaver

Grocery Meals Financial savings Jar March 2024 Replace

Why will we observe our grocery reductions for all the yr?

Tracking Our Grocery Discounts For One Year + Free Printable

I’ll tally it on the finish of the yr to see how a lot we saved buying reduced food products.

Learn the 2023 End of Year Grocery Food Savings Jar Review.

We saved $76.61 for March utilizing coupons, rewards apps, and Flashfood.

A few of our financial savings have been dairy merchandise, together with 4L luggage of natural milk for $3.00 on Flashfood.

To date, in 2024, buying discounted meals has saved us $357.54.

I can’t complain about that!

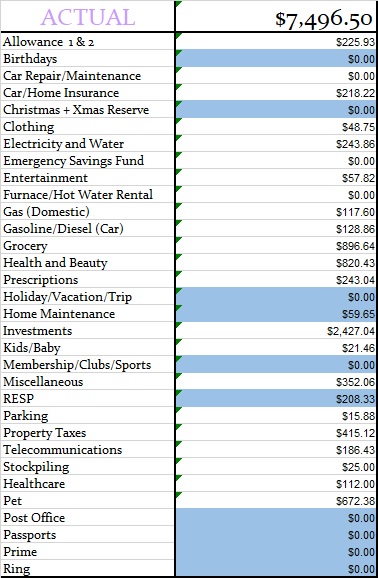

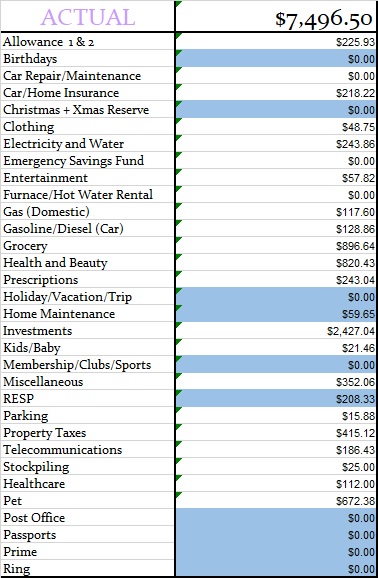

March 2024 Finances Estimation and Precise Finances

Under are two tables: Our March 2024 Finances and our Precise Finances.

Our March 2024 finances represents two adults and a 9-year-old boy.

Finances Color Key: It’s a projected expense when highlighted in blue.

Since Might 2014, we’ve been mortgage-free, redirecting our cash into investments and residential enchancment initiatives.

Spending lower than we earn and budgeting has been the simplest method to pay off our debt and save money.

Any such finances is a zero-based budget the place all the cash has a house.

Estimated March 2024 Finances

We might not want all the cash we budgeted for in every class; nevertheless, bear in mind the quantity is just an estimate from the earlier yr.

Don’t overlook to budget for projected expenses as a result of your whole month can fail because of not planning.

Precise March 2024 Finances

Canadian Banks, We Use

March 2024 Finances Class Adjustments

Our budget categories remained the identical in March.

Breakdown Of Our March 2024 Finances

Under are a few of our variable bills from March that I’ll focus on.

Allowance Mrs. CBB

Our allowance class is over due to Mrs. CBB and never me. Haha!

She might need to surrender her allowance in April and Might to catch up. Haha!

Prescriptions

Moreover Mrs. CBB’s paying for the shingles vaccine, our prescription bills have been commonplace.

The overall value for each shingles prescriptions will likely be beneath $400 and never lined by our medical insurance.

She’s now affected by every day full-body hives, so there will likely be much more bills for us till we type that out.

Grocery Finances March 2024 Finances

Our month-to-month grocery finances is $900 plus a $25 stockpile finances.

We spent $896.64, or $3.36, beneath finances for our March groceries.

That doesn’t occur typically, nevertheless it’s a cheerful time on the CBB house when it does.

Currently, we’ve been extra attentive to coupons than ever earlier than, though we don’t use lots of the merchandise supplied.

Pet Bills

In March, our pet bills of $672.28 have been over the finances of $350 for our two cats.

This was not a deliberate expense for our cats; nevertheless, we mentioned how this may make our lives simpler and theirs happier.

The cats at all times need to go exterior since that’s their intuition, and now they’ll do it after we are within the backyard or having fun with dinner on the deck.

We discovered an outdoor Catio for Mr. Black Snack Cat and Huge Ginger to allow them to get pleasure from some contemporary air this summer season.

The value was a $219-$20 coupon, which we thought was respectable after comparison shopping.

Because the furnishings and decor weren’t included, we bought two attachable hanging cat beds for $20 every.

Additionally, due to their fabulous gross sales, we ordered extra cat meals and treats from Chewy, a novel new Canadian pet meals firm.

Spend $80, save $20, and the costs are higher than Amazon so I wouldn’t miss out.

Supply is about the identical as Amazon, too, inside two days.

Lastly, we bought a Cat and Dog grooming vacuum 6 in 1, primarily for Huge Ginger, who has plenty of hair. He will get brushed every day exterior, however this machine is magical throughout the winter.

We purchased it on sale and paid $122.72, together with taxes, for the machine.

Well being And Magnificence

We budgeted $270 and spent $820, and I do know you assume that’s impulsive, nevertheless it occurred with good cause.

As famous in our finances replace, this was our worst finances class for March.

Most of what was bought beneath this class got here from Costco, Amazon, and Buyers Drug Mart.

Objects reminiscent of bathroom paper, which we stocked up on from Costco after which Zehrs, have been $14.99 x 4 for 30 double rolls.

Additionally, at Zehrs, the Scotties Tissue was on sale for $3.99 reg $8.99, so we picked up 3 packing containers.

I discussed a deal on Amazon for Tide and Achieve laundry cleaning soap on Fb in March.

Spend $75 and save $20, which was laborious to go up although it’s a financial savings above our month-to-month budgeted quantity.

Each laundry and softener have been on sale and at aggressive costs, so we made two purchases to top off.

I nonetheless bear in mind shopping for laundry cleaning soap for $0.50 after utilizing a $3.50 off coupon.

We had 96 jugs or Purex in our chilly room for years, however sadly, they’re gone.

This goes again to 2010-2012 when offers and coupons have been sizzling!

Wholesome Residing

In reviewing receipts and Amazon, I discovered purchases for Pure Protein Bars, Atkins Protein Bars, a hair wax stick, Crest toothpaste, and nutritional vitamins. (All gadgets have been on sale and in contrast.)

We additionally took benefit of 20x the PC Optimum Factors at Buyers Drug Mart and bought hair spray, Pantene conditioner, sunscreen, Reactine, Cerave face cream and wash, and a few grocery gadgets.

Mrs. CBB (see how she dominates this class, haha) bought IL MAKIAGE merchandise for her face from New York.

She purchases from them a few times yearly, so it’s not a month-to-month expense.

Greatest Protein Shakes In Canada

Lastly, Mrs. CBB purchased a stockpile of Good Protein shakes in virtually each taste for us.

We love Good Protein, which causes no fuel or bloating and has zero chalky aftertaste like whey protein.

It presents 100% pure plant-based substances with a steadiness of vitamins.

If you wish to attempt Good Protein, we extremely recommend this product.

Our favorite flavours are Creamy Vanilla, Mini Eggs, Peanut Butter Chocolate, Mocha, and Salted Caramel.

Now that we’re stocked on protein powder and have bought silicone granola bar molds, we plan to make protein bars as a substitute of shopping for them.

Free delivery on orders over $55, and also you get 60 days to attempt it, and when you don’t prefer it, you don’t pay for it.

It’s so standard that there’s even a devoted fan Fb group for Good Protein.

Right here’s 30% off your first Good Protein order utilizing coupon code Save30!

FlashFood App

Each one who indicators up will get a $5 credit score, a freebie supplied by Flashfood for brand new app clients.

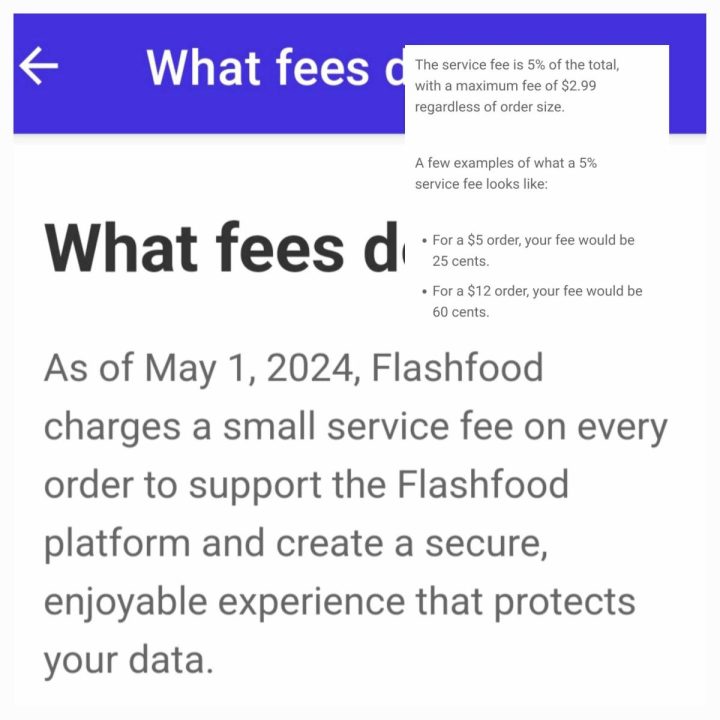

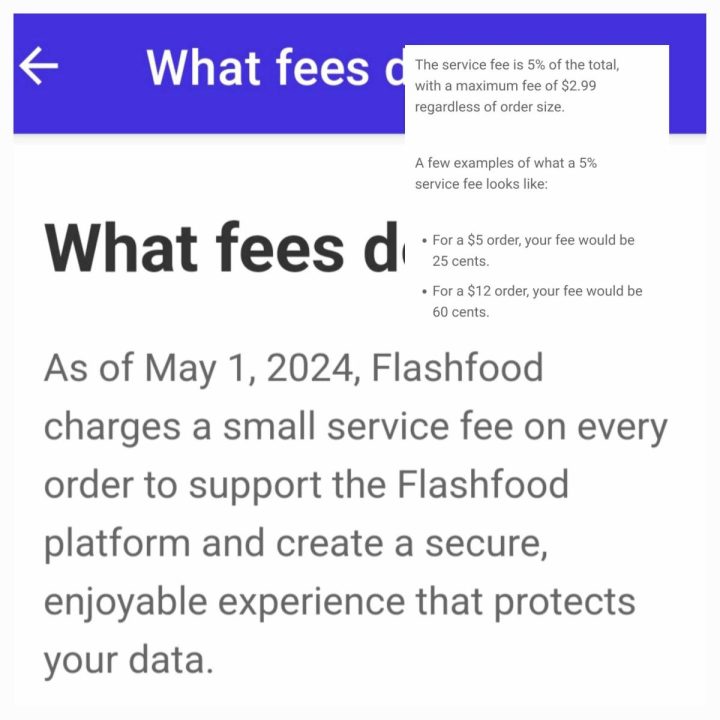

Additionally, Flashfood has added a small service charge to each order, which I really feel is appropriate. No enterprise can run with out incomes cash, and no one can work free of charge.

Flashfood was sort sufficient to drop by the CBB Fb web page to reply questions beneath my put up and clarify the service charge.

Use my referral code, MOCD28ZN4, to get the $5 credit score, and your first buy have to be over $15.

For the document, FlashFood retains altering the referral earnings from $3 to $5 for brand new members who join free.

Because of this when you use my code, you’ll both get $3 or $5 money again into your account based mostly on what they’re providing on the time.

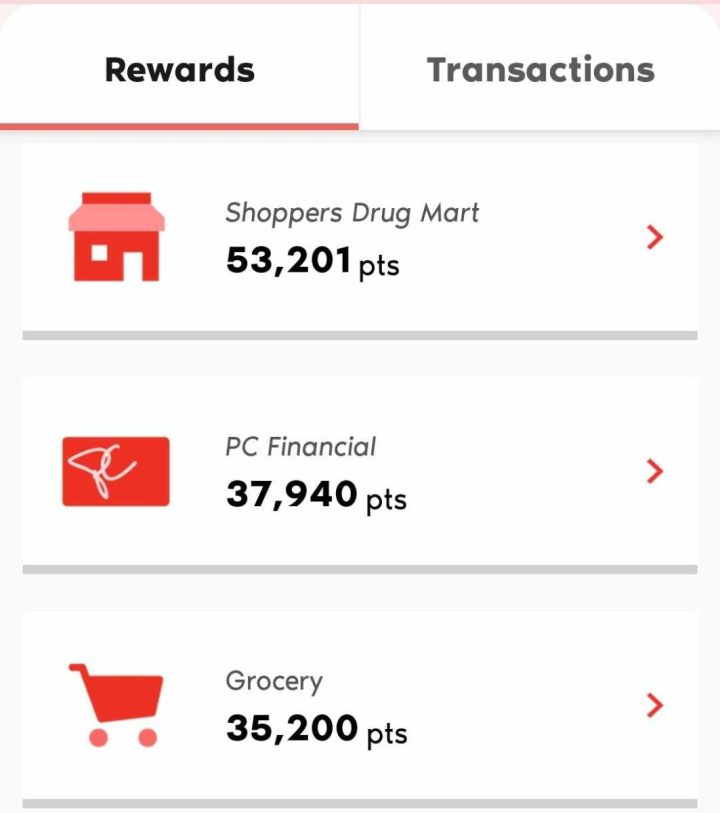

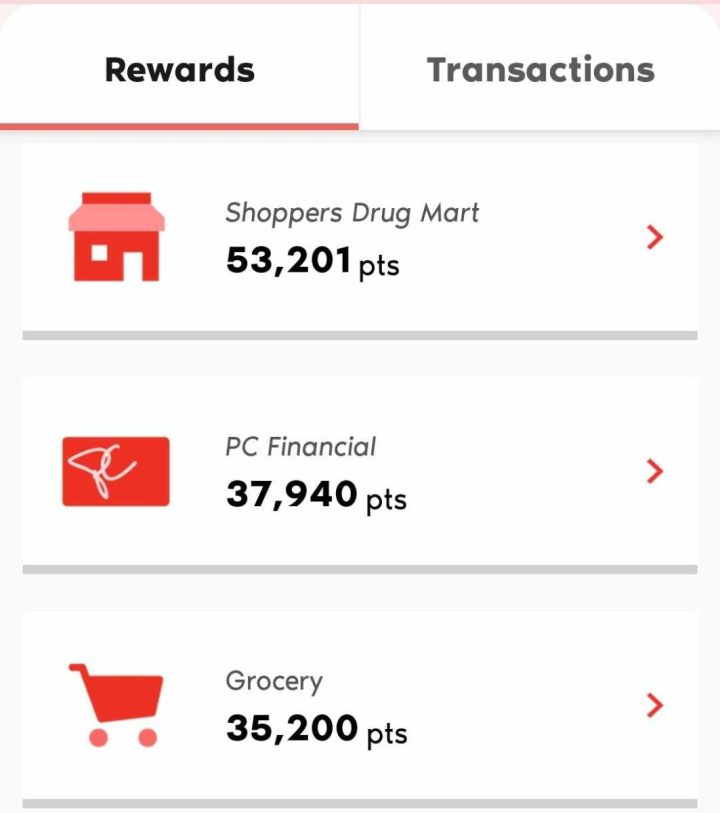

PC Optimum Rewards Factors 2024

During the last 45 days, March into April, we’ve earned 126,341 PC Optimum Factors or roughly $126 of free product.

We began 2024 with beneath 7 million PC Optimum Factors, or $7000, and now we lastly hit the mark.

I do know a lot of you may assume it is a large variety of factors, and we agree.

The method of saving them began after our son was born in 2014.

Between diapers and formulation, we amassed factors quicker than we might spend them.

Sure, we’ve redeemed many occasions, however solely throughout their Mega Bonus Occasion at Christmas.

Redeem 250,000 factors for $500; I consider it was $600 at one level.

A number of weblog posts can be found for anybody who desires to study extra about how we earn PC Optimum Factors.

TD Visa Money Again Quantity

Our TD Visa has a cash-back steadiness of $432.01. Sure, I do know I maintain saying I’ll use or switch it, and I’ll quickly.

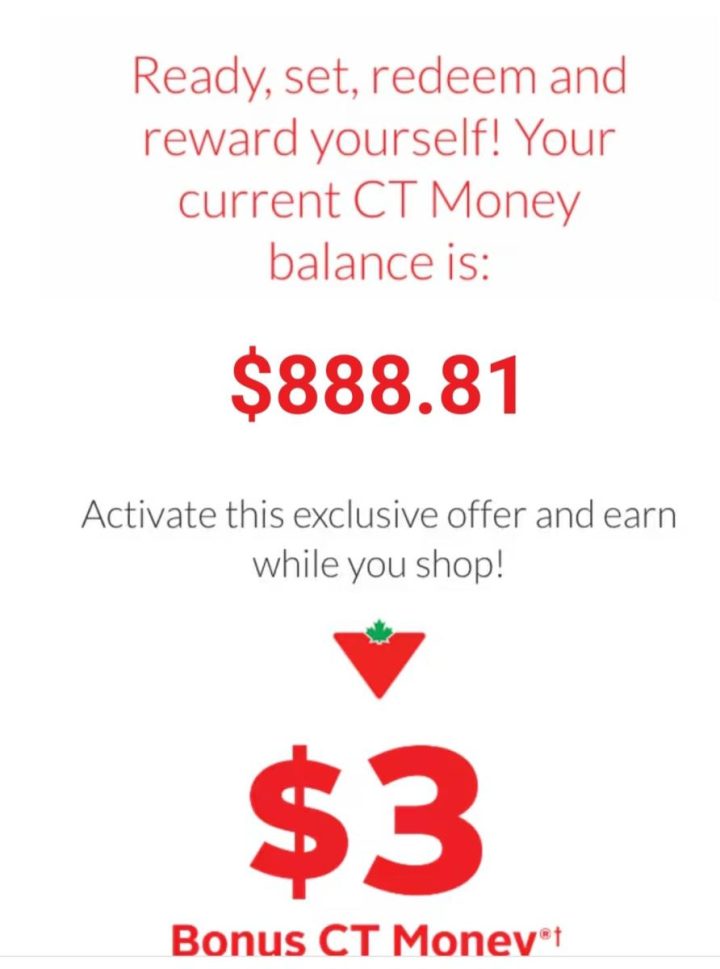

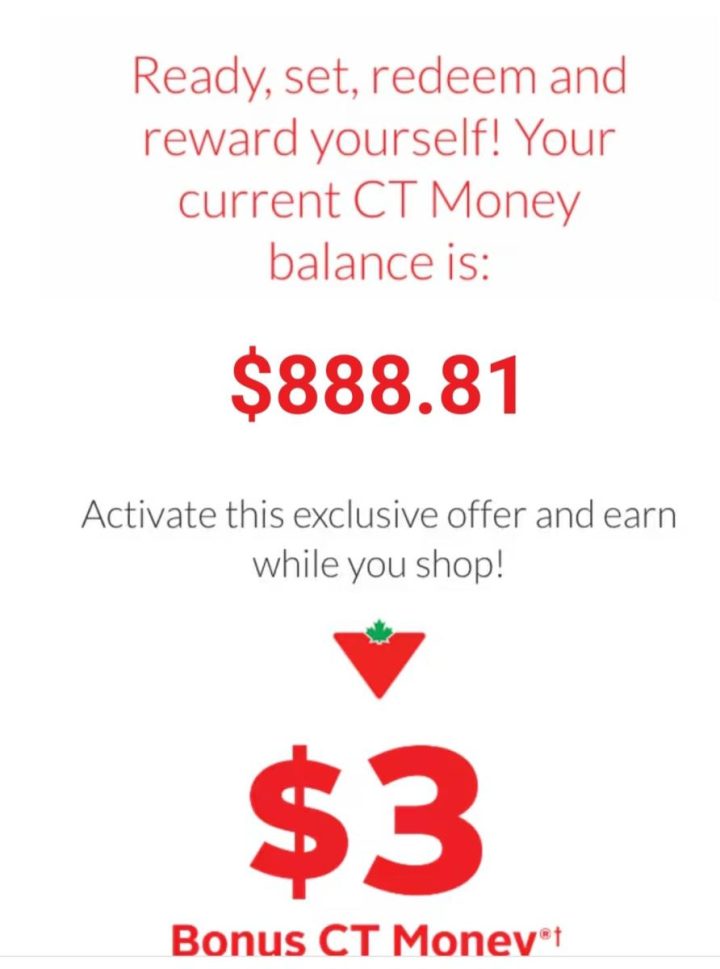

Canadian Tire Rewards Credit score Card

I’m saving this to place in the direction of purchases to decorate the storage so I can purchase an outdated automotive or truck to repair with our son.

Dream Air Miles March 2024

I’m including Air Miles as a result of they emailed Mrs. CBB, and we realized we hadn’t invested a lot curiosity in this system.

Most factors are from our home and automotive insurance coverage, which presents Air Miles.

There was a degree the place we had to decide on Money Miles or Dream Miles.

Since my household lives within the UK, we felt the Dream Miles would have labored greatest for us.

I hope to discover this program in 2024 and would love suggestions from all of you who make investments the time into constructing miles.

Hit reply and inform me about your Air Miles experiences.

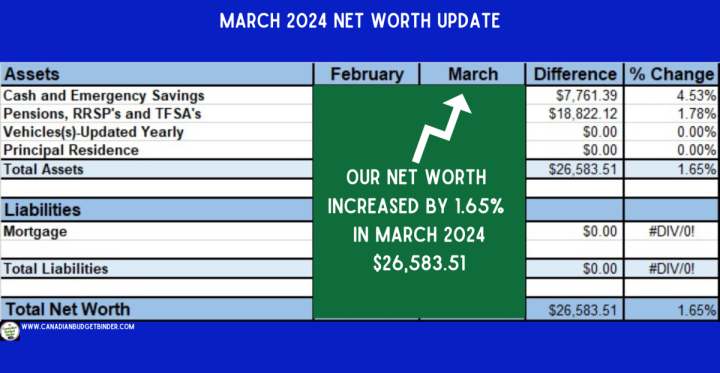

March 2024 CBB Internet Price Replace

After tallying three rewards playing cards, we discovered $7432.01 in money/rewards to redeem.

The above quantity will not be factored into our internet price, though the $1320.82 Canadian Tire rewards and TD Rewards are money.

For March, we noticed a rise in our funding portfolios by $18,822.12 or 1.78%.

Our money and emergency financial savings elevated by $7,761.39, or 4.53%.

We elevated our internet price by 1.65% or $26,583.51 in March

Investing is an enormous a part of growing our internet price, and it’s important to prioritize your funds.

When you’ve got any particular questions on how we make investments our cash, please remark under, and I’d be comfortable to reply them.

Till Subsequent Time!

That’s all for our March 2024 Month-to-month Finances.

I will likely be again in Might to overview our April month-to-month finances.

If there’s one thing you’d prefer to see in our month-to-month replace, hit reply to this e mail and let me know.

Thanks for stopping by, and please subscribe if you’re new to CBB to get my weekly weblog put up and month-to-month e-newsletter.

Learn our budget updates from 2012-current.

Mr. CBB

[ad_2]

Source link