[ad_1]

Just lately, the TaxA tax is a compulsory cost or cost collected by native, state, and nationwide governments from people or companies to cowl the prices of basic authorities providers, items, and actions.

Basis’s instructional program, TaxEDU, performed a nationwide tax ballot to know American taxpayers’ data of and opinions concerning the tax code. The outcomes: most Individuals are confused by and dissatisfied with the federal tax code.

To make sound monetary selections and help higher tax coverage, taxpayers ought to perceive the taxes they face. Sadly, most U.S. taxpayers have no idea or are uncertain of primary tax ideas.

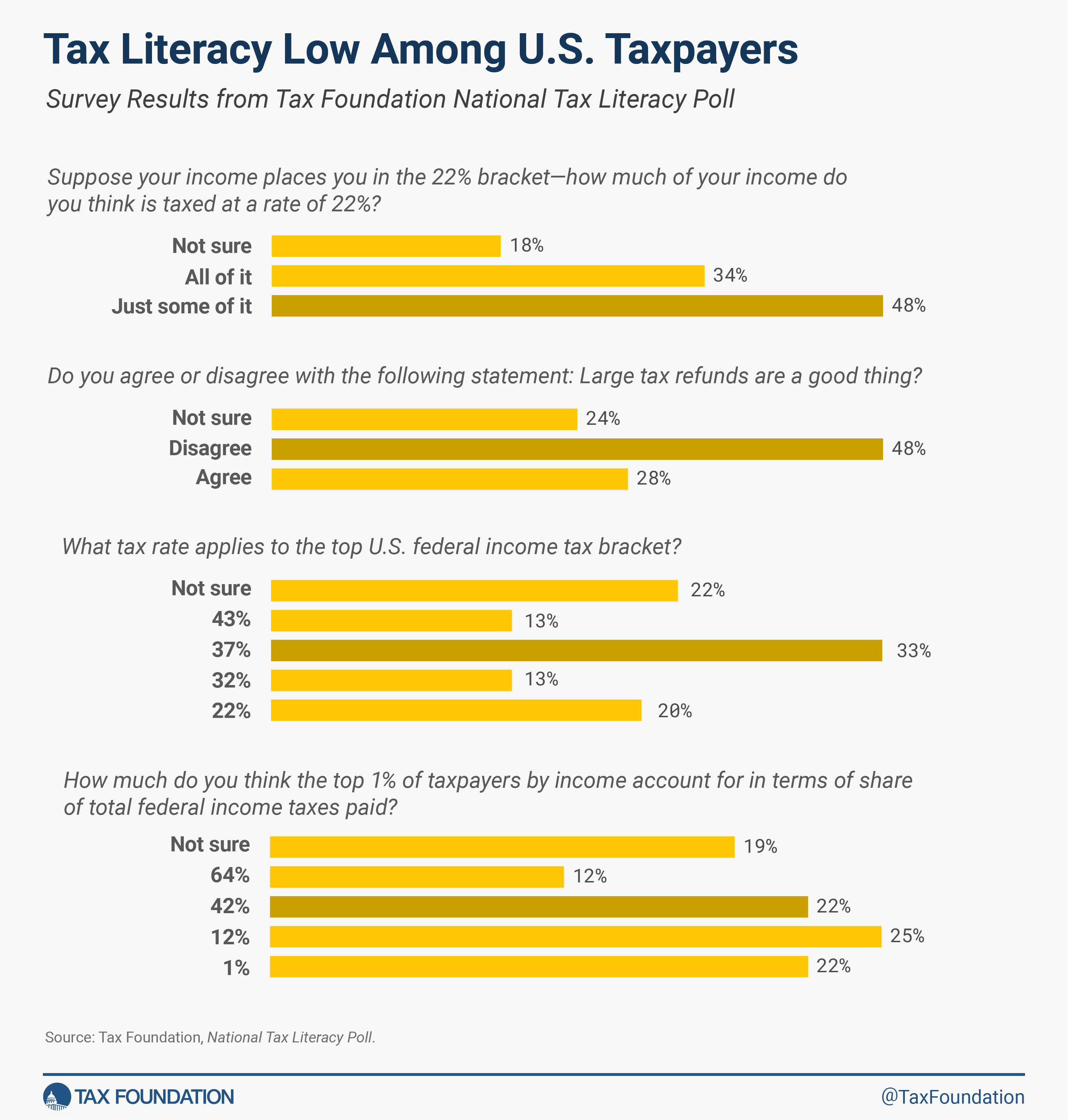

We reported outcomes that confirmed greater than two-thirds of respondents didn’t know the highest federal earnings tax price and over half didn’t know how tax brackets work. The vast majority of respondents additionally answered incorrectly when surveyed concerning the worth of tax credits versus tax deductions.

TaxEDU’s goal is to advance tax coverage schooling, dialogue, and understanding in lecture rooms, dwelling rooms, and authorities chambers. So, what are the appropriate solutions to the tax literacy portion of the ballot?

Query 1: To the very best of your data, what tax price applies to the highest U.S. federal earnings tax bracketA tax bracket is the vary of incomes taxed at given charges, which usually differ relying on submitting standing. In a progressive individual or corporate income tax system, charges rise as earnings will increase. There are seven federal particular person earnings tax brackets; the federal company earnings tax system is flat.

?

The highest federal earnings tax bracket for the 2023 tax submitting season was 37 percent. This bracket applies to earnings of $578,125 or extra for single filers, or $693,750 and above for married people submitting joint tax returns. For heads of family, the speed is utilized to earnings of $578,100 or extra.

Of these surveyed, solely 33 % answered this query accurately.

Respondents who fall into decrease tax brackets answered this query with much less accuracy (18 % appropriate) than these in greater brackets (44 % appropriate). However understanding this query is essential for all taxpayers.

Understanding the distribution of the tax burden can affect your private monetary decision-making, the way you work together with conversations about taxing excessive earners, and even the way you vote.

Once we dove deeper into tax brackets themselves, over half didn’t know or have been uncertain of how tax brackets work.

Query 2: Suppose your earnings locations you within the 22% bracket—how a lot of your earnings do you suppose is taxed at a price of twenty-two%: simply a few of it, or all of it?

The U.S. federal earnings tax is a progressive, graduated price system, the place charges enhance as earnings enhance. This method presently options seven tax brackets—or ranges of earnings—which can be taxed at charges from 10 % to 37 %.

The tax price related along with your prime tax bracket does not apply to all of your earnings, simply the portion that falls into that highest bracket.

How does this work? Any earnings that falls inside the vary of the primary/lowest bracket is taxed solely at that price (10 % in 2023). The very subsequent greenback you earn over that first bracket then falls into the second bracket and solely these extra {dollars} inside the vary of that bracket face that price (12 % in 2023).

This continues till you attain your prime bracket.

It is necessary for all taxpayers to know how tax brackets work to not solely perceive their very own tax burden, but additionally to tell selections about performing additional work via a second job or additional time, or pursuing new streams of earnings.

Query 3: Suppose you might be being taxed at a price of 10% on $10,000 of earnings, which do you suppose is extra useful to you: a $1,000 earnings tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a hard and fast quantity. Itemized deductions are common amongst higher-income taxpayers who usually have important deductible bills, corresponding to state and local taxes paid, mortgage interest, and charitable contributions.

or a $1,000 earnings tax creditA tax credit score is a provision that reduces a taxpayer’s last tax invoice, dollar-for-dollar. A tax credit score differs from deductions and exemptions, which cut back taxable earnings, relatively than the taxpayer’s tax invoice straight.

or do you suppose these are the identical factor?

When requested which was extra useful: a $1,000 tax credit score or a $1,000 tax deduction, 64 % of respondents answered incorrectly or have been uncertain which offered extra worth when submitting. The reply to the query above? The $1,000 credit score is extra useful.

Tax credits straight cut back tax legal responsibility greenback for greenback, whereas tax deductions cut back tax legal responsibility by the quantity deducted multiplied by the taxpayer’s marginal tax rateThe marginal tax price is the quantity of extra tax paid for each extra greenback earned as earnings. The common tax price is the overall tax paid divided by complete earnings earned. A ten % marginal tax price implies that 10 cents of each subsequent greenback earned can be taken as tax.

.

A $1,000 earnings tax credit score would prevent $1,000 outright, whereas a $1,000 deduction would solely cut back your taxable incomeTaxable earnings is the quantity of earnings topic to tax, after deductions and exemptions. For each people and firms, taxable earnings differs from—and is lower than—gross earnings.

by $1,000, saving you $100.

For these within the decrease earnings quintiles, tax credit are typically extra useful than deductions, since there’s much less earnings to deduct and marginal tax charges are decrease. In contrast, deductions could also be most popular by some higher-income taxpayers since they’re topic to greater marginal tax charges.

Query 4: How a lot do you suppose the highest 1% of taxpayers by earnings account for when it comes to share of complete federal earnings taxes paid?

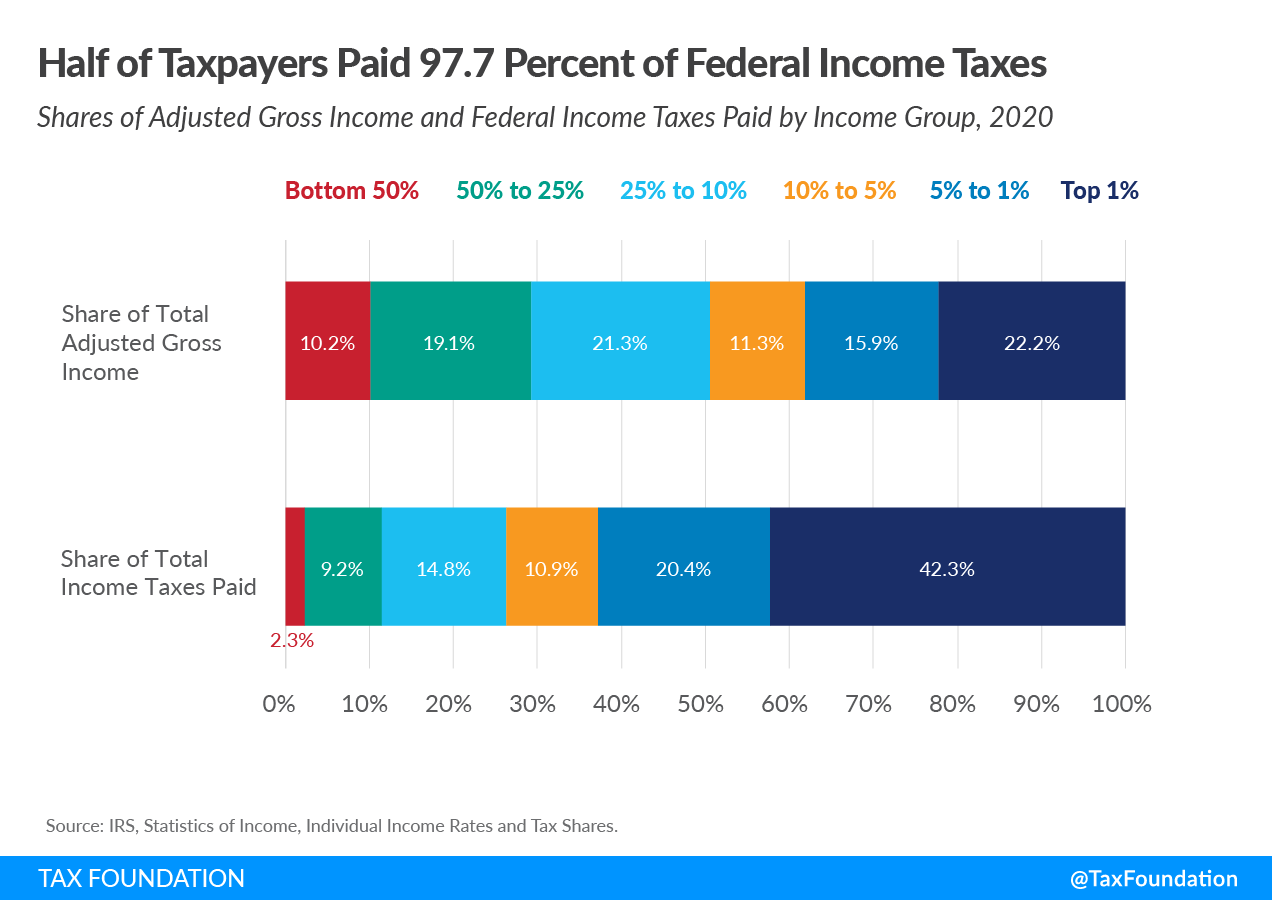

78 % didn’t know or have been uncertain of the share the highest 1 % of earners pay in federal earnings taxes: roughly 42 percent.

The share of earnings taxes paid by the highest 1 % elevated from 33.2 % in 2001 to 42.3 % in 2020. Over the identical interval, the share paid by the underside 50 % of taxpayers fell from 4.9 % to only over 2.3 % in 2020.

A preferred discourse in terms of U.S. tax coverage is that top earners ought to be taxed extra. By understanding what share excessive earners presently pay, we are able to have extra strong discussions surrounding tax coverage, and help extra sound coverage strategies from elected officers.

Query 5: Do you agree or disagree with the next assertion: Giant tax refunds are factor.

Of these surveyed, 48 % understood tax refunds have been nothing to have fun.

Many people stay up for receiving a refund when it comes time to file our taxes. More money is thrilling to obtain, however provided that it’s genuinely “more money.”

A tax refundA tax refund is a reimbursement to taxpayers who’ve overpaid their taxes, usually because of having employers withhold an excessive amount of from paychecks. The U.S. Treasury estimates that almost three-fourths of taxpayers are over-withheld, leading to a tax refund for thousands and thousands. Overpaying taxes may be viewed as an interest-free mortgage to the federal government. Alternatively, roughly one-fifth of taxpayers underwithhold; this will happen if an individual works a number of jobs and doesn’t appropriately regulate their W-4 to account for extra earnings, or if spousal earnings isn’t appropriately accounted for on W-4s.

is nothing to have fun as a result of it’s not “more money.” In case you obtain a refund, it’s since you over-withheld and gave the federal government an interest-free mortgage for the yr. In case your withholdingWithholding is the earnings an employer takes out of an worker’s paycheck and remits to the federal, state, and/or native authorities. It’s calculated based mostly on the quantity of earnings earned, the taxpayer’s submitting standing, the variety of allowances claimed, and any extra quantity of the worker requests.

was correct and also you had that cash as an alternative, you might have made cash with it by, say, placing it in a financial savings account or investing within the inventory market.

Nationwide Tax Literacy Ballot

Our nationwide tax ballot surveyed greater than 2,700 U.S. taxpayers over 18 years outdated—spanning the political spectrum and earnings distribution.

This survey reveals how, regardless of taxes taking part in a major function in private funds and being levied on a large portion of the U.S. inhabitants, most Individuals aren’t simply sad with the present tax code but additionally don’t perceive it. Education is step one in attaining extra correct and productive conversations about taxes, extra knowledgeable monetary decision-making, and even higher tax insurance policies.

Observe: That is the second in a collection of weblog posts concerning the Tax Basis’s Nationwide Tax Literacy Ballot. A full evaluation might be launched on the finish of the collection. The survey knowledge is accessible upon request presently and might be accessible through our web site with the discharge of the complete evaluation.

Keep up to date on the newest instructional sources.

Stage-up your tax data with free instructional sources—primers, glossary phrases, movies, and extra—delivered month-to-month.

Share

[ad_2]

Source link