[ad_1]

Partially one among my weblog, I explored how present macroeconomic occasions are akin to a photo voltaic storm and the Northern Lights are the manifestation of the banking trade’s response to uncertainty. Partially two, I’ll focus on key areas banks ought to give attention to to keep away from turning into paralyzed by the challenges they face.

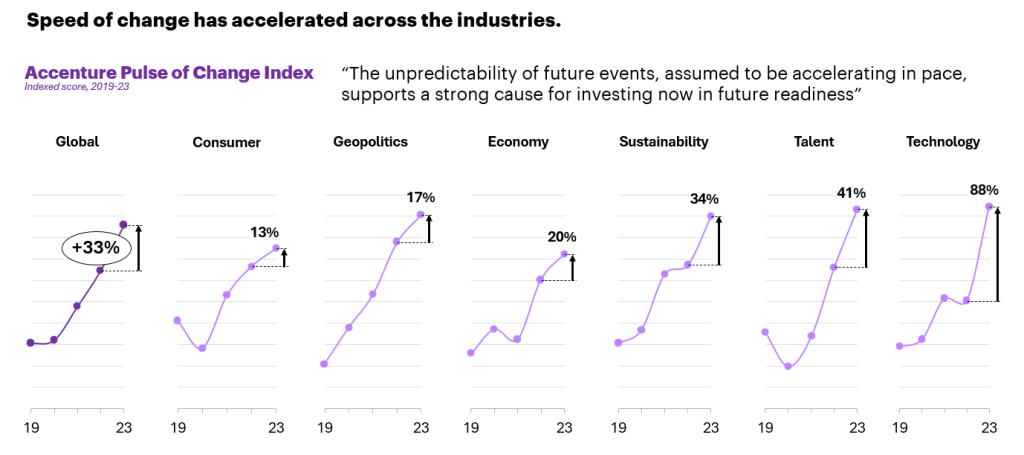

Over the previous 18 months, as soon as clear message has emerged: unpredictability is persistent. The period of low charges and predictable macroeconomic forces has ended. I imagine that our financial cycles—together with charges, inflation and credit score high quality—will solely proceed to evolve with higher tempo. The unpredictability of future occasions, assumed to be accelerating in tempo, helps a robust trigger for investing now in future readiness (see beneath). Adopting versatile expertise and a scalable working mannequin will likely be essential for shortly adapting to the accelerating tempo of financial modifications.

Click on to view bigger. Supply: Accenture Pulse of Change Index 2024.

Balancing the books: Prioritizing monetary well being in fast financial shifts

To ensure that banks to arrange for accelerated financial cycles, banks must prioritize their stability sheets. After years of low cost capital, low deposit prices and secure credit score high quality, these requirements are below strain. Banks ought to look to defend their operations from the dangerous radiation of the “photo voltaic storms” by specializing in managing rates of interest and credit score dangers successfully.

Rate of interest administration

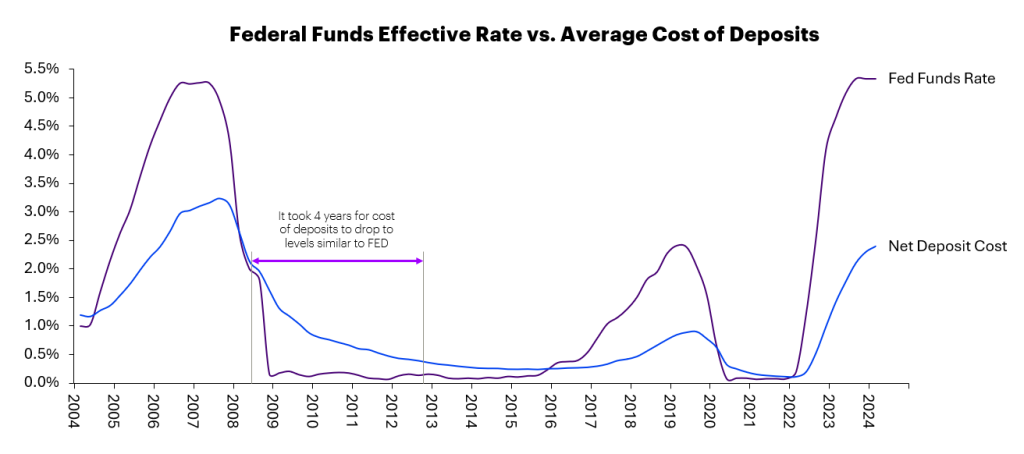

Over the past interval of declining rates of interest from 2008 to 2012, it took banks almost 4 years to regulate their deposit prices to match the federal funds charges. Whereas my earlier weblog mentioned how banks ought to capitalize from greater earnings when charges elevated, now they should give attention to deposit administration to get forward of potential losses when charges are anticipated to fall. Banks took the chance to regularly improve their beta to maintain revenue margins as charges rose. Nonetheless, lowering the deposit charges they provide prospects too swiftly to match decreases within the FED funds fee can result in the danger of shoppers shifting their cash elsewhere.

Click on to view bigger. Supply: Accenture Analysis

Credit score threat

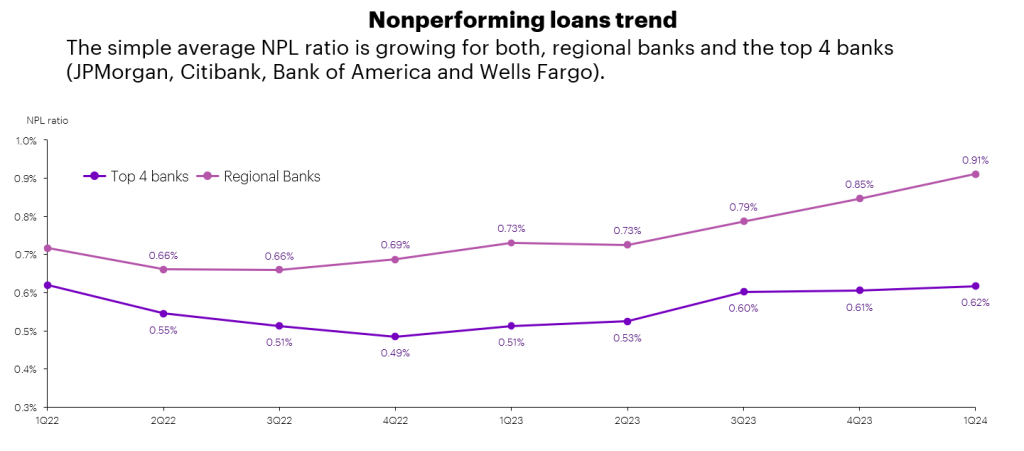

As prospects of retail banks have used up their financial savings from the pandemic and began utilizing credit score to deal with rising costs, the standard of credit score within the trade has declined. Non-performing loans are on the rise with provisions as a % of income at 9.5% (avg non-recessive years = 6.4%) *, and client debt now at $17.5 trillion (non-housing debt elevated 63.2% over the past ten years).

Along with conventional portfolio administration and growing loss provisions, banks can take into account two extra methods to handle credit score threat:

1.Enhanced credit decisioning with alternative data: Banks can improve their credit score decisioning processes by integrating different information sources by means of open banking and fintech capabilities. This strategy goes past conventional metrics like FICO® scores, earnings, and employment historical past, incorporating transactional information from utilities, hire, and healthcare funds. Moreover, banks can make the most of insights from behavioral economics, social media, and geolocation information to refine their threat evaluation methods.

For instance, Citigroup has introduced two pilot packages below the to prolonged credit score to debtors with out credit score making it simpler for underbanked to borrow funds.

Venture REACh permits banks to share this information with the — Experian, Equifax and TransUnion — which compile the credit score stories that inform your credit score scores. Some banks, together with Chase, can already take a look at financial institution deposits and money circulate to assist assess credit score eligibility for customers with no credit score historical past.

2. Knowledge-driven smart collections: By making use of rules of behavioral economics and using complete information evaluation, banks can develop customized engagement methods for collections. This methodology not solely improves response charges but in addition will increase the chance of profitable outcomes. Moreover, banks can improve buyer expertise by offering easy accessibility to fee reminders, personalized fee choices, and easy strategies for scheduling and making funds.

For instance, a regional financial institution confirmed a double-digit % improve of delinquency decision inside 60 days of launch of a personalized digital assortment platform.

Future-proof banking: Embracing composable structure for agile operations

For many of us, listening to concerning the subsequent lunar eclipse or meteor bathe with a couple of days’ discover is loads of time to arrange for a correct viewing. Sadly, retail banks’ skill to pivot their capabilities in response to a macroeconomic occasion isn’t but fairly as nimble.

A number of North American banks have begun to modernize their digital experiences and underlying structure. They’re shifting functions and workloads to the cloud, streamlining core platforms and constructing integration layers. These steps are all essential for supply true ‘digital’ and never simply ‘digitized’ banking providers. Given the fast tempo of change throughout all industries, together with banking, then a shift towards a extremely composable structure is crucial to remain aggressive and future-proof the enterprise.

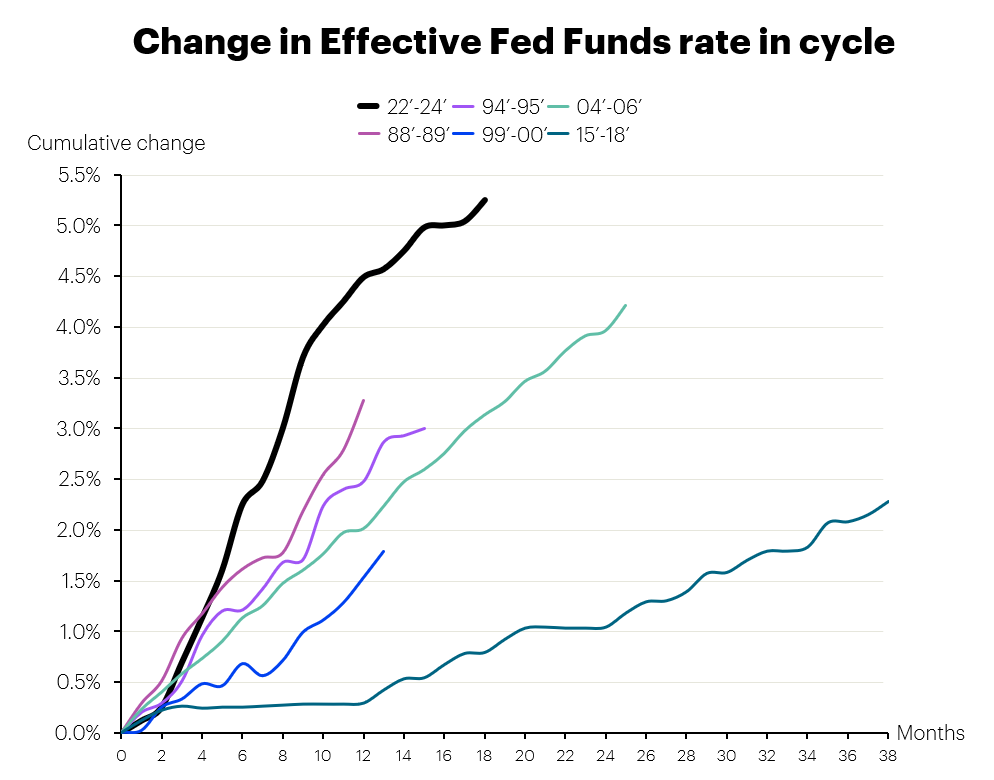

To curb inflation, the federal funds fee was elevated by 525 foundation factors in simply over 16 months: a fee of improve not seen since 1994. As charges escalated at tempo, retail banks shifted their focus to deposit merchandise for the primary time in a long time. Nonetheless, banks efforts to handle deposit expense successfully and introduce really modern capabilities —with out merely chasing short-term deposits—have been hindered by outdated programs. These legacy programs, characterised by tightly built-in platforms, slowed down the introduction of recent capabilities and made them pricey.

Click on to view bigger.

Adopting a composable structure turns into a ‘no regrets’ choice. Listed here are some great benefits of a contemporary composable structure:

-

- Velocity to market: Reduces the lead time throughout infrastructure, platform and operations, enabling faster expertise deployment.

- Agility: Facilitates the swift activation of recent enterprise capabilities, leveraging each inside and exterior ‘better of breed’ companions

- Elasticity/Scalability: Enhances dynamic capability administration, together with options like autoscaling and optimization, to regulate assets as wanted.

- Value Discount: Achieves financial savings by means of the industrialization and standardization of the platform.

In keeping with Gartner’s Hype Cycle for Digital Banking composable core banking is acknowledged as one of many few transformational advantages anticipated to succeed in mainstream adoption throughout the subsequent 18 months.

Banking on innovation: Making ready for the “photo voltaic storm”

Banks that may keep targeted on the precise transformation actions, avoiding distractions just like the Aurora Borealis, will likely be higher outfitted to reply to the ever-changing setting. This focus will place them to serve their prospects extra successfully with capabilities which might be tailor-made to their wants, whatever the financial or credit score cycle.

For extra data contact me and skim our Banking Top 10 Trends for 2024.

* Supply Accenture Analysis

This makes descriptive reference to emblems that could be owned by others. The usage of such emblems herein isn’t an assertion of possession of such emblems by Accenture and isn’t meant to characterize or suggest the existence of an affiliation between Accenture and the lawful house owners of such emblems.

Disclaimer: This content material is offered for common data functions and isn’t meant for use rather than session with our skilled advisors. Copyright© 2024 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

[ad_2]

Source link