[ad_1]

Rates of interest and inflation are on everybody’s minds. Value-conscious prospects need to see worth for his or her cash and don’t need to pay for what they don’t use. Corporations, in flip, wish to higher align their pricing with prices. Whilst budgets tighten, they need to entice new prospects, cut back churn and enhance income.

The upshot? Small and enormous companies throughout industries are rethinking how they value their merchandise. That’s the place usage-based pricing is available in. In the event you haven’t but thought-about this pricing mannequin, now is perhaps the time.

What’s usage-based pricing and why does it matter?

Utilization-based pricing means an organization costs a buyer for the way a lot of a services or products they use somewhat than a flat payment. In the event you’ve paid a utility invoice or used a rideshare app, then you realize what usage-based pricing is.

Pricing usually varies by once you pay and the way utilization is priced. For once you pay, there are two fashions. In a pre-payment/credit score burn-down mannequin, prospects pay for a services or products earlier than they obtain or use it. Funds are deducted based mostly on utilization. In a pay-as-you-go/metered mannequin, the shopper pays after use.

How utilization is priced

| Quantity-based Pricing | Graduated Pricing | Tiered Pricing | Overage Pricing |

| Based mostly on unit consumption. | Per-unit value differs by use degree. | Based mostly on a pre-set consumption tier for the interval. | Based mostly on a flat subscription payment for a base variety of items, with a per-unit value utilized to every unit that exceeds the bottom quantity. |

| Cellular Telephone Plan Instance: pay $0.05 per minute on a cell phone plan. | Cellular Telephone Plan Instance: pay $0.05 per minute for the primary 500 minutes and $0.10 per minute thereafter. | Cellular Telephone Plan Instance: pay the 500-1,000 minute unit value for 750 minutes used. | Cellular Telephone Plan Instance: pay $19.99 for the primary 500 minutes plus a further $0.05 per minute for each minute over 500. |

Prospects have a tendency to love usage-based pricing as a result of worth is instantly tied to cost. The upfront value is usually low, they usually can scale their use as wanted to regulate their spending with out having to renegotiate the plan.

This buyer enchantment is a plus for companies that need to broaden their shopper base or launch new merchandise. The mannequin additionally helps companies enhance buyer lifetime worth. By monitoring utilization, they will drive adoption and discover new alternatives for cross-sell and up-sell. One other profit? There’s no cap on income. As utilization goes up, so can earnings. Utilization-based public software-as-a-service (SaaS) corporations noticed 31% more year-over-year revenue growth than their non-usage-based friends.

Assembly enterprise demand for value-added companies

As companies transfer to usage-based pricing, they want cost and billing options to help this new pricing mannequin. Bigtechs and fintechs have been fast to step in.

Accenture’s analysis, Reinventing commercial payments for profitable growth, exhibits {that a} failure to supply value-added business payment companies like usage-based pricing is a high frustration for companies. 4 out of 10 business funds purchasers surveyed mentioned they might seemingly swap to a different cost supplier that provided value-added companies.

These companies additionally rely closely on fashionable digital know-how cores akin to cloud, AI and knowledge for deployment and enablement. Nevertheless, a giant concern highlighted by our business funds analysis is that greater than 50% of banks nonetheless have comparatively low ranges of digital core know-how maturity.

Future-thinking banks and business cost suppliers want to contemplate how they will remodel their choices to help their purchasers’ wants.

Those who don’t have the capabilities can collaborate with a fintech to grab this chance and switch business funds into an engine for income development.

Who’s providing usage-based pricing now?

Utilization-based pricing is frequent in utilities, telecom and cloud computing. Now, different industries, from leisure to transportation, are beginning to embrace it, too.

Generative AI will seemingly enhance the recognition of this pricing mannequin much more. Why? Massive language mannequin (LLM) computation prices are excessive. Companies that construct their merchandise on LLMs might want to align their pricing to maintain this value and cross it alongside to their prospects.

Intercom, for instance. This AI customer support platform supplier costs a buyer a small payment every time its AI agent, Fin, resolves a buyer’s query. The shopper pays provided that Fin delivers outcomes. If Fin can’t reply the question, the buyer doesn’t pay. By pricing this manner, Intercom not solely ties value to worth, it additionally lowers threat for patrons, making it simpler for them to offer Fin a attempt. Hear what Intercom’s CTO Darragh Curran has to say about their firm’s transfer to usage-based billing for Fin.

Adapting a enterprise to usage-based pricing

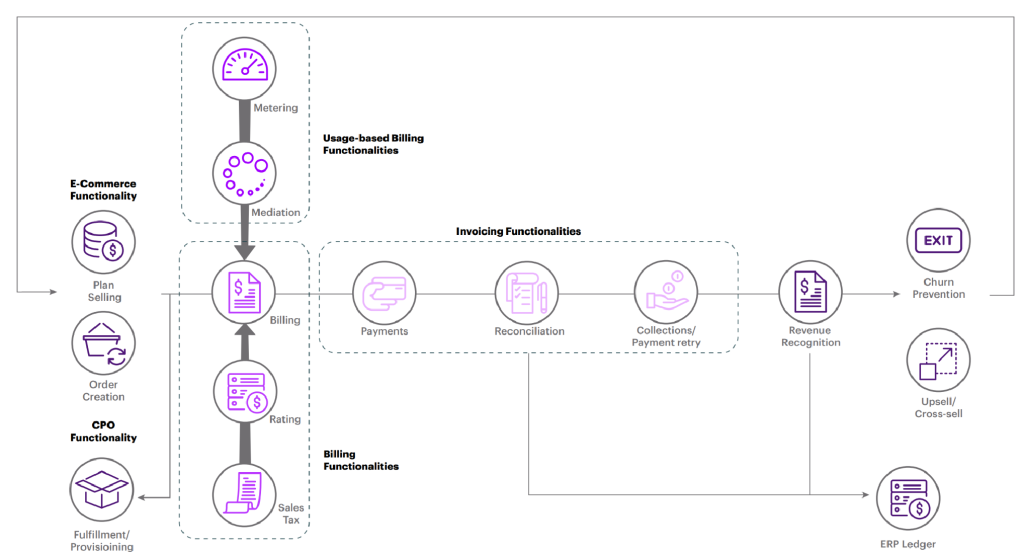

Utilization-based pricing touches nearly each operate throughout the enterprise, from gross sales to income recognition, remodeling the quote-to-cash (Q2C) course of. Billing isn’t any exception.

Prospects and customer-facing groups want to trace utilization and spending in actual time. So, corporations should have the ability to meter utilization, immediately mixture the info, tie it to a value plan and pull it right into a invoice.

The quote-to-cash course of beneath usage-based pricing

It takes time, planning and considerate execution to implement usage-based pricing and billing. Listed here are a couple of vital concerns:

-

- Select the suitable metric to cost for: Decide a utilization metric that reflects your product’s worth and is straightforward to know. Use metering and mediation to trace and convert the info into readable billing info.

-

- Present utilization visibility: Plan for the necessity to equip your staff and prospects with instruments or dashboards to trace real-time utilization and spending.

-

- Give attention to accuracy and reliability: With usage-based billing, there’s an enormous quantity of information throughput per minute. Simply seconds of system downtime can result in a major lack of information or billing errors.

Selecting the suitable supplier

With the suitable engineering staff and assets, you may construct and handle the mandatory programs in-house. Nevertheless, sustaining and updating them to maintain tempo with regulatory necessities, new merchandise, pricing adjustments and growth into new markets could also be greater than you need to tackle.

One option to deal with this effort is to work with a companies supplier—a preferred choice, significantly for invoice funds. Accenture analysis exhibits that nearly 60% of clients are highly likely to subscribe and buy these companies.

Revenue and Finance Automation (RFA) stack in order that it will probably function a one-stop store for key companies akin to billing, utilization, income recognition, tax and funds.

“We now allow usage-based billing with our new Meters API. You possibly can ingest utilization knowledge in actual time, join it to your pricing, guarantee correct billing based mostly on utilization, and cohesively combine it with the remainder of the RFA Suite for end-to-end administration of usage-based income.”

Is usage-based pricing proper for your enterprise?

Ask your self a couple of questions first:

-

- Do you may have the workers and assets you want? Utilization-based pricing is extra complicated than different pricing fashions. It’s vital to contemplate whether or not you and your companions have the suitable capabilities to make this transformation.

-

- Are your opponents providing it? If they’re, usage-based pricing may work to your firm. In the event that they aren’t, you continue to could need to experiment and add usage-based pricing to your present pricing mannequin.

-

- Is your services or products a superb match? Profitable usage-based pricing relies on having the suitable metric. In case your product is difficult, it will not be simple to establish one.

Utilization-based pricing is gaining reputation. Whether or not you’re a enterprise planning to supply this sort of pricing to your prospects or a financial institution that helps corporations deal with their cost wants, now’s a good time to consider how one can unlock worth to your purchasers.

We’d love to listen to your ideas about usage-based pricing and billing. Please contact both Sulabh Agarwal or Austin Brizgys.

You’ll want to obtain the Accenture report, Reinventing Commercial Payments for Profitable Growth and browse Stripe’s report on the state of subscription and billing management.

This makes descriptive reference to logos which may be owned by others. Using such logos herein is just not an assertion of possession of such logos by Accenture and isn’t meant to symbolize or suggest the existence of an affiliation between Accenture and the lawful homeowners of such logos.

Disclaimer: This content material is supplied for basic info functions and isn’t meant for use instead of session with our skilled advisors. Copyright© 2024 Accenture. All rights reserved. Accenture and its brand are registered logos of Accenture.

[ad_2]

Source link