[ad_1]

As you begin strategic planning this August, take into account this: automated, data-driven lending is not a future imaginative and prescient—it’s occurring now. In our Commercial Banking Top Trends for 2024, we highlight this essential pattern shaping the trade’s future.

This three-part weblog sequence appears at the way forward for lending, reflecting on trade experiences and offering insights into its transformative energy. We discover how banks can use fragmented digital banking fashions, improve buyer experiences, forge ecosystem partnerships and leverage superior digital know-how to maneuver from defending market share to attaining substantial progress. We define strategic shifts to drive progress in lending over the following 5 years and can present real-world examples all through. However let’s begin by anchoring on the important thing disruptions occurring in lending.

Disruptions within the lending house

Lending is experiencing a exceptional transformation, pushed by a convergence of technological improvements, evolving client expectations and dynamic modifications within the world financial system.

- Prospects are demanding extra seamless and private experiences, prompting lenders to reflect bigtech in how they reimagine person interfaces, improve transparency and use buyer information for customized credit score.

- Digital advances, powered by AI, information analytics and composable technology, are reshaping mortgage origination, enabling hyper-personalized choices, revolutionizing danger evaluation and streamlining servicing.

- Regulatory frameworks are adapting, amid this evolution, to accommodate rising fashions whereas safeguarding client pursuits and responding to regulator calls for.

- Bigtech’s modern lending fashions, concentrating on billions of customers, pose a systemic menace to conventional lenders. Giants like Amazon, Meta, Apple, Google and Alibaba are leveraging their huge person bases and applied sciences to supply customized lending fashions and merchandise starting from private loans to futuristic digital actual property mortgages. For instance, Amazon has built-in its Sellers Central portal into its quasi-bank, providing customized enterprise loans to 1.7 million companies based mostly on real-time gross sales information.

These forces create a dynamic setting the place collaboration between conventional lenders and agile fintechs can revolutionize the way in which people and companies entry capital. The longer term guarantees velocity, accessibility and customization, the place borrowing and lending are seamlessly built-in into the material of our digital lives.

So how can banking leaders achieve this imaginative and prescient? We suggest six key shifts:

- Digitize the end-to-end origination experience

- Fuel data-driven lending with a digital mind

- Embed finance into the client journey

- Take full benefit of sustainable finance and inexperienced loans

- Reimagine product and repair choices

- Remodel the lending enterprise mannequin

Shift #1: Digitize the end-to-end origination expertise

Digital mortgage origination that mixes information and AI can unlock the potential for immediate decisioning and disbursement. The origination journey is being remodeled by applied sciences that embrace workflow orchestration instruments, hyper-personalized digital assistants within the worth chain and most not too long ago, generative AI. It’s like giving your mortgage software a turbocharged GPS with AI—sooner routes, fewer bumps and all the time realizing the place you’re headed!

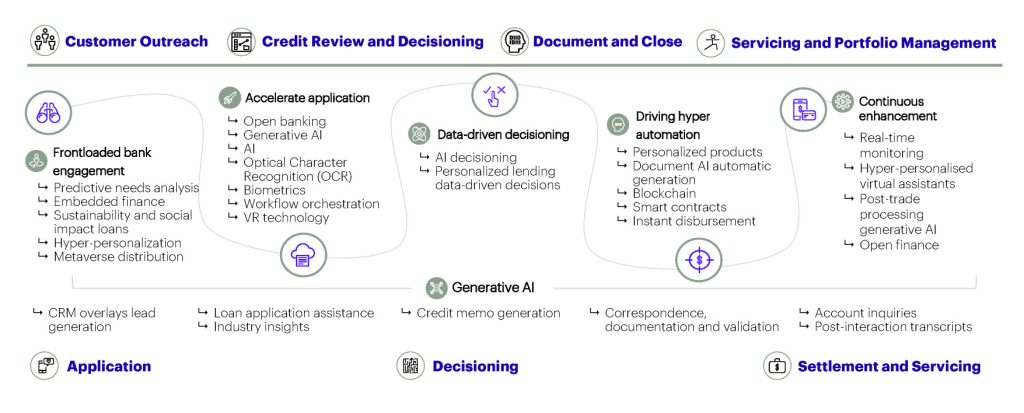

Lending origination journey from buyer outreach to servicing and portfolio administration

By digitizing end-to-end, banks can create a streamlined and strong expertise for debtors, making certain a seamless journey at every stage, from software to approval. For instance, a South American financial institution has successfully used superior applied sciences reminiscent of AI, machine studying and information analytics to rework and digitize an end-to-end auto mortgage course of. They developed a digital platform that lets prospects apply for a automotive mortgage instantly from their automotive utilizing a cell app – and so they solely have to enter seven items of data. Prospects shortly discover out if they’re pre-approved and be taught the utmost mortgage quantity and phrases. This use of know-how shifts the mortgage approval course of to the beginning of the car-buying journey, making it sooner and simpler for sellers to promote vehicles.

Some banks have chosen to innovate in essential components of the worth chain. A big North American financial institution is utilizing transaction historical past, firmographics (agency demographics), income and product utilization information with machine studying fashions to offer relationship managers with the next-best dialog prompts embedded inside the CRM platform. Wealthy Information Corp (RDC), an Australian Fintech working with Australian and US banks, makes use of banking transaction information units to offer real-time early warning alerts. This supplies continuous monitoring and detection of potential dangers as much as 6 months earlier utilizing predictive analytics.

However the way forward for lending includes greater than digitizing the journey. Within the subsequent submit, we’ll cowl three extra shifts that cowl data-driven lending, embedded finance and inexperienced loans.

Within the meantime, should you’d wish to know extra about automated, data-driven lending, we suggest our latest report: Commercial Banking Top Trends for 2024. Be at liberty to contact us—we’d love to debate your financial institution’s journey to the way forward for lending.

We’d wish to thank our colleague, Gustavo Pintado, for his contribution— he works carefully with a lot of our monetary companies shoppers as they develop and implement their lending methods.

This makes descriptive reference to emblems which may be owned by others. Using such emblems herein is just not an assertion of possession of such emblems by Accenture and isn’t meant to signify or suggest the existence of an affiliation between Accenture and the lawful homeowners of such emblems.

Disclaimer: This content material is offered for common data functions and isn’t meant for use rather than session with our skilled advisors. Copyright© 2024 Accenture. All rights reserved. Accenture and its brand are registered emblems of Accenture.

[ad_2]

Source link