Home Republicans say they need to balance the federal budget in 10 years by chopping spending solely, and appear to have acquired a promise from newly-elected Home Speaker Kevin McCarthy (R-CA) to carry such a plan to the ground for a vote someday this 12 months.

I can’t wait to see what it seems to be like.

Reaching fiscal stability in 10 years via spending cuts solely is, nicely, not possible. In fact, many of those Home Republicans don’t actually need to stability the finances. Their true aim is to slash the scale of presidency.

If these lawmakers have been severe about chopping the deficit, they might not have simply adopted House rules that make it simpler to chop taxes and tougher to boost them. However let’s take them at their phrase. How might Congress stability the finances in 10 years with none tax will increase?

Trying on the numbers

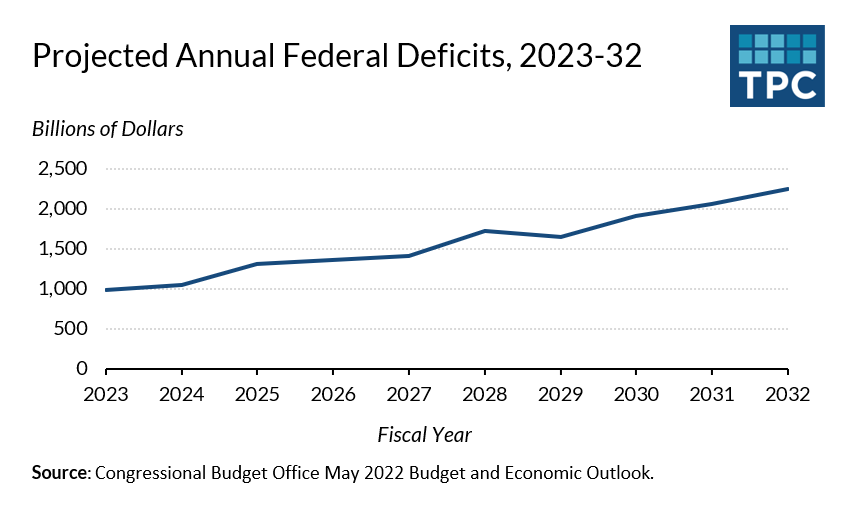

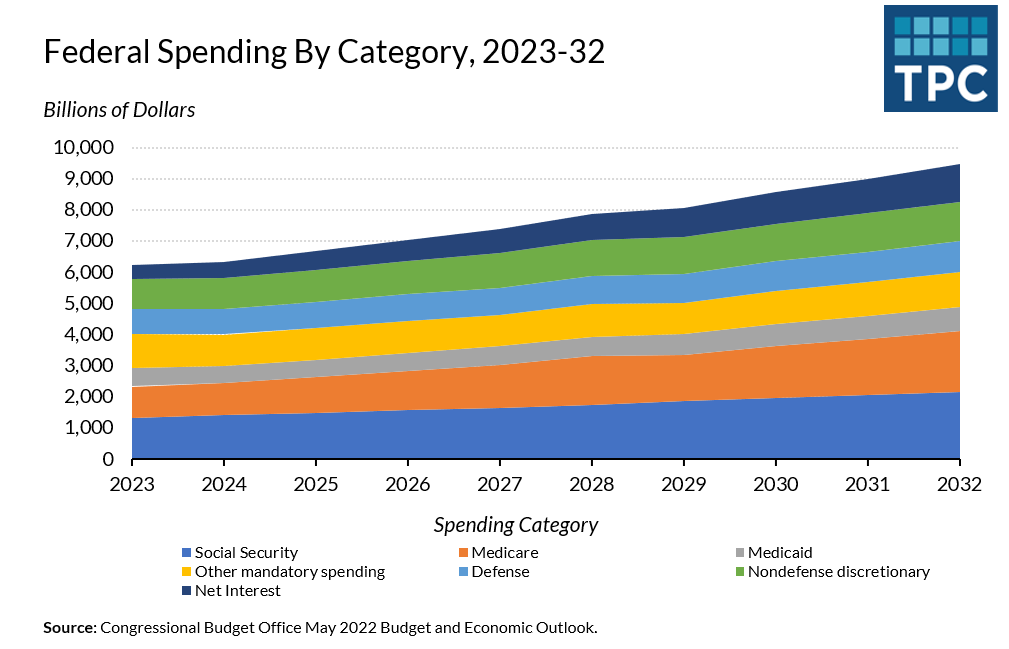

Begin with the Congressional Funds Workplace’s baseline budget projections from final Could. They estimated the federal authorities will elevate about $56 trillion over the subsequent decade however spend roughly $72 trillion. However in December, Congress added about $740 billion in additional spending over 10 years, assuming spending continues to rise with inflation. And Home Republicans have vowed to make everlasting the person earnings tax cuts within the 2017 Tax Cuts and Jobs Act (TCJA). That would reduce revenues by another $3 trillion over a decade, plus further curiosity prices on the added debt.

Let’s simply spherical it off and say the hole between spending and revenues over the subsequent decade will probably be roughly $20 trillion. Right here’s how the spending breaks down:

Assume no tax will increase, that are inconceivable within the Home. And key Home Republicans, together with the brand new Appropriations Committee chair Kay Granger (R-TX), say they won’t cut military spending. Meaning Republicans must fill the complete $20 trillion fiscal gap by chopping Social Safety, Medicare, Medicaid, and different home applications, plus no matter financial savings they’d get from decrease curiosity funds.

What wouldn’t it take?

How might Home Republicans get to stability? They might slash well-liked entitlements reminiscent of Social Safety, Medicare, and Medicaid. Alternatively, in the event that they defend these applications, they’d need to get rid of practically all different home spending. And that may cancel applications expensive to their voters, reminiscent of farm subsidies, western water tasks, border safety, and the air visitors management system. We just saw what happened when that failed for just a few hours.

What if the cuts are primarily based on every program’s share of non-interest spending? For instance, since Social Safety represents about one-quarter of that pie, projected advantages must be reduce by roughly $4.5 trillion over 10 years.

If Republicans defend navy spending, Social Safety advantages could be slashed by roughly 30 %. If the reduce occurred this 12 months, the Home would reduce the common month-to-month profit by $565, from $1,827 to less than $1,300.

Precise program cuts could be smaller since Treasury would notice some curiosity financial savings as nicely. Even when Republicans actually imply they need to get rid of solely the first deficit (excluding curiosity funds), they’d nonetheless have to chop Social Safety advantages by $3.2 trillion and Medicare funds by $2.6 trillion.

Any manner you depend it

There are numerous methods to have a look at the issue. The Committee for a Responsible Federal Budget has published an analysis. Its numbers are barely totally different however the story is identical. You would take a look at the deficit simply in 12 months 10, as a substitute of over 10 years. However any manner you depend it, the required cuts are far too massive to be credible.

And there are different issues.

Some spending cuts well-liked with the Home GOP would enhance the deficit. For instance, CBO estimates the Home vote to slash most new IRS funding would add $114 billion to the deficit over the subsequent decade since fewer sources would make it tougher for the company to gather taxes owed.

Don’t neglect how these modifications would have an effect on the financial system that might be rising slowly or by no means later this 12 months. Do Republicans actually need to reduce authorities spending, which might be sharply contractionary, when the US could also be headed for a recession?

Coverage malpractice

Make no mistake, Congress must get the federal finances beneath management. The public debt now exceeds $24 trillion. Annual curiosity funds are approaching a half-trillion {dollars}. Years in the past, my Tax Coverage Heart colleagues warned about catastrophic budget failure—the implications of pairing profligate spending with inadequate tax revenues.

However attempting to stability the finances in 10 years with home spending cuts solely is coverage and political malpractice. And as soon as it fails, how will the GOP to justify permitting the nation to breach its debt restrict. How do you cease new borrowing when your spending exceeds your revenues?

Home Republicans are about to find that really passing a balanced finances, particularly with their self-imposed constraints, is so much tougher than calling for one.