[ad_1]

The US-incorporated Silicon Valley Financial institution (SVB) failed final Friday. It’s not clear what the extent of the failure is perhaps as but: recommendations are that it’s bancrupt to the tune of many tens of billions of {dollars}, however this may exaggerate the difficulty. What appears sure is that it can’t meet the banker’s promise of fee on demand when sums are due and which means it’s bust.

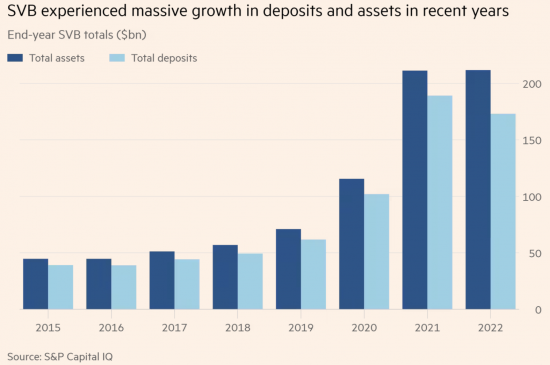

The financial institution failed for an easy purpose. Though it claimed to be a tech financial institution it really was little greater than a money deposit taker in actuality. Throughout the Covid period the dimensions of the financial institution grew massively, largely by taking extra deposits, as this chart from the FT confirmed:

The difficulty for this financial institution (and a few others, as it isn’t the one US financial institution failure this weekend) is that nobody needed the money being deposited with it. The loans they made compared to deposits had been small. As an alternative they needed to discover one other use for the cash so as to pay curiosity to depositors.

To do this they purchased what appeared like useful bonds (primarily however nit completely US authorities ones), which paid curiosity that appeared above common on the time in proportion to worth. By doing in order that they elevated the obvious charge of return they made by about 0.4% in comparison with the return they may have made by inserting funds on deposit with different banks.

Nonetheless, rates of interest then rose, and evidently SVB had by no means deliberate for that chance. Consequently that they had not thought of the implications for them of this eventuality.

If the Silicon Valley Financial institution had positioned cash on deposit it wotld not be bust now. It could nonetheless have that cash. It could even be making good cash on its funds. However it had purchased bonds and when rates of interest rise the worth of bonds fall as a result of the precise curiosity paid on them is mounted and due to this fact the one means during which the effective interest rate on them could be elevated is by their value falling.

It’s not clear by how a lot the bond portfolio of the Silicon Valley Financial institution has fallen in worth, however it might be, as already famous, by tens of billings of {dollars}. This was no downside if depositors appreciated that this was solely a paper loss that will solely give rise to an actual money value if the bonds needed to be offered. Final week that hope fell aside. Depositors requested for $42bn of cash from SVB final week. The Silicon Valley Financial institution couldn’t discover it. An try to lift new share capital was unsuccessful. Inadequate bonds may very well be offered. People who may very well be had been loss making. The financial institution was bust.

Hearsay has it that HSBC will take over the UK operation of SVB this morning.

Within the US the federal government has assure all depositor’s cash utilizing the fund it has created to underpin its deposit assure scheme although most of the deposits in query far exceed the $250,000 that scheme ensures.

It appears probably that the UK authorities is attempting to ensure one thing related right here.

So, what are the teachings?

The primary, and most evident is that these bankers clearly had no clue as to what they had been doing. But once more the so-called ‘masters of the universe’ have gotten issues unsuitable.

Second, regulation failed. The dangers on this financial institution had been clearly incorrectly appraised by them, and it was allowed to proceed buying and selling when there was clearly an excessive amount of danger implicit in an apparently properly funded stability sheet.

Thrd,the financial institution had inadequate capital for the dangers it took. If there had bern enough capital it will not now be bust.

Fourth, as ever, this financial institution presumed the state would cowl its danger. As ever that has proved to be right. The mockery of privately owned banks continues when what they really do is extract worth for personal achieve secure within the information that governments is not going to allow them to fail.

Fifth, the fallout from the over-inflation of rates of interest by the Fed is evident. These are being artificially manipulated upward when there is no such thing as a want for that, most particularly when there is no such thing as a US wages spiral. Synthetic danger is being created as an alternative by over deflating asset costs too rapidly for markets to deal with. This disaster was created by the Fed.

Sixth, this financial institution was utilized by the properly off and the businesses they personal. There’s at all times an excuse for bailing them out. None is discovered for anybody else. Wealth flows upwards, as ever.

Seventh, money deposits served no financial function right here: most of what this financial institution did added no financial worth. Regardless of that it’ll safe an costly bail out. At a while we’ll realise that financial savings don’t equate to funding, and the fashions we have now for saving make no financial sense, as this failure proves. However we’re not there but.

Eighth, that is market failure as a result of this financial institution couldn’t even handle money, essentially the most fundamental job requested of it. It was mentioned to be actuality good at tech. Based mostly on this are we actually anticipated to consider that? Certainly we are able to do higher than this?

In abstract, it appears this financial institution failed as a result of it didn’t even perceive money administration. I hope no state funds are concerned in its bail out.

[ad_2]

Source link