The rising menace of local weather change has spurred banks and different monetary providers firms to step up efforts to turn out to be sustainable. Many have pledged to struggle local weather change and scale back their greenhouse gasoline emissions to internet zero. Far fewer companies, nonetheless, have begun the very important job of arresting the destruction of our pure surroundings.

With no wholesome pure surroundings, and its many various ecosystems, efforts to fight local weather change will likely be of little worth.

Proper now, monetary providers companies have a possibility to maneuver to the forefront of world efforts to guard and restore nature. These companies which have begun their journey to internet zero ought to look to broaden their sustainability methods by additionally aligning their companies with initiatives that safeguard nature. Moreover, monetary establishments which have began utilizing their affect, sources and experience to encourage their prospects and suppliers to turn out to be carbon impartial (see our Rising to the Challenge of Net Zero Banking report) may use comparable approaches to immediate these events to turn out to be nature-friendly.

Banks, insurers and wealth managers that transfer shortly to deal with the wants of nature in addition to the modifications in local weather will seemingly set up themselves as champions of sustainability within the eyes of their prospects and buyers, in addition to amongst regulators and environmental companies.

Whereas efforts to fight local weather change are vital, it’s crucial that companies additionally begin taking motion to cease the destruction of our pure surroundings—the forests, rivers and seas that maintain life and underpin our economies.

“Greater than half the world’s annual financial output depends upon our planet’s pure sources.”

World Economic Forum, 2020

Round US$44 trillion, more than half the world’s annual economic output, is in danger due to the continued depletion of our planet’s pure sources, in line with the World Economic Forum. The UN Convention to Combat Desertification (UNCCD) discovered that humans have already degraded up to 40% of the earth’s land surface and altered 87% of the oceans.

The populations of mammals, birds, amphibians, reptiles and fish dropped by a median of near 70% between 1970 and 2016, reviews the UNCCD. Highlighting the shut ties between local weather change and the wellbeing of nature, the UN’s Intergovernmental Panel on Climate Change estimates that one in ten terrestrial and freshwater species is more likely to face a excessive threat of extinction if world temperatures rise an extra 2C°—the restrict set by the Paris Agreement.

Environmental companies, governments and regulators are more and more elevating the alarm concerning the fast degradation of our pure surroundings. They usually’re seeking to companies in all sectors to assist halt the destruction of nature.

As but, few firms have risen to the problem.

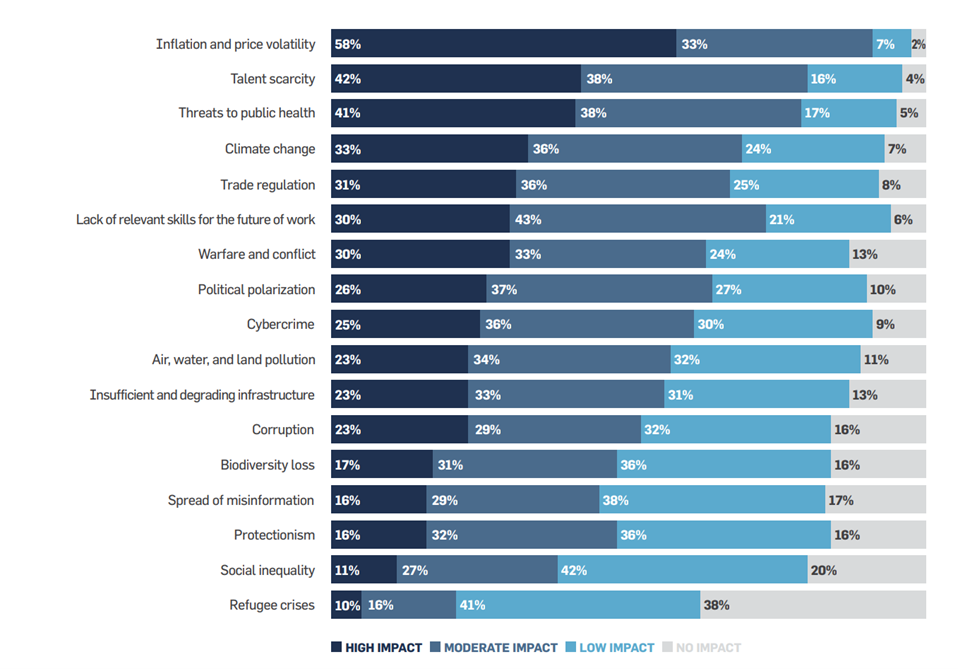

Our analysis exhibits that nearly all CEOs now believe tackling sustainability is key to their jobs. Nevertheless, solely 17% acknowledge their firms’ dependence on nature and see biodiversity loss as a critical menace to their companies. Equally, in a examine with the UN Global Compact, we discovered that 80% of CEOs acknowledge that their companies influence biodiversity. But simply 35% try to treatment potential injury to the surroundings by embarking on tasks to guard or restore nature.

High challenges going through CEOs in 2023

Click on/faucet on picture to enlarge. Supply: United Nations Global Compact-Accenture CEO Study

Monetary providers companies are perfect candidates to turn out to be standard-bearers in a world marketing campaign to guard nature and make sure the wellbeing of our planet. Not solely do they possess substantial financial affect and vital sources. In addition they have appreciable threat publicity to nature due to their funding of nature-dependent industries reminiscent of agriculture, transport and meals processing.

To broaden their sustainability methods, to allow them to turn out to be nature-positive in addition to internet zero, monetary establishments must embark on initiatives that encourage each biodiversity and bio-abundance. Danger controls and frameworks that already monitor their influence on the local weather must be prolonged to accommodate elements associated to nature. Moreover, methodologies and incentives used to encourage the funding of climate-friendly firms and tasks could possibly be tailored to advertise the allocation of capital to nature-positive enterprises.

The Task Force on Nature-related Financial Disclosures (TNFD) is presently drafting a framework that will help providers of finance identify nature-related risks and opportunities. Just like the framework devised by the Task Force on Climate-related Financial Disclosures (TCFD), the TNFD doc is meant to encourage the circulate of world capital away from purposes that threaten the surroundings in direction of investments that assist nature.

The TNFD framework may turn out to be the blueprint for nature-related monetary disclosures

The TNFD is because of launch the primary model of its nature-focused framework in September. It will, amongst different issues, assist firms align their biodiversity reporting with finest practices and help them in figuring out nature-related dependencies, dangers and alternatives. It’s going to additionally present firms with a information to incorporating elements associated to nature into their governance, technique and threat administration in addition to their credit score and funding decision-making.

Accenture not too long ago performed a pilot undertaking utilizing the proposed TNFD framework to realize an understanding of its personal influence and dependence on nature. My colleague Barnabas Harrison discusses among the findings of the undertaking here. It highlighted, amongst different issues, the shortage of knowledge to assist firms measure their influence and dependence on nature, the restricted scope of many datasets and instruments, the complexity of most analytical merchandise and instruments, and the necessity for better transparency into the methodologies and processes that assist the present era of geospatial options.

Disclosure of nature-related threat is but to turn out to be necessary. Nevertheless, regulators and authorities companies are more likely to require such disclosure quickly. The TNFD framework might observe the instance of its TCFD counterpart and turn out to be the blueprint for nature-related monetary disclosures.

Already, the French authorities has included biodiversity disclosure in its local weather laws. Article 29 of France’s energy and climate law compels monetary establishments to indicate how their companies influence biodiversity and to reveal their publicity to threat associated to nature.

The European Union’s recent Corporate Sustainability Reporting Directive (CSRD) now requires firms in member states to audit data they report about biodiversity initiatives that handle, for instance, land and water sources. The mandate furthermore contains particulars of local weather motion in addition to social initiatives, range programmes, anti-corruption measures and human rights tasks. The Kunming-Montreal Global Biodiversity Framework, drafted in December on the UN’s COP15 conference in Canada, can also be more likely to spur additional biodiversity regulation. As many as 150 monetary providers firms known as on governments world wide to undertake the framework which contains, amongst different issues, biodiversity conservation and restoration targets.

Monetary providers companies shouldn’t look ahead to regulators to immediate them to include nature-related publicity into their sustainability initiatives. The time to behave is now. Banks, insurance coverage firms, wealth managers and different allocators of capital have a vital position in safeguarding our planet for the good thing about all its inhabitants.

I wish to thank Jay Barrymore, International Sustainable Funding Lead at Accenture, for his contribution to this weblog publish.

In the event you’d prefer to study extra about how banks can broaden their sustainability methods to embody nature-positive initiatives in addition to net-zero targets, I’m eager to listen to from you. You’ll be able to attain me here or on LinkedIn.