What number of of those are you responsible of?

The primary mistake is usually noticed amongst younger working adults and singles, as most of us are likely to suppose we’re invincible at that age and life stage (some dangers solely grow to be extra visibly apparent as we get older).

The alternative additionally occurs, typically to folks (who’re overly kiasu about their youngsters) or those that felt pressured into shopping for plans to assist their mates within the line.

The third occurs while you don’t evaluate your monetary portfolio regularly. This was me only a few months in the past, after I realised I had been unknowingly paying (by way of GIRO) for a rewards membership programme regardless of not having used it since turning into pregnant in 2018.

However extra worryingly, I discover that most individuals are responsible of the ultimate mistake on the checklist, the place they’ve varied insurance coverage insurance policies however none (or too few) covers their highest-probability occasions.

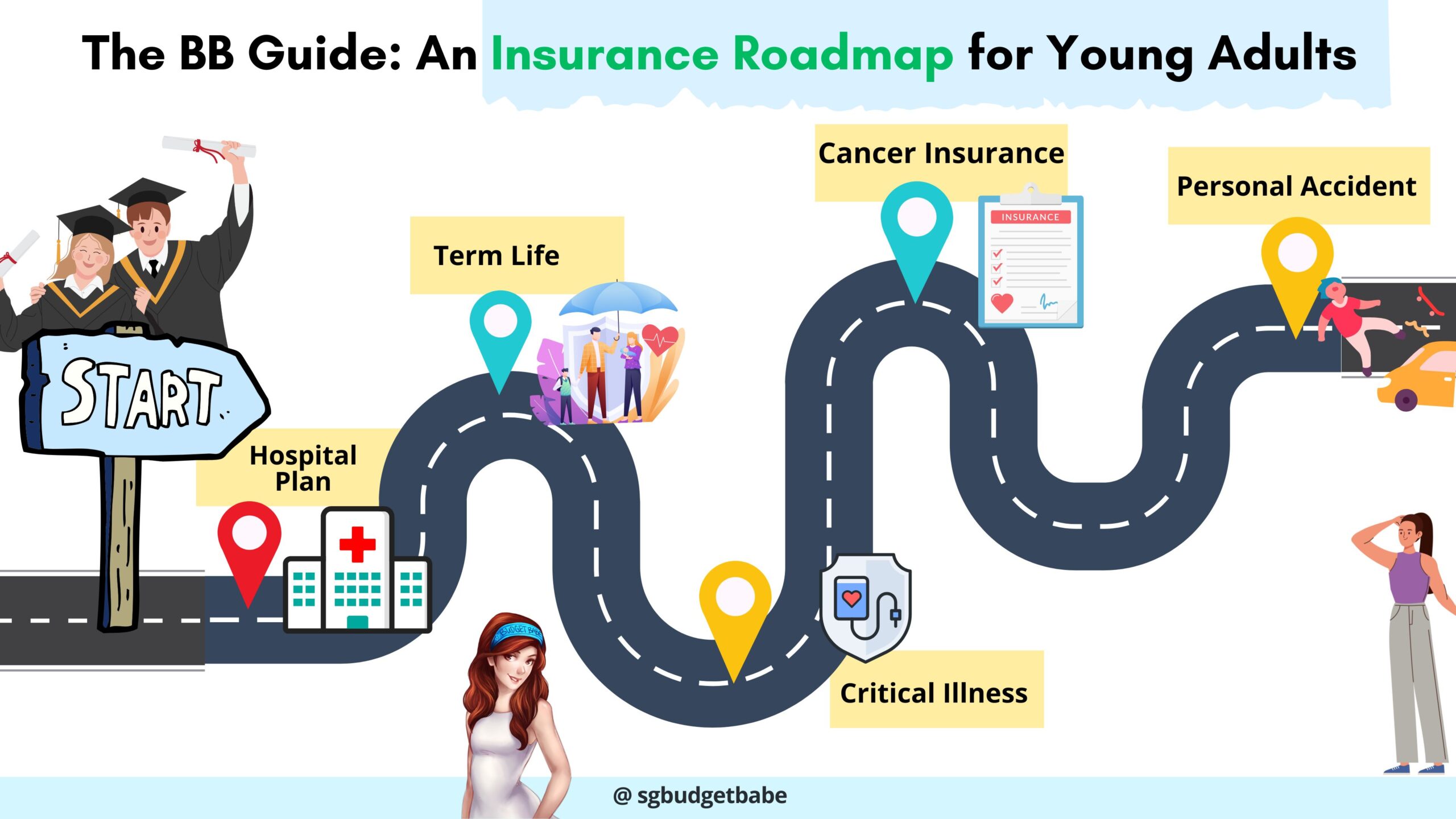

Right here’s a greater plan

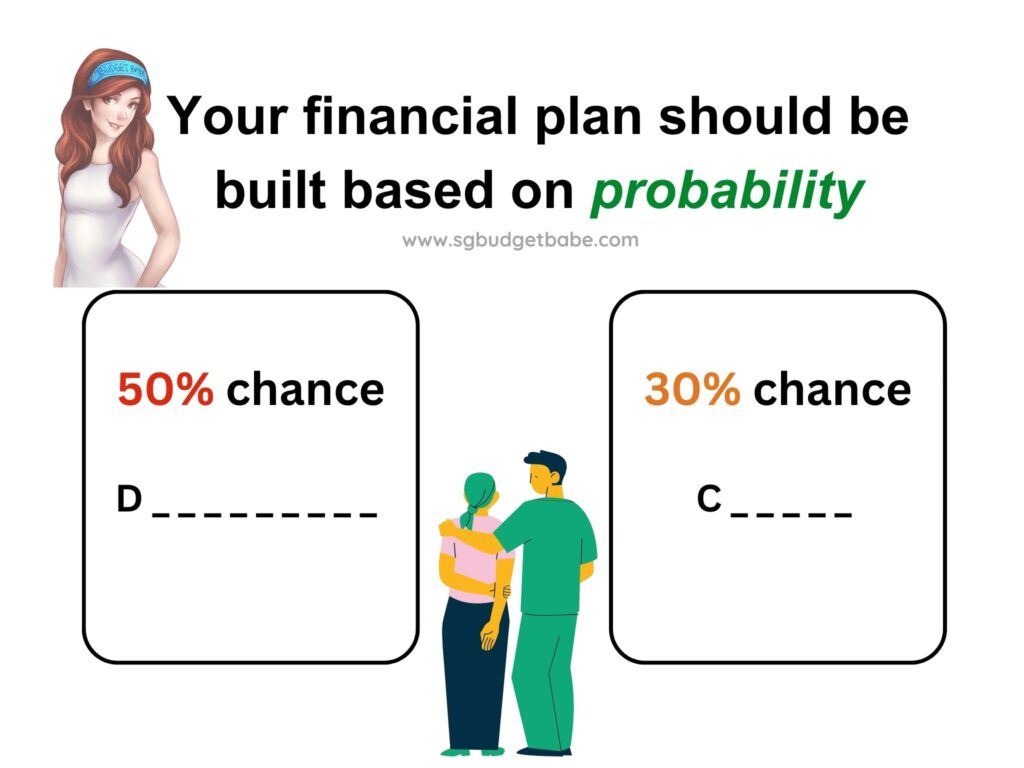

A greater approach is to weigh the chances which might be stacked in opposition to us and insure in opposition to these accordingly.

And in the event you requested me, the very best chance occasion for many of us is incapacity.

That’s as a result of even MOH estimates that “1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime, and may need long-term care”. Contemplating how the typical life expectancy of a Singaporean is now at 83.7 years previous, meaning our odds for incapacity are stacked at 50%.

Whereas most of us have already got minimal safety in opposition to incapacity – due to CareShield Life – the fact is that the payouts can only provide some basic support and might not be enough to cover the average costs of long term care.

Unsure what CareShield Life is? Read more about the national severe disability insurance scheme and how it fits into your future plans here.

You’ll be able to choose by asking your self, do you reckon S$600 a month will probably be sufficient in the event you’re disabled? Since S$600 is already inadequate at this time, what extra sooner or later when medical payments and caregiving bills are certain to be larger?

The answer: get a CareShield Life complement, in the event you haven’t already with Singlife CareShield Standard/Plus.

My husband and I’ve personally boosted our personal payouts to above S$2,000 – as a result of that’s how a lot we suspect will probably be wanted at a minimal to pay for long-term care every month, and we don’t need to burden our youngsters with having to pay that for us.

Professional tip: even when funds is a matter, you’ll be able to doubtlessly nonetheless safe a better incapacity protection for your self for free. That’s proper – so long as you’ve S$15,000 in your MediSave account, you’ll already be getting not less than S$600 price of curiosity yearly, which implies you’ll be able to pay your premiums with out forking out any extra money (particularly in case you have but to utilise your MediSave for any CareShield Life or ElderShield complement).

One other fear that retains me up at evening is that of most cancers.

It’s no secret that most cancers is the #1 cause of deaths in Singapore, as reported by MOH. Since 2016, most cancers alone is the reason for almost 30% of deaths right here, and the cost of cancer treatments have been rising over the years.

I’m in my 30s, and I already know of a number of mates in my circles who’ve gotten identified with most cancers. Fortunately, they managed to beat most cancers and are in remission proper now, however the prices could be scary (two of my mates spent over $100k of their battle in opposition to it). I lately additionally learn one other story (here) of how one girl in her 30s handled most cancers and noticed the way it’s potential to bounce again with the fitting assist – financially and in any other case

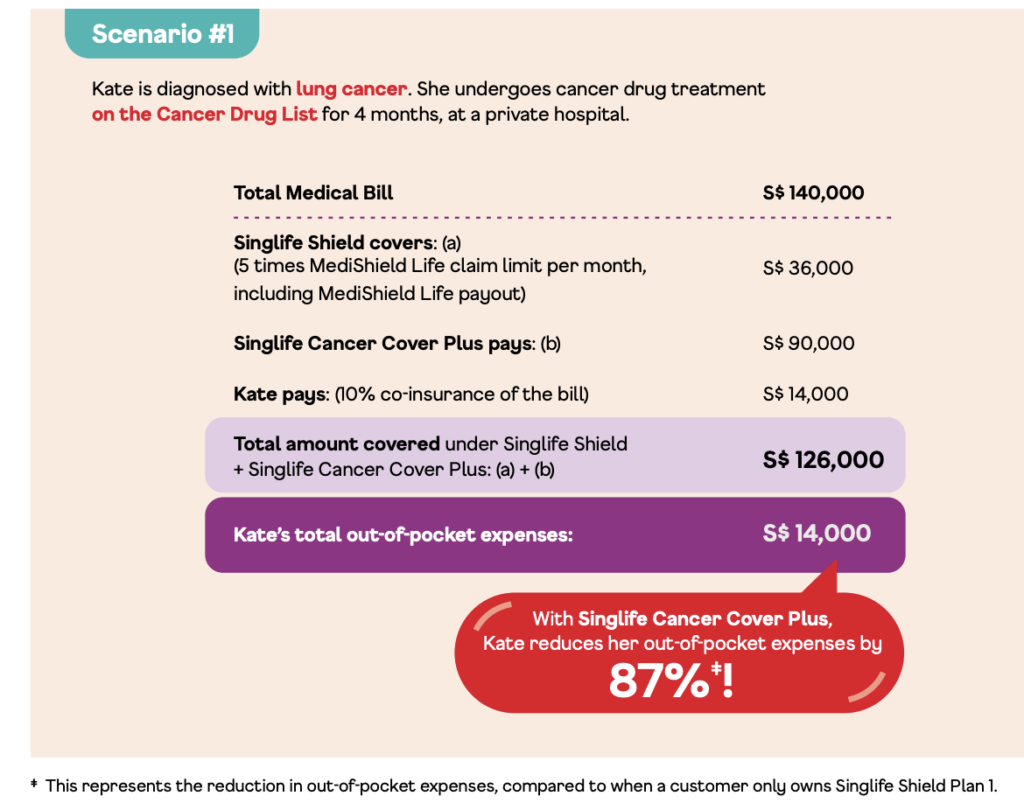

Whereas our authorities is making an effort to stem rising healthcare prices, the issue is that for the person, we’re those who must cope with the fact of probably big out-of-pocket funds which most of us could not have the money for. And since we can’t management the dimensions of our invoice, there is no such thing as a saying how a lot we’d find yourself having to pay.

That makes it exhausting to plan. In spite of everything, nobody likes the considered how one’s lifetime financial savings may simply find yourself being worn out in a single occasion due to an surprising medical situation, and even worse…find yourself having to borrow.

And now that even sufferers on IPs will solely be coated as much as a most of:

S$18k a yr (i.e. S$1,500 a month) for most cancers companies, it signifies that our money portion will probably be even larger.

Be aware: The $18k restrict is computed based mostly on 5 occasions of the MediShield Life $3,600 cap.

The federal government has additionally mentioned that 30% of Singapore residents do not have Integrated Shield Plans, and among those who do, only less than half are covered under riders.

If you happen to don’t need cash to carry you again from getting the most cancers care that you simply reckon is finest for you, then it’s possible you’ll need to go for a plan that gives as-charged protection for claims, corresponding to Singlife Cancer Cover Plus with a excessive annual protection restrict (as much as S$1.5 million).

Your odds may fluctuate within the short-term, corresponding to while you journey. On this case, it’ll be higher to adapt accordingly.

How I do it’s to lock in my protection for higher-probability occasions, however preserve flexibility for the remaining.

Journey insurance coverage, as an example, is an space the place it pays to have extra flexibility. There may be completely no have to decide to an annual journey insurance coverage coverage in the event you make simply a few journeys annually. What you could possibly do as a substitute is to purchase from whichever insurer that’s operating a promotion on the level of your journey.

Nonetheless, in case your larger problem is having an unpredictable schedule (e.g. in the event you’re the boss of your organization / self-employed / have younger youngsters who fall sick typically), then a journey plan that I maintain coming again to is Singlife Travel Insurance, as it’s the solely insurer that pays us ought to we’ve to cancel our journey for any purpose that would not have been foreseen beforehand e.g. in case your baby out of the blue fell sick (even when it’s only a nasty flu).

Professional tip: You’ll be able to get pleasure from as much as 48% off single-trip plans* in the event you’re an present MINDEF / MHA policyholders or a member of the family of 1!

In fact, whereas these are some key protection areas I usually pay extra consideration to, your wants could differ from mine. Therefore, don’t make the error of merely following generic recommendation in terms of insurance coverage; it’s best to know that there’s NO “one-size-fits-all” protection portfolio.

As an alternative, have a look at the massive image of your funds, and determine what insurance policies finest suit your wants (be it to guard, save and even make investments).

Disclaimer: This text is delivered to you in partnership with Singapore Life. All private opinions are that of my very own.

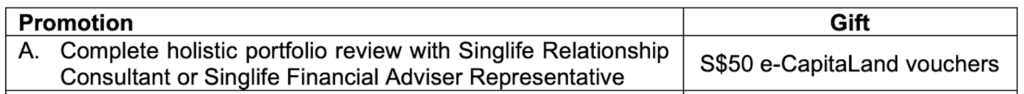

Want one more reason to finish your individual holistic monetary evaluate? Properly, in the event you decide to doing so earlier than 30 June 2023, you may get a S$50 e- voucher for redemption throughout any CapitaLand mall in Singapore while you book and complete a review with Singlife here!

*Promotion and Coverage Phrases and situations apply.

This coverage is underwritten by Singapore Life Ltd. Finances Babe is just not an insurance coverage agent/middleman and can’t solicit any insurance coverage enterprise, give recommendation, suggest any product or prepare any insurance coverage contract. Please direct all enquiries to Singapore Life Ltd. This materials is printed for common info solely and doesn’t have regard to the precise funding aims, monetary scenario and specific wants of any particular individual. You need to learn the Product Abstract and search recommendation from a monetary adviser consultant earlier than making a dedication to buy the product. As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage normally includes excessive prices and the give up worth, if any, that’s payable to it’s possible you’ll be zero or lower than the full premium paid. Shopping for a medical insurance coverage that isn’t appropriate for it’s possible you’ll influence your capacity to finance your future healthcare wants. This commercial has not been reviewed by the Financial Authority of Singapore. Protected as much as specified limits by SDIC. Info is correct as at 24 Could 2023.