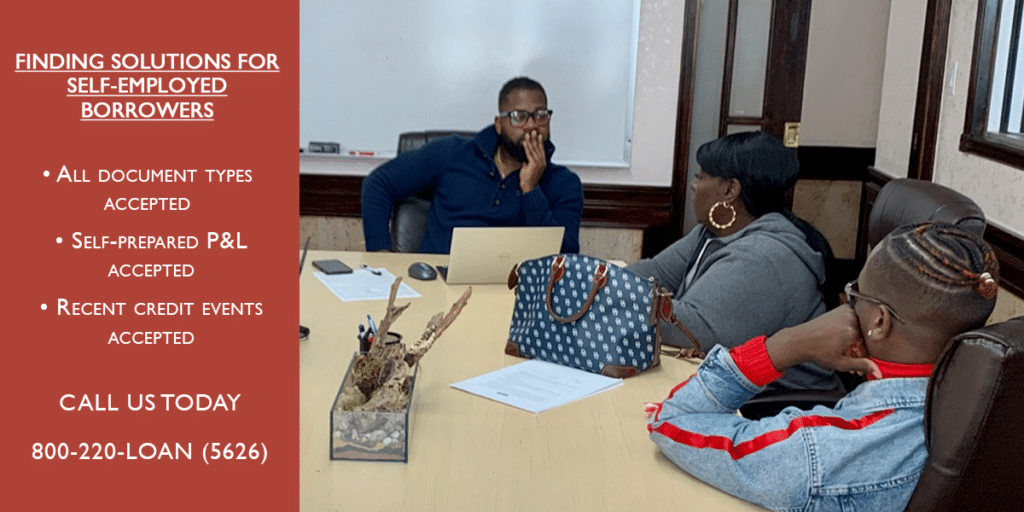

In at the moment’s mortgage business, it’s frequent to have purchasers who’re freelancers, contractors, gig staff, and different self-employed debtors. At MortgageDepot, we perceive the distinctive challenges these debtors face, and we’ve tailor-made options to satisfy their wants. Our educated workforce of non-QM lending specialists is right here to assist. Let’s take a more in-depth have a look at the options in our Non-QM lineup.

Options of Our Non-QM Lineup

- BANK STATEMENTS – 12 & 24-month choices: We provide flexibility by accepting bank statements as proof of earnings for self-employed debtors. Select between 12 or 24-month financial institution assertion choices.

- All doc varieties accepted: We perceive that self-employed debtors could have various kinds of earnings documentation. That’s why we settle for varied doc varieties, together with financial institution statements, 1-year 1099, WVOE solely, Asset Utilization, and P&L only – with no extra financial institution statements required.

- Self-prepared P&L accepted: We acknowledge that self-employed debtors could have the experience to organize their very own revenue and loss statements. With us, self-prepared P&L statements are accepted with out the necessity for extra financial institution statements.

- No-income investor money stream – with No Minimal DSCR*: We provide a novel answer for buyers with no minimal Debt Service Protection Ratio (DSCR) requirement. This enables buyers to qualify based mostly on the money stream of the property, even with out private earnings.

- Current credit score occasions accepted: We perceive that life occurs, and credit score occasions comparable to foreclosures, chapter, or quick sale could have occurred. Our Non-QM lineup considers current credit score occasions, giving debtors an opportunity to qualify.

- As much as 90% LTV: We provide loan-to-value (LTV) ratios of as much as 90%, offering debtors with extra financing choices.

- As much as 55% DTI: We perceive that self-employed debtors could have increased debt-to-income (DTI) ratios as a consequence of enterprise bills. Our Non-QM lineup permits for DTIs of as much as 55%.

- Versatile mortgage phrases: We provide a wide range of mortgage phrases to go well with completely different wants. Select from a 40-year fixed-rate mortgage with an Curiosity-Solely possibility or adjustable-rate mortgages (ARMs) with Curiosity-Solely choices, together with 5/6, 7/6, and 10/6 ARMs.

- Limitless cash-out with 6-months seasoning: Debtors can entry their residence fairness with limitless cash-out choices, offered there’s a 6-month seasoning interval.

- FICOs from 600: We perceive that credit score scores can differ for self-employed debtors. That’s why we settle for FICO scores from 600 and above.

- Appraisal Transfers Accepted: When you’ve got just lately obtained an appraisal on your property, we settle for appraisal transfers, saving you money and time.

- Solely 30 days of belongings to confirm funds for closing: We streamline the closing course of by requiring solely 30 days of asset verification, making it simpler for self-employed debtors to offer proof of funds.

At MortgageDepot, we’re dedicated to discovering extra methods to qualify self-employed debtors. Contact our workforce at the moment to be taught extra and discover the probabilities on your purchasers.